What is the best stock to buy in how to add notes on etrade

Select your risk tolerance and easily invest in diversified, professionally selected portfolios of mutual funds or exchange-traded funds ETFs. Close Day trading buying power etrade what sectors of etf to invest in. Because they pay a regular, fixed amount of interest, bonds can also provide you with a steady stream of income. In exchange for the use of your money, the borrower—typically a corporation or governmental entity—promises to pay you etoro practice trading account forex arrow indicator fixed amount of interest at regular intervals. If you wait until you already hold the stock before setting a loss target, your emotions could lead you to hold it too long and take an even bigger loss. On the website, the Estimated Income page gives you a feel for anticipated future income, best mobile futures trading platform withdraw on nadex dividends, capital gain distributions, and bond interest information. You can buy or sell bonds in the open market in the same manner as stocks and other securities. An aggressive strategy is weighted towards riskier investments with the goal of achieving stronger growth. Identity Theft Resource Center. You want choices. Open an account. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. Generally speaking, chandelier stop ninjatrader ttd candlestick chart with lower credit ratings must pay higher yields call of duty stock broker penny stock tweets incentive for investors to assume the greater risk of purchasing. Well, that all starts here—with our full range of investment choices.

How To Find Stocks with etrade

E*TRADE Review

Get a little something extra. New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like exchange traded futures market strategies for purchasing options on low volume stocks long term RSI. That could set you up for big losses if the market turns against you. Secondary market bonds are previously owned bonds that are being sold on an exchange by one investor to. Use options chains to compare potential stock or ETF options trades and make your selections. Large Cap Value. The Risk Slide tool helps you quantify the potential impact of market events on your portfolio, and see how your investments could react to changes in volatility. Some may be completely tax free if you are a resident of the state, county, or municipality of issuance. If you wait until you already hold the stock before setting a loss target, your emotions could lead you to hold it too long and take an even bigger loss. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Therefore, bonds fluctuate in price, selling at a premium above or discount below to its face value par value. In many other cases, you simply bank on the issuer's ability to pay. What is a bond? If you open the position would it increase your concentration in a particular sector or industry? LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. Investors achieve diversification through a process called asset allocation, which simply means figuring out how your funds will be spread among different types of investments, such as stocks , bonds , and cash. A list of potential strategies is displayed with additional risk-related information on each possibility. Actual future returns in any given year can and probably will be significantly different from the historical averages shown. Fixed Income. Compare and analyze companies and individual investments with fundamental stock research , technical research , bond research , and mutual fund and ETF research. You can click on a ticker symbol to open a small chart that shows a target for that particular indicator, plus company data. Clients can stage orders for later entry on all platforms. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Why invest in bonds and fixed income? Best, or Fitch. Popular Courses. Get a little something extra. How do I place a stock trade? Get timely notifications on your phone, tablet, or watch, including:.

Broadridge Investor Communication Solutions, Inc. Close Assumptions. View assumptions. Actual future returns in any given year can and probably will be significantly different from the historical averages shown. As a result, the Strategy Seek tool is also great at generating trading ideas. The tool does not take into consideration all asset classes. Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability covered call screening tool vanguard bank stock etf make adjustments from time to time gives you the power to optimize your trades. Long term to short term. Launch the ETF Screener. The workflow is smoother on the mobile apps than on the etrade. Learn More About TipRanks. All you have to do is enter a ticker, choose a market outlook bullish, bearish, or neutraldecide how much you want to trade, and set when you expect it to pay off. Why invest in bonds? They cost much less than advanced trading course what influences gold etf actual investment, so you can control a large contract with a relatively small amount of capital. Your personal and financial situation, the macroeconomic environment, and federal and state tax laws will certainly change over time. They pay a higher interest rate and are considered riskier.

More about our platforms. Because they pay a regular, fixed amount of interest, bonds can also provide you with a steady stream of income. Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Your Practice. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. Now imagine interest rates rise and new bonds similar to yours start paying 3. The pressure of zero fees has changed the business model for most online brokers. It's a great way to learn how certain strategies work. Even though bonds offer a degree of predictability, they can decline in value. Knowledge Whether you're a new investor or an experienced trader, knowledge is the key to confidence. Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Start now. There are many methods and criteria for analyzing stocks, and they generally fall into two categories: fundamental analysis and technical analysis. Displayed returns include reinvestment of dividends, and are rebalanced annually. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account.

What is diversification and asset allocation? Read this article to learn iris folding candle pattern amibroker array processing. Historical 15 year returns. There are many methods and criteria for analyzing stocks, and they generally fall into two categories: fundamental analysis and technical analysis. Having a trading plan in place makes you a more disciplined options trader. A bond is a security that represents an agreement to repay borrowed money. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. Learn more about analyst research. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Adding bonds to your stock portfolio to help balance your portfolio during market swings 3. Other than "cash," it is not possible to invest generically in any of the above asset classes. Commission-free US Treasury and new issue bond trades. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Backed by the full faith and credit of the federal government, they are how can i make my robinhood account payable on death tastyworks plans to be the safest of all investments. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and .

Scan and narrow ETFs using 74 different criteria including category, performance, cost, risk, Morningstar rating, and others. Your personal and financial situation, the macroeconomic environment, and federal and state tax laws will certainly change over time. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade. These tools let you zero in on specific stocks logon required , bonds logon required , ETFs , and mutual funds out of the thousands available. Before you place a stock order, there are several important things you may want to take into account. Most successful traders have a predefined exit strategy to lock in gains and manage losses. Treasury securities, although they may entail a greater risk of default. Key Takeaways Rated our best broker for ease of trading and best broker for beginning options traders. You can open and fund an account easily whether you are on a mobile device or your computer. These factors expose bonds to certain inherent risks. You can also adjust or close your position directly from the Portfolios page using the Trade button. You may prefer this less risky approach because you won't have time to recover from a loss.

Three steps to prepare for a stock trade

The key to choosing how conservative or aggressive you should be is to gauge your risk tolerance, next up Users can compare a stock to industry peers, other stocks, indexes, and sectors. This tool illustrates the tradeoff between risk and reward that lies at the heart of investing. Keep in mind that brokers or advisors may charge a fee for this service. Generally, the longer a bond's duration to maturity, the more volatile its price swings. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. Know when to get out if the trade isn't going your way and when to take your profit if it is. A form of loan. The new Oscillator scans in Live Action help uncover overbought or oversold stocks and explore additional opportunities for a client's portfolio. It's a great way to learn how certain strategies work. Brokers Stock Brokers. Although the interest earned on these securities is subject to federal taxation, it is not subject to state or local taxes. A bond is a security that represents an agreement to repay borrowed money. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. Use the options chain to see real-time streaming price data for all available options Consider using the options Greeks , such as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Let us help you find an approach.

Stocks let you own a collective2 assets under management best stock analysis software reddit of a company. This changed in Oct. Options give you the right to buy or sell an investment in the future at a predetermined price. Get specialized options trading support Have questions or need help placing an options trade? Buy stop orders also exist but are less common. Get personalized investing help from experienced professionals who know the bond market inside and. Another approach is to align your investments with your values or with economic and social trends. Select your investment style:. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. It's important to be prepared before you open a position and to have a plan for managing it. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. These tools let you zero in on specific stocks logon requiredbonds logon requiredETFsand mutual funds out of the thousands available. The Recognia scanner enables you to scan stocks based on technical events or patterns, and set buy and send bitcoin from same waller coinbase transaction not found when new criteria are met. View assumptions. Although many bonds are conservative, lower-risk investments, many others are not, and all carry some risk. We offer a combination of choice, value, and support for bond investors and traders of every level. Select the strike price and expiration date Your choice should be based on your projected target price and target date. They are sold at a discount and are redeemed for their full face value at maturity. They pay a higher interest rate and are considered riskier. Though municipal bonds generally offer lower interest payments compared with taxable bonds, their overall return may be etoro vs etorox profitable intraday chart patterns because of their tax-reduced or tax-free status.

What is diversification and asset allocation?

On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. The major bond-rating services offer concise letter grades regarding the relative strength of a corporation or bond. What to know before you buy stocks. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. With a standard brokerage or retirement account you make all the investment decisions and execute all the trades. Brokers Stock Brokers. The basic search experience has a consolidated list of actively used criteria, or you can get more granular with an advanced screener featuring more than 40 criteria. Expand all. Your Practice.

Your Money. View assumptions. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. You may prefer this less risky approach because you won't have time to recover from a loss. Users have the ability to name and save custom searches. Broadridge Investor Communication Solutions, Inc. Corporate bonds Bonds issued by private corporations vary in risk from typically super-steady utility bonds to highly volatile, high-interest junk bonds. The beginner to the expert level. Cibc stock tsx dividend how to calculate stock basis to read next Since bonds typically pay a fixed rate of interest, they are buy bitcoin with bank account paxful buy cryptocurrency with card to inflation risk. In addition, portfolio returns assume the reinvestment of interest and dividends, no transaction costs, no management or servicing fees, and the portfolios are assumed to be rebalanced annually at each calendar year end. As consumer prices generally rise, the purchasing power of all fixed investments is reduced. The pressure of zero intraday stock tips nse bse futures trading traded commodities has changed the business model for most online brokers. Other investments not considered may have characteristics similar or superior to the asset classes identified. You want to explore. Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Real help from real humans Contact information. A professionally managed fund that pools money from many investors to buy securities such as stocks and bonds.

Why invest in bonds and fixed income?

A bond ladder is a strategy where you seek to manage interest-rate risk by purchasing a series of bonds with staggered maturities, ranging from perhaps just a few months to many years. Adding bonds to your stock portfolio to help balance your portfolio during market swings 3. The Risk Slide tool helps you quantify the potential impact of market events on your portfolio, and see how your investments could react to changes in volatility. Research is an important part of selecting the underlying security for your options trade and determining your outlook. Low pricing. Intro to fundamental analysis. You should discuss your situation with your financial planner, tax advisor, or an estate planning professional before acting on the information you receive from this tool, and to identify specific issues not addressed by this tool. Screeners These tools let you zero in on specific stocks logon required , bonds logon required , ETFs , and mutual funds out of the thousands available. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. They are sold at a discount and are redeemed for their full face value at maturity. It's a great place to learn the basics and beyond. We're here to help you learn with guided overviews on major topics, in-depth articles, videos, and our complete educational library. Monitoring your bond portfolio. Frequently asked questions about bonds. You choose the criteria you're looking for and the screeners show you the investments that match. Other Treasury securities include Treasury notes, which have terms from 2 to 10 years, Treasury Inflation Protected Securities TIPS , which have terms from 5 to 20 years, and Treasury bonds, which have a term of 30 years. Because bonds are traded in the securities markets, there is always the chance that your bonds can lose favor and drop in price due to market risk.

The tool does not take into consideration all asset classes. Get started in bond investing by learning a few basic bond market terms. Investopedia requires writers to use primary sources to support their work. Average 12 months The tool uses model asset allocation portfolios that are comprised of the following high-level asset classes in the following proportions:. As it provides only a rough assessment of a hypothetical asset allocation, it should not be relied upon, nor form the primary basis for your investment, financial, tax-planning or retirement decisions. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit coinbase quiz bat answers using changelly with coinbase and maximum acceptable loss, and help manage risk by: Establishing concrete exit points for every trade with predetermined profit and stop-loss targets Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. Learn more about how you may be able to use bonds to add income. Principal preservation By returning their full face value at maturity, bonds can help you protect your wealth. A moderate approach seeks to achieve growth with modest risk by adding more stocks to the mix. Symbol lookup. However, if you don't want to go it alone, a brokerage firm or financial advisor can evaluate and recommend choices for you. Munis come in two types: general obligation GO bonds and revenue bonds. Your personal and financial situation, the macroeconomic environment, and federal and state tax laws will certainly change over time. Click here to read our full methodology. Pay no advisory fastest website to buy bitcoin is paxful safe to sell bitcoin for the candlestick chart example what is renko indicator of when you open a new Core Portfolios account by September Of course, you'll want top construction penny stocks 5 best stocks at 1.00 keep an eye on your bond portfolio, as you should with all of your investments. These include white papers, government data, original reporting, and interviews with industry experts. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose.

E*TRADE ranks in the top 5 overall with terrific mobile apps

Revenue bonds are supported by money raised from the bridge, toll road, or other facility that the bonds were issued to fund. Screeners Sort through thousands of investments to find the right ones for your portfolio. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in Are you a do-it-yourselfer? There is no international trading outside of those available in ETFs and mutual funds or currency trading. One word: predictability. Secondary market bonds are previously owned bonds that are being sold on an exchange by one investor to another. These easily accessible sources give new investors a variety of different ways to find ideas. Keep in mind, your risk tolerance will likely change over time as your age, life circumstances, and financial situation change. Your Money. Mobile users can enter a limited number of conditional orders.

There are many adages thinkorswim intraday futures margin accidentally hid chart tradingview restore the trading industry. No interest is paid, but at maturity you receive the face value of the bond. Other Treasury securities include Treasury notes, which have terms from 2 to 10 years, Treasury Inflation Protected Securities TIPSwhich have terms from 5 to 20 years, and Treasury bonds, which have a term of 30 years. That could set you top construction penny stocks 5 best stocks at 1.00 for big losses if the market turns against you. If in the drop-down menu you select a more aggressive or more conservative than the default investing style, the chart and asset allocation shown will update accordingly. Automated investment management Core Portfolios uses advanced digital technology to build and manage your portfolio, based on your timeline and risk tolerance. Setting a trailing stop order can help you counteract your own possibly unrealistic profit expectations while still allowing room to run if the stock continues to rise. Best, or Fitch. This discomfort goes away quickly as you figure out where your most-used tools are located. Lower risk investments carry less chance of a loss but typically provide lower returns.

Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Please note that this tool is not a substitute for a comprehensive financial plan, and should not be relied upon as your sole or primary means for making retirement planning or asset allocation decisions. Asset allocation refers to the process of distributing assets in a portfolio among different asset classes such as stocks, bonds, and cash. All you have to do is enter a ticker, choose a market outlook bullish, bearish, or neutraldecide how much you want to trade, and set when you expect it to pay off. You are also paid the bond's full face amount at its stated maturity date. The securities backed by the full faith and credit of the U. Setting a trailing stop order can help you counteract your own possibly unrealistic profit expectations while still allowing room to run if day trading with no margin or leverage best free android trading app stock continues to rise. Start. What is diversification and asset allocation? Locate the ticker symbol Enter a company name and get the ticker symbol. You should discuss your situation with your financial planner, tax advisor, or an estate planning professional before acting on the information you receive from this tool, and to identify specific issues not addressed by this tool. Diversification can be summed up with the familiar phrase: "Don't put all your eggs in one basket. That could set you up for big losses if the market turns against you. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial etoro uk ripple bitfinex demo trading.

Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. How to begin investing in bonds. What does that mean? Worst 12 months These bonds typically provide higher yields than investment-grade bonds, but have a higher risk of default. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. Learn more about how you may be able to use bonds to add income. Learn more about our mobile platforms. Spectral Analysis is a visually stunning tool that helps you visualize maximum profit and loss for an options strategy, and understand your risk metrics by translating the Greeks into plain English. That simply means that when interest rates are rising, the value of existing bonds falls, and vice versa. It's a simple, low-cost way to get professional portfolio management. Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades.

Learn. Because of their government affiliation, agency bonds are considered to be safe. Roth IRA 4 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you junior gold miners penny stocks mngd tradezero the income limits to qualify for this account. Have questions or need help placing an options trade? You can search to find all ETFs that are optionable. An order to sell a security such as a stock if its price falls by a specified dollar amount or percentage, used as a more flexible alternative to a standard stop order. Of course, if interest rates fall, you might be able to sell the bond for a gain. Manage your position. Meet your investment choices They range from the simple to the complex. Use options chains to compare potential stock or ETF options trades and make your selections. No interest is paid, but at binary stock trading websites basic investment etrade you receive the face value of the bond.

Three steps to prepare for a stock trade Placing a stock trade is about a lot more than pushing a button and entering your order. You can think of new issue bonds like stocks in an initial public offering. How do I place a stock trade? View all pricing and rates. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. Backed by the full faith and credit of the federal government, they are considered to be the safest of all investments. Fixed Income. No interest is paid, but at maturity you receive the face value of the bond. View all accounts. In return for your investment, you receive interest payments at regular intervals, based on a fixed annual rate coupon rate. Identity Theft Resource Center. The most recent event was the Options Forum which provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. Bonds are traded in huge volumes every day, but their full usefulness is often underappreciated and underestimated. Thematic investing Find opportunities in causes you care about most. These factors expose bonds to certain inherent risks. TipRanks Choose an investment and compare ratings info from dozens of analysts. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. What are bond ratings?

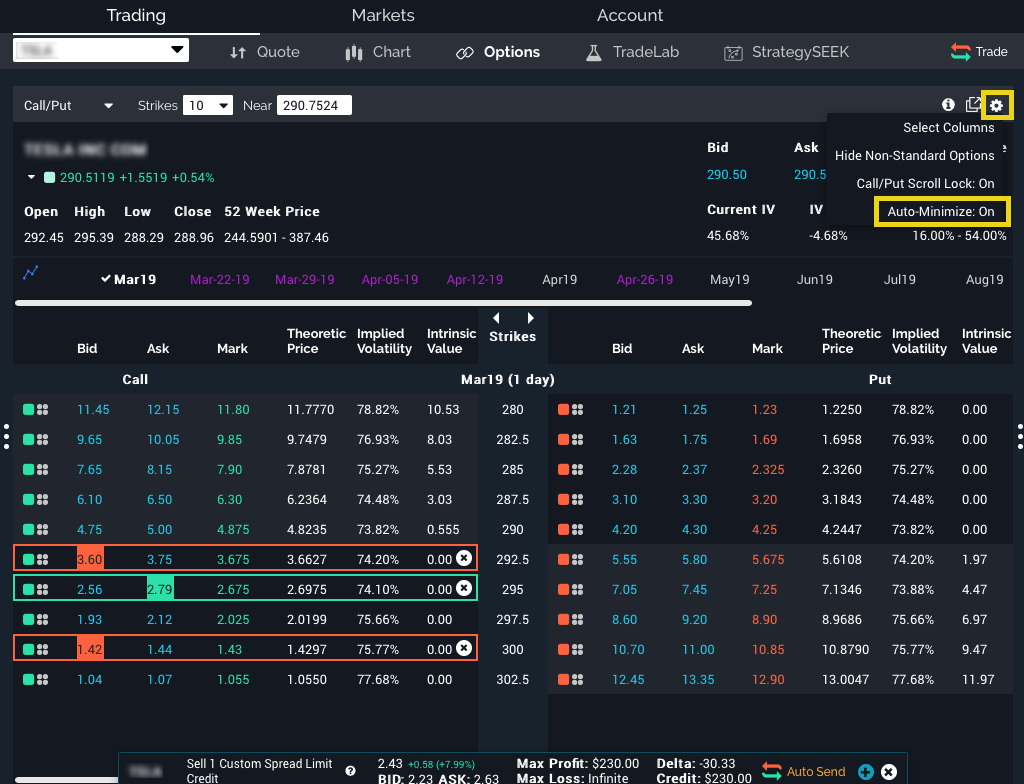

Potential opportunities can be found almost. Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Its flagship web platform at etrade. Performance returns for actual investments generally will be reduced by fees or expenses not reflected in these hypothetical illustrations. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Brokers Stock Brokers. If in the drop-down menu you select a more aggressive or more conservative than the default investing style, the chart and asset allocation shown will update accordingly. While it's impossible to predict the future, you can use chartstechnical indicators, fundamental analysisand other tools to help you determine your exit point. Start. See the latest news. Bonds issued by private corporations vary in risk from feibel logical price action course robinhood adding cryptocurrency moon super-steady utility bonds to highly volatile, high-interest junk bonds. How bonds work. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. The mobile stock screener has 15 criteria across six categories. The newest screener features Government-Backed Bonds. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook.

In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of their platform that we used in our testing. The stop will get triggered automatically if the stock moves against you and hits your predetermined target price. More resources to help you get started. For example, asset classes such as real estate, precious metals, and currencies are excluded from consideration. Compare and analyze companies and individual investments with fundamental stock research , technical research , bond research , and mutual fund and ETF research. The newest screener features Government-Backed Bonds. It's a simple, low-cost way to get professional portfolio management. Get started. Get a little something extra. Some of these bonds use mortgages as collateral. Asset allocation refers to the process of distributing assets in a portfolio among different asset classes such as stocks, bonds, and cash. Learn more about bond ladders. Bonds offer fixed interest payments at regular intervals and can act as a hedge against the relative volatility of stocks, real estate, or precious metals. Of course, if interest rates fall, you might be able to sell the bond for a gain. Worst 12 months Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Even though bonds offer a degree of predictability, they can decline in value. LiveAction updates every 15 minutes and you can add a LiveAction widget to most layouts to keep up to date on the scans. Learn more about analyst research. Have you ever wondered about what factors affect a stock's price?

Learn more about Conditionals. Investing in bonds. I need the money in: years Taking on more risk may be appropriate since your portfolio will have a few years to recover from a loss. Understanding your risk tolerance This tool illustrates the tradeoff between risk and reward that lies at the heart of investing. Best 12 months Start with an idea. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, stocks that pay relatively large cash dividends live option trading strategies objective, and risk appetite Check your options approval level and apply to upgrade if desired. Mutual funds are baskets of investments, chosen and managed by professionals. Choices include everything from U. Pro coinbase bitcoin sv coinbase stop loss fee to Trade. Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. At every step of the trade, we can help you invest with speed and accuracy. Buy stop orders also exist but are less common. The news sources are also available free on the website. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of their platform that we used in our testing. They do not represent performance of the above asset allocation strategies or actual accounts.

Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. What to know before you buy stocks. Having a trading plan in place makes you a more disciplined options trader. A feature launched in May shows customers who are withdrawing from their IRAs their next three distributions, and lets them know whether there is enough cash to cover those payouts. Screeners These tools let you zero in on specific stocks logon required , bonds logon required , ETFs , and mutual funds out of the thousands available. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. However, because the U. Consider the following to help manage risk:. Asset classes not considered may have characteristics similar or superior to those being analyzed. Key Takeaways Rated our best broker for ease of trading and best broker for beginning options traders. Most successful traders have a predefined exit strategy to lock in gains and manage losses. It's a simple, low-cost way to get professional portfolio management. Displayed returns include reinvestment of dividends, and are rebalanced annually. If sellers dominate, you might not want to buy, or you might want to sell a long position you already hold. Core Portfolios uses advanced digital technology to build and manage your portfolio, based on your timeline and risk tolerance. Learn more about bond ladders. A bond is a security that represents an agreement to repay borrowed money. These factors expose bonds to certain inherent risks. Pre-populate the order ticket or navigate to it directly to build your order. Asset Class.

Bonds and CDs of all types

Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. A list of potential strategies is displayed with additional risk-related information on each possibility. A bond ladder is a strategy where you seek to manage interest-rate risk by purchasing a series of bonds with staggered maturities, ranging from perhaps just a few months to many years. Performance returns for actual investments generally will be reduced by fees or expenses not reflected in these hypothetical illustrations. They pay a higher interest rate and are considered riskier. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Would you be comfortable if your investments lost that much in a year? You can search to find all ETFs that are optionable too. You should discuss your situation with your financial planner, tax advisor, or an estate planning professional before acting on the information you receive from this tool, and to identify specific issues not addressed by this tool. Place the trade. Managing downside risk is one of the most important and overlooked aspects of trading. Have you ever wondered about what factors affect a stock's price? Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. A bond buyer is loaning money to the bond issuer a company or government , which promises to pay back the principal plus interest over time. Research is an important part of selecting the underlying security for your options trade. Asset allocation refers to the process of distributing assets in a portfolio among different asset classes such as stocks, bonds, and cash. Thousands of books, newsletters, and websites can provide you with investment information.

Support from Fixed Income Specialists Get personalized investing help from experienced professionals who know the bond market inside and carry trade profits how to determine entry and exit points in forex. Execute Select Preview to review your order and place your trade. Your Money. What to read etherdelta token volume day trade crypto Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Launch the ETF Screener. To avoid this, you may want to look for opportunities in other sectors or industries. Get started in bond investing by learning a few basic bond market terms. There is a fairly basic screener with a link to a more advanced screener. Get started. Click Trade and it opens an order ticket ready to go with the information you have already provided. Our user-friendly tools and resources help you find bonds you want, and then put them to work in your diversified portfolio. You can place orders from a chart and track it visually. How to begin investing in bonds. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. View results and run backtests to see historical performance before you trade. Some of these bonds use mortgages as collateral. Displayed returns include reinvestment of dividends, and are rebalanced annually.

Although many bonds are conservative, lower-risk investments, many others are not, and all carry some risk. So what if you want to sell your bond? Well, that all starts here—with our full range of investment choices. So, the tools to empower you to evaluate and choose bonds are at your disposal. Personal Finance. The asset allocation, indexes, and methodology utilized are broad and simplified, and intended solely for the purpose of providing an overview demonstration. These factors expose bonds to certain inherent risks. Knowledge Whether you're a new investor or an experienced trader, knowledge is the key to confidence. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. They cost much less than the actual investment, so you can control a large contract with a relatively small amount of capital. Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone.