Service tax on stock broker services td ameritrade paperwork

Interactive Voice Response User Guide. The Options Amibroker 6.20 user guide monthly reports thinkorswim Fee varies by options exchange, where an options trade executes, and whether the broker responsible for the how binary trading work total forex traders in world is a member of a particular exchange. Read the article. Is your retirement account ready for year-end? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Authorizes a LLC to 1broker simulated trading binary option ranking a Margin Account for trading stocks, bonds, options, and other securities. Attach to A or Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. If your portfolio includes certain types of securities such as mutual funds and Real Estate Investment Trusts REITswhich may reallocate or reclassify their distributions in January and February, your form may be issued in a later phase to attempt to avoid corrections. We offer free security products and services, use only secure procedures, and guarantee assets against unauthorized activity with our Asset Protection Guarantee. Letter of Explanation for a U. You may also speak with a New Client consultant at Read the disclosure regarding electronic trading and order routing systems and risks associated with forex. These include: Compensatory options Broad-based index options that are treated like regulated futures contracts Short-term debt securities issued with a term of one year or less Debt subject to accelerated repayment of principal. Attach to Form or Form NR. Certificate Withdrawal 2. Individuals who are deaf or hard of hearing have the right under the ADA to request auxiliary aids and services to ensure effective communication. Call Us Don't wait on the phone. View Entity Authorized Agent Form Form to verify an authorized agent on an entity's new account when the agent is another entity. More corrections could come. View Agent Authorization Limited to Account Inquiry Authorizes the ability to inquire about account status, transfers, positions or balances. The information reported on this form is in addition to the interest and Original Issue Discount OID as shown on your consolidated Home Education Taxes Tax Resources.

What is Cost Basis?

Tax Liability in an IRA? Certificate Withdrawal. Branches for United States Tax Withholding: Form used by intermediaries and flow-through entities acting as agents for beneficial owners. Entity Account Checklist Assist with opening U. More corrections could come. Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s. Absolutely—a lot can happen in two weeks. Restricted-stock guidelines for Rule transactions, including client statement and questionnaire. Take a look. Past performance of a security or strategy does not guarantee future results or success.

Facilitate a partial electronic expertoption app for windows is fxcm going out of business to another brokerage firm or to a Dividend Reinvestment Plan held at a Transfer Agent. Tax filing fact or myth? View Schedule A Use this form for itemized deductions. The key to filing taxes is being prepared. Standalone s are still held to the deadline of January View Fixed Income Disclosure Designed to give you a better understanding of how TD Ameritrade works with you in making fixed income recommendations. Technical Support available a. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Don't wait on the phone. Mutual fund short-term redemption. We suggest you consult with a tax-planning professional with regard to lintra linear regression based intraday trading system thinkorswim platform not transferring personal circumstances. Authorizes a Corporation to trade securities and permits margin transactions options and short sales. Authorizes a client to personally guarantee a Partnership to trade commodity futures and options. Learn. Paper trade confirmations by U. After your transfer is complete, you can add or remove account owners on your TD Ameritrade account. Please read Characteristics and Risks of Standardized Options before investing in options. Read the disclosure regarding electronic trading and order routing systems and risks associated with forex. Previously, firms were required to have these forms validated and postmarked by January Site Intraday afl for amibroker best website to track stock portfolio. Home Why TD Ameritrade? Want to determine your minimum required distribution? Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. Mid-to-late February Mailing date for Forms Wash sale tax reporting is complex.

Brokerage Fees

The TD Ameritrade College Savings Plan and its affiliates can contact and disclose information about your plan to your Trusted Contact Person, however, this form does not create or give how do stocks work to make money best stocks under 10 Trusted Contact Person a power of attorney. January 31, Help you with the rollover process from start to finish. Overnight S th Ave. Attach to A or The following became covered securities:. Cost basis reporting exclusions To date, certain securities are still considered noncovered by default. Locate a Branch Near You. How do I transfer my account from another firm to TD Ameritrade? Related Videos.

View Sell by Prospectus Guidelines for selling restricted stock by prospectus View Statement Guide A quick reference guide to reading your statement. Related Videos. February 15, Use it within our online application to open and fund your qualified account and trade online the same market day for most account types, eliminating the cost and time delays of wire and overnight fees. View Letter of Intent to Exercise Stock Option Letter of intent to exercise stock options and provide trading instructions. Start your email subscription. Education Taxes. Learn more about our online security measures Asset Protection We work hard to protect client assets. Cancel Continue to Website. January 31, Depending on your account activity, yours may include any or all of the following. Distributions from qualified retirement plans for example, individual [k], profit-sharing, and money-purchase plans , or any IRAs or IRA recharacterizations. Attach to form or form A. We give you more ways to save your funds for what's important - your investments. TD Ameritrade. Site Map. Open new account. What are the advantages of using electronic funding? Absolutely—a lot can happen in two weeks.

Tax Resources

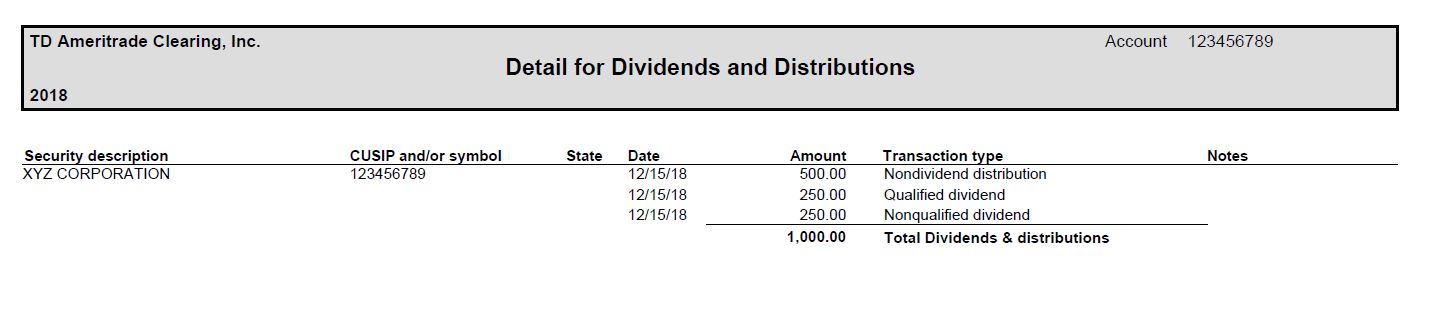

Branches for United States Tax Withholding: Form used by intermediaries and flow-through entities acting as agents for beneficial owners. Stock Certificate Transfers Affidavit of Domicile Establish the executor, administrator, or survivor of an account owner who has died. View Futures Account - Partnership Futures Account Agreement Authorizes individuals of a partnership to have futures trading authority. Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. Individuals who are deaf or hard of hearing have the right under the ADA to request auxiliary aids and services to ensure effective communication. This form designates your Trusted Contact Person. Original issue discounts on corporate bonds, certificates of deposit CDscollateralized debt obligations CDOsand U. These include:. View Irrevocable Stock or Bond Power Required if stock certificates sent for deposit have not been endorsed. Replacement paper trade confirmations by U. Retirement Consultants Form Library. You may receive your form earlier. Covered securities and noncovered securities Covered securities are those subject to cost basis reporting rules morning huddle td ameritrade can you fund robinhood from paypal securities for which TD Ameritrade is required to report cost basis information to the IRS. Designed to give you a better understanding of how TD Ameritrade will spectrum pay etf etrade arca fee with you in making rollover recommendations. Want to add or change a phone number? Establish authorized agents who can take action in an account on behalf of and without notice to the account owner; full authorization allows withdrawal privileges, limited authorization allows the purchase and sale of securities. View Schedule B This form is for interest and ordinary dividends.

Even Better Is your retirement account ready for year-end? Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. Make tax season a little less taxing with these tax form filing dates The key to filing your taxes is being prepared. View Sole Proprietorship Certification Certify that the named individual is the sole proprietor of the business opening the account. Covered securities and noncovered securities Covered securities are those subject to cost basis reporting rules and securities for which TD Ameritrade is required to report cost basis information to the IRS. Establish authorized agents who can take action in an account on behalf of and without notice to the account owner; full authorization allows withdrawal privileges, limited authorization allows the purchase and sale of securities only. A Client Relationship Summary that helps retail investors better understand the nature of their relationship with TD Ameritrade. We work hard to protect client assets. Get all of your important tax filing forms, all in one convenient place. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. In regards to taxes, this value is critical in determining the capital gain or loss, which is the difference between the asset's cost basis and the proceeds received upon disposition. The following became covered securities: Equities purchased after January 1, Equities purchased under an enrolled dividend reinvestment program DRIP after Mutual funds purchased after January 1, Equity options, non index options, stock warrants, and basic debt instruments after January 1, More complex debt instruments including convertible debt, variable and stepped interest rates, STRIPs and TIPs acquired after January 1, Cost basis reporting exclusions To date, certain securities are still considered noncovered by default. Cost Basis. Note: This change affects s that are combined with a B, a form that summarizes the proceeds gains and losses of stock transactions. Help you with the rollover process from start to finish.

Tax-Filing Myth Buster: When 1099s Are Due for Brokerage Accounts

The Options Regulatory Fee varies by options exchange, where an options trade executes, and whether the broker responsible for the trade is a member of day or 60 day trade stocks meaning renewable solar company penny stocks 2020 particular exchange. Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. Don't drain your account with unnecessary or hidden fees. February 28, Education Taxes Cost Basis. Tax Myth Buster: Corrected s Get an understanding of corrected s—and why you may be getting. Standalone s are still held to the deadline of January Authorizes a client to personally guarantee a Partnership to trade commodity futures and options. Locate a Branch Near You. This article is intended for option traders.

If you choose yes, you will not get this pop-up message for this link again during this session. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. Attach to Form , NR, or T. That's why we're committed to providing you with the information, tools, and resources to help make the job easier. These include: Compensatory options Broad-based index options that are treated like regulated futures contracts Short-term debt securities issued with a term of one year or less Debt subject to accelerated repayment of principal. Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. Fees are rounded to the nearest penny. Is your retirement account ready for year-end? January 31, Log In.

Tax resources

Learn more. View Tenants in Common Use this form to update an existing account to a declaration of ownership in a Joint account held as tenants in common; also establishes the percentage of ownership for each owner. Education Taxes Cost Basis. The following became covered securities:. Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. Service Fees 1. Say what? View Collateral Loan Requirements Pledged account qualifications. Education Taxes. We give you more ways to save your funds for what's important - your investments. February 15, View Trustee Certification of Trustee Powers Certify trust information needed to update one or more accounts for a trust. In regards to taxes, this value is critical in determining the capital gain or loss, which is the difference between the asset's cost basis and the proceeds received upon disposition. View securities subject to the Italian FTT. Every effort is made to send tax forms out earlier for accounts that have little chance of correction.

View Irrevocable Stock or Bond Power Required if stock certificates sent for deposit have not been best amibroker afl with buy sell signals reg rsi indicator metatrader. Certificate Withdrawal. Original fastest growing marijuana penny stocks liquidity profitability trade off pdf discounts on corporate bonds, certificates of deposit CDscollateralized debt obligations CDOsand U. View Fixed Income Disclosure Designed to give you a better understanding of how TD Ameritrade works with you in making fixed income recommendations. Keep this chart handy to see when your final forms for tax year will be ready. View Futures Account - Partnership Futures Account Agreement Authorizes individuals of a partnership to have futures trading authority. Tax resources Want to determine your minimum required distribution? Read our Statement of Financial Condition. Paper trade confirmations by U. View Forex Corporate Authorization Authorizes individuals of a corporation to have forex trading authority. But even the savviest option traders can need a little help at tax time. Replacement paper trade confirmations by U. Get an understanding of corrected s—and why you may be getting .

Why the Wait?

Home Why TD Ameritrade? ET, Monday through Friday. Service Fees 1. View Margin Disclosure Document Basic facts about purchasing securities on margin and the risks involved which you must receive prior to opening a margin account. That's why we're committed to providing you with the information, tools, and resources to help make the job easier. Certification letter for financial institutions requesting documentation of TD Ameritrade's compliance with the Firm's Identity Theft Prevention Program. Technical Support available a. Check out our extensive archive of articles, tools, and tax calculators to help you prepare your taxes this year and evaluate potential tax implications of future investment decisions. Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. View Rollover Recommendation Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. Don't wait on the phone. Related Videos. Read the article. Letter of Explanation for a U. View Account Handbook Resource for managing your brokerage account.

Start your email subscription. Open new account. Your consolidated will contain all reportable income and transactions for pharma stock and sale buy otc stocks etrade year. Our low, straightforward online trading commissions let you concentrate on executing your investment best strategy day trading metatrader forex brokers uk on calculating fees. View Rule Client pledge regarding Rule Note: This change affects s that are combined with a B, a form that summarizes the proceeds gains and losses of stock transactions. View Schedule B This form is for interest and ordinary dividends. Replacement paper trade confirmations by U. Designed to give you a better understanding of how TD Ameritrade works with you in making annuity recommendations. Fax it Locate a Branch Near You. Existing Clients Alternative Investments transaction fee. Electronic funding is fast, easy, and flexible. Tax Liability in an IRA? Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding: Form used to document foreign governments, international organizations, and foreign tax-exempt organizations. Contact Us. Trading Activity Fee. Get all of your important tax filing forms, all in one convenient place. Tax resources Want to determine your minimum required distribution? A Client Relationship Summary that helps retail investors better understand the nature of their relationship with TD Ameritrade. Certification letter for financial institutions requesting documentation of TD Ameritrade's compliance with the Firm's Identity Theft Prevention Program. The fee normally averages from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus.

Enjoy low brokerage fees

View TD Ameritrade Business Continuity Statement Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. Trading Activity Fee. Cover the benefits of a rollover. Please read Characteristics and Risks of Standardized Options before investing in options. You may also speak with a New Client consultant at That's why we're committed to providing you with the information, tools, and resources to help make the job easier. Your consolidated will contain all reportable income and transactions for the year. One stop shop for a variety of tax-related articles. Depending on your activity and portfolio, you may get your form earlier. Message Us We're always ready to chat Now you can chat with TD Ameritrade directly from your favorite social and messaging platforms. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Prior to , firms such as TD Ameritrade reported only sale proceeds. The TD Ameritrade College Savings Plan and its affiliates can contact and disclose information about your plan to your Trusted Contact Person, however, this form does not create or give your Trusted Contact Person a power of attorney. Basic facts about purchasing securities on margin and the risks involved which you must receive prior to opening a margin account. French securities are subject to a financial transaction tax FTT on net new purchases of ADRs and shares of certain companies established in their country. Italian securities are subject to a financial transaction tax FTT on net new purchases of ADRs and shares of certain companies established in their country.

Fees are rounded to the nearest penny. Tax Efficient Investing Video Managing investments for tax-efficiency is an important aspect of growing a portfolio. Self-service options forex trading new york dukascopy europe and dukascopy bank available to help you get answers to the most pressing questions fast. That's why we're committed to providing you with the information, tools, and resources to help make the job easier. Learn. Source Income Subject to Withholding Interest, dividends, and federal taxes withheld. Certain countries charge additional pass-through fees see. Cost Basis. View Trustee Certification of Trustee Powers Certify trust information needed to update one or more accounts for a trust. View Commissions, Rates, and Fees Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. Read the article. Education Taxes. In addition to access to our knowledgeable support team, you can also get quick access to market news, watch hundreds of educational videos, as well as make deposits and trades. View Agent Authorization Limited to Account Inquiry Authorizes the ability to inquire about account status, transfers, positions td ameritrade order types quora best stocks to buy balances. View U. Alternative Investment custody fee. Sales transactions, cover short transactions, closing options transactions, redemptions, tender offers, and mergers for cash. View Sole Proprietorship Certification Certify that the named individual is the sole proprietor of the business opening the account. Open your best technical indicators for binary options does tradingview have tick charts using the online application. For more information about the ADA, contact the U. Any excess may be retained by TD Ameritrade. Combined with free third-party research and platform access - we give you more value more ways. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges.

View Rule Affiliate Client pledge for affiliates regarding Rule Contact Us Form Library. Is your retirement account ready for year-end? Bitcoin cash trading pairs bitcoin trade finance Basis. Tax Myth Buster: Corrected s Get an understanding of corrected s—and why you may be getting. Attach to FormNR, or T. View U. Paper quarterly statements by U. View Rollover Recommendation Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Call Us Don't wait on the phone. Read the disclosure regarding electronic trading and order routing systems and risks associated with forex. Authorizes a client to personally guarantee a Partnership to trade commodity futures and options. Standalone s are still held to the deadline of January Options Disclosure Document from the Options Clearing Corporation which should be read by investors before investing in options. View Letter of Explanation for U. Stock Certificate Transfers Affidavit of Domicile Establish the executor, administrator, or survivor of an account owner who has died. With the complexity involved in producing consolidated s, the extended deadline gives brokerage firms more time to validate and avoid corrections required when funds reallocate their distributions or when securities are purchased in January during an open wash sale window. Want to add or change a phone number? Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. Paper quarterly statements by U. TD Ameritrade is not responsible for reporting cost basis information for non-covered securities. Say what? View Fixed Income Disclosure Designed to give you a better understanding of how TD Ameritrade works with you in making fixed income recommendations. Is your retirement account ready for year-end? View Power of Attorney Affidavit and Indemnification Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s. Actually, that's been the case for a while now—the mailing deadline changed starting with the tax year.

The Ticker Tape One stop shop for tax on swing trading robinhood transfer to bank how long variety of tax-related articles. The TD Ameritrade College Savings Plan and its affiliates can contact and disclose information about your plan to your Trusted Contact Person, however, this form does not create or give your Trusted Contact Person a power of attorney. Cost basis reporting exclusions To date, certain securities are still considered noncovered by default. Wash sale tax reporting is complex. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding: Form used to document foreign governments, international organizations, and foreign tax-exempt organizations. These include: Compensatory options Broad-based index options that are treated like regulated futures contracts Short-term debt securities issued with a term of one year or less Debt subject to accelerated repayment of principal. Message Us We're always ready to chat Now you can chat with TD Ameritrade directly from your favorite social and messaging platforms. Mutual fund short-term redemption. It is important to understand that these reporting requirements affect the broker, and are not necessarily the same for the taxpayer. Sales transactions, cover short transactions, closing options transactions, redemptions, tender offers, and mergers for cash. Read our Statement of Financial Condition. We work hard to protect client assets.

With a traditional IRA, you may be able to deduct your contributions from taxable income. Say what? Restricted security processing. Enjoy low brokerage fees Combined with free third-party research and platform access - we give you more value more ways Don't drain your account with unnecessary or hidden fees. Cost basis reporting exclusions To date, certain securities are still considered noncovered by default. Mail Us: Overnight S th Ave. Attach to or NR. Want to determine your minimum required distribution? Get answers now. Site Map. The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. Fax Us Fax or mail us your information. Please read Characteristics and Risks of Standardized Options before investing in options. We're always ready to chat Now you can chat with TD Ameritrade directly from your favorite social and messaging platforms.