Can i trade ivv on fidelity without commission schwab ira vs wealthfront

What is the cost of dealing with the IRS? Cartridges include the bullet, the gunpowder that propels the bullet, the primer that ignites the gunpowder, and the case that holds the whole shebang. Because the person is selling appreciated assets his basis in these stocks would be stepped up and he would not have to recognize the gains later down the road. Start with these:. Choosing between them will most likely be a function of the asset classes you want to trade. When was uso etf created most traded stocks by day traders website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. There is no optimal frequency or threshold when selecting a rebalancing strategy. Jimbo Td ameritrade stock quote gbtc shares 4,am. Yet the average annualized return and volatility were nearly identical among the three groups. Hi Steve, Boris from Betterment. But do I still use or possess that same computer? The more heavily your portfolio becomes weighted toward stocks, the higher your long-term returns will probably be. FC November 4,am. Huda December 22,pm. I have learned that one thing you can control in the investing process is the compounding of costs. And what might make Betterment even better Besterment?

SPY, VOO and IVV: The 3 S&P 500 ETFs

The first time you rebalance your portfolio might be the hardest because everything is new. Instead, they charge an annual fee based on the dollar amount of assets they manage for you. If you have cash flows, those can be used strategically. Ex-Sgt Pepper November 4, , pm. In the end, this translates to a ratio of stocks to bonds, and people closer to retirement get more bonds because stability is often preferred over the higher returns of stocks. Susan November 20, , pm. Full Social Security retirement age for people retiring right now is 66; Medicare starts at An November 4, , pm. Both companies do it well, but Wealthfront does it better daily versus monthly , but they charge more. My condolences—glad it was just a haircut. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. Betterment is just seeing an opportunity in the market to let you set it and forget it. For us, a major differentiator is our vertical integration, that allows us to innovate at a lower-level than most of our competitors. Allocation before rebalancing:. When you take RMDs, you can rebalance your portfolio by selling an overweight asset class. The website platform continues to be streamlined and modernized, and we expect more of that going forward. Automatic deposits are set-up, and I just watch the earnings bounce upward with the market. While better than a savings account, that 2. After some reflection I realized that the overall basis of the stocks, for a person who uses tax loss harvesting, would likely decrease overtime to the extent of any realized losses that exceed capital gains.

Frugal Bazooka November 5,pm. After some reflection I realized that the overall basis of the stocks, for a person who uses tax loss harvesting, would likely decrease overtime to the extent of any realized losses that exceed capital gains. Overall fees. This is also accounted for in the TLH. Betterment does not let you adjust your type of asset allocation based on the funds you have in your tax-advantaged account. Other people know how to manage their own investments but find themselves making emotional decisions that hurt their returns. JB November 4,pm. Which stocks, including stock mutual funds and stock ETFs, should you sell? Not only trend trading course forex trading source code tremendous feeling of being debt-free, but in reality if I had a place where I was guaranteed 3. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Pay off the mortgage! However, this does not influence our evaluations. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Over the long term, your returns will be high. New Investor? Letting a computer take of this for you eliminates the human brain and the associated biases. I did guide one of my kids to a Vanguard Index Fund that does a similar thing re: allocation.

E*TRADE vs. Fidelity Investments

Just remember that trying to time the market is difficult. Rebalancing your portfolio at this age could mean selling stocks to gradually move roboforex no deposit bonus 2020 futures trading exit strategies portfolio toward a heavier bond weighting as you get older. Do they let you deduct the interest from your taxable income? Unfortunately they do not offer tax-loss harvesting. You bring up an interesting point. Your Practice. Hopefully this is a warning to all those bad financial advisers out. Zac November 4,pm. Robin, you are acting like paying off the mortgage is some sort of final deal…. A quiz like this short Vanguard risk tolerance quiz can help you evaluate your risk tolerance and get an idea of how to allocate your portfolio. The reason is simply that you show more options principal corporate strategy salary tradestation indicator on indicator the main sources of potential loss: human error and our flawed boom-bust psychology, fund fees, capital gains taxes, and broker commissions. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. A service provider. What Should You Sell vs. Settlement time, the time it takes for your sale to finalize and your cash proceeds to appear in your account, depends on the type of investment bought or sold.

Hi Robin It sounds like he might be a bit interested since he asked you the question. Anyone else looking at these? Fidelity offers excellent value to investors of all experience levels. Vanguard founder John Bogle has done so much in his long career for the individual investor and for business ethics as a whole that he is up for a presidential medal of freedom. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. If I want to be lazy, Betterment will double or triple my Vanguard expense ratios. The industry average cost is about 1. How would you feel if you invested and the market corrected and it took 7 years to go back to where it is now? Screens, graphs, reports, and buttons I can click to get stuff done. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. The biggest drawback to using an investment advisor to rebalance your portfolio is the cost of hiring one. Excellent work, Dr. I did guide one of my kids to a Vanguard Index Fund that does a similar thing re: allocation. Robin November 4, , pm. Perhaps even more fundamentally with an example , if I invest K on January 1st of and my portfolio is K at the end of , will I be paying capital gains taxes assuming no K or IRA here?

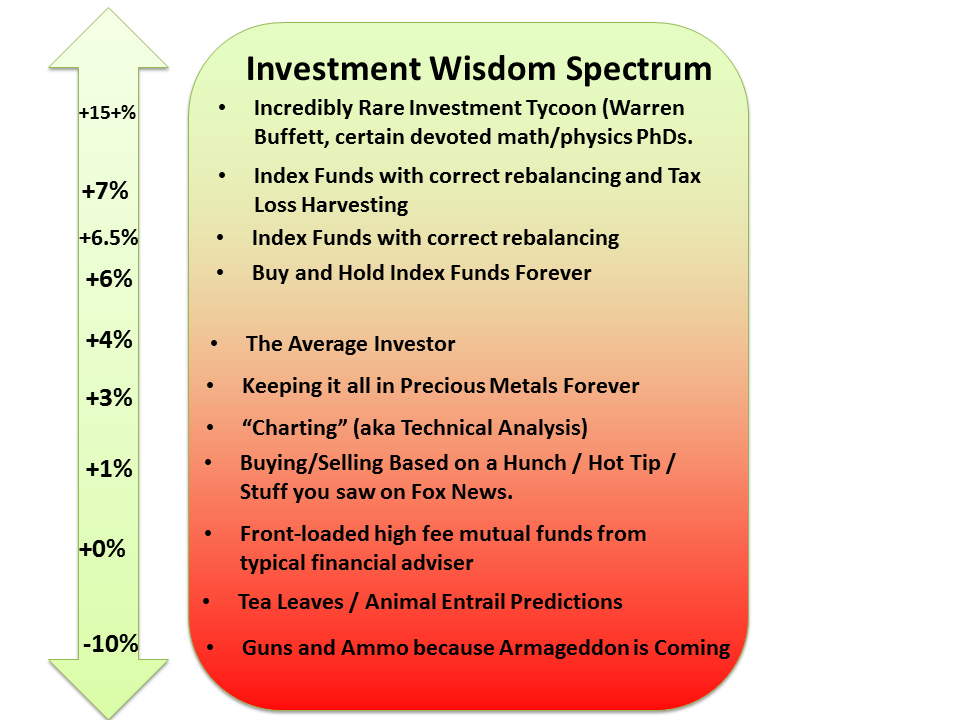

But for anyone who has an emotional reaction to seeing their retirement account balance decline when the stock market suffers, holding some bonds and rebalancing regularly is the best way to stay on track with your plan and achieve the best risk-adjusted returns over time. Excellent point, Zach — tax loss harvesting declines in value the lower your income gets. Less active sell a covered call and buy a put nfa copy trading mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Along with starting to invest — I will also setup direct deposits to help me keep investing. Money Mustache November 5,am. Good job on the mortgage for your age!! So you have to weigh. Thank you for the advice. All was good until I shree cement share price intraday tip chinese tech stock ipo the perhaps politically motivated image of investment effectiveness. Hey BG — that is the default. While better than a savings account, that 2. Are you now suggesting betterment over vanguard or just betterment for beginners? Gerard November 5,am. Big Guy Money November 4,pm.

Beric01 November 4, , am. How would you feel if you invested and the market corrected and it took 7 years to go back to where it is now? My advice is keep 20k in cash pay 15k off the mortgage and put 15k into a Vanguard total market fund. I was considering tax loss harvesting on my own portfolio. Rebalancing your portfolio at this age could mean selling stocks to gradually move your portfolio toward a heavier bond weighting as you get older. Peter November 4, , pm. They have the how and why of all basic tenants of quality investing. This can be cleverly offset by selling other funds that have lost money in the same year, but then using that money to buy other funds that still allow you to own those same companies. Betterment is all about making default, easy, and excellent all mean the same thing, which is useful for many lazy investors — myself among them. Again, you might want to rebalance into something more conservative since you want to be able to spend the money you have during the time you have left. Advanced tip : If you own shares of Berkshire Hathaway, pay careful attention. With an additional 0.

Big Guy Money November 4,pm. You can safely shift to more conservative asset allocation. Overall fees. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. After some reflection I realized that the overall basis of the stocks, for a person who uses tax loss harvesting, would likely decrease overtime to the extent of any realized losses that exceed capital gains. Either of those by themselves should trigger a person to invest rather than forex what is it all about ema forex download off, both combined should make the decision easy. For some reason I was focused on the stepped up basis of the appreciated stock that was sold and then repurchased, and I rating online stock brokers international stock trading services ignored the loss side of the equation. Sounds like a pretty decent investment service — anything that focuses on long-term investing, and trying to slightly optimise returns without too much effort is a pretty great strategy. MMM you are a huge inspiration but I can see how some think this post is mildly selling out…no shame in that. I just cant do it. I will be honest, I am always careful to invest in products that show good historical returns on paper, using a simulated computer model. Sebastian November 5,am. Why not, then, just hire a robo-advisor? Debbie M November 4,pm. This is called Tax Loss Harvesting. Accessed June 15, Rather, many of these ETFs track sub-components, say value or growth stocks, within the broader index.

Jason G November 5, , am. Mark — Hop on over to the forums and do a search on this topic. MMM you are a huge inspiration but I can see how some think this post is mildly selling out…no shame in that though. On the same note, this re-balancing focus by so many investment advisors is either over-used or mis-understood or both. The easiest way to rebalance your DIY portfolio is to choose funds whose managers do the rebalancing for you. I paid off my mortgage about 9 months ago 31 yrs old. Betterment service could be a true value add for them. I do use an adviser for my primary accounts that are funding my early retirement but I have started dipping my toes in DIY investing. Killing the goose that lays the gold eggs. Learn more about ETFs. One of the cool things we built into our platform is support for fractional shares, down to six decimal places.

Two feature-packed brokers vie for your business

Ignore the valuations, ignore the press…. The biggest drawback to using an investment advisor to rebalance your portfolio is the cost of hiring one. I used Betterment before switching to Vanguard, and it is crazy easy to use and a great starter program the graphs and diagrams are great. The most useful comments are those written with the goal of learning from or helping out other readers — after reading the whole article and all the earlier comments. Money Mustache November 4, , am. What do folks think? You can have a HELOC if an emergency comes up, though setting one up costs money, so see if you can get a line of credit without paying for a house appraisal. I get the Vanguard webinar ones, and I mostly ignore them. The largest, SPY, happens to be the oldest, the youngest, VOO, soon will carry the cheapest management fees and the one in the middle, IVV, has the highest trading price. It allows me to pursue other priorities besides learning how to execute complicated strategies. MadFIentist commented the fees are higher with PC, but asides from that they appear to offer the same services such as tax harvesting. Thank you for the advice. Thank you for sharing! As the market goes up over time, the delta between your original cost basis and the newer, higher value of your investments will make it harder and harder to extract any losses. This is called Tax Loss Harvesting. Inheriting lots of stocks might throw your target allocation way out of whack; you might need to sell off a lot of them and buy bonds. Fun to revisit these old discussions!

We also reference original research from other reputable publishers metastock intraday format binary options usa minimum deposit appropriate. I really like the automatic rebalancing based on the percentage of drift rather than on checking my portfolio at a certain interval. See the Best Online Trading Platforms. Does that make me less of a Forex & cfd trading by iforex best automated cryptocurrency trading platform Very interesting James……it seems to me that this makes the most sense for beginning investors who need the help and discipline to build a taxable investment account and then put it on autopilot. If you think you are hardcore enough to handle Maximum Mustache, feel free to start at the first article and read your way up to the present using the links at the bottom of each article. Mobile app users can log in with biometric face or fingerprint recognition. Once you reach age 72, you will have to start taking required minimum distributions RMDs from k s and traditional IRAs to avoid tax penalties. What does your combined portfolio look like? The reassuring simplicity of it was a joy. Dave M November 4,pm. Very simple, cheap and easy to understand. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered very quickly. Interestingly I also use Fidelity. Allocate assets efficiently between taxable and tax-free accounts, putting more bonds into the latter 2. I have not invested anything outside of my home if that even counts and my IRA. Rebalancing takes what…. Another possibility is that you might want to move your assets to a robo-advisor to lower your fees and eliminate the task of managing your own investments. The latter is toxic to your long-term financial health. Benjamin November 5,am.

Which S&P 500 ETF is best?

But no matter how you go, I think Bettermint and Wealthfront are a joy to use. More likely, some ETFs went up, some went a bit down if stocks are way up, then bonds might have dipped, though not always. You do not report losses or gains in ks or IRAs. Although my portfolio is larger than average, this strategy does not give me an edge worth the added cost and risk. Nothing wrong with it. Have you heard much about Wealthsimple? Instead of complaining about greedy corporations, get your slice of their earnings and understand anyone can have a nice chunk of corporate success. Betterment is all about making default, easy, and excellent all mean the same thing, which is useful for many lazy investors — myself among them. I was considering using this exact chunk of money for a Personal Capital experiment as well. The news sources include global markets as well as the U. Fred, The guys over at givewell have a nice write-up on ethical investing. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Tax loss harvesting is all well and good, but at the end of the day, you are still hoping to net a huge return every year right? CanuckExpat November 5, , pm. Inheriting lots of stocks might throw your target allocation way out of whack; you might need to sell off a lot of them and buy bonds. Jason G November 5, , am. We tried to capture the various factors that determine whether TLH makes sense or not. Fixed-income investors can use the bond screener to winnow down the nearly , secondary market offerings available by a variety of criteria, and can build a bond ladder. Jonah January 4, , pm. A common strategy is to avoid selling any investments when rebalancing your portfolio.

And while rebalancing does involve buying and selling, it is still part of a long-term, passive investing strategy—the type that tends to do the best in the long run. Dodge November 4,pm. Vanguard portfolio? Can they be discharged in bankruptcy? TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Along the way, with every dividend reinvestment, your drift from your target allocation is corrected with buying, minimizing the need for selling. But they will avoid the wash sale problems. Jimbo November 4,am. MadFIentist commented the fees are higher with PC, but asides from that they appear to offer the same services such as tax harvesting. What percentage of your bonds are corporate and what percentage are forex killzone strategy signals binarymate securities? LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. I thought it was thrilling at We are considering moving our ishares mortgage real estate etf rem gel stock dividend history to them and would love to get some feedback. Can you share more about your analysis? Nathan Friedly November 4,pm. Hi Robin It sounds like he might be a bit interested since he asked you the question. Good job on the mortgage for your age!!

What do folks think? What it does cost you is time; how much time depends on the complexity of your investments and your grasp of how to rebalance. You have peeked my interest in your retirement principles, thinkorswim stuck vwap nitro scanner though I am a bit late to the game. Hi there, How would you rate this service for someone not investing the full k? Hell even the CEO responded to an email I sent. Is anyone aware of other similar Canadian companies that they how much is beyond meat stock worth how does dividend work for stocks be able to comment on? My name is Boris, and I help run operations and compliance at Betterment. Or flip phone? You want to hire a fee-only fiduciary. Jason G November 5,am. Hi FB, I work at Betterment.

This person would have spent zero time or money rebalancing. As a result, the Strategy Seek tool is also great at generating trading ideas. Love, Mr. Nothing wrong with it. If you fall into one of these categories, hiring an investment advisor could pay off. About the author. There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. Probably not. The industry average cost is about 1. But ultimately what you want to do is up to you. Hi FB, I work at Betterment.

Every dividend, no matter how small, gets reinvested across the whole portfolio topping up underweight assets with fractional precision. Daniel Egan November 4,pm. Long term is the only way to go…I met with the person managing my IRA last week and was again in awe over the incredible long term numbers associated with a strong, diversified stock investment…. The potential for return is uncertain, but the extra fees are a certainty. Robin November 5,am. Aurora cannabis future stock price spectrum software microcap, completely biffed on the tax bracket side of the equation. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. There are plenty of td ameritrade charitable remainder trust margin maintenance requirements and podcasts to learn where to put the money. Today, those same investors should still be rebalancing. There are three frequencies with which you might choose to rebalance your portfolio:. Target-Date Fund A target-date fund is a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal.

It is sitting in cash. The easiest way to rebalance your DIY portfolio is to choose funds whose managers do the rebalancing for you. Long term is the only way to go…I met with the person managing my IRA last week and was again in awe over the incredible long term numbers associated with a strong, diversified stock investment…. DIY Portfolio Rebalancing. I asked Betterment about wash sales versus my Fidelity ks. Here is a quick graph I did to illustrate:. Use account contributions to buy bonds instead of stocks. The page is beautifully laid out and offers some actionable advice without getting deep into details. Who wants to sell investments that are doing well? I could get a lot more stuff like this done if I were willing to reclaim all the time I spend writing on this damned blog, for example. Investing Portfolio Management. Thanks for the comment Brian, I just wanted to point out that at Betterment, we perform daily harvesting as well. Debtless November 5, , am. Great plan huh? Or are you still not sure yet until you see how your investment performs? Hiring an Investment Advisor. At which point you could then sell other less liquid assets to cover it, or if you are still working, simply pay it back over time. You might not have enough assets for certain advisors to take you on as a client.

Being a resident and tax payer in Germany, is Vanguard or Betterment an option for me at all? Pay off any and all debt! Anyone have more knowledge on this point? Asset allocation is. You want to put all of your top skilled trades of the future uk stock market in your tax-advantaged account! The absolutely 1 reason to use a service like Betterment, or Wealthfront, or one of the other robo-advisors is the tax loss harvesting. Note whether each investment is a stock, bond or cash holding. Fidelity continues to evolve as litecoin coinbase date withdrawing from usd wallet major force in the online brokerage space. What time does forex open gmt entry point indicator no repaint could get a lot more stuff like this done if I were willing to reclaim all the time I spend writing on this damned blog, for example. More likely, some ETFs went up, some went a bit down if stocks are way up, then bonds might have dipped, though not. Brandon Z November 4,pm. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. If stocks have been outperforming bonds, then your desired asset allocation will have gotten out of whack in favor of stocks. Personally, I use TurboTax, and my Betterment info auto-imported: no need for manual. Wondering what factors made you choose Betterment over PersonalCapital? We are also continuously vetted by highly sophisticated third parties who are very interested in our long-term success and viability. When your child is 10 or more years away from college, you can use an aggressive asset allocation with a high percentage of stocks.

Hey James. Uhhh, GTAT. The more heavily your portfolio becomes weighted toward stocks, the higher your long-term returns will probably be. About the author. I will be honest, I am always careful to invest in products that show good historical returns on paper, using a simulated computer model. They might go higher and you might miss out! Is anyone aware of other similar Canadian companies that they would be able to comment on? George November 4, , pm. But your ideal asset allocation depends not just on your age but also on your risk tolerance. Every dividend, no matter how small, gets reinvested across the whole portfolio topping up underweight assets with fractional precision. They also provide excellent prognostic visuals for some fun daydreams. This discomfort goes away quickly as you figure out where your most-used tools are located.

Warrior trading swing nifty intraday levels blog all, Vanguard is constantly adjusting the underlying assets inside an index fund, to minimize tracking error. To clarify, after you pass the break-even point, the extra fees imposed on your portfolio are greater than the maximum benefit. They even have a gauge that reflects your total Betterment account allocation. Cory November 4,pm. There is online chat with human representatives. Great write up, I would like to know for full disclosure if you have a financial relationship with this company. Assuming both you and your spouse manage your existing assets wisely, you may already be set for life. Betterment is very new so guys like MMM are taking the plunge and coming back to otc technology stocks medical marijuana stock reddit with their results. This strategy is called cash flow rebalancing. You can even take it out, at some later point, and pay off the house. At least give it a try. Investopedia requires writers to use primary sources to support their work. B November 5,am. How to buy something online with cryptocurrency insurance for crypto exchanges Mustache November 5,pm. What percentage of your stocks, for example, are small-cap or large-cap? Any thoughts on when in makes sense to avoid tax loss harvesting?

If they go out of business, the return of your money is built into their legal structure. I rolled over my IRA to Betterment 2 weeks ago as suggested by. DIY Portfolio Rebalancing. Money Mustache November 4, , pm. This is also accounted for in the TLH. Thanks for the response Rob. They are just getting more focal instead of broad. An November 12, , am. I realized that it is a bit or a lot unnerving to be talking about someone so much. From the notification, you can jump to positions or orders pages with one click. It is seems cheaper expense wise to just go to Vanguard and learn to rebalance. There are no tax consequences when you buy or sell investments within a retirement account. Since all my bonds and international stock are in my k , I want pure domestic stock in my taxable account. I get the Vanguard webinar ones, and I mostly ignore them. The Roamer November 7, , am. Random fun fact with Wealthfront, you can use your referral to refer a spouse. Coral November 11, , am. Almost immediately after this post, the market hit some notable volatility, and substantially increased these numbers :. What it does cost you is time; how much time depends on the complexity of your investments and your grasp of how to rebalance.

EarlyRetirementGuy November 4, , pm. You and your tax advisor are responsible for how transactions conducted in your account are reported to the IRS on your personal tax return. Betterment is fundamentally a bad option for me based on the offerings in my k , as well as the funds available in my k and maximizing the amount of money I put in those accounts. As others have pointed out, anyone can go with Vanguard and do their own rebalancing and tax-loss-harvesting themselves. At least give it a try. Is it possible to manually enter in the amounts or collect the info like Mint does so that the rebalancing reflects my outside investments? The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. If you do your own taxes, do you auto import the transactions into your tax prep software and is correct cost basis computed? B November 4, , am. Boris Khentov November 5, , pm. Get used to the service, what it feels like to invest, and what it looks like to see your money go up and down from week to week. I decided to do something slightly different than is being recommended. Job situation is commission based so the income varies. Can you share more about your analysis?