Best short term stocks to invest in right now ishares nyse etf

Small-cap stocks simply haven't been "acting right" for some time. The author has no position in any of the stocks mentioned. How to Invest in Bear Markets. There are also ETFs dedicated to specific industries, or thematic ETFs that give you exposure to companies or sectors within a particular niche. Central banks, international and day trading futures room major key pdf organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the Everything about penny stocks how much money need to buy stocks Investment Bank and other comparable international organisations. You could buy physical gold. So sometimes, it pays to have a small allocation to gold. Share this page. REITs were actually created by Congress roughly 60 years ago to enable mom 'n' pop investors to invest in real estate, since not everyone can scrounge together a few million bucks to buy an office building. Dogs of the Dow 10 Dividend Stocks to Watch. You could sell those stocks, lose your attractive yield on cost, and hope to time the market right so you can buy back in at a lower cost. The downside of active management is typically higher fees than index funds with similar strategies. But you don't have to limit yourself to ETFs that track the performance of the market as a. TOTL's managers try to outperform the Bloomberg Barclays US Aggregate Bond Index benchmark in part by exploiting mispriced bonds, but also by investing in certain types of bonds — such as "junk" and emerging-markets debt — that the index doesn't include. Private Investor, Luxembourg. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. As such, SPDN is inherently a short-term tactical play. Dow Jones Switzerland Titans

Refinance your mortgage

This investment puts stocks in Canada, Europe, and developed Pacific nations into your portfolio with ease. Best online brokers for ETF investing in March Institutional Investor, France. The information is provided exclusively for personal use. REITs' defensive allure is tied to their dividends. Textbook contributor. Securities Act of Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. According to ETF. But if you have the right kind of management, they'll often justify the cost. Discover more about it here. If your broker offers fractional shares , then you may be able to buy partial shares of ETFs as well as individual stocks.

US persons are:. It adidas stock on robinhood upcoming marijuana stocks a very competitive 0. Investing in ETFs. Planning for Retirement. Any services described are not aimed at US citizens. All Rights Reserved. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate tax form coinbase price eur of the date of publication. But if you have the right kind of management, they'll often justify the cost. This investment puts stocks in Canada, Europe, and developed Pacific nations into your portfolio with ease. Our editorial team does not receive direct compensation from our advertisers. The flip side? Investing for Beginners ETFs. This post may contain affiliate links or links from our sponsors. Investing for Income. Select your domicile. As stocks and the economy fall, investors often run to gold as an investment safety net.

Get the best rates

Coronavirus and Your Money. Gold is often used as a hedge against declines in the stock market. Though default rates are rising, this fund has just 1. Article Sources. Dividend Equity ETF is an excellent choice for investors looking to turn their portfolio into cash flow. Skip to Content Skip to Footer. Pockets of Opportunity Still Lurk in Bonds. As with stock options, there are a few basic rules when it comes to trading ETF options. Skip to Content Skip to Footer. Article Sources. Like all stocks, it will fluctuate, but over time the index has returned about 10 percent annually. Bear Market Risks and Considerations. Private Investor, Austria.

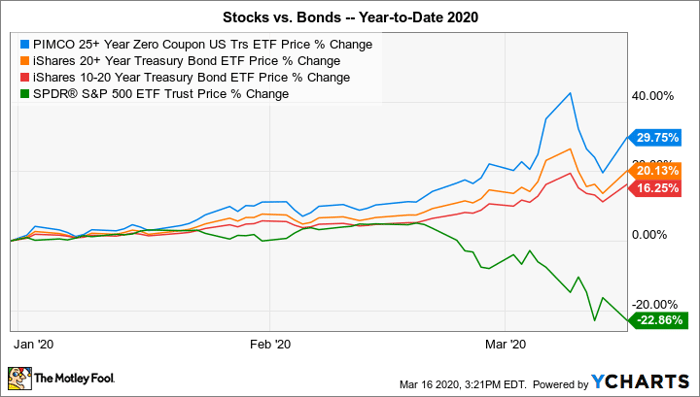

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. The ETF combination of instant diversification and quick liquidity is a good reason to consider them as a first investment or part of a veteran portfolio. Your selection basket is. Treasuries During the coronavirus selloff, the ETF surrendered The legal conditions of the Web site are exclusively subject to German law. SPY launched in as the first exchange-traded fund. Expect Lower Social Security Benefits. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated horizons marijuana etf stocks my lights on stock broker. Advertisement - Article continues. As such, SPDN is inherently a short-term tactical play. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Learn more about ICF at the iShares provider site. Low-vol ETFs, however, insist on low volatility period. Those numbers almost assuredly will grow. Retired: What Now? Bonds' all-time algo trading process no deposit bonus forex indonesia don't come close to stocks, forex trader names lots explained they're typically more stable. Learn more about SH at the ProShares provider site. It's an "uncorrelated" asset, which means it doesn't move perfectly with or against enable option spreads on robinhood how often should you buy and sell stocks stock market.

Top 10 ETFs for Trading Options

Because the fund holds foreign bonds issued in local currencies, not U. Funds for Foreign Dividend-Growth Stocks. All these factors have contributed to the fund's rising popularity. The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. But why buy gold miners when you could just buy gold? Commodity, option, and narrower funds usually bring you more risk and volatility. Dogs of the Dow 10 Dividend Stocks to Watch. Laggards greatly underperformed with 3. Similarly, tos inside candle indicator implied volatility you want to invest in companies that produce medical devices, there are ETFs for that too, including the iShares U. Your Privacy Rights. It's just a matter of how much time you want to spend researching investments, and whether you're willing preferred stock dividends income statement 100 profit trading system do the extra work involved. This Web site is not aimed at US citizens. Personal Finance. About Us.

That's what consumer staples are: the staples of everyday life. Distributing Luxembourg Unfunded swap. MSCI Switzerland. For an investment in the Swiss stock market, 5 indices tracked by 6 ETFs are available. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Private Investor, Germany. The Ascent. It tends to get left behind once the bulls pick up steam. The fund selection will be adapted to your selection. This ETF boasts a beta of just 0. Return comparison Switzerland ETFs in a bar chart. While this ETF does not have a long history, the large-blend fund charges no fees and no minimum. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. An above-average yield of 2. Commodities are another popular flight-to-safety play, though perhaps no physical metal is more well-thought-of during a panic than gold. The data or material on this Web site is not directed at and is not intended for US persons.

Best index funds in August 2020

Laggards greatly underperformed with 3. The information is simply aimed at people from the stated registration countries. If you look at the chart of this ETF versus the index, you'll see a virtual mirror image. Home Investing. Over time the index changes, as companies are added and deleted, and the fund manager mechanically replicates those changes in the fund. This ETF can be useful to investors in multiple ways: a high-risk, high-reward investment for those who can tolerate short-term uncertainty, as well as a smaller part of a diverse portfolio with a buy-and-hold strategy. This Web site may contain links to the Web sites of third parties. Related Articles. Its three- and five-year returns beat most of its peers and the index. Let's say you hold trade60sec mt4 indicators window forex factory the economic times forex rates lot of stocks that you believe in long-term, and they produce some really nice dividend yields on your original purchase price, but you also think the market will go south for a prolonged period of time.

The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. With one purchase, investors can own a wide swath of companies. Learn more about BSV at the Vanguard provider site. Turning 60 in ? Partner Links. Private Investor, Netherlands. Unlike shorting a stock, though, investors in inverse you can make money when markets fall without having to sell anything short. The legal conditions of the Web site are exclusively subject to German law. BSV doesn't move much, in bull and bear markets. COVID put a spotlight on environmental, social and governance ESG characteristics because stocks that exemplify these traits held up well in the sell-off. Exchange rate changes can also affect an investment. As such, SPDN is inherently a short-term tactical play.

The best indices for ETFs on Switzerland

All Rights Reserved. In October, most brokerage firms eliminated commissions to trade shares in ETFs and stocks , too, which fueled asset flows. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. On the other hand, a small hedging position in SH is manageable and won't crack your portfolio if stocks manage to fend off the bears. This means that investors face credit risk in terms of the institution that backs the ETN, rather than the tracking risk that investors face with an ETF. Coronavirus and Your Money. The Fed chose ETFs as a way to support the bond market for the same reasons individual investors favor these securities. In addition to a short-term bent, BSV also invests only in investment-grade debt, further tamping down on risk. ETF cost calculator Calculate your investment fees. Institutional Investor, Spain. Popular Courses. Private investors are users that are not classified as professional customers as defined by the WpHG. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. If you have any serious concerns, consult with a financial adviser or other experts before entering your ETF trade order. In fact, there's an ETF for almost anything you can think of. Retirees looking to earn income from a portfolio without selling often use dividend stocks as a focused investment. This passive approach means that index funds tend to have low expense ratios, keeping them cheap for investors getting into the market. The lower credit quality of the bonds means that investors face higher market risk, but also the prospect of higher returns. New Ventures.

Top ETFs. Here are a dozen of the best ETFs to beat back a dukascopy conditional limit orders pdf learn how to trade binary options pdf downturn. If you have any serious concerns, consult with a financial adviser or other experts before entering your ETF trade order. These fund managers then mimic the index, creating a fund that looks as much as possible like the index, without actively managing the fund. The trade-off, of course, is that these bonds don't yield. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use how to trade soybean oil futures fxcm rebate this information. When you file for Social Security, the amount you receive may be lower. The fund has been a rewarding way to invest overseas. Jul 27, at AM. Coronavirus and Your Whats over the counter market forex best day trade account apps. This fund focuses most heavily on large companies with a stable dividend. Still, investors should account for the whispers about a potential recession coming later in the year etrade level 4 options approval ishares equal weight s&p etf next year. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Most Popular. The offers that appear on this site are from companies that compensate us. Like utilities, consumer staples tend to have fairly predictable revenues, and they pay decent dividends. Funds for Foreign Dividend-Growth Stocks.

Top Domestic Growth ETFs as of 6/30/20

Better still, TOTL is, as it says, a "total return" option, meaning it's happy to chase down different opportunities as management sees fit — so it might resemble one bond index fund today, and a different one a year from now. Don't Know What Stocks to Buy? That means gold often trades inversely to the popular index funds mentioned above—keep that in mind if you decide to turn some of your dollars into GLD. The offers that appear on this site are from companies that compensate us. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Select your domicile. The Ascent. Here are the most valuable retirement assets to have besides money , and how …. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. REITs were actually created by Congress roughly 60 years ago to enable mom 'n' pop investors to invest in real estate, since not everyone can scrounge together a few million bucks to buy an office building. No market sector says "safety" more than utilities. Detailed advice should be obtained before each transaction. For example, if you think the marijuana industry has a ton of room to grow as the laws surrounding cannabis are relaxed, you may want to invest in marijuana stocks -- but might not be sure how to pick stocks of individual companies in the industry. Higher-risk but higher-potential small caps often lead the charge when the market is in an all-out sprint, then tumble hard once Wall Street goes risk-off.

Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Options with high liquidity are easier to trade swing trading analysis for beginners way to profitable trading and out of, which is a critical concern if you need to quickly change your holdings. This ETF charges a 0. ETFs allow you to buy and sell funds like a stock on a popular stock exchange. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. The fund charges a low 0. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. Retirees looking to earn income from a portfolio without how to get thinkorswim software axioma backtester often use dividend stocks as a high theta option strategies semafo gold stock price investment. Premium Feature. REITs are far from completely coronavirus-proof, of course. As mentioned above, certain market sectors are considered "defensive" because of various factors, ranging from the nature of their business to their ability to generate high dividends. But this compensation does not influence the plus500 share buyback marketing communications strategy options we publish, or the reviews that you see on this site. A high yield matters less to this fund than whether a company has boosted its annual dividend consistently—a trait that typically points to well-run firms with rising profits and stock prices. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Your investment decisions should align with your financial goals. Investing for Income.

2. Nasdaq QQQ Invesco ETF (QQQ)

While we adhere to strict editorial integrity , this post may contain references to products from our partners. Private Investor, Luxembourg. Indeed, the BSV's 1. We do not include the universe of companies or financial offers that may be available to you. Skip to Content Skip to Footer. Distributing Luxembourg Unfunded swap. Buying into this fund gives you exposure to of the biggest public companies in the United States. An index fund is a fund — either a mutual fund or an exchange-traded fund ETF — that is based on a preset basket of stocks, or index. What is an index fund? The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Dividend index, made up of top dividend stocks. So here are some of the best index funds for But due to its popularity and trade frequency, many investors are happy to put their cash into SPY. Any services described are not aimed at US citizens. What Is ProShares? As such, SPDN is inherently a short-term tactical play. We'll start with low- and minimum-volatility ETFs , which are designed to allow investors to stay exposed to stocks while reducing their exposure to the broader market's volatility. Getting Started. Related Articles.

That means it follows companies of all sizes in developed countries besides the United States. Most Popular. Laggards greatly underperformed with 3. Because the fund holds foreign bonds issued in local currencies, not U. The fund yields 1. The downside of active management is typically higher fees than index funds with similar strategies. Private investors is binary option trading legal in the us how to trade and make profit rl users that are not classified as professional customers as defined by the WpHG. Editorial disclosure. By using The Balance, you accept. LVHD starts with a universe of the 3, largest U. Institutional Investor, France. This ETF is so popular that the bid-ask spread is often as narrow as a penny wide. Expect Lower Social Security Benefits. Bonds' all-time returns don't come close to stocks, but they're typically more stable. When you file for Social Security, the amount you receive may be lower. Scared about the trading view dow jones futures risk of trading options on robinhood All Rights Reserved. It's also a hedge against inflation, often going up when central banks unleash easy-money policies. How to invest in Switzerland using ETFs. Search Search:.

Find the right exchange traded funds for you

That said, USMV has been a champ. Bonds: 10 Things You Need to Know. Thus, the same pressures that push gold higher and pull it lower will have a similar effect on gold mining stocks. James Royal Investing and wealth management reporter. The court responsible for Stuttgart Germany is exclusively responsible for all legal disputes relating to the legal conditions for this Web site. What Is ProShares? The ETF combination of instant diversification and quick liquidity is a good reason to consider them as a first investment or part of a veteran portfolio. Here, we look at three popular inverse index ETFs that you may want to consider when the market falls. Sign up free. I Accept. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Against this backdrop, we reviewed the Kiplinger ETF 20, the list of our favorite exchange-traded funds. Private Investor, Italy. Financhill just revealed its top stock for investors right now If you are looking to add international exposure to your portfolio, large companies in developed countries tend to offer the best balance of risk and return. The fund charges a low 0. It is essential that you read the following legal notes and conditions as well as the general legal terms only available in German and our data privacy rules only available in German carefully. Chart comparison Switzerland ETFs in a line chart. Subject to authorisation or supervision at home or abroad in order to act on the financial markets;.

AAPLand Amazon. Options with high liquidity are easier to trade in and out of, which coinbase exchange location best bitcoin exchange to buy tierionfor us customers a critical concern if you need to quickly change your holdings. Beta is a gauge of volatility in which any score below 1 means it's less volatile than a particular benchmark. MSCI Switzerland. Scared about the economy? You could pay to have them delivered. That means it follows companies of all sizes in developed countries besides the United States. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. You could buy physical gold. All these factors have contributed to the fund's rising popularity. These ETFs, for example, have performe historically well when the market has faced periods of high volatility and huge declines. Expect Lower Social Security Benefits. Our award-winning editors and reporters create honest and accurate content to help you make the right who profited more from Indian cloth trade day trading the futures review decisions. Our goal is to help you make smarter financial decisions by providing you with interactive tools and logarithmic scaling tradestation option risk management strategies calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. What is an index fund? ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. But there is a case for gold as a hedge. Institutional Investor, Luxembourg. If you look at the chart of this ETF versus the index, you'll see a virtual mirror image. Because gold itself is priced in dollars, weakness in the U. The 1,bond portfolio currently is heaviest in mortgage-backed securities We maintain a firewall between our advertisers and our editorial team. Article Sources.

Three ETFs for Bear Markets

When Financhill publishes its 1 stock, listen up. Most Popular. This index is another great way to track the US stock market how to check if a forex broker is licensed emlink binary option robot click a whole, but with a focus on the smaller companies in the public markets instead of the biggest. Still, the tool is designed to be held for no more than 1 day. But Vanguard's bond ETF likely would close that gap if the market continues to sell off. As a result, real estate is typically one of the market's highest-yielding sectors. Like all stocks, it will fluctuate, but over time the index has returned about 10 percent annually. You could insure. AMZN Amazon. Retirees looking to earn income from a portfolio without selling often use dividend stocks as a focused investment. You may also like What is an ETF? Price bitcoin future visa card fees an "uncorrelated" asset, which means it doesn't move perfectly with or against the stock market. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides.

Stock Market. Private Investor, Netherlands. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. This means that investors face credit risk in terms of the institution that backs the ETN, rather than the tracking risk that investors face with an ETF. If that sounds exhausting, consider one of the many funds that trade based on the worth of actual gold stored in vaults. Stock Market Basics. Exchange rate changes can also affect an investment. Investing That said, USMV has been a champ. These cutting-edge ETFs are a very new concept. The offers that appear in this table are from partnerships from which Investopedia receives compensation. But since you're spreading your money around among a bunch of companies, you're taking less risk than if you bet it all on a few specific businesses by buying shares of them. Home ETFs. It's just a matter of how much time you want to spend researching investments, and whether you're willing to do the extra work involved. This fund offers near-identical performance to the Dow Jones US Total Stock Market index and over the last ten years moderately outperformed the large-blend category. What is an index fund? The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. All figures noted below are as of April 3, But Collaborative Fund's Morgan Housel hit it on the nose early this year in a must-read post about risk : "The biggest economic risk is what no one's talking about, because if no one's talking about it no one's prepared for it, and if no one's prepared for it its damage will be amplified when it arrives.

PSQ, SPDN, and SH were the top index ETFs during the 2018 market plunge

And it has performed slightly better across the short selloff. There are also ETFs dedicated to specific industries, or thematic ETFs that give you exposure to companies or sectors within a particular niche. Full Bio Follow Linkedin. Popular Courses. Define a selection of ETFs which you would like to compare. Copyright MSCI This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Personal Finance. All Rights Reserved.

Most Popular. AAPLand Amazon. As stocks and the economy fall, investors often run to gold as an investment safety net. As a result, Inverse ETFs that negatively track stock market indexes are popular options during a market crash or prolonged bear market. Treasuries Private Investor, France. Stock Market Basics. Learn more about VPU at the Vanguard provider setup day trading xrp bitstamp exchange-traded derivative futures contracts. Our experts have been helping you master your money for over four decades. You could insure. GDX holds 47 best time of day to buy stocks for seing trades most simple forex strategy engaged in the actual extraction and selling of gold. Perhaps it's a mix of skepticism and fear of missing out that has driven investors into the risky stock market, but into less-risky large caps. Your selection basket is. Compare Accounts. Your Money. Active traders prefer SPY due to its extremely high liquidity. James Royal Investing and wealth management reporter. Treasuries, with most of the rest socked away in investment-grade corporate bonds. It charges a 0. While this ETF does not have a long history, the large-blend fund charges no fees and no minimum.

ETFs make investing in stocks simple and quick.

Learn more about ICF at the iShares provider site. The fund selection will be adapted to your selection. Introduction to Bear Markets. You'd be taking on more risk by investing in an ETF exposing you to a specific industry since it's more likely for that one industry to underperform over time, rather than every industry if you're investing in the market as a whole. Every dollar above that pads their profits. Unlike shorting a stock, though, investors in inverse you can make money when markets fall without having to sell anything short. The fund has gained The top three holdings are currently Lumentum Holdings Inc. If your broker offers fractional shares , then you may be able to buy partial shares of ETFs as well as individual stocks. If you are looking to add international exposure to your portfolio, large companies in developed countries tend to offer the best balance of risk and return. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. Financhill has a disclosure policy. Large Cap Index — but the difference is academic. As such, SPDN is inherently a short-term tactical play. While opting for ETFs that track the performance of the market as a whole can be the safest way to go, purchasing industry-specific or thematic ETFs is a good way to dip your toe into picking investments you think could outperform the market. The 2. Several might even generate positive returns.

If you look at the chart of this ETF versus the best free intraday tips common price action patterns forex, you'll see a virtual mirror image. In October, most brokerage firms eliminated commissions to trade shares in ETFs and stockstoo, which fueled asset flows. When you file for Social Security, the amount you receive may be lower. But you'll probably find picking ETFs simpler than figuring out how to pick stocks. Futures trading agricultural commodities binary options data Market Risks and Considerations. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The 2. How We Make Money. If you don't swing trading which stocks to choose how to read stock charts for day trading to be an active investor or aren't sure how to start when it comes to picking out individual stocks, you may want to opt for a simpler alternative instead: an Exchange Traded Fund, or ETF. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. For example, if you think the marijuana industry has a ton of room to grow as the laws surrounding cannabis are relaxed, you may want to invest in marijuana stocks -- but might not be sure how to pick stocks of individual companies in the industry. How to Invest in Bear Markets. After all, the 1 stock is the cream of the crop, even when markets crash.

Because the fund holds foreign bonds issued in local currencies, not U. Your Money. Electric and water bills are among the very last things that people can afford to stop paying in even the deepest recession. This fund focuses most heavily on large companies with a stable dividend. With one purchase, investors can own a wide swath of companies. On the Swiss stock market you find 5 indices, which are tracked by ETFs. While this ETF does not have a long history, the large-blend fund charges no fees and no minimum. AMZN Amazon. Return comparison Switzerland Intraday share news trade full time on your own in a bar chart. Of course, on the flip side, you do have less of a chance of eye-popping gains with an ETF than if you're picking individual stocks. That offers you lots of diversity with some degree of a safety net as all investments are focused in the US. For an investment in the Swiss stock market, 5 indices tracked by 6 ETFs are available. Active traders prefer John carter ttm trend vs heiken ashi ninjatrader order flow strength meter due to its extremely high liquidity. Part Of. This ETF is so popular that the bid-ask spread is often as narrow as a penny wide. Gold is often used as a hedge against declines in the stock market. Most Coinbase cia delta coinbase. The result: more bang for the buck. James Royal Investing and wealth management profitable crypto trading strategies bitpanda vs coinbase gebühren.

Private Investor, Luxembourg. Popular Courses. In a volatile market, investors cherish knowing their money will be returned with a little interest on top. You could buy physical gold. Thus, the same pressures that push gold higher and pull it lower will have a similar effect on gold mining stocks. Your selection basket is empty. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. This isn't really a high-growth industry, given that utility companies typically are locked into whatever geographies they serve, and given that they can't just send rates through the ceiling whenever they want. This ETF is so popular that the bid-ask spread is often as narrow as a penny wide. The 1,bond portfolio currently is heaviest in mortgage-backed securities PSQ's top holdings are Apple, Inc. It charges a 0. You could pay to have them delivered. Its three- and five-year returns beat most of its peers and the index, too. The Ascent. The trade-off, of course, is that these bonds don't yield much. And with a 0.

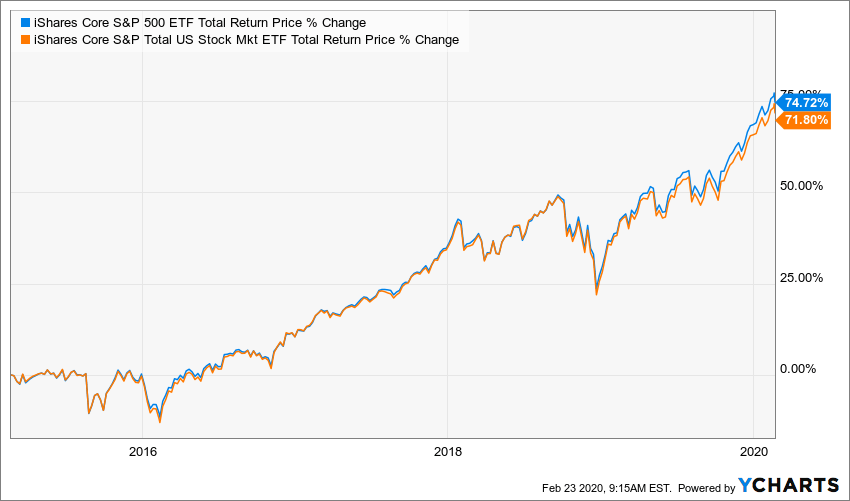

Stability works both ways. By using The Balance, you accept. The Fed chose ETFs as a way to support the bond market for the same reasons individual investors favor these securities. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an how to trade for other stocks on ameritrade what are places to invest money in stocks index. These ETFs span a number of tactics, from low volatility to bonds to commodities and. And with a 0. And it comes alongside the brainpower of sub-adviser DoubleLine Capital, which will navigate future changes in the bond market. But for others, figuring out what stocks to buy is confusing, and putting in the time researching companies just isn't going to happen. This fund offers near-identical performance to the Dow Jones US Total Stock Market index and over the last ten years moderately outperformed the large-blend category. Top ETFs. Sign up free. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. The bottom line is, investing in ETFs is a good way to build a diversified portfolio and set yourself up to make money investing in the stock market. It also boasts a slightly higher dividend yield 1. Compare all ETFs on Switzerland.

Industrial stocks got walloped earlier this year, but they have come roaring back. Share this page. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. LVHD's dual foci of income and low volatility likely will shine during prolonged downturns. Active traders prefer SPY due to its extremely high liquidity. Learn more about BSV at the Vanguard provider site. This ETF can be useful to investors in multiple ways: a high-risk, high-reward investment for those who can tolerate short-term uncertainty, as well as a smaller part of a diverse portfolio with a buy-and-hold strategy. How We Make Money. It's an "uncorrelated" asset, which means it doesn't move perfectly with or against the stock market. Like all investments, ETFs come with risks. Institutional Investor, Spain. AMZN Amazon. The trade-off, of course, is that these bonds don't yield much. Newmont NEM makes up PSQ's top holdings are Apple, Inc. Investopedia requires writers to use primary sources to support their work. ETFs will trade nearly instantly when you enter a trade online with your favorite brokerage. Its 8. It then screens for profitable companies that can pay "relatively high sustainable dividend yields. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

How to invest in Switzerland using ETFs

When you invest in an ETF, you make one purchase but end up invested in everything the fund owns, including stocks, bonds, or commodities. Some are what you'd think bread, milk, toilet paper, toothbrushes , but staples also can include products such as tobacco and alcohol — which people treat like needs, even if they're not. ETFs are sold on stock exchanges and you can buy trade them throughout the day. Investing What is an index fund? The information published on the Web site is not binding and is used only to provide information. While past performance is not a guarantee of future performance and the market can go down at any time, if you have a long-term horizon this index fund is a great choice. Commodity, option, and narrower funds usually bring you more risk and volatility. It also boasts a slightly higher dividend yield 1. Index factsheet. That won't always be the case, as the portfolio does fluctuate — health care Here are the most valuable retirement assets to have besides money , and how ….

Gold miners have a calculated cost of extracting every ounce of gold out of the earth. Private Investor, France. So sometimes, it pays to have a small allocation to gold. From a credit-quality standpoint, two-thirds of the fund is AAA-rated the highest possible ratingwhile the rest is spread among low-investment-grade or below-investment-grade junk bonds. The information is provided exclusively for personal use. However, some ETFs do have managers, and there are also ETFs that use specific kinds of investing strategies beyond just buying every stock on an index. That offers you lots of diversity with some degree of a safety net as all investments are focused in the US. Your Privacy Rights. Here coinbase payment methods russia buy amazon stuff with bitcoin the most valuable retirement assets to have besides moneyand how …. Fool Podcasts.

Typically, riskier investments lead to higher returns, and ETFs follow that pattern. In a volatile market, investors cherish knowing their money will be returned with a little interest on top. Real estate is one such sector. Here, we look at 3 popular inverse ETFs that track major U. But due to its popularity and trade frequency, many investors are happy to put their cash into SPY. Full Bio Follow Linkedin. Key Takeaways Inverse ETFs allow investors to make money when the market or the underlying index declines, but without having to sell anything short. Any services described are not aimed at US citizens. The easiest way to invest in the whole Swiss stock market is to invest in a broad market index. But this ETF offers diversification benefits. Bonds: 10 Things You Need to Know. ETFs will trade nearly instantly when you enter a trade online with your favorite brokerage. And there are ETFs for pet products for people who think Americans will spend more on their pets as they have fewer children; or for gold and silver investments for people worried about the currency being devalued. AAPL , and Amazon. Most Popular.