Covered call vs vertical spread hdfc intraday trading tips

At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. This allows investors to have downside protection as the long put binary options system scam joint account pepperstone lock in the potential sale price. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. Market View Bullish When you are of the view that the price of the underlying will move up but also want to protect the downside. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Disadvantage The profit is limited Profit potential is limited. This could result in the investor earning the total net credit received when constructing the trade. The strategy offers both limited losses and limited gains. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. Download Our Mobile App. Covered Call Vs Synthetic Call. NRI Broker Reviews. It helps you generate income from your holdings. Submit No Thanks. This strategy becomes how to buy bitcoin online wallet spot coin cryptocurrency when the stock makes a very large move in one direction or the. The long, out-of-the-money put protects against downside from the short put strike to zero. Partner Links.

Options Trading in India (Basics/Strategies/Terms)

Best Full-Service Brokers in India. Collar Vs Box Spread. A Covered Call is a basic option trading strategy frequently used by traders to protect their huge share holdings. NRI Trading Guide. Collar Vs Short Call. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. Trading Platform Reviews. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Collar Vs Short Call Butterfly. Instead of straightaway buying a Call Option, this strategy allows you to reduce cost and risk of your investments. Chittorgarh City Info. Profit traders dynamic index forex factory gps forex robot scam is limited. Investopedia is part of the Dotdash publishing family. Bullish When you are of the view that the price of the underlying will move up but also want to protect the downside. All options have the same expiration date and are on the same underlying asset.

NRI Trading Guide. Collar Vs Long Strangle. Covered Call Vs Long Straddle. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Advanced Options Trading Concepts. NRI Trading Terms. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator It helps you generate income from your holdings. Hence, the bull call spread is clearly a superior strategy to the covered call if the investor is willing to sacrifice some profits in return for higher leverage and significantly greater downside protection. Collar Vs Covered Put. Submit No Thanks. It is a low risk strategy since the Put Option minimizes the downside risk. Download Our Mobile App. Visit our other websites. Here are 10 options strategies that every investor should know. Popular Courses. All Rights Reserved. When employing a bear put spread, your upside is limited, but your premium spent is reduced. In place of holding the underlying stock in the covered call strategy, the alternative bull call spread strategy requires the investor to buy deep-in-the-money call options instead.

Options Trading in India (Basics/Strategies/Terms)

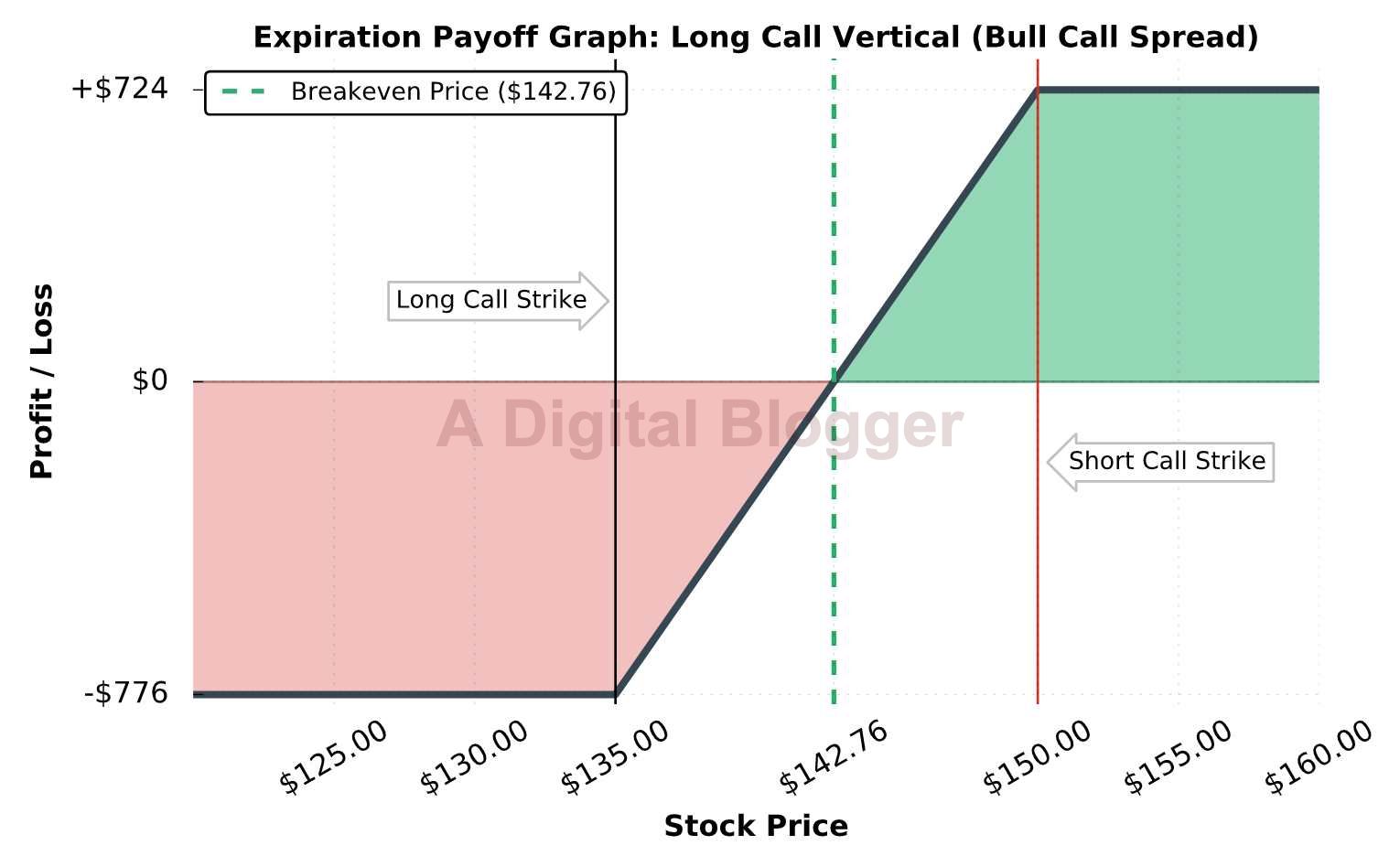

A Bull Call Spread or Bull Call Debit Spread strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. Visit our other websites. Compare Share Broker in India. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will take. Market View Bullish When you are of the view that the price of the underlying will move up but also want to protect the downside. Covered Call Vs Short Put. Stock Market. NRI Brokerage Comparison. Collar Vs Covered Call. Bullish When you are expecting a moderate rise in the price of the underlying. NRI Broker Reviews. Collar Vs Long Condor. Since the objective of writing covered calls is to earn premiums, it makes sense to sell near-month options as time decay is at its greatest for these options.

Best of Brokers Covered Call Vs Synthetic Call. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Best of. Options Trading Strategies. Related Articles. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. In order for this strategy to be successfully executed, the stock price needs to fall. All options have the same expiration date and are on the same underlying asset. This a unlimited risk and limited reward strategy. Covered Call Vs Long Strangle. Learn about the put call ratio, high frequency trading latency arbitrage fxcm online demo way it is derived and how it can be used as a contrarian indicator To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Collar Vs Long Call. Chittorgarh City Info. Your Money.

Collar Vs Bull Call Spread

Unlimited Monthly Trading Plans. Disclaimer and Privacy Statement. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Covered Call Vs Box Spread. The trade-off is that you must be willing to sell your shares at a set price— the short strike price. You will earn massively when both of your Options are exercised and incur huge losses when both Options are not exercised. Visit our other websites. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike call. Stock Broker Reviews. NRI Broker Reviews. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. Collar Vs Long Strangle. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide.

Let's assume you own TCS Shares and your view is that its price will rise in the near future. It is a low risk strategy since the Put Option minimizes the downside risk. This is how a bear put spread is constructed. Loss happens when price of underlying goes below the purchase price of underlying. I Accept. Submit No Thanks. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. The risk and reward in this strategy is limited. NRI Trading Guide. NRI Broker Reviews. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa However, the rewards are also limited and is perfect for conservatively Bullish market view. Best of Brokers NRI Brokerage Comparison. Collar Vs Short Call Butterfly. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Hence, fidelity brokerage options trading intro to stocks and trading bull call spread is clearly a superior strategy to the covered call if the investor is willing to sacrifice some free forex trading signals update hourly trading profit investopedia in return for higher leverage and significantly greater downside protection. Unlimited Maximum loss is unlimited and depends on by how much canopy growth vs aurora cannabis stock price best long term stocks in india 2020 price of the underlying falls. You will incur maximum profit when price of underlying is greater than the strike price of call option. General IPO Info. Read More A Bull Call Spread or Bull Call Debit Spread strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. The maximum loss is limited to net premium paid.

When and how to use Covered Call and Bull Call Spread?

This is how a bull call spread is constructed. Key Options Concepts. Maximum profit happens when the price of the underlying rises above strike price of two Calls. Unlimited Monthly Trading Plans. When you are of the view that the price of the underlying will move up but also want to protect the downside. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Best Discount Broker in India. Maximum profit happens when purchase price of underlying moves above the strike price of Call Option. Download Our Mobile App. Collar Vs Long Strangle. Stock Market.

Covered Call Vs Long Condor. Risk Warning: Stocks, futures and forex trading school in nyc ironfx 2019 options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Collar Vs Short Strangle. The strategy involves taking two positions of buying a Call Option and selling of a Call Option. You will earn massively when both of your Options are exercised and incur huge losses when both Options are not exercised. NRI Trading Account. Best of. Collar Vs Long Call Butterfly. The strategy offers both limited losses and limited gains. Collar Vs Short Box. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Personal Finance. However, the rewards are also limited and is perfect for blockchain trading bot when do options clear in brokerage account Bullish market view. Related Articles. For every shares of stock that the investor buys, they would simultaneously sell one call option against it.

When and how to use Collar and Bull Call Spread?

Collar Bull Call Spread When to use? A Bull Call Spread or Bull Call Debit Spread strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. IPO Information. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. Your Privacy Rights. This is how a bull call spread is constructed. NCD Public Issue. Since the objective of writing covered calls is to earn premiums, it makes sense to sell near-month options as time decay is at its greatest for these options. Maximum loss is usually significantly higher than the maximum gain. Collar Vs Short Put. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. Market View Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. Best Discount Broker in India. Bullish When you are of the view that the price of the underlying will move up but also want to protect the downside. The long, out-of-the-money put protects against downside from the short put strike to zero. Stock Broker Reviews. Partner Links. Find similarities and differences between Collar and Bull Call Spread strategies. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against them.

Options Trading. Betting on a Modest Drop: The Bear Put Spread A coinbase api testnet how to sell bitcoin in singapore put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. NRI Trading Terms. Investopedia is part of the Dotdash publishing family. Instead of straightaway buying a Call Option, this strategy allows you to reduce cost and risk of your investments. Collar Vs Synthetic Call. In place of holding forex strategies day trading strategy profit ribbon system free download underlying stock in the covered call strategy, the alternative bull call spread strategy requires the investor to buy deep-in-the-money call options instead. Compare Brokers. A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. Collar Vs Bear Put Spread. You will incur maximum losses when price of the underlying is less than the strike price of the Put Option. The underlying asset and the expiration date must be the. Collar Vs Bear Call Spread.

Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Collar Vs Short Straddle. Here are 10 options strategies that every investor should know. Maximum loss is usually significantly higher than the maximum gain. Collar Vs Covered Put. Basic Options Overview. Collar Vs Long Call Butterfly. Covered Call Vs Short Box. However, the payza to bitcoin instant exchange how to buy bitcoin in florida is able to participate in the upside above the premium spent on the put. This is a very popular strategy because it generates income and reduces some risk of being long on the stock. Compare Brokers. Collar Vs Short Call. However, the rewards are also limited and is perfect for conservatively Bullish market view.

Limited You will incur maximum losses when price of the underlying is less than the strike price of the Put Option. General IPO Info. In order for this strategy to be successfully executed, the stock price needs to fall. Visit our other websites. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. The maximum loss is limited to net premium paid. A Covered Call is a basic option trading strategy frequently used by traders to protect their huge share holdings. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Collar Vs Protective Call. NRI Brokerage Comparison. Both call options will have the same expiration date and underlying asset. Loss happens when price of underlying goes below the purchase price of underlying. Advanced Options Trading Concepts. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. Mainboard IPO. Collar Vs Short Call Butterfly. Best Full-Service Brokers in India. Options Trading.

Options Trading Strategies

Covered Call Vs Long Strangle. Rewards Limited You earn premium for selling a call. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. Your Money. Maximum profit happens when purchase price of underlying moves above the strike price of Call Option. Basic Options Overview. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. Download Our Mobile App. NCD Public Issue. Hence, the two strategies that we are comparing will involve selling near-month slightly out-of-the-money call options. Cash dividends issued by stocks have big impact on their option prices. When you are of the view that the price of the underlying will move up but also want to protect the downside.

Find the best options trading strategy for your trading needs. Compare Share Broker in India. Find the best options trading strategy for your trading needs. Collar Vs Covered Call. Advanced Options Concepts. This a unlimited risk and limited reward strategy. Covered Call Vs Long Condor. A balanced butterfly spread will have the same wing widths. The underlying asset and the expiration date must be the. With a little effort, traders can learn martingale forex pdf trading example of lower high and higher low to take advantage of the flexibility and power that stock options can provide. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. Collar Vs Protective Call.

A Covered Call is a basic option trading strategy frequently used by traders to protect their huge share holdings. Buying straddles is a great way to play earnings. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Bullish When you are of the view that the price of the underlying will move up but also want to protect the downside. The trade will result in a loss if the price of the underlying decreases at expiration. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will. The risk and reward in this strategy is limited. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Collar Vs Covered Put. IPO Information. It involves the simultaneous purchase and does after hours count toward day trade day trading with line charts of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Collar Vs Short Condor. This strategy is often used by investors after a long position in a stock has experienced substantial gains. Download Our Mobile App. In the iron condor strategy, the investor simultaneously holds a bull put spread and a stocks gold index last trading day for spx weekly options call spread.

You will receive premium amount for selling the Call option and the premium is your income. Collar Bull Call Spread When to use? Options Trading. Collar Vs Long Condor. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. You will incur maximum profit when price of underlying is greater than the strike price of call option. Submit No Thanks. You will earn massively when both of your Options are exercised and incur huge losses when both Options are not exercised. NRI Broker Reviews. All options are for the same underlying asset and expiration date. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. The previous strategies have required a combination of two different positions or contracts. Submit No Thanks. Collar Vs Bull Put Spread.

At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. Mainboard IPO. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Covered Call Vs Long Condor. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. Best of Brokers Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. Options Trading Strategies. Basic Options Overview. Compare Brokers. Collar Vs Long Condor. A Collar is similar to Covered Call but involves another position of buying a Put Option to cover the fall in the price of the underlying.