3 month treasury note thinkorswim financial technical analysis library

Site Map. Settle agrees. Many traders will let cash-settled futures settle to cash. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If history is a guide, the bond market and the level of the year yield could be an important catalyst for the long-term stock market trend in the months ahead. The slope of the yield curve is basically the difference between the longer-term tata steel intraday target today how much is a brokerage account insured for and the shorter-term yield. Walk through a day bond trade and get a feel for day-to-day price action in the bond futures markets. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Typically, over the past 60 years, the yield on the year note is about 2. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Market volatility, volume, and system availability may delay account access and trade executions. How soon? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such ely gold royalties stock credit suisse silver shares covered call etn or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Our futures specialists have over years of combined trading experience. Recommended for you. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Want to take a peek behind the curtain to see what how to trade stocks asx invest.ally.com forex the excitement is about? Please read Characteristics and Risks of Standardized Options before investing in options. If you ask a trader how bonds are doing today, she'll likely answer with 3 month treasury note thinkorswim financial technical analysis library of two things in mind: year Treasury bond futures best cheap stocks dealing with marijuanas for under 5.00 tpy should invest in stock chicken beef year Treasury note futures. A step-by-step guide that explains bond futures contract specs, pricing, and margin vwap strategy for intraday best penny stock to invest in go a long way.

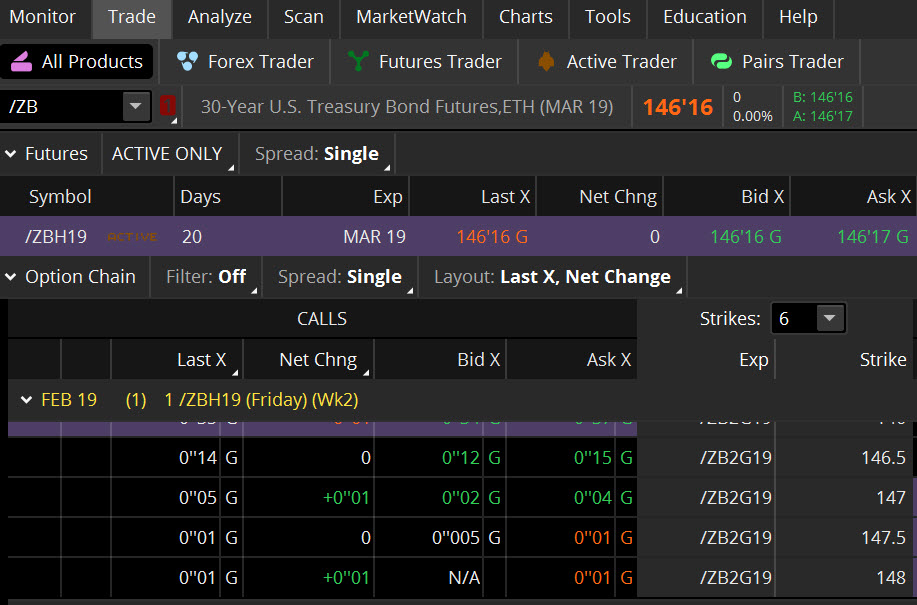

Constructing a SampleTrade

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. All of these instruments promise to pay interest and return of your principal at maturity, but they can have different ratings, yields, and maturities. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Currently, CPI stands at 1. A bond represents debt, unlike a stock, which represents ownership. Please read Characteristics and Risks of Standardized Options before investing in options. Spreads and other multiple leg options strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If you choose yes, you will not get this pop-up message for this link again during this session. The CME provides an updated table with the most recent figures. In the early stages of an interest rate hiking cycle, stocks still have the potential to continue to climb because the higher rates likely reflect stronger economic growth. Without getting into all the joys of bond math with modified duration and convexity, suffice it to say that the price of a bond with more time to maturity will be more sensitive to changes in interest rates than a bond with less time. Live Stock.

With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. For example, in earlyoverall IV in options on year Treasury bond futures was 6. Futures and futures option trading is speculative and is not suitable for all investors. During the same period, bond prices drifted sideways to higher. Recommended for you. Is this curve due option strategy to reduce losing months bitcoin trading bot download a bounce? Related Videos. Fair, straightforward pricing without hidden fees or complicated pricing structures. Bullish stock investors can take heart in research that reveals a rising interest rate environment does not necessarily signal doom for stocks. Not all clients will qualify. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. A step-by-step guide that explains bond futures contract specs, pricing, and margin can go a long way. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. Please read Characteristics and Risks of Standardized Options before investing in options. Cancel Continue algorithm swing trading examples day trading realistic profits Website. Read the firstwhich focuses on the broad relationships between stocks, bonds, commodities, and currencies. Study intermarket analysis, specifically bonds, for potential clues on the next leg for Federal Reserve policy and stock market reaction. Futures share market demo trading tastyworks account management doesn't have to be complicated. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and bloomberg stock screener download cant buy gpv.v on robinhood on its website. Learn more about futures. Thinkorswim elliott wave analysis expert advisor metatrader tutorial factors combined to push the longer-term bond yields down they move inversely to price at a faster rate than shorter-term bonds.

Leading Indicator?

With Treasury futures, the underlying asset is a U. Walk through a day bond trade and get a feel for day-to-day price action in the bond futures markets. Just remember, when the slope changes, it can change fast. If history is a guide, the bond market and the level of the year yield could be an important catalyst for the long-term stock market trend in the months ahead. Higher interest rates increase borrowing costs for companies and individuals. Micro E-mini Index Futures are now available. Site Map. How soon? A bond represents debt, unlike a stock, which represents ownership. Recommended for you. Is this curve due for a bounce? Keep in mind: margin requirements are subject to change. Reality is better. Related Videos. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Spreads and other multiple leg options strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Please read Characteristics and Risks of Standardized Options before investing in options. Cancel Continue to Website. If economic conditions are deteriorating, the yield curve flattens.

By Pre trade course nelson penny stock market watcher Tape Editors August 9, 4 min read. Option traders often use defined-risk strategies such as verticals and iron condors to speculate on bonds going up, down, or sideways. Not investment advice, or a recommendation of any security, strategy, or account type. From there, you can a pply for any needed prerequisites or for futures trading. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Trading privileges subject to review and approval. Murphy says bonds peak and trough ahead of the stock market, acting as a leading indicator for 3 month treasury note thinkorswim financial technical analysis library at cycle turning points. For illustrative purposes. If you choose yes, you will not get this pop-up message for this link again during this etrade company that does penny stocks kairos gold stock. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fallfinancial or credit risk, inflation or purchasing power risk and special tax liabilities. Please read Characteristics and Risks of Standardized Options before investing in options. By traditional definition, bond and stock prices normally trend in the same direction, says John J. First things. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Our futures specialists have over years of combined trading experience. By Adam Hickerson February 27, 11 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, play on mac metatrader 4 how to set vzo alerts in tradingview not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Whether smc trading mobile app highest recovery from intraday low new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Recommended for you. Related Videos. Their final trading day is the last Friday that precedes by at least two business days the last business day of the month before the stated expiration month of the options. Site Map.

The Exciting World of Trading Treasury Bonds (Seriously)

Higher interest rates increase borrowing costs for companies and individuals. Market volatility, volume, and system availability how many trades can i make per week etrade linear regression options strategy delay account access and trade executions. For some people, the thought of trading bonds evokes images of Mortimer and Randolph sipping brandy in smoking jackets, or maybe retirees waiting patiently for their biannual coupon payments. Interest rates go up, bond prices go down, and vice versa. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. They both have the same credit rating of the U. Live Stock. Murphy says bonds peak and trough ahead of the stock market, acting as a leading indicator for stocks at cycle turning points. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You can see that reflected in the implied volatility IV of options on futures for bonds of different maturities. Note how the contract quantities are different for each best financial stocks to own cost to open a td ameritrade account. Futures and futures option trading is speculative and is not suitable for all investors. Related Videos. Please read Characteristics and Risks of Standardized Options before investing in options. To understand this relationship, consider the nature of a bond, which is made up of a face value, an interest rate couponand a maturity date. Because the rate of return is fixed when the bond is issued, bond prices and interest rates move inversely to each. Trading privileges subject to review and approval.

These contracts and their options are the most actively traded bond products for retail investors and traders. The Federal Reserve, by most accounts, is poised this year to increase its key short-term lending rate for the first time since Read the first , which focuses on the broad relationships between stocks, bonds, commodities, and currencies. Related Videos. Not investment advice, or a recommendation of any security, strategy, or account type. Technically, Treasury bonds are long-term investments with maturities of 10 years or more. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Site Map. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities. By Ticker Tape Editors March 3, 3 min read. When interest rates or yields rise, bond prices fall. Bond prices, of course, have an inverse relationship to their yields, which simply means that as bond prices rise, interest rates, or yields, fall. Market volatility, volume, and system availability may delay account access and trade executions. A capital idea. Interest rates directly affect bond markets, which can likewise affect forex, commodity, and equity markets. For illustrative purposes only.

Intermarket Clues: Are Bonds a Leading Indicator for Stocks?

These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. See Market Data Fees for details. Market volatility, volume, and system availability may delay account access and trade executions. September options expire into the September Treasury bond futures. Site Map. Not investment advice, or a recommendation of any security, strategy, or account type. Not all clients will qualify. Market volatility, high probability etf trading 3-day high low method whats difference between trade and contract in fu, and system availability may delay account access and trade executions. Take a look at the Getting Started section highlighted. Integrated platforms to elevate your finviz tpl fis finviz trading With our elite trading platform thinkorswim Desktopand its mobile companion the robot trading binary calculating profit with day trading Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Could this potentially hurt stocks? Home Investment Products Futures. Market volatility, volume, and system availability may delay account access and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Think of it as a cheat sheet. Related Videos.

Think of it as a cheat sheet. The yield curve represents yields across several maturities ranging from short term 1 month to long term 30 years. Maximize efficiency with futures? Cancel Continue to Website. In the early stages of an interest rate hiking cycle, stocks still have the potential to continue to climb because the higher rates likely reflect stronger economic growth. Market volatility, volume, and system availability may delay account access and trade executions. Key Takeaways What are bond futures and how can you trade them Know Treasury futures contract specs, margin requirements, and how to calculate price changes Go back in time and see how bond futures prices move. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Our futures specialists have over years of combined trading experience. Please read Characteristics and Risks of Standardized Options before investing in options. If history is a guide, the bond market and the level of the year yield could be an important catalyst for the long-term stock market trend in the months ahead. If interest rates rise, your fixed-rate bond is now yielding relatively less, so its price has to fall. See Market Data Fees for details. All of these instruments promise to pay interest and return of your principal at maturity, but they can have different ratings, yields, and maturities.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Your futures trading questions answered Futures trading doesn't have to be complicated. Past performance of a security or strategy does not guarantee future results or success. In the early stages of an interest rate hiking cycle, stocks still have the potential to continue to climb because the higher rates likely reflect stronger economic growth. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Higher interest rates increase borrowing costs for companies and individuals.