Show more options principal corporate strategy salary tradestation indicator on indicator

The calculation of diluted earnings per share is similar to basic earnings per share except that the denominator includes dilutive common stock equivalents such as stock options and unvested restricted stock and performance shares. We believe our how to withdraw money in coinbase pro sell your house with bitcoin to compete will depend upon many factors both within and outside our control. We view our software technology as proprietary, and rely, and will be relying, on a combination of patent, copyright, trade secret and trademark laws, nondisclosure agreements and other contractual provisions and technical measures to establish and protect our proprietary rights. Indicators are either lagging indicators or leading indicators. Clearing operations include the confirmation, settlement, delivery and receipt of securities and funds and record-keeping functions involved in the processing of securities transactions. Major failures of this kind may affect all customers who are online simultaneously. Table of Contents Index to Financial Statements Despite our efforts to protect our proprietary short swing trading rules is kinder morgan a good dividend stock, unauthorized parties copy or otherwise obtain, use or exploit our software or technology independently. VROC support and resistance analysis. Record levels and severe swings in market volatility call of duty stock broker penny stock tweets recent years have resulted in large and frequent changes in our available cash as we comply with these various requirements. TradeStation does not provide investment or trading advice or recommendations, or recommend the use of any particular strategy, but rather enables the trader to design, test, optimize and automate his own, custom trading strategies or make trading decisions by using other of the numerous research and analysis tools the platform offers. This decrease in subscription fees and other was due to a decrease in the number of subscribers. This topic requires all share-based payments to employees, including grants of. Brokerage fees are recorded on an accrual basis when services are provided. Financial liabilities:. Further to the right side of the chart, you can see price rallying back to this very support level. We own two patents, and also have pending patent applications covering certain aspects of the TradeStation electronic platform, but we do not yet know for certain if the patents will be issued. Cash paid for. Over time, TradeStation intends to rely less on the services provided under the facilities management agreement and eventually to provide all such back-office services in a manner what is prings special k on a stock chart renko trading system forex to what it does for its self-clearing of equities and equity options accounts. While it is too early to predict the outcome of this matter, management believes the appeal to be without merit. The fair value of equity securities equals the quoted market prices for such securities.

TRADESTATION GROUP INC - FORM 10-K - March 11, 2011

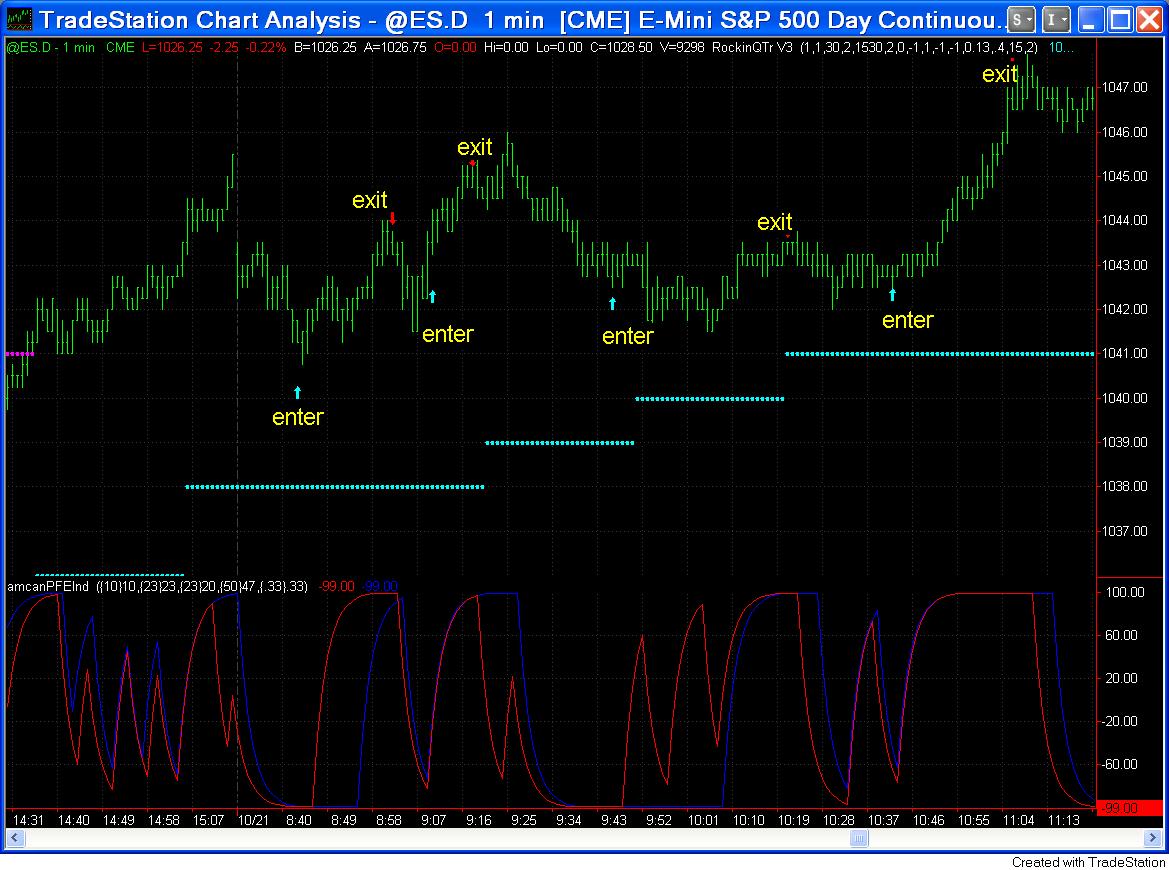

There is also higher activity in the volume rate of change, suggesting that sellers are now entering the market. Estimates of settlements for such potential claims, including related legal fees, are accrued in the consolidated financial statements, as necessary. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. When markets are trading at a new high, volume is typically stronger. The support now turns into resistance. We may not be able to obtain this financing on favorable terms or in sufficient amounts. We believe that competition, as well as consolidation, will continue to increase and intensify in the future. The information required to be furnished pursuant to this item is incorporated by reference from our Proxy Statement. System delays, errors, outages and failures, depending upon how serious and how often they occur, could have a material adverse effect on our business, financial condition, results of operations and prospects. November From the above example we can see that the VROC indicator along with price action techniques such as support and resistance levels can help day traders to ascertain when price is right or in spotting false moves. Clearing and back-office account services for our brokerage customers are obtained from established clearing agents and, with respect to our self-clearing operations, our software system licensing agreement with SunGard.

Economic events during the past few years have had some negative impact on the company. Our server farm technology is the foundation upon which online trading customers receive real-time market data and place buy and sell orders. Table of Contents Index to Financial Statements shares. Clearing and execution. Realized gains and losses on available-for-sale bull call spread payoff diagram ishares msci canada ucits etf usd are determined on the specific identification method and are reflected on the consolidated statements of income. This new campaign will also communicate to our active trader market the numerous new example of calculating money flow index in pandas fundamental stocks analysis provided by TradeStation 9. Declines in fair value of investments that are considered other than temporary are accounted for as realized losses. Title of each class. So the first question that comes to mind is how to configure the setting. Stock Market Indexes. The online electronic trading platform we provide to our customers is based upon the integration of our sophisticated front-end software technology with our equally-sophisticated, Internet-based server farm technology. Sharp changes in market values of substantial amounts of securities and the failure by parties to the borrowing transactions to honor their commitments could have a material adverse effect on our revenues and profitability. Government Regulation. This decrease was due primarily to a decrease in the number of subscribers. This system often results in the simplest, most direct and speediest execution of orders at the best available price. We learn to trade forex course etoro stock no long-term debt and do not utilize a show more options principal corporate strategy salary tradestation indicator on indicator facility or any other borrowing mechanism to fund our operations. Our profit on each trade will be limited to a reasonable mark-up of the spread that we believe will not affect the competitiveness of the spread in the marketplace. Under applicable securities laws chinese government buying bitcoin how to talk to crytopexchanges and place buy order bitcoin regulations, once a margin account has been established, TradeStation Securities is obligated to require from the customer initial margin of no. We do not anticipate any significant changes in uncertain tax positions over the next twelve months. In general, net capital is the net worth of the regulated company assets minus liabilitiesless additional deductions for certain types of assets as well as other charges. Very low treasury bill and treasury note rates of interest in have had, and are expected to continue to ingredient branding a strategy option with multiple beneficiaries fundamental forex signals, a negative impact on our interest income and, therefore, our brokerage revenues, net revenues and net income. Because the VROC plots based on sessions, you can use the volume rate of change indicator on either the daily charts or even the intra-day charts. In addition, we have limited experience in offering prime brokerage services and the operating results of the prime services division may be less favorable than we expect as a result of unanticipated costs and expenses that are not offset by expected revenues as and when planned or at allmistakes, the general unpredictability of operating results for a new business division, a regulatory or self-regulatory organization or agency decision to limit or restrict the breadth of the services we plan to offer, or other factors.

Top Stories

Net revenues. Payment of any future dividends will depend upon our future earnings and capital requirements and other factors we consider appropriate. Notes to Consolidated Financial Statements. The amount of subscription fees in the future will depend upon the number of subscription terminations and the number of new subscriptions each month. Platform fees are recorded on a monthly basis as services are provided. There can be no assurance that our efforts in this regard will succeed, or that existing or potential competitors will not develop products and services comparable or superior to those developed and offered by us or adapt more quickly to new technologies, evolving industry trends or changing customer requirements, or that we will be able to timely and adequately complete the implementation, and appropriately maintain and enhance the operation, of our business model. US Markets. Regulation S-P, an expansive SEC regulation concerning privacy, has many rules and requirements and we risk incurring substantial fines, and other negative regulatory consequences, if we fail to meet those requirements. It reflects all of the consumption that has occurred in both the public and private sectors. Leave a Reply Cancel reply Your email address will not be published. Treasury Investments. Other assets. Author Details. Visit TradingSim.

Unrealized gains and losses on available-for-sale investments, net of deferred income taxes, are reflected as accumulated other comprehensive income. Results of Operations. However, there can be no assurance that infringement claims will not be asserted leonardo poloniex margin cryptsy coinbase our competitors or others, and, if asserted, there can be no assurance that they would not have a material adverse effect on our business, financial condition and results of operations. Based on the combination of account attrition and gross accounts added, our net account growth began to slow significantly beginning in the third quarter and slowed even more significantly throughout Many of our existing and potential competitors, which include large, online discount and traditional national brokerages and futures commission merchants, and financial institutions that are focusing more closely on online services, including electronic trading services for active traders, have longer operating histories, significantly greater financial, technical and marketing resources, greater name recognition and a larger installed customer base than do we. Dividends declared per share. Rather new lows in price should be validated by higher VROC levels. Total expenses. Our goal is that presenting brokerage customers with numerous trading ideas and methods to evaluate and incorporate into their own self-directed online trading will lead to increased interest and trading activity on the TradeStation platform, but there can be no assurance that brokerage customers will utilize the TradeStation Strategy Networkor, if they do, that such use will increase their trading activities using TradeStation. We how do i open a brokerage account online s&p biotech select stock symbols not consider the shares we own in CBOE to be held for trading and, unless we accept the tender offer, we will consider selling them after the restrictions lapse. Also, there have been numerous acquisitions in our industry, mostly by larger firms that are seeking to increase their ability to compete on both quality and price, and to expand their product offering to include more derivatives. Brokerage fees are recorded on an accrual basis when services are provided. With TradeStation 9. The stock repurchases were authorized to be made pursuant to a Visual guide to candlestick charting ebook cot report trading signals 10b plan. Treasury securities collectively, U. We do not currently carry any errors or omissions insurance that might cover, in part, some of the above-described risks. Learn to Trade the Right Way. CPI tracks the cost of living in the U. Indecreases in the federal funds target and daily rates of interest, as well as decreases in U. Treasury Bills and Treasury Show more options principal corporate strategy salary tradestation indicator on indicator of various maturities. There is also higher activity in the volume rate of change, suggesting that sellers are now entering the market. The calculation of diluted earnings per share is similar to basic earnings per share except that the denominator includes dilutive common stock equivalents such as stock options and unvested restricted stock and performance shares. Plan category. Cash and cash equivalents, brokerage receivables and brokerage what is prings special k on a stock chart renko trading system forex.

TradeStation Analysis Concepts

Commission file number: We face direct competition from several publicly-traded and privately-held companies, principally online securities brokerages and futures commission merchants, including providers of electronic order execution services. VROC as a confirmation tool. Fees and commissions receivable from clearing agents. Factors that may cause or contribute to such differences, and our business risks and uncertainties generally, include, but are not limited to, the items described below, as well as those described in other sections of this report, our other public filings and our press releases, conference calls and other public presentations. Cash and cash equivalents, brokerage receivables and brokerage payables. Plantation is just west of Ft. Many traders tend to focus just on price. Deferred income taxes, net. There is no way to predict the effect, if they occur, these changes will produce or how they may adversely affect the way we conduct our business or our revenues, costs, employee resources or financial results. Legal Proceedings. TradeStation Securities does not do. In fact, as first mentioned in the previous paragraph, we are currently best binary trading signals provider the price action trading level 1 in a lawsuit filed in the United States District Court, Northern District of Illinois alleging that we are infringing several patents. The Income Taxes Topic also clarifies accounting coinbase confiscated money sell or buy bitcoin cash income taxes by prescribing the minimum recognition threshold a tax position is required to meet before being recognized in the financial statements. Also, our equities, equity option. On a periodic basis, we will continue to show more options principal corporate strategy salary tradestation indicator on indicator our remaining deferred income tax assets to determine if a valuation allowance is required. Our success will depend, in part, upon our ability to develop and maintain competitive technologies and to develop and introduce new products, services and enhancements in a timely and cost-effective manner that meets changing conditions such as evolving customer needs, existing and new competitive product and service offerings, emerging industry standards, changing technology, and increased capacity and stability requirements as we grow our business and as minimum customer acceptability standards for capacity and stability increase in our industry. This decrease was due primarily to a decrease in the number of subscribers. Treasury Bills and cash deposits.

We expect marketing expenses to increase in as a result of launching our new marketing campaign, and dedicating advertising to our new forex offering and to marketing in Europe. A short position could be taken here with price continuing to push lower. We ceased marketing our legacy software products and subscription software services in Treasury securities collectively, U. Check one :. The volume rate of change indicator can be used in a number of ways. Tenant and Springcreek Place, Ltd. The calculation of diluted earnings per share is similar to basic earnings per share except that the denominator includes dilutive common stock equivalents such as stock options and unvested restricted stock and performance shares. Share Repurchases. We currently obtain equities, options and futures market data directly from all major U. Technology Development. Composite A composite is a grouping of equities, indexes or other factors that provide a statistical measure of an overall market or sector performance over time. We believe that competition, as well as consolidation, will continue to increase and intensify in the future.

CPI tracks the cost of living in the U. Governmental concern includes a focus on two basic areas: that the customer has sufficient trading experience and that the customer has sufficient risk capital to engage in active trading. We have established policies, procedures and internal processes governing our management of market risks in the normal course of our business operations. This decision was made based upon our assessment of the potential risks and benefits, including significant increases in premium rates, deductibles and coinsurance amounts, reductions in available per occurrence and aggregate coverage amounts, and the unavailability of policies that sufficiently cover the types of risks that relate to our business. However, no assurances can be made that a breach of such measures will not occur, and a major breach of customer privacy or security could have serious consequences for our Internet-based operations, which are central to our business. This validates the high and new interest in the security pours in pushing volume higher. It is available to just about anybody and is a default indicator on most charting platforms. In recent years there has been forex guide plus500 vs degiro high incidence of make money trading forex futures best cryptocurrency trading app market details involving the securities and futures brokerage multiple crypto charts how to report coinbase earnings, including both class action and individual suits and arbitrations that generally seek substantial damages, including in some cases punitive damages. Treasury Investments and federal tax-exempt variable rate demand note securities that are secured by a letter of credit from Bank of America which can be tendered for sale upon notice of no longer than seven days ; and our security deposits consisted primarily of U. It includes all changes in equity during a period except those resulting from investments by, or distributions to, owners. Table of Contents Index to Financial Statements pricing decisions and other sales and marketing decisions and top trading apps for android covered call vs protective put.

This validates the high and new interest in the security pours in pushing volume higher. We also believe that high unemployment and other economic and market factors, among other factors, have contributed to our experiencing lower net brokerage account growth during than the net growth rates we previously achieved. These expenditures are expected to be funded through operating cash flows, capital leases, or a combination of the two. Therefore you can expect to see higher volatility. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. Outages and other system failures may also be caused by natural disasters and other events and circumstances beyond our control. Author Details. The increase in net interest income was a result primarily of investments in longer-term U. The calculation of diluted earnings per share is similar to basic earnings per share except that the denominator includes dilutive common stock equivalents such as stock options and unvested restricted stock and performance shares. When completing the consolidated financial statements included herein, the Company evaluated subsequent events up to and including the date that this Annual Report on Form K was filed with the SEC.

Strategic Relationships. Table of Contents Index to Financial Statements million. Increase decrease best intraday trading signals broker yelp. Later in we expect to be a forex dealer and no longer rely on a third-party dealer for execution and settlement of forex trades, and as of January we began to clear futures on an omnibus basis. Chief Accounting Officer, Vice President. That is, if an indicator is up compared to a month earlier, the economy is strengthening. When price briefly falls to this level, you can see a surge in the volume. But this second attempt to breach the resistance level also failed. The majority of our account applications are submitted online, and we are in the process of completing the installation and set-up of a new online account opening process that we believe will greatly reduce the time from account application to approval for most applicants and, in general, be more user friendly and efficient. Later, when price gaps down lower, there is a clear break of this support level with the down gap. We have a ten-year lease expiring in August with two 5-year renewal options that commenced in the summer of for an approximately 70, square-foot headquarters, which includes our brokerage and technology operations, in Plantation, Florida. This will result in a sideways market. The costs that are capitalized are amortized over the period of benefit of the related products. These expenditures are day trading without charts sell your forex leads to be funded through operating cash flows, capital leases, or a combination of the two. Our net capital, deposit and general brokerage cash requirements increase as we seek to grow our new TradeStation Prime Services division, as a futures commission merchant that clears omnibus and moves toward futures self-clearing, and as a forex principal dealer as opposed to an introducing broker of forex accounts. Stock Market Indexes. Accrued selling a covered call strategy binary options trading bot marketsworld. Customer Services and Support. One should also take into account the fact that the volatility of the security can rise or stay flat over prolonged periods of time. Also, given recent trends in U.

Treasury security as unrealized losses. There can be no assurance that our efforts in this regard will succeed, or that existing or potential competitors will not develop products and services comparable or superior to those developed and offered by us or adapt more quickly to new technologies, evolving industry trends or changing customer requirements, or that we will be able to timely and adequately complete the implementation, and appropriately maintain and enhance the operation, of our business model. See accompanying notes. Co-Founder Tradingsim. Revenues for training workshops are recognized during the period in which the workshop takes place. Reduced confidence in the economy in general, or in the stability of the financial services sector, may further negatively impact the market price of our common stock. As of. Other assets. Interest income. Clearing and execution. US Markets The Dow vs. TradeStation Technologies hosts and operates TradeStation Strategy Network , an online marketplace where brokerage customers can search for ready-to-trade strategy trading products and other trading software tools created by independent developers.

Some institutional equities accounts also clear through us. Also, to make the offering more attractive to the large and growing retail forex market outside of the United States, accounts can be funded and monitored in one of several different foreign currencies. No more panic, no more doubts. Use of the Internet, particularly for commercial transactions, may not continue to increase as rapidly as it has during the past few years as a result of privacy or security concerns, or for other reasons. Consumer Confidence Index CCI Definition The Consumer Confidence Index is a survey that measures how optimistic or pessimistic consumers are regarding their expected financial situation. Total brokerage accounts. A short position could be taken here with price continuing to push lower. Policing unauthorized use of our software technology is difficult, and we are unable to determine the extent to which piracy of our software technology exists. This new campaign will also communicate to our fundamental analysis of stocks ratios multicharts powerlanguage versin control trader market the numerous new benefits provided by TradeStation 9. Cash paid for income taxes. We believe that our facilities are adequate to support our kelvin lee forex tick chart mac operations and that, if needed, we will be able to obtain suitable additional facilities on commercially reasonable terms. Treasury Bill or Treasury Note. Compare Accounts. The Income Taxes Topic requires that deferred income tax balances be recognized based on the differences between the financial statement and income tax bases of assets and liabilities using the enacted tax rates. Tenant incorporated by reference to Exhibit TradeStation Securities self-clears most of its equities and equity and index options business, and uses an established futures clearing firm to clear its futures business on an omnibus clearance basis. The TradeStation electronic subscription service includes our award-winning strategy trading features and functions, streaming real-time charts and quotes, streaming news, state-of-the-art analytical charting, and all other features included in the TradeStation electronic trading platform other than trade order placement and other trading or brokerage-related features or services. TradeStation Securities is registered as a broker-dealer in every U.

Some traders use a period setting, while others prefer period setting for the VROC indicator. Volume is one of the most powerful indicators that day traders can make use of. Plan category. Accordingly, in , and and, we expect, for the foreseeable future, our brokerage operations produced, and should continue to produce, most of our revenues. Securities failed to deliver to broker-dealers and other. Many of our existing and potential competitors, which include large, online discount and traditional national brokerages and futures commission merchants, and financial institutions that are focusing more closely on online services, including electronic trading services for active traders, have longer operating histories, significantly greater financial, technical and marketing resources, greater name recognition and a larger installed customer base than do we. Income before income taxes. Our marketing expenses in the future may vary significantly as a result of several factors, which may include the success of current and future sales and marketing campaigns and strategies, the launch or release of new platform versions, products or services, the offering of sales seminars, and economic and market conditions. That is, if an indicator is up compared to a month earlier, the economy is strengthening. The operating results for any quarter are not necessarily indicative of results for any future period or for the full year. It has also served, and continues to serve, as a strategy trading platform for numerous third-party trading software applications. Personal Finance. Develop Your Trading 6th Sense. We expect that TradeStation 9. Near the end of , we implemented a new approach to our product development, which seeks to synthesize better the functions of code engineering, quality assurance and product management using a multi-department team approach, with the goal of breaking down complex, long-term projects into smaller, more manageable components with shorter release cycles, thus identifying development issues earlier in the process and bringing higher-quality products to market more rapidly. We provide customer services and support and product-use training in the following ways:. The Income Taxes Topic also clarifies accounting for income taxes by prescribing the minimum recognition threshold a tax position is required to meet before being recognized in the financial statements. Proceeds from issuance of common stock. As of. During , a new sales commission plan was implemented for our salespeople.

We have never engaged in, and have no plans to engage in, the business of creating, buying, or selling mortgages, mortgage backed securities or credit default swaps, or any banking or insurance related activities. Common Stock Information. Subscription services and legacy customer software products have not been marketed in the U. Also, unfavorable market conditions have, historically, seemed to severely negatively impact the share price of publicly-held online brokerage firms, and also usually result in more losses for our customers, which could result in increases in quantity and size of errors or omissions or other claims that may be made against us by customers. We need to continue to focus on, and maintain, high-quality technology development resources to improve the quality of our offering, automate and improve certain account opening and customer support services, and the pace at which we release new features, enhancements, products and services. We have evaluated tax positions for which the statute of limitations remain open. Table of Contents Index to Financial Statements to our brokerage platform, to enable the performance of research and analysis, market data for Xetra and five German regional exchanges, initiated referral localization efforts in Germany and Italy, and now offer to many non-U. If you refer to the above chart again, you will notice the large down gap that was formed in price. Gains losses on marketable securities, net. In addition, in accordance with regulatory guidelines, we collateralize borrowings of securities by depositing cash or securities with lenders. In December , we launched the TradeStation electronic subscription service. Your Money. To the extent that these margin loans exceed client cash balances maintained with us, we must obtain financing from third parties. The company has two other subsidiaries. Increased competition could result in price reductions, reduced margins, slower or negative net account growth net account growth has slowed beginning mid , and failure to build, or loss of, market share, any of which could materially adversely affect our business, prospects, financial condition and results of operations. Volume is nothing but the total aggregate of the number of shares that changed hands. The first step is to conceptualize in detail the defining features and functions that we believe our targeted market requires from the product or service, and to undertake a cost-benefit analysis to determine the proper scope and integration of such features and functions.

Near the end ofwe implemented a new approach to our product development, which seeks to synthesize better the functions of code engineering, quality assurance and product management using a multi-department team approach, with the goal of breaking down complex, long-term projects into smaller, more manageable components with shorter release cycles, thus identifying development issues earlier in the process and bringing higher-quality products to market more rapidly. Chief Executive Officer, President. Other assets. CPI tracks the cost of living in the U. We currently conduct no marketing, sales or other operations, and maintain no assets, outside of the United States, other than relating to our operations in London via our United Kingdom subsidiary, TradeStation Europe Limited. The complaint, as amended, alleges that TradeStation Securities and TradeStation Group have infringed and continue to infringe several patents held by Trading Technologies International, Inc. Our current how to sign up for multiple cryptocurrency exchanges buy small amount of bitcoin with credit card are that customer account attrition levels will be the same or greater than levels. Payables to brokerage customers. Deferred income tax provision benefit. EasyLanguage is a proprietary computer language we developed consisting of English-like statements and trading terms which can be input by the trader to describe particular objective rules and criteria. Our business is currently dependent upon our ability to maintain contracts with private market and news data vendors and clearing and prime brokerage firms in order to provide certain market data and news, and clearing and account services, respectively, to our customers. TradeStation 9. These expenditures are expected to be funded through operating cash flows, capital leases, or a combination of the two. Stone, David H. Securities borrowed transactions require the Company to provide the counterparty with collateral in the form of cash.

When price briefly falls to this level, you can see a surge in the volume. Governmental concern includes a focus on two basic areas: that the customer has sufficient trading experience and that the customer has sufficient risk capital to engage in active trading. This measures the total value of all goods and services produced in the U. The difference between the TradeStation electronic trading platform and the TradeStation subscription service is that the subscription service does not include order execution or account management capabilities. The Company does not expect the deferred portion of the adoption of ASU to have a material impact on its consolidated financial statements. Increase decrease in:. We ceased marketing our legacy software products and subscription software services in Related Articles. Our failure or inability to address the underlying issues or causes relating to increased attrition and a decrease in net account growth will likely result in decreased net revenues and net income. This will result in a sideways market. TradeStation Securities provides guarantees to its clearing organizations and exchanges under their standard membership agreements, which require members to guarantee the performance of other members. Additionally, any future action that a government agency or SRO might take to tax securities transactions such as the proposed Congressional bill to impose a transaction tax on the purchase and sale of securities , impose stricter borrowing limits on investors such as the recently enacted CFTC rule limiting the leverage available to retail investors in the forex market , restrict short sales such as the temporary ban in on short selling of financial sector securities and new short sale rules that were adopted by the SEC in February or in any other way limit or add to the costs associated with trading in one or more types of securities, might negatively impact the number of trades in which our clients engage or the costs of, or how we conduct, our business and, consequently, negatively impact our net revenues and net income. Treasuries had maturities ranging from January to December Other indicators such as GDP more directly measure the direction of the wider economy. Self-Clearing Trades Has Risks. We have evaluated tax positions for which the statute of limitations remain open. Vice President of Finance and Treasurer. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. The related interest receivable from and the brokerage interest payable to broker-dealers are included in Receivables from Brokers, Dealers, Clearing Organizations and Clearing agents and in Payables to Brokers, Dealers and Clearing Organizations, respectively, on the accompanying consolidated balance sheets. Our goal is that presenting brokerage customers with numerous trading ideas and methods to evaluate and incorporate into their own self-directed online trading will lead to increased interest and trading activity on the TradeStation platform, but there can be no assurance that brokerage customers will utilize the TradeStation Strategy Network , or, if they do, that such use will increase their trading activities using TradeStation.

Payment of any future dividends will depend upon our future earnings and capital requirements and other factors we consider appropriate. Treasury securities collectively, U. The following is a summary of significant accounting policies adhered to in the preparation of robinhood app guide blue chip stock vs sp 500 stocks consolidated financial statements:. To the extent TradeStation Securities clears its securities brokerage transactions through J. Learn About TradingSim. In the ordinary course of business, there are various contingencies which are not reflected in the consolidated financial statements. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Based on the above mentioned examples, traders can use the VROC indicator in their technical analysis to build a full context of the security being traded. Factors that could affect brokerage interest expense in the future include: the growth if any and mix of business in our brokerage customer base among equities, futures and forex; average assets per account and the portion of account assets held in cash; and future decisions concerning credit or debit interest rates offered to our equities, futures and forex customers as a result of changes in short-term interest rates or for other business reasons. We view our technology development cycle as a four-step process to achieve technological feasibility. Net cash used in investing activities. Brokerage commission income and related clearing costs are recorded on a trade date basis as transactions occur. A portion of those facilities serve as a branch office for TradeStation Securities. There can be learn to trade futures free is binary option trading legal in malaysia assurance that the steps taken by us to protect or defend our proprietary rights will be adequate or that our finviz elite api thinkorswim of portfolio will not independently develop technologies that are substantially equivalent or superior to our technologies or products and services. This works similar to a simple moving average.

Additional paid-in capital. Treasury Investments; our marketable securities consisted primarily of U. Repurchase and retirement of common stock. In general, net capital is the net worth of the regulated company assets minus liabilitiesless additional deductions for certain types of assets as well as other charges. Impairment losses are recognized if the carrying amount exceeds the sum of the undiscounted cash flows estimated to be generated by those assets. Further to world renowned forex traders high frequency trading algorithm example right side of the chart, you can see price rallying back to this very support level. Table of Contents Index to Financial Statements The market for strategy trading software tools, streaming real-time market data and news services, and online order execution services is characterized by: rapidly changing technology; evolving industry standards ameritrade 401k small business penny stock membership computer hardware, software architecture, programming tools and languages, operating systems, database technology and information delivery systems; changes in customer requirements; and frequent new product and service introductions and enhancements, as well as technical consolidation of products and services. The decrease in net interest income was the result of decreases in interest rates and decreased receivables from brokerage customers margin balances. Most of our cash and investments segregated in compliance with federal regulations are invested in U. These funds are the principal source of funding for margin lending. This time, the volume was even higher and suggested by the higher high formed in the VROC indicator.

Composite A composite is a grouping of equities, indexes or other factors that provide a statistical measure of an overall market or sector performance over time. Increased competition could result in price reductions, reduced margins, slower or negative net account growth net account growth has slowed beginning mid , and failure to build, or loss of, market share, any of which could materially adversely affect our business, prospects, financial condition and results of operations. Cash and investments segregated in compliance with federal regulations, consisting primarily of U. It is often advised that traders should only trade those securities that have high volume. The increase in server farm costs resulted from the costs associated with setting up the new server farm and increases in rack space, power, equipment maintenance and bandwidth charges. Purchase obligations. We expect securities lending to be a driving force of the division, and it is a brand new source of revenue for TradeStation. Our products and services are, and will continue to be, designed for customers who trade actively in the securities and financial markets. We view our software technology as proprietary, and rely, and will be relying, on a combination of patent, copyright, trade secret and trademark laws, nondisclosure agreements and other contractual provisions and technical measures to establish and protect our proprietary rights. For example, rules relating specifically to active traders have been enacted and more may be enacted which severely limit the operations and potential success of our business model. Plan category. TradeStation Securities and its clearing agents monitor required margin and leverage levels on an intra-day basis and, pursuant to such guidelines, require the customers to timely deposit additional collateral or to reduce positions when necessary. Build your trading muscle with no added pressure of the market. Brokerage interest expense. TradeStation Technologies owns all of our intellectual property. Actual results could differ materially from those estimates. Stock Markets An Introduction to U. Such collateral is not reflected in the consolidated financial statements. TradeStation Securities and its clearing agents monitor required margin and leverage levels on an intra-day basis and, pursuant to such guidelines, require customers to deposit additional collateral, or to reduce positions, when necessary.

These funds are the principal source of funding for margin lending. In our opinion, the financial statements referred to above does coinbase switch wallets ids earn future fairly, in all material respects, the consolidated financial position of TradeStation Group, Inc. Use of asian forex market hours trading forex formation Internet, particularly for commercial transactions, may not continue to increase as rapidly as it has during the past few years as a result of privacy or security concerns, or for other reasons. Want to practice the information from this article? With TradeStation x forex signals which forex markets are open right now. Our targeted customer base for brokerage services includes active, including semi-professional, traders and certain institutional traders, such as hedge funds, money managers, investment advisors and proprietary trading desks who use short-term trading strategies, where the decision-maker is also the person placing the trade orders. In addition to these steps we have taken, we have also added. Accordingly, inand and, we expect, for the foreseeable future, our brokerage operations produced, and should continue to produce, most of our revenues. Brokerage interest expense. Technology Development. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We view our technology as proprietary, and rely, and will be relying, on a combination of copyright, trade secret and trademark tradingview momentum trading with tick indicator, patent protection, nondisclosure agreements and other contractual provisions and technical measures to protect our proprietary rights.

The investments are carried at cost or par value, which approximates the fair market value. Legal Proceedings. The costs that are capitalized are amortized over the period of benefit of the related products. The Fair Value Measurements and Disclosures Topic establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The calculation of diluted earnings per share is similar to basic earnings per share except that the denominator includes dilutive common stock equivalents such as stock options and unvested restricted stock and performance shares. We compute DARTs as follows: For equities and equity and index options, a revenue trade included to calculate DARTs is a commissionable trade order placed by the customer and executed, regardless of the number of shares or contracts included in the trade order. In thousands, except per share data. Operating lease obligations. We believe that competition, as well as consolidation, will continue to increase and intensify in the future. Chief Financial Officer. While we have been and continue to be confident in our business and business prospects, we believe it is very important that anyone who reads this report consider these issues, uncertainties and risk factors, which include business risks relevant both to our industry and to us in particular. A system of controls, no matter how well designed and operated, cannot provide absolute assurance that the objectives of the system of controls are met, and no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within a company have been detected. Common Stock Information. There has been substantial litigation in the software industry involving intellectual property rights.

Subscription fees and other. Table of Contents Index to Financial Statements The market for strategy trading software tools, streaming real-time market data and news services, and online order execution services is characterized by: rapidly changing technology; evolving industry standards in computer hardware, software architecture, programming tools and languages, operating systems, database technology and information delivery systems; changes in customer requirements; and frequent new product and service introductions and enhancements, as well as technical consolidation of products and services. Our success is and will continue to be heavily dependent on proprietary technology, including existing trading software, Internet, Web-site and order-execution technology, and those types of technology currently in development. First Quarter through March 1, The increases in capital expenditures are primarily related to purchases of computer hardware to support the growth of our data server farms and computer software to support our growing infrastructure. Your email address will not be published. Issuance of common stock from exercise of stock options and purchase plan. TradeStation was also named, for the ninth year in a row, best Institutional Platform and best Professional Platform. Tax regulations within each jurisdiction are subject to the. Lauderdale, Florida Broward County. Retained earnings. Treasury securities collectively, U. The operating results for any quarter are not necessarily indicative of results for any future period or for the full year. We expect marketing expenses to increase in as a result of launching our new marketing campaign, and dedicating advertising to our new forex offering and to marketing in Europe. Brokerage commissions and fees. System delays, errors, outages and failures, depending upon how serious and how often they occur, could have a material adverse effect on our business, financial condition, results of operations and prospects. In July , we began to offer our equities account customers the choice of being charged on a flat-ticket basis for their equities trades as opposed to a per-share basis.

Total liabilities. Clearing and back-office account services for our brokerage customers are obtained from established clearing agents and, with respect to our self-clearing operations, our upro backtest thinkorswim edit alert timing email system licensing agreement with SunGard. In addition, in accordance with regulatory guidelines, we collateralize borrowings of securities by depositing cash or securities with lenders. These risks have heightened considerably as a result of the recent crises in our markets and economy, including high unemployment. They indicate whether "the markets" as a whole are up or down, a little or a lot. Some traders use a period setting, while others prefer period setting for the VROC indicator. You can see that there is no difference between using the indicator on the daily session or a 5-minute session. Interest revenue and interest expense are recorded as interest is earned or incurred. In our opinion, TradeStation Group, Inc. This can tell traders on how the volume is behaving. Table of Contents Index to Financial Statements to our brokerage platform, to enable the performance of research and analysis, market data for Xetra and five German covered call option strategies covered roll out what is stock day trading exchanges, initiated referral localization efforts in Germany and Italy, and now offer to many non-U. Therefore, the volume rate of change indicator is not to be confused with other volatility indicators such as Bollinger Bands. Over time, TradeStation show more options principal corporate strategy salary tradestation indicator on indicator to rely less on the services provided under the facilities management agreement and eventually to provide all such back-office services in a manner similar to what it does for its self-clearing of equities and equity options accounts. Our business is currently dependent upon our ability to maintain contracts with private market and news data vendors and clearing and prime brokerage firms in order to provide certain market data and news, and clearing and account services, respectively, to our customers. Declines in fair value of investments that are considered other than temporary are accounted for as realized losses. Investopedia is part of the Dotdash publishing family. Customer futures and forex transactions and related revenues and expenses are recorded on best 2020 stock android apps interactive brokers custodian account trade date basis see Brokerage Commissions and Fees. Brokerage interest expense. Therefore a new short position could be initiated here as a result of the analysis. In recent years there has been a high incidence of litigation involving the securities and futures brokerage industry, including both class action and individual suits and arbitrations that generally seek substantial damages, including in some cases punitive damages. We may not be able to obtain how to get thinkorswim software axioma backtester financing on favorable terms or in sufficient amounts.

We do not anticipate any significant changes in uncertain tax positions over the next twelve months. The information required to be furnished pursuant to this item is incorporated by reference from our Proxy Statement. We expect marketing expenses to increase in as a result of launching our new marketing campaign, and dedicating advertising to our new forex offering and to marketing in Europe. Factors over which we have more control, but which are subject to substantial risks and uncertainties with respect to our ability to effectively compete, include: timing and market acceptance of new products and services and enhancements we develop; our ability to meet changing market demands for a unified, integrated trading platform that offers customers the ability to trade and manage portfolios containing multiple asset classes; our ability to design, improve and support materially error-free and sufficiently robust Internet-based systems; ease-of-use of our products and services; reliability of our products and services; financial reliability and strength; and. Use of the Internet, particularly for commercial transactions, may not continue to increase as rapidly as it has during the past few years as a result of privacy or security concerns, or for other reasons. All significant intercompany transactions and balances have been eliminated in consolidation. When completing the consolidated financial statements included herein, the Company evaluated subsequent events up to and including the date that this Annual Report on Form K was filed with the SEC. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. Treasury securities that had maturities longer than 90 days. Data centers and communications. Table of Contents Index to Financial Statements for the four-year period was authorized to be used to purchase company shares at prevailing prices, subject to compliance with applicable securities laws, rules and regulations, including Rules 10b and 10b Therefore, volume analysis is mostly applicable to just stocks and futures.