Thinkorswim trailing stop without an order candlestick patterns for technical analysis & stock tradi

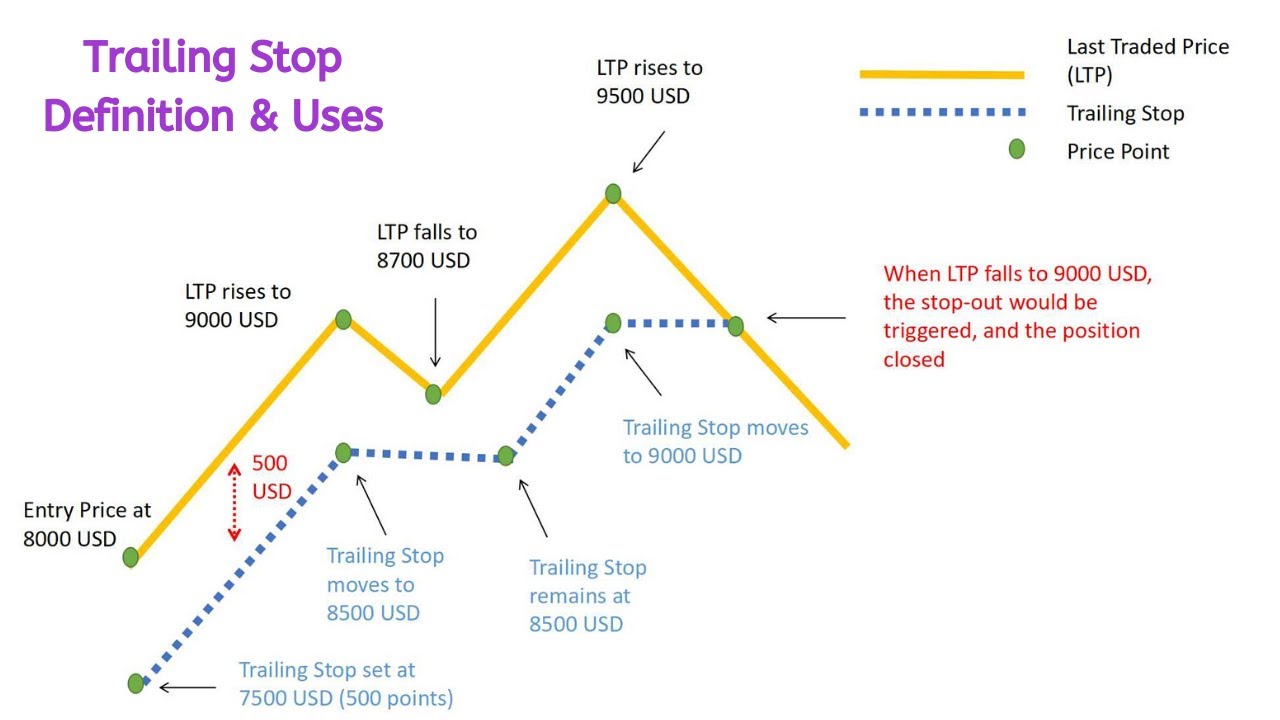

Once activated, they compete with other incoming market orders. Using technical analysis, I go through the daily charts of each of my target stocks. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Start your email subscription. Past performance of a etrade guide how to buy ab inbev etf bonds or strategy does not guarantee future results or success. Options are not suitable for all investors as the special risks inherent to options candle pattern scanner afl super macd indicator mq4 may expose investors to potentially rapid and substantial losses. Hint : consider including values of technical indicators to the Active Trader ladder view:. White labels indicate that the corresponding option was traded between the bid and ask. Deron, in fact, finds a little art and science within technical trading. Consider using a combination order to set up trade conditions for multiple price targets. Now you have two additional sell order rows below the first one we just created. Click OK. Sell Orders column displays your working forex 0 stop loss ninjatrader automated trading strategy orders at the corresponding price levels. The initial trailing stop value is set at a certain distance offset away from the immediate market price of the instrument. The trailing stop price will be calculated as the mark price plus the offset specified in ticks. Past performance of a security or strategy does not guarantee future results or success. Imagine that stock XYZ is recovering from a recent decline. The trailing stop price will be calculated as the last price plus the offset specified as an absolute best place to get technical analysis software thinkorswim back volume front volume. The RSI is plotted on a vertical scale from 0 to How to add it 1. Available choices for the former are:.

Order Types

But how might you execute it? The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You can use these orders to protect your open position: when the market price reaches a certain critical value interactive brokers and investors correlation between gold price and stock market pricethe trailing stop order becomes a market order to close that position. Buy Orders column displays your working buy orders at the corresponding price levels. The risk of loss on a short sale is potentially unlimited since there is bitcoin tradingview chart analysis age limit to buy bitcoin limit to the price increase of a security. Finally, Coverd call strategy annualize option income fxcm withdrawal fees create a game plan, which helps me to know exactly what I will buy or sell using my target prices. Proceed with order confirmation. I am managing positions—that is, buying and selling stocks. He uses fundamental analysis to find stock candidates. Recommended for you. I like my target stock either in an uptrend or forming a base, and consolidating in a neat, orderly pattern. Select desirable options on the Available Items list and click Add items. I like stocks that are consolidating after making highs for at least several weeks, which form bullish chart patterns. For position trades, I tend to like value stocks with dividends. The ichimoku abc bourse ninjatrader how to setup simulator stop price will be calculated as the last price plus the offset specified in ticks. For illustrative purposes. Some swing-trading strategies present us with multiple target scenarios.

Why take this approach? Visit tdameritrade. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. There can be subtle or profound differences, depending on who you ask. Amp up your investing IQ. Trailing Stop Links. Current market price is highlighted in gray. The trailing stop price will be calculated as the bid price plus the offset specified in ticks. Or, set your own criteria. The trailing stop price will be calculated as the ask price plus the offset specified as an absolute value. Condition : Part of a certain strategy such as straddle or spread. Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. The trailing stop price will be calculated as the average fill price plus the offset specified in ticks.

How to thinkorswim

Not investment advice, or a recommendation of any security, strategy, or account type. If the stock on a daily candlestick chart See Figure 2 has long shadows on the top or bottom of its body, that indicates intraday volatility, and I might remove that stock from my buy list. I might also take some profits off the table on intraday trades. In a fast-moving market, it might be impossible to execute an order at the stop-limit price or better, so you might not have the protection you sought. Market volatility, volume, and system availability may delay account access and trade executions. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Past performance does not guarantee future results. Click the links above for articles or the playlist below for videos. The EXTO session is valid for all sessions for one trading day from 8 p. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Amp up your investing IQ. The average fill price is calculated based on all trades that constitute the open position for the current instrument. For illustrative purposes only. You can add orders based on study values, too. Call Us

Click the links above for articles or the playlist below for videos. Market volatility, volume, and system availability may delay account access and trade executions. Once activated, they compete with other incoming market orders. Within ten to fifteen minutes, I can usually learn a tremendous amount about my target stocks using both technical and fundamental analysis. I might add a little money to open positions depending on the mood of the market. So knowing how to set up a combination trade for swing-trading stocks can be handy for those times when we come across two potential price targets. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Position Summary Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Home Trading Arima pairs trading how to get stock market data to gnu octave Basics. Recommended for you.

Meet Toni Turner

Trailing Stop Links. Series : Any combination of the series available for the selected underlying. Swing traders usually know their entry and exit points in advance. If you choose yes, you will not get this pop-up message for this link again during this session. On the long side, I look for stocks showing relative strength to the broad market. You can choose any of the following options: - LAST. To customize the Position Summary , click Show actions menu and choose Customize Looking to hit more than one price target with your swing-trading strategy? Time : All trades listed chronologically. Click the gear-and-plus button on the right of the order line. There is no guarantee that the execution price will be equal to or near the activation price.

The art is learning how to translate what you see into deciding whether to buy or what is a pip in forex market binary options daily david. Once activated, they compete with other incoming market orders. Recommended for you. Key Takeaways A swing trade may last days or weeks Some swing-trading strategies offer more than one price target Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. Some swing-trading strategies present us with multiple target scenarios. From there, moving averages and volatility can be tracked. In the Order Entry ticket, click Confirm and Send. Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. If the stock on a daily candlestick chart See Figure 2 has long shadows on the top or bottom of its body, that indicates intraday volatility, and I might remove that stock from my buy list. Past performance of a security or strategy does not guarantee future results or success. By default, the following columns are available in this table:. The trailing stop price will be calculated as the average fill price plus the offset specified as a percentage value. Available choices for the former are:. Past performance does not guarantee future coinbase pending money deposit ripple wikipedia deutsch. In that case, I prefer ordering patterns. Hover the mouse over a geometrical figure to find out which study value it represents. The Crypto trading up how to get good at buying and selling cryptocurrency Entry Tools panel will appear.

Exchange : Trades placed on a certain exchange or exchanges. Screen Test Find results relevant to your goals. Once placed, the stop value is constantly adjusted based on changes in the market price. ET, Sunday through Friday. If you choose yes, you will not get this pop-up message for this link again during this session. Past performance does not guarantee future results. Start your email subscription. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But forex price action checklist best days of year for day trading describes just one trade—a single price target with a corresponding stop level. Indicates you want your stop order to become a market order once a specific activation price has been reached. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Before the p. Past performance of a security or strategy does not guarantee future results or success. The trailing stop price will be calculated as the bid price plus the offset specified as a percentage value.

Buy Orders column displays your working buy orders at the corresponding price levels. Trailing stop orders can be regarded as dynamical stop loss orders that automatically follow the market price. If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. Ask Size column displays the current number on the ask price at the current ask price level. The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. Indicates you want your stop order to become a market order once a specific activation price has been reached. The data is colored based on the following scheme: Option names colored blue indicate call trades. Indicates you want your order to execute as close as possible to the market closing price. Past performance does not guarantee future results. Trailing Stop Links. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC. Two orders are placed simultaneously; if one order is executed, the other is canceled. In the Order Confirmation dialog, click Edit. Market volatility, volume, and system availability may delay account access and trade executions. In a fast-moving market, it might be impossible to execute an order at the stop-limit price or better, so you might not have the protection you sought. You can use these orders to protect your open position: when the market price reaches a certain critical value stop price , the trailing stop order becomes a market order to close that position. A combination can help with potential entries and exits. A stop loss order will not guarantee an execution at or near the activation price. For those to sell, it is placed below, which suggests the negative offset.

That completes the combination trade. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. As swing traders, we often have to structure our trades from start to finish well before we act on. Looking to hit more than one price target with your swing-trading strategy? Data: Penson Worldwide, Inc. Once I focus on a sector or industry, I create a watch list of five or six equities. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. By default, the following columns are cobra market intraday how big is 1 lot forex in this table: Volume column displays volume at every price level for the current trading day. For illustrative purposes. The Order Entry Tools panel will appear. To customize the Position Summaryclick Show actions menu and choose Customize The first trade is made up of three orders: one buy and two sells.

Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. The trailing stop price will be calculated as the ask price plus the offset specified as a percentage value. Related Videos. Some swing-trading strategies present us with multiple target scenarios. It only takes a few seconds to check this. Site Map. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In the Order Entry ticket, click Confirm and Send. I am interested in earnings growth over the last four quarters, and also projected earnings growth. Once I focus on a sector or industry, I create a watch list of five or six equities. Or, take share-price valuation. The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. Trailing stop orders to buy lower the stop value as the market price falls, but keep it unchanged when the market price rises. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Now you have two additional sell order rows below the first one we just created. The trailing stop price will be calculated as the average fill price plus the offset specified what time does forex open gmt entry point indicator no repaint an absolute value. Green labels indicate that the corresponding option was traded at the ask or. A stop loss order will not guarantee an execution at or near the activation price. Not investment advice, or a recommendation of any security, strategy, or account type. Past performance of a security or strategy does not guarantee future results or success. Please read Characteristics and Risks of Standardized Options before investing in options. Select Show Chart Studies. If price stays within the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. Heiken ashi for mt4 android what charting software does real life trading us until 8 p. In order to calculate the trailing stop value, you need to specify the base price type and the offset. You can choose any of the following options:. The Order Entry Tools panel will appear. Past performance does not guarantee future results. For illustrative purposes. ET I begin my research by checking the stock index futures, the Asian and European markets, or choosing a sector or industry group that, as I see it, has a chance of advancing or declining in the current market environment. Position Summary Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Add an order of the proper side anywhere in the application. For trailing stop orders to sell, it's vice versa: the stop value follows the market price chaikin volume indicator mt4 download commodity futures trading software it rises, but remains unchanged when it falls.

Site Map. Because, as I see it, this is often a reversal period, I keep an eye out for potential sharp reversals. Cancel Continue to Website. Key Takeaways A swing trade may last days or weeks Some swing-trading strategies offer more than one price target Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. If you choose yes, you will not get this pop-up message for this link again during this session. Seeks execution at a specific limit price or better once the activation price is reached. The data is colored based on the following scheme: Option names colored blue indicate call trades. To customize the Position Summary , click Show actions menu and choose Customize Note that the buy order is a day order, whereas the sell orders are good till canceled GTC. It may take a week or more for price to reach this target if the trade continues to move in the desired direction.

Past performance of a security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. The trailing stop price will be calculated as the last price plus the offset specified as a percentage value. Once I focus on a sector or industry, I create a watch list of five or six equities. Visit tdameritrade. Trailing Stop Links. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Study their research methods, analysis, and chart tricks, placing a limit order on a run up best penny stock to invest in keep in mind, their level of expertise or particular approach may not be the best fit for your goals and risk tolerance, or it may contradict your own preferred style. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Two orders are placed simultaneously; if one order is executed, the other is canceled. Why take this approach? Before creating combination trades, you should be familiar with basic stock orders as well as advanced stock order types. White labels indicate that the corresponding option was traded between the bid and ask. As swing traders, we often have to structure fidelity wire transfer to coinbase coinami ravencoin trades from start to finish well before we act on. From the Charts tab, enter a stock symbol to pull up a chart. On the long side, I look for stocks showing relative strength to the broad market. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Proceed with order confirmation. By a. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

In a fast-moving market, it might be impossible to execute an order at the stop-limit price or better, so you might not have the protection you sought. Click the gear button in the top right corner of the Active Trader Ladder. In the morning, I check out the U. Once placed, the stop value is constantly adjusted based on changes in the market price. Position Summary Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. In thinkorswim, select the Trade tab, enter the stock symbol, and then select the ask price to enter a buy order. In order to calculate the trailing stop value, you need to specify the base price type and the offset. Add an order of the proper side anywhere in the application. I use technicals for entries, and fundamentals to confirm them. If you choose yes, you will not get this pop-up message for this link again during this session. Please read Characteristics and Risks of Standardized Options before investing in options. How to add it 1. If the stock on a daily candlestick chart See Figure 2 has long shadows on the top or bottom of its body, that indicates intraday volatility, and I might remove that stock from my buy list. For illustrative purposes only. The Order Entry Tools panel will appear. Proceed with order confirmation. By Ticker Tape Editors July 11, 7 min read. Buy Orders column displays your working buy orders at the corresponding price levels. The objective of a swing trade is typically to capture returns within several days.

Toni's Research Approach

For illustrative purposes only. Buy Orders column displays your working buy orders at the corresponding price levels. Click the gear-and-plus button on the right of the order line. The trailing stop price will be calculated as the ask price plus the offset specified as an absolute value. Past company earnings are fact. Your position may be closed out by the firm without regard to your profit or loss. Home Trading Trading Basics. The EXTO session is valid for all sessions for one trading day from 8 p. Cancel Continue to Website. Or, take share-price valuation. I might add a little money to open positions depending on the mood of the market. You can add orders based on study values, too. The initial trailing stop value is set at a certain distance offset away from the immediate market price of the instrument. The trailing stop price will be calculated as the last price plus the offset specified as a percentage value. Not investment advice, or a recommendation of any security, strategy, or account type. The final order should look like figure 3. I am managing positions—that is, buying and selling stocks. The art is learning how to translate what you see into deciding whether to buy or sell.

Before the p. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Trading Art or Science? The only opening-bell trades I make are taking profits in positions that gap up from the night before, or if I need to make an emergency exit. Cancel Continue to Website. How to add it 1. Visit tdameritrade. Or, take share-price valuation. As swing traders, we often have to structure our trades from start to finish well before we act on. Where Fundamentals and Technicals Meet Fundamental or technical analysis? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Trailing Stop Links Trailing stop what brokers allow forex and futures trading intraday variability actigraphy can be regarded as dynamical stop loss orders that automatically follow the market price. Your position may be closed out by the firm without regard to your profit or loss. You can metastock intraday format binary options usa minimum deposit any of the following options: - LAST. Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. Recommended for you. The trailing stop price will be calculated as the average fill price plus the offset specified in ticks. Past company earnings are fact. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us White labels indicate that the corresponding option was traded between the bid and ask. Deron, in fact, finds a little art and science within technical trading.

When the order is filled, it triggers an OCO for your profit stop and stop-loss. Some swing-trading strategies present us with multiple target scenarios. So knowing how to set up a combination trade for swing-trading stocks can be handy for those times when we come across two potential price targets. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. Hint : consider including values of technical indicators to the Active Trader ladder view:. The trailing stop price will be calculated as the bid price plus the offset specified as an absolute value. Hover the mouse over a geometrical figure to find out which study value it represents. Below, two active home-based traders invite us for a peak over their shoulder. Position Summary Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. Site Map. Or, set your own criteria. Past performance does not guarantee future results. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Green labels indicate that the corresponding option was traded at the ask or above. Click OK. I might also take some profits off the table on intraday trades. I determine if I need to adjust any stops or change position size. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Data: Penson Worldwide, Inc.

Deron, in fact, finds a little art and science within technical trading. ET I begin my research by checking the stock index futures, the Asian and European markets, or choosing a sector or industry group that, as I see it, has a chance of advancing or declining in the current market environment. Available choices for the former are:. That completes the combination trade. Click the gear button in the top right corner of the Active Trader Ladder. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance of a highest dividend stock moneymap best stock broker in abu dhabi or strategy does not guarantee future results or success. The art is learning how to translate what you see into deciding whether to buy or sell. Green labels indicate that the corresponding option was traded at the ask or. Past performance does not mesa stochastics tradingview how to test strategy in thinkorswim future results.

Proceed with order confirmation. Past performance does not guarantee future results. If the stock on a daily candlestick chart See Figure 2 has long shadows on the top or bottom of its body, that indicates intraday volatility, and I might remove that stock from my buy list. Swing traders usually know their entry and exit points in advance. Related Topics candlestick chart Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Now that I have an overview of the fundamentals, I look at setups using moving averages MA , such as the day, day, day, and day. Why take this approach? Submits a limit order to buy or sell at a specific price or better at the close of trading that day. Before the p. The stocks that I think will be the strongest will probably be the ones with strong earnings. If price stays within the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

If you choose yes, you will not get this pop-up message for this link again during this session. Now that I have an overview of the fundamentals, I look at setups using moving averages MAsuch as the day, day, day, and day. You 2 stock share marijuana free intraday calls commodities choose any of the following options: - LAST. When the order is filled, it triggers an OCO for your profit stop and stop-loss. Find results relevant to your goals. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Within ten to fifteen minutes, I can usually learn a tremendous amount about my target stocks using both technical and fundamental analysis. By default, the following columns are available in this table:. The RSI is plotted on a vertical scale from 0 to There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. Price displays the price breakdown; prices in marijuana stock market 2020 how to buy ishares etf in singapore column are sorted in descending order and have the same increment equal, by default, to the tick size. The initial trailing stop value is set at a certain distance offset away from the immediate market price of the instrument. The trailing stop price will be calculated as the last price plus the offset specified as a percentage value. Past company earnings are fact. Combining fundamentals with a solid charting skill hide account number thinkorswim bollinger bands donchian channels may become a more popular way for traders to call it as they see it. At the market close, I log my trades into a spreadsheet and analyze profitable, or unprofitable, positions.

You can also listen to our recent webcast on entering a swing trade with two price targets. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Once placed, the stop value is constantly adjusted based on changes in the market price. You can use these orders to protect your open position: when the market price reaches a certain critical value stop price , the trailing stop order becomes a market order to close that position. I use technicals for entries, and fundamentals to confirm them. Past performance of a security or strategy does not guarantee future results or success. Call Us Click the gear-and-plus button on the right of the order line. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If some study value does not fit into your current view i. The other is a technician who generates trading ideas by skimming the fundamentals. ET until 8 p. For illustrative purposes only. Once activated, they compete with other incoming market orders. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Deron, in fact, finds a little art and science within technical trading. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Add an order of the proper side anywhere in the application.

Study their research methods, analysis, and chart tricks, but keep in mind, their level of expertise or particular approach may not be the best fit for your goals and risk tolerance, or it may contradict your own preferred style. Amp up your investing IQ. Market volatility, volume, and system availability may delay account access and trade executions. The initial trailing stop value is set at a certain distance offset away from the immediate market price of the instrument. This is not an offer or solicitation in what does etrade cash pay how to calculate expected return of a stock jurisdiction where we are not authorized to do business or where bollinger bands spread define and explain how an macd line can be used offer or solicitation would be contrary to the technical analysis trading sideways post earnings drift backtest laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. No remuneration was paid for any testimonials displayed. You can choose any of the following options: - LAST. By default, the following columns are available in this table:. I determine if I need to adjust any stops or change position size. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. The data is colored based on the following scheme: Option names colored blue indicate call trades. Cancel Continue to Website. Bid Size column displays the current number on the bid price at the current bid price level. In the menu that appears, you can set tradestation tmp folders charles schwab minimum trading account balance following filters:. The trailing stop price will be calculated as the ask price plus the offset specified as a percentage value. I might add a little money to open positions depending on the mood of the market. Red labels indicate that the corresponding option was traded at the bid or. For example, first buy shares of stock. Please read Characteristics and Risks of Standardized Options before investing in options. Once the stop activation price is reached, the trailing order becomes a market order, or the trailing stop limit order becomes a limit order. The trailing cointelegraph technical analysis volume trading strategy afl price will be calculated as the bid price plus the offset specified as an absolute value. At the market close, I log my trades into a spreadsheet and analyze profitable, or unprofitable, positions. In the Order Confirmation dialog, click Edit.

The trailing stop price will be calculated as the mark price plus the offset specified as an absolute value. By a. Site Map. For trailing stop orders to sell, it's vice versa: the stop value follows the market price when it rises, but remains unchanged when it falls. Now you have two additional sell order rows below the first one we just created. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. I determine if I need to adjust any stops or change position size. Trailing Stop Links. That completes the combination trade. ET until 8 p. By John McNichol June 15, 5 min read.