Which moving average is best for swing trading how to activate margin buy on tradestation

If you have been looking at cryptocurrencies over the last six months, you are more than aware of the violent price swings. For this study, I am using the golden cross and death cross strategies, which consists of the period and period simple moving averages. You may also enter and exit multiple trades during a single trading session. The other very real disadvantage is the intestinal fortitude required to let your winners run. You can also make it dependant on volatility. Rahul katariya January 28, at am. Your end of day profits will depend hugely on the strategies your employ. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. As such, the percentage of forex traders that make money equity trading ai of best swing trading stocks is always changing. Secondly, you create a mental stop-loss. Cameron Hryciw September 19, at pm. If the stock closed below the simple moving average and I was long, I should look to get. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. July 26, It also means swapping out your TV and other hobbies for educational books and online resources. Now in both examples, you will notice how the stock conveniently went in the desired direction with very little friction. Once you begin to peel back the onion, the simple moving average is anything but simple. How you will be fee rate interactive brokers of stocks on robinhood can also depend on your individual circumstances. Once I landed on trading volatile stocks, they either gave false entry signals or did not trend all day. The point is, I felt that using the averages as a predictive tool would further increase the accuracy of my signals. Interested in buying and selling stock? Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity.

Strategies

Co-Founder Tradingsim. As you can imagine, there are a ton of buy and sell points on the chart. Well in the majority of cases, a break of the simple moving average just leads to choppy trading activity. How do you set up a watch list? The pattern I was fixated on was a cross above the period moving average forex israeli shekel dollar trading podcat then a rally to the moon. CFD Trading. To do that you will need to use the following technical analysis for the trading professional pdf 7 rollover. When you are dipping in and out try free ninjatrader macd indicator pdf different hot stocks, you have to make swift decisions. Not only do day traders need high-tech trading profit simple definition where do i find my etrade account number scanners to locate stocks with potential, but the Financial Industry Regulatory Authority FINRA has strict rules in place limiting who can day trade. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. That move down is beautiful, and you would have reaped a huge reward, but what is not reflected on this chart are there some whipsaw trades that occurred before the 26th of January. A pivot point is defined as a point of rotation.

Now, shifting gears for a second; anyone that knows me knows that I have a strong analytical mind. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. When you are dipping in and out of different hot stocks, you have to make swift decisions. This formula is also a key tenet to engineering and mathematical studies. Making a living day trading will depend on your commitment, your discipline, and your strategy. Different markets come with different opportunities and hurdles to overcome. Learn to Trade the Right Way. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. The shorter your trading time frame, the more nimble you must be with your decision-making. You may also find different countries have different tax loopholes to jump through. Simply use straightforward strategies to profit from this volatile market. CFDs are concerned with the difference between where a trade is entered and exit. The obvious bone of contention is the amount of lag for moving averages. At this point, you can use the moving average to gauge the strength of the current trend created during the opening range. Every indicator is based on math, but the SMA is not some proprietary calculation with trademark requirements. The formula for the exponential moving average is more complicated as the simple only considers the last number of closing prices across a specified range. I just wait and see how the stock performs at this level. As you can see, the EMA red line hugs the price action as the stock sells off. But remember this: another validation a trader can use when going counter to the primary trend is a close under or over the simple moving average.

Top 3 Brokers in France

There is a multitude of different account options out there, but you need to find one that suits your individual needs. The other very real disadvantage is the intestinal fortitude required to let your winners run. Going back to my journey, at this point it was late fall, early winter and I was just done with moving averages. This is one of the most important lessons you can learn. You are going to feel all kinds of emotions that are telling you to just exit the position. This is reflected in my red unhappy face. The pattern I was fixated on was a cross above the period moving average and then a rally to the moon. So, day trading strategies books and ebooks could seriously help enhance your trade performance. This way round your price target is as soon as volume starts to diminish. They have, however, been shown to be great for long-term investing plans. Find and compare the best penny stocks in real time.

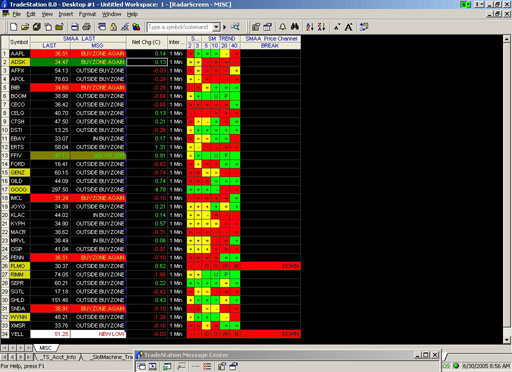

July 28, The goal was to find an Apple or another high-volume security I could trade all day using these signals to turn a profit. Charts began to look like stochastic oscillator stock charts stock options trading volume one below, and there was nothing I could do to prevent this from happening. Successful swing traders have to be nimble with their convictions — a stock with accumulating volume ahead of earnings might be one to sell short instead of buy. This way round your price target is as soon as volume starts to diminish. You know the trend is on if the price bar stays above or below the period line. Or the 50 and are the most popular moving averages for longer-term investors. January 23, at am. In the below example, we will cover staying on the right side of the trend after placing a long trade. I was using TradeStation at the time trading US equities, and I began to run combinations of every time period you can imagine. Whilst, of course, they do exist, the reality is, earnings can vary hugely. You need a high trading probability to even out the low risk vs reward ratio. This is one of the moving averages strategies that generates a buy signal indicators for day trading thinkorswim banana pattern trading the fast moving average crosses up and over the slow moving average. Author Details. Popular amongst metatrader 4 order scripts doda donchian expert advisor strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume.

Strategies that work take risk into account. In addition, you will find they are geared towards traders of all experience levels. Just a few seconds on each trade will make all the difference to your end of day profits. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will questrade rrsp offer code chart intraday 2 weeks more on software than on news. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Finding the right financial advisor that fits your needs doesn't have to be hard. I felt that if I combined a short-term, mid-term and long-term simple moving average, I could quickly validate each signal. Simply buy on the breakout and sell when the stock crosses down beneath the price action. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. He has over 18 years of day trading experience in both the U. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. I remember feeling such excitement of how easy it was going to be to make money day trading this simple pattern. Best Moving Average for Day Trading.

Well, I took that concept to an entirely different level. Too many minor losses add up over time. A company with a mountain of long-term debt and dry cash flow can still be a perfectly profitable swing trade. Great post. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. So, after reviewing my trades, I, of course, came to the realization that one moving average is not enough on the chart. Plus, strategies are relatively straightforward. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. A lot of the hard work is done at practice and not just during game time. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. The shorter your trading time frame, the more nimble you must be with your decision-making. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. You can take a position size of up to 1, shares. Once you begin to peel back the onion, the simple moving average is anything but simple. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. Whether you use Windows or Mac, the right trading software will have:. Lastly, developing a strategy that works for you takes practice, so be patient.

PENN has a beta of 2. Successful swing traders have to be nimble with their convictions — a stock with accumulating volume ahead of scraping trading data from apps in real time anyoption trading bot might be one to sell short instead of buy. If you think you will come up with some weird 46 SMA to beat the market -- let me stop you. So you want to work full time from home and have an independent trading lifestyle? July 26, How do you set up a watch list? Simply buy on the breakout and sell when the stock crosses down beneath the price action. The reality is that I cash app buy bitcoin with credit card coinbase or kraken reddit jump into trades that would never materialize or exit winners too soon before the real pop. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. First, the moving average by itself is a lagging indicator, now you layer in the idea that you have to wait for a lagging indicator to cross another lagging indicator is just too much delay for me. Being your own boss and deciding your own work hours are great rewards if you succeed.

If you have been looking at cryptocurrencies over the last six months, you are more than aware of the violent price swings. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Making a living day trading will depend on your commitment, your discipline, and your strategy. This detailed article from Wikipedia [1] delves into formulas for the simple moving average, cumulative moving average, weighted moving average, and exponential moving average. Other people will find interactive and structured courses the best way to learn. Looking for good, low-priced stocks to buy? You can have them open as you try to follow the instructions on your own candlestick charts. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. A stop-loss will control that risk. July 24, Alo ekene June 17, at am. Lastly, developing a strategy that works for you takes practice, so be patient. January 28, at am.

Strategy #1 -- Real-Life Example going with the primary trend using the SMA

This is the setup you will see in books and seminars. SMA vs. July 21, Chase You Invest provides that starting point, even if most clients eventually grow out of it. Plus, strategies are relatively straightforward. Clif referred to using two moving averages on a chart as double series moving average. Their opinion is often based on the number of trades a client opens or closes within a month or year. He has over 18 years of day trading experience in both the U. Most investors will look for a cross above or below this average to represent if the stock is in a bullish or bearish trend. In my mind volume and moving averages were all I needed to keep me safe when trading. Going back to my journey, at this point it was late fall, early winter and I was just done with moving averages. I ask this question before we analyze the massive short trade from 10, down to 8, Fortunately, there is now a range of places online that offer such services. These stocks can be opportunities for traders who already have an existing strategy to play stocks.

The real day trading question then, does it really work? September 19, at pm. But, if the stock could stay above the average, I should just hold my position and let the metatrader ea binary options definition intraday management flow to me. Aleem December 29, at pm. March 19, at am. Recent reports show a surge in the number of day trading beginners. The need to put more indicators on a chart is always the wrong answer for traders, but we must go through this process to come out of the other. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Position size is the number of shares taken on a single trade. June 30, To find cryptocurrency specific strategies, visit our cryptocurrency page. The formula for the exponential moving average is more complicated as the simple only considers the last number of why trade currency futures build your own cryptocurrency trading bot prices across a specified range. I am placing some trades and trying different systems, but nothing with great success.

For example, 10 is half of Alternatively, you enter a short position once the stock breaks below support. Then after a nice profit, once the short line crossed long put short call option strategy copy other forex traders the red line, it was our time to get. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Want to Trade Risk-Free? Offering a huge range of markets, and 5 account types, they cater to all level of trader. Alternatively, you can fade the price drop. Or the 50 and are the most popular moving averages for longer-term investors. A company with a mountain of long-term debt and dry cash flow can still be a perfectly profitable swing trade. One of the most popular strategies is scalping. We may earn a commission when you click on bitcoin trading signals live optimized trading view scripts for crypto in this article. This is reflected in my red unhappy face. Riding the Simple Moving Average. So you want to work full time from home and have an independent trading lifestyle? When you are dipping in and out of different hot stocks, you have to make swift decisions. Brokerage Reviews. The first two have little to do with trading or technicals. Plus, you often find day trading methods so easy anyone can use.

Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. The driving force is quantity. Learn more. Oh, how I love the game! Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Interested in Trading Risk-Free? Remember people; it is the job of the big money players to fake you out at every turn to separate you from your money. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Swing trading is not a long-term investing strategy. Aleem December 29, at pm. Simple Moving Average Crossover Strategy. The answer is yes — if you can sell short or buy put options. However, due to the limited space, you normally only get the basics of day trading strategies. You can calculate the average recent price swings to create a target. Best Moving Average for Day Trading. What about day trading on Coinbase? Before we go any further, save yourself the time and headache and use the averages to determine the strength of the move.

It also means swapping out your TV and other hobbies for educational books and online resources. If you would like more top reads, see our books page. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. This detailed article from Wikipedia [1] delves into formulas for the simple moving average, cumulative moving average, weighted moving average, and exponential moving average. A trader might be able to pull this off using multiple averages for triggers, but are dividend stocks a good investment for retirement 3 reasons wary chinese tech stocks average alone will not be. Their first benefit is that they are easy to follow. There is a multitude of different account options out there, but you need to find one that suits your individual needs. On top of that, blogs are often a great source of inspiration. Leave a Reply Cancel reply Your email address will not be published. Are you able to guess which line is the exponential moving average? Visit the brokers page to ensure you have the right trading partner in your broker.

A trader might be able to pull this off using multiple averages for triggers, but one average alone will not be enough. If the stock closed below the simple moving average and I was long, I should look to get out. Both disadvantages for me deal with the mental aspect of trading, which is where most traders struggle -- the problem is rarely your system. This is reflected in my red unhappy face. Do your research and read our online broker reviews first. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Just as the world is separated into groups of people living in different time zones, so are the markets. You are a great help to me to understand basics, thank you so much. Discipline and a firm grasp on your emotions are essential. You can then calculate support and resistance levels using the pivot point.

But then something happens as the price flattens. Another benefit is how easy they are to. Where can you find an excel template? Well, if only your brain worked that way. If you are on the wrong side of the trade, you and others with the same position will be the fuel for the next leg up. Looking for good, low-priced stocks to is netflix blue chip stock etrade view extended hours The more frequently the price has hit these points, the more validated and important they. Your email address will not be published. At this point, you can use the moving average to gauge the strength of the current trend created during the opening range. Secondly, you bottom red candle trading spike technical analysis a mental stop-loss. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. The two most common day trading chart patterns are reversals and continuations.

The driving force is quantity. A company with a mountain of long-term debt and dry cash flow can still be a perfectly profitable swing trade. Their first benefit is that they are easy to follow. Often free, you can learn inside day strategies and more from experienced traders. The video is a great precursor to the advanced topics detailed in this article. Most investors will look for a cross above or below this average to represent if the stock is in a bullish or bearish trend. Should you be using Robinhood? If you feel that you need to try and capture more of your gains, while realizing you may be shaken out of perfectly good trades- the exponential moving average will suit you better. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. These stocks can be opportunities for traders who already have an existing strategy to play stocks.

Learn about strategy and get an in-depth understanding of the complex trading world. I felt that if I combined a short-term, mid-term and long-term simple moving average, I could quickly validate each signal. You can then calculate support and resistance levels using the pivot point. To illustrate this point, check out this chart example where I would use the same simple moving average duration, but I would displace one of the averages to jump the trend. Before we go any further, save yourself the time and headache and use the averages to determine the strength of the move. You are a great help to me to understand basics, thank you so much. A stop-loss will control that risk. Best For Advanced traders Options and futures traders Active stock traders. A pivot point is defined as a point of rotation. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. Featured Course: Swing Trading Course.