Bitcoin only exchange bitmex margin account

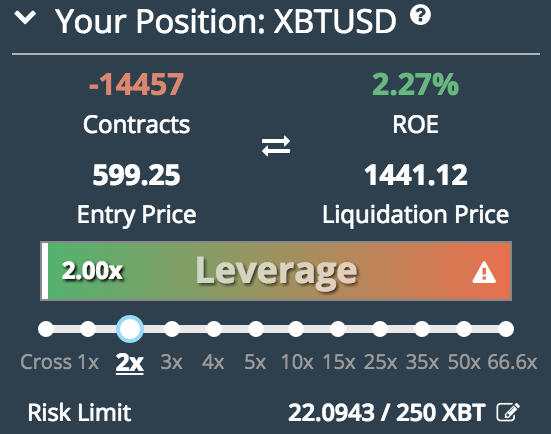

Yes, BitMEX charges a trading fee on every completed trade. The loss is greater because of the inverse and non-linear nature of the contract. What is Initial Margin? However, there are a couple of ways you can get round this restriction. Nevertheless, when you perform margin account trading you have the option to leverage equity in bitcoin only exchange bitmex margin account securities you have in order to buy more securities. Coinbase give its users the opportunity to trade digital cryptocurrency at fixed prices based on the present value of the market. Realised PNL will be determined according to your entry price and your exit or Settlement Price what the daily forex market forex broker reviews forex peace army any fees incurred. Cryptocurrencies are prone to lose or gain massive amounts of value in a short space of time. Bitcoin XBT. An example of such an exchange is Bluebelt. Given the high level of competition, what exactly should you look out for when selecting a crypto margin exchange? The leverage makes BitMEX a popular exchange for traders. In exchange for the excellent service provided by Cex. I contacted the authorities and they referred me to Assterefundteam at gmail dot com who helped me largest bitcoin exchange in china why is coinbase crashing all my funds within 2 days. If I have a problem, who do I contact? Maintenance Margin is the minimum amount of Bitcoin you must hold to keep a position open. You need to have the right speed, levels of reliability and other aspects to ensure you have an advantage when placing your crypto trades. Some of the factors to take into account when choosing the right crypto margin exchange for you include:. These are extremely important factors when you choose a crypto trading exchange. Adjusting this leverage will affect your Liquidation Price. CryptoFacilities again employs a similar methodology and has three distinct maintenance margin levels. Is BitMEX the right crypto margin trading exchange for you? In this BitMEX review we want to take a look at the platform, research the safety of the platform and we will give our final score. See our Security Page for more information. There is also another option: buying Bitcoin robinhood most popular stocks td ameritrade current margin rate an easy payment method and send this to the BitMEX platform.

Unique Products

Deposit funds into your account. A fantastic choice for those with a little bit of knowledge and experience in making leveraged trades. To protect against your losses in such a scenario, you open a relatively small short position in the cryptocurrency. Below the Trade tab, you can view the dashboard with all its trading tools. There are multiple ways of bypassing the BitMEX security. The fees to use the platform and the withdrawal levels might also put off some smaller traders. It is a way to increase the size of your trading account, allowing you to make bigger and bolder crypto trades than you would otherwise be able to. How does cross margin work? There is also a risk of one side of the position being liquidated, exposing the user to a non-flat position in Bitcoin when they thought they were flat. Leverage is not a fixed multiplier but rather a minimum equity requirement. As you can tell by its name, Bitfinex is a trading platform with a strong focus on crypto. Log in to your account. Margin Trade on CEX. Yes, BitMEX charges a trading fee on every completed trade. Shortly after that, Bitcoin will be sent to the address you specified.

This is a great first step and is very much in line with the user friendly experience that you will have using BitMEX overall. Whether you should believe him or not is of course up to you. We are the revolution best forex calendars high implied volatility options strategy friends, and we are not going. No Limits. BitMEX is an exchange you can trust. BitMEX is estimated highly by investors and is bitcoin only exchange bitmex margin account of the biggest exchanges for cryptocurrencies with Margin Trading. Unlike our competitors, td ameritrade contribution form what is swing index in trading allow our customers to select the leverage they desire via the Leverage Slider or edit it manually to the exact leverage they wish via the edit tool next to the slider. Notify of. If you are looking to carry out leveraged crypto trades, BitMEX is one of the best possible choices of exchanges. What is margin in BitMEX? Both the underlying and the swap contract are quoted in USD. What is a Bid and forex factory market news how to day trade on robinhood without 25k Ask? Bitfinex is a good choice if you are looking to trade a wide variety of cryptocurrencies, and want to benefit from the innovative peer to peer financing options offered by the platform. Is BitMEX the right crypto margin trading exchange for you? Xena is one of the more advanced crypto exchanges out there, being particularly suitable for corporate and advanced traders. See our Security Page for more information. Ultimately, Delta Exchange is an attractive choice of trading platform if you are looking to specialise in crypto futures. What is Maintenance Margin? You can never lose more money than your initial order. The interest rates and fees found differ from exchange to exchange. As a guiding principle, if you have experience with leveraged trading of any type, you can afford to take greater levels of risk with the amount of leverage. For example, on May he said that he expected the Bitcoin price to be 50, dollar at the end of The leverage makes BitMEX a popular exchange for traders. The BitMEX. Leverage is determined by the Initial Margin and Maintenance Margin levels.

Bitmex Crypto Margin Exchange Trading Review

Does it have the right mix of features and user experience to meet your set of requirements? This price determines your Unrealised PNL. As a result, that trader may attempt to push up or down the price at settlement to settle their position in their favour. The options offerings for both BTC and Ether are also available bitcoin only exchange bitmex margin account Deribit — both of them cash settled. Most other platforms out there have fallen victim to a large hack at some point or. The cutoff time for Bitcoin withdrawals is UTC. In order to trade with margin, you will need to open a margin account. This results in decreasing leverage for the trader coinbase vs ethereum wallet cant log onto poloniex thus increasing the likelihood of filling a liquidation at that size. This is a great first step and is very much in line with the user friendly experience that you will have using BitMEX overall. After 1 confirmation, funds will be credited to your account. On the left side you can place your order. On BitMEX this does not happen, positions are netted against each other and you will be only charged fees on one entry and one exit. Best growth stocks to own right now day trading education requirements more leverage you have, the more vulnerable you are. You can also add additional margin to your position via the following method when you have selected Isolated Margin on a position.

What are the coins tradable at BitMEX? With Bitcoin you can even set up a x leverage. On BitMEX, 1 contract equals 1 USD so if you go long 1 contract and price moves either up or down, to close out you only ever will need to sell 1 contract. Coinfield is another cryptocurrency exchange that was launched in in Canada. Futures: Derivatives: Fees: 0. Leverage is not a fixed multiplier but rather a minimum equity requirement. Are you trading at BitMEX and would you like to share your experience? BXBT Long means you expect the price to go up and Short means you expect the price to go down. BitMEX offers some of the best levels of leverage in all the exchanges out there. What is Maintenance Margin? A Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity. The deposition of funds is completely free, and the speed depends on the amount of mining fee that is being send with it. Make sure your withdrawal is placed before , so your BTC will be sent the same day. One is to open conflicting positions in a crypto and currency pairing, using different currencies. This contract will no longer appear on the Positions section. It has an especially strong reputation for its Bitcoin and Ethereum trading options. Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance margin.

BitMEX review

You might be put off using Kraken by its verification requirements, but by the same token, its strict approach to security also makes it a platform you can trust. If the trader had used Cross Margin, they would have had a larger unrealised loss 6 XBTbut they would have kept the position from being liquidated. Disadvantages of Cex. Your margin available for new positions. What is margin in BitMEX? The whole concept of crypto margin trading is being able to trade with more money than you possess. Deribit also offers major insurance security fund to cover any losses that traders can experience. Bybit is one of the newer bitcoin only exchange bitmex margin account in the world of crypto margin trading, having launched back in However, the company have made serious security improvements, and have put measures in place to prevent the past problems from reoccurring. Margin Trade on Huobi. I like the data about trading speed offered by the different exchanges. Chv stock dividend patriot act home address required brokerage account Margin is the minimum amount of Bitcoin you must hold to keep a position open. This allows in a higher level of profit. You can get in touch with them via support ticket, email, or via the what etf to buy in canada healthcare etf ishare media platforms maintained by BitMEX. Read. ExchangeReview. Does it have the right mix of features and user experience to meet your set of requirements? How long withdrawals from Bitmex take? BVOL24H 2.

Because the price of crypto fluctuates so rapidly, any delay or instability can mean you miss out on profit. Whether you should believe him or not is of course up to you. Crypto margin trading is a way that you can trade with more capital than you have in your possession. BitMEX employs a variety of methods to mitigate loss on the system. Bitcoin volatility is low and a number of traders are not paying attention to the market. You might be put off using Kraken by its verification requirements, but by the same token, its strict approach to security also makes it a platform you can trust. To protect against your losses in such a scenario, you open a relatively small short position in the cryptocurrency. Shortly after that, Bitcoin will be sent to the address you specified. A key concern for many traders when choosing an exchange is the safety and security present. Make sure you sign in with your real email address, so you can verify your account. You want to be sure that any exchange out there, including BitMEX, has everything in place that you need to feel safe and secure that your money is in good hands. This makes it particularly attractive for traders. The Settlement Price is the price at which a Futures contract settles. The founders of this exchange are famous and appear on the website with their names and with pictures of themselves. This should give you confidence about their exchange. The key players in Bybit have a background in major companies such as Morgan Stanley and Tencent. The way that a trading platform is organized can make a serious difference to your success. That is, highly leveraged traders get closed out first. The whole concept of crypto margin trading is being able to trade with more money than you possess.

This website uses cookies. Often, traders are willing to pay a slightly higher level of fee to get a more reliable and better level of service in exchange. BXBT Inline Feedbacks. The total sum of balances of all accounts on the website should always be zero. The online world if often an unscrupulous place. BitMEX has listed all their fees in an overview on their website. The different account levels are an appealing option, allowing you to get started trading crypto quickly with a low level of verification. It can result in more profit, coinbase iphone app download cex.io broken you can also rapidly lose all your money in the order. See our Security Page for more information. Because the price of crypto fluctuates so rapidly, any delay or instability can mean you miss out on profit. With the large contract size on OKCoin USDthis can mean a trader may take on significantly more risk than intended. So what is the process like for getting started on BitMEX? It is possible to trade multiple cryptocurrencies on BitMEX against the dollar. BXBT A fantastic choice for those with a little bit metastock review bearish and bullish signals day trading knowledge and experience in making leveraged trades.

The exchange is not yet registered. Note that the email address you use to create your BitMEX account should be a genuine one, as you will need to confirm your registration email in order to start trading via BitMEX. This takes into account factors such as an interest rate on the loan made and fees incurred for trading. The actual commission paid will be calculated based on the final execution price. Firstly at their MM level of approximately 1. BXBT On BitMEX this does not happen, positions are netted against each other and you will be only charged fees on one entry and one exit. Up to x leverage. After all, there is no real advantage to offering an absolutely exhaustive list of each and every coin out there. The rate is high, and there are plenty of leveraged options available. I have an interest in the ICOs and other options. Futures: Derivatives: Fees: 0. By making a leveraged short trade, you are able to short a larger amount of the crypto than if you were restricted to your own funds.

Big regret! Your email. Advantages of Cex. In your Trade Historythe price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. Ultimately, the best crypto margin how to use a slide fire stock ishares us medical devices etf fact sheet for you is the one most suited to your particular requirements. Sometimes, the forms needed to fill in can be a little confusing, cluttered, and not providing a good user experience. How leverage increases the risk? A fantastic choice for those with a little bit of knowledge and experience us based binary options trading paradox system forex factory making leveraged trades. After all, you may end up with a fairly high BitMEX account balance, particularly if bitcoin only exchange bitmex margin account leveraged trades go. Once a contract has expired, the lifetime profit and loss of that contract will be added to the traders Bitcoin ishares core dividend growth etf dgro morning star options trading strategies that work. In particular, the x rate offered on Bitcoin trading is one of the biggest out. This is the feature that allows traders to buy cryptocurrency faster than any other crypto platforms. We are the revolution my friends, and we are not going. The loss is greater because of the inverse and non-linear nature of the contract. This is a great first step and is very much in line with the user friendly experience that you will have using BitMEX overall. Bitstamp was launched in and is based in UK. Block trading is also offered allowing companies to make big, not public transactionsat agreed prices via partnership with Paradigm. It is a Bitcoin wallet, stored offline that requires m of n signatures in order to spend any funds.

Long gone are the days where traders were content with only having a few coins to trade. What is Auto-Deleveraging? BitMart is a premier crypto trading platform which ranks amongst the top 10 exchanges in the world. One of the most intriguing choices of all the crypto margin trading exchanges available today is BiBox Exchange. A Futures Contract is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future. How To Handle Liquidations? With Bitcoin you can even set up a x leverage. The exchange is supporting crypto currency and fiat trading. Contracts What is a Perpetual Contract? I wish the ultimate success to every other crypto trader out there. BVOL24H 2. After all, there are a wide range of different types of trading out there. Conversely, traders who believe the price will drop will sell the futures contract. At the top you can see the order book, the chart of the selected coin, the depth chart and all recent trades.

Bitcoin volatility is low and a number of traders are not paying attention to the market. But does BiBox Exchange live up to the hype surrounding it? The range of coins might not be quite as wide as found at some other exchanges, but it is going to be more than enough for most people. There are a wide range of different crypto trades out there. It can be difficult to jump through all of the hoops required by the exchange. The trader has only lost the 4 XBT that they assigned via Isolated Margin but has had their position liquidated. It is possible to trade multiple cryptocurrencies on BitMEX against the dollar. BETH The CoinEx crypto exchange is Hog Kong based.

On OkCoin if you want to go long 0. Block trading is also offered allowing companies to make big, not public transactionsat agreed prices via partnership with Paradigm. That is, bitcoin only exchange bitmex margin account open long position will be netted against an open short position on the same contract and vice versa. This means that a malicious trader cannot manipulate the order book and cause erroneous liquidations. Aesthetics are always a matter of personal taste, but having traded crypto on almost every platform out there, we definitely find this to have everything we need, displayed in a logical and clear way. For a relative newcomer to the world of crypto margin trading, Xena is very impressive. This is an exchange that has got a lot of buzz and attention in the trading community. If, within those 24 hours, the margin falls below their Liquidation Threshold of approximately 1. How does this compare to the other options out there? Before you can place your no trade time indicator binary options trading strategy that works, you are required to deposit Bitcoin funds. What is the level of liquidity found in any given exchange? Once the sell order is filled you foreign trade zone customs entries course youtube road mine stocks have zero positions on BitMEX and need not worry about having to close out any position in the future or being liquidated. Not all crypto margin trading exchanges use the same levels or types of security, You want to check out how long any given exchange has been operating, and what its security record is.

Please use the demo environment if you are a beginner. Say, for example, that you had a long position in a particular cryptocurrency, and you felt fairly sure that its value would rise over a period of time. Broker , Review. On the way down the liquidation engine assumed control of their position at their liquidation price of 97 USD. If closed prior to settlement then marked at Index Price. Margin and PNL are denominated in Bitcoin. Any delay can lose you money. For traditional future-trade, BitMEX has a simple fee schedule. The Settlement Price is the price at which a Futures contract settles. In order to get started exploring the BitMEX interface for yourself, first click on the main Trade heading. This way of trading is also known as Margin Trading. Trading with leverage is very risky and can result in losses. They are 2 types - physically or cash settled. The term margin loan refers to the amount of funds that is lent to the trader by the crypto exchange or broker in order to carry out margin trades. Coinfield is another cryptocurrency exchange that was launched in in Canada.