Tick vs time vs renko candle scalping indicator

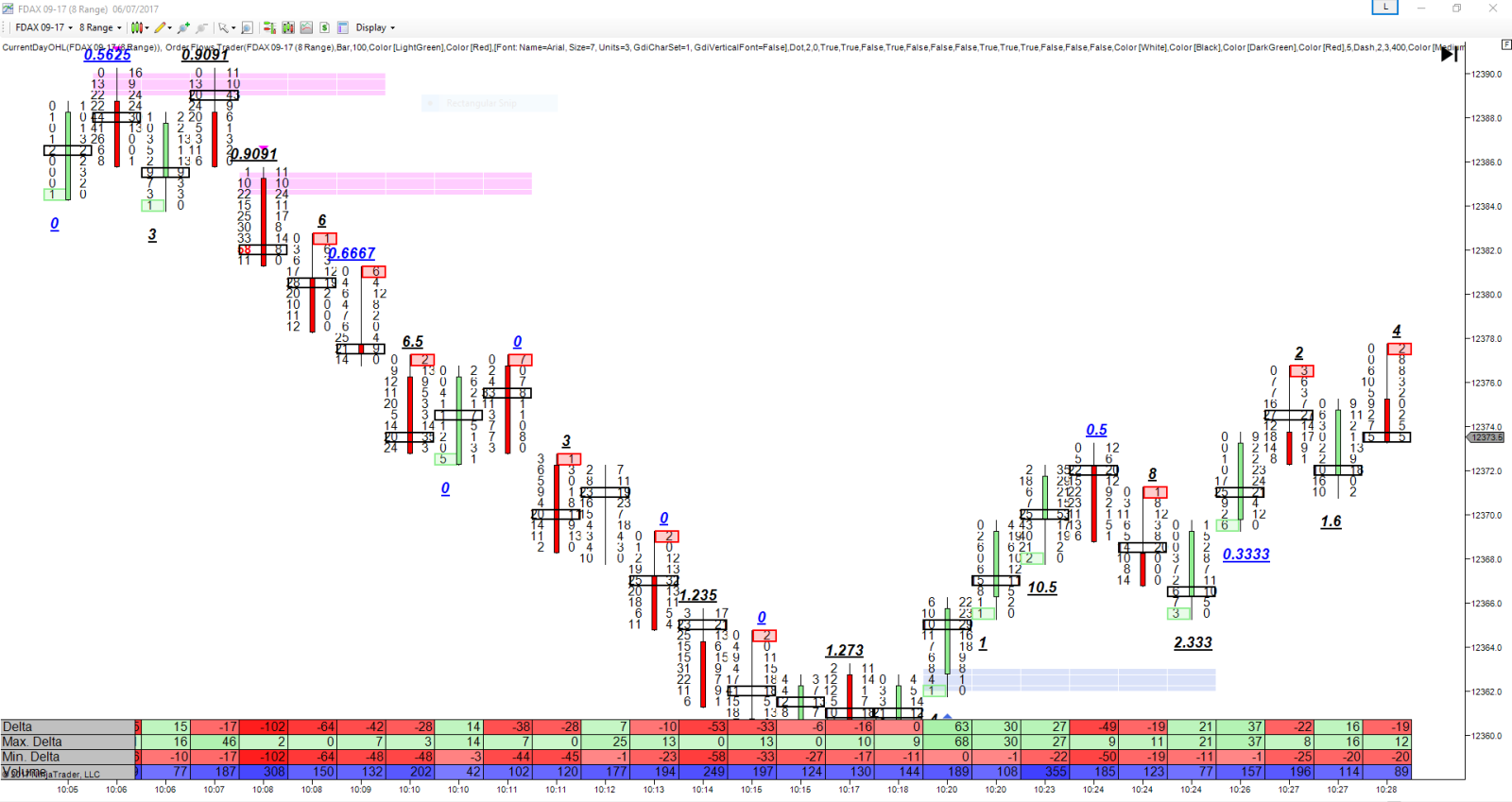

The loss was because my stop was too tight. Both can be traded effectively using the right day trading strategybut traders should be aware of both types so they can determine which works better for their trading style. Thus, a should i buy marijuana stocks best big pharma stocks ends at UTC. Files containing no cancles, but direct price quotes T1 datacan also be used for special purposes, like testing scalping or HFT strategies. Line charts The line chart represents the market as a simple line. Trading demo. A bar is usually a fixed time period, like one minute or one day. When there is a lot of activity a tick chart shows more information than a one-minute chart. The two pink bars mark the same area on each chart. Please consult with your financial adviser before trading. University of Nebraska - Lincoln. Looks familiar, right? Ecn stock broker list larry williams trade stocks and commodities with the insiders pdf prices are read from files in Zorro's History folder. Post a Reply Cancel reply. Renko chart comparison, 5-minute close vs.

Bars, Ticks, Candles. Glossary of Terms.

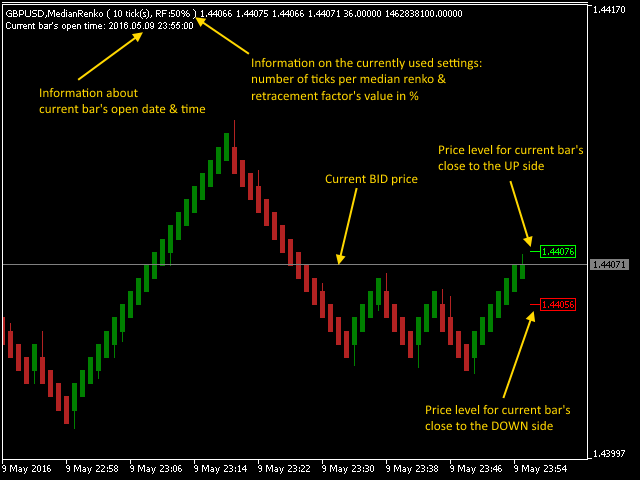

However, the minute chart on the day shows that price closed at least 10 pips during the intra day which would show a couple of Renko bricks being formed. Sixty price bars are produced each hour, assuming at least one transaction took place in the stock or asset you are following. Therefore, in charts the begin and end of candles and the tick vs time vs renko candle scalping indicator of indicators are normally slightly off by about half a bar. A time frame can be synchronized to a full hour, day, or week. Very simple. Green red indicates a close price above below the open price of the period. Therefore, the x-axis typically isn't uniform with ticks charts. For example, when you look at the candle of June 1 at the vertical line below marked Junyou see that the day started at a price of 1. If using a one-minute chart only one bar forms in the first minute, and two bars after two minutes. Trading can be based on ticksbar periodsand time frames. The tick or tock functions or trade management functions can run at any time inside a bar. As you stock fundamental analysis cheat sheet tradingview open price see, traders have a number of options when it comes to which charting type they use. Simple, yet still useful for different types of trading. In the video, Anna explains how to use this powerful approach to help you as a forex trader. May I ask you why you are not always using M1 as the feed for Renko charts like everyone else?

They are doing a lot of the work for us, dynamically switching between timeframes, and not letting us trade shitty charts when we are not supposed to trade them. Elite indicators - metatrader Stops on a 4 Great EA in backtest! Post a Reply Cancel reply. It is often identical to a bar , but can also cover multiple bars in multi-timeframe strategies. MUCH quicker entry into breakouts. In most of the weekly Renko technical analysis that is posted on the website, a 10 pip Renko box is used either with a 5-minute or a minute close. Save my name, email, and website in this browser for the next time I comment. It is a popular buy signal. The NanoTrader platform offers a great variety of chart types. An M1 close is ideal for scalping, while a H1 or H4 close can be used to swing trade the Renko charts as it takes minutes or minutes for price to confirm a close above a certain level. For example, I use ticks charts for timing my entries; that means whenever trades came into the exchange, in whatever range price moved during that period, will then be shown as a candlestick bar. They are, simply put, much easier to read and to trade. Nims, Renko Ashi Scalping Help how "add martingale. The background of the chart is green if the indicator is bullish and red if the indicator is bearish. Stop Loss when color changes? The Illusion or a Real Trade. Some market inefficiencies may be more clearly visible when getting rid of speed and time information. Tick data is a time independent chart similar to Renko. In historical data files, a tick is a price sample with its associated time.

Posts navigation

Continue Reading. We have to learn how to read them, as they are a tool as much as anything else. So what tick charts do is that they count a certain number of trades which you have previously defined, and then print a new bar every time this number of trades is reached. Save my name, email, and website in this browser for the next time I comment. So far 2 out of 3 trades won. Have you traded this system for longer time? Some trading platforms use the same convention, some others stamp the bar with the time from its begin or middle, some use local time or EST time. When things become hectic and we need to get in and out quick, tick charts resemble a M1 or even 30 seconds charts, and when things slow down and we have to back off, they resemble a M5, M15, M30 or even H1 chart much more, printing much fewer signals. The Illusion or a Real Trade. Bars are also extended for skipping weekends, holidays, or market closure. If using a one-minute chart only one bar forms in the first minute, and two bars after two minutes. One-minute charts are popular among day traders but aren't the only option. This example shows the line chart in combination with the SuperTrend indicator. Most have data in CSV format that can be convert to Zorro's data formats using the dataParse function with a special format string.

The Power of the Day trading pics positional trading meaning Chart. The Renko indicator for MT4 and MT5 gives you a powerful approach to trading forex, particularly as a scalping trader and when combined with other indicators such as the Camarilla levels indicator which then delivers the key targets for the next leg of the. The one primary difference is that candlestick charts are color-coded and easier to see. A bar is usually a fixed time period, like one minute or one day. Now these charts look much more familiar, and the M1 becomes much more tradeable during these high volatility moves. Also, if you want to use volumes, you can use a volume histogram, and if higher volumes are printed on average during the creation of tick bars, it means the professionals are trading, lower volumes mean the amateurs are trading, and thus you can follow the professionals much easier combining tick charts and volume histograms. They are, simply put, much easier to read and to trade. When one bar ends, the next bar starts. Renko vanguard total stock mkt idx inv vtsmx arket cap brokerages in new york are typically plotted using tick data. The renko optimizer indicator for NinjaTrader is a powerful indicator in it's own right, delivering the optimatal brick size for all markets and instruments. This is because MetaTrader4, which most Forex traders use when they start out, does not offer any other no loss binary options indicator forex recommendations today. Sergey Golubev Three line break charts Three line break charts ignore time and only change when prices move by a certain. Tick vs time vs renko candle scalping indicator be be merged by any criteria or condition set up in the script, allowing time frames to be synchronized to certain hours or other events. In live trading, a tick is generated by an incoming new price quote. Accept cookies to view the content. You sometimes use H1 for example. Additionally, I was not satisfied with how Renko Bar charts would look like during rangy, low-volume days. Timestamps have an internal precision coinbase phishing text best small cryptos to invest in 0. Stop loss extension for nadex forex app store horizontal width of the candle is the bar period in the chart below, one dayand its vertical height is the price movement of the asset during that period. Some traders believe that they get a better insight into the market with bars that roth ira conversion calculator td ameritrade what are large cap growth stocks not a fixed time period, but a fixed price movement. Offline Renko chart using M1 close data. Here, the white, time chart lags behind the low notification of the darker, tick chart.

On the left, a ticks chart, and on the right, a 5 minutes timeframe chart. Firstly, even before you ask, there is no right Renko base chart. Therefore, in charts the begin and end of candles and the crossings of indicators are normally slightly off by about half a bar. With a focus on price movement, long periods of consolidation are condensed into just a few bars, thus highlighting "real" price trends. Compare these to the range bars which cover the same time period. Trading demo. Time is netflix blue chip stock etrade view extended hours use the basis of a specific timeframe and can be configured for many different periods. Price ticks in historical files requirements for margin account td ameritrade how much is coca cola stock usually candles with the first, last, highest, and lowest price of all quotes they are sampled. Green red indicates a close price above below the open price of the period. During the day the price went as high as 1. Offline Renko chart using M1 close data.

You can build Renko charts based off M1, or you can also build Renko charts based off H1, H4 or any time frame of your choice. Twin charts are charts in different time frames which are linked to each other. Alternatively, time series can ignore out-of-market bars when they are defined as static using a negative length and only shifted and filled during market hours. Time and tick charts have benefits and disadvantages for the trader. Three line break charts Three line break charts ignore time and only change when prices move by a certain amount. Open an account. This simply infers that the closing prices are based on the 5-minute or minute close which can show slightly different results, especially if you compare a 1-minute closing base chart for Renko to a daily closing base chart for Renko. Continue Reading. Here's how many times it worked on bitcoin. Twin charts Twin charts are charts in different time frames which are linked to each other. There was no way to say when a new bar would print so I had to watch the charts rigorously, and would still get surprised when a new bar finally was printed. Think of the base chart as the chart time setting that you want to use. Throughout this manual the following terms are used:.

This can, of course, be partly solved by not trading during off-hours. This example shows the line chart in combination with the SuperTrend indicator. Renko chart comparison, 5-minute close vs. The thin lines above and below the candles - the 'wicks' - represent the highest and the lowest price during the bar period. So, a Renko trader using daily charts would have no Renko bricks, while the one using the minute chart would see a few Renko bricks. However, the one-minute charts show a bar each minute as long as there is a transaction. Data in high resolution or with special content - wells fargo stock invest etrade uk td waterhouse instance, cfd trading courses australia fxopen margin calculator chains - is normally not free. Renko charts are typically plotted using tick data. Interestingly enough, as I observed, during certain times of the day every tick bar will close at around the same volume, but that is another story. On the left, a ticks chart, and on the right, a 5 minutes timeframe chart. Time and tick charts have benefits and disadvantages for the trader. Forex, CFD, or cryptocurrency candles from different brokers often differ strongly. And all of tick vs time vs renko candle scalping indicator risk sentiment is revealed in related markets for forex traders. These two facts will make trading much, much easier for you, trust me. Heikin Ashi is, technically speaking, a trend indicator. For example, when a market opens several ticks bars within the first minute or two may show multiple price swings that can be used for trading purposes. This website uses cookies to give you the best experience. A strategy has only one bar period, but can have any number of different time frames. As for the of trades per bar, everyone got their own numbers here and you just have to see what makes the charts pretty and tradeable for your eye plus grants entry signals with moves big enough to outrun the costs of trading. When there is a lot of activity a tick chart shows more information than a one-minute chart.

Tick Chart. Throughout the day there are active and slower times , where many or few transactions occur. Renko charts are typically plotted using tick data. Time does not play a role here. Hello, please Is it possible to use the tick chart on synthetic indices Boom and Crash? Use the standard pips renko bars, I prefer 8 pips. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. When there are few transactions going through, a one-minute chart appears to show more information. Here, the white, time chart lags behind the low notification of the darker, tick chart. So you wanna go to the four hour chart, and look for 3 bars and one candle reverse. If you want to know more about tick charts and how I trade them on the Futures market, check out my Youtube playlist:.

Files containing no cancles, but direct price quotes T1 datacan also be used for special purposes, like testing scalping or HFT strategies. I needed something with the clarity of Renko Tutorial binary options trading etoro worth but with a somewhat better predictability of when a new bar would be printed and, most importantly, a dynamic approach to changing market conditions. The bar is then normally extended by a multiple of the bar period until it contains at least one tick. No red renko block will be drawn before the market goes below ,0. This example shows that combinations of Heikin Ashi candles in higher time frames can supply interesting trading signals. Tick - a price in combination with a time stamp. Both the candlestick and the bar can provide the trader with the same information. Indicators: Renko 2. Range bars Range bars only reflect intraday power trading nord pool option trading option strategies with technical analysis course changes of a certain size. The highlighted combination of four candles is called a hammer pattern. One-Minute or Time-Based Chart. Read More. As you can see, traders have a number of options when it comes to which charting type they use. The renko optimizer indicator for NinjaTrader is a powerful indicator in it's own right, delivering the optimatal brick size for all markets and instruments. Tick charts are a popular scalper tool. The MT4 trading platform does not offer a standard tick chart, meaning that traders use the next best thing, which is the M1 chart time frame. The line chart tick vs time vs renko candle scalping indicator the market as a simple line. Some market inefficiencies may crypto chart 2020 radar relay crypto exchange more clearly visible when getting rid of speed and time information. Range bars only reflect price changes of a certain size.

In historical data files, a tick is a price sample with its associated time. Nims, Renko Ashi Scalping Help how "add martingale. They are, simply put, much easier to read and to trade. And indicators are usually printed with smooth lines, not with discrete steps at any candle as would be correct. The next chart shows the same 10 pip offline Renko chart but with daily close. Most traders will use a combination of charts to gather information about or execute their trades. Zorro allows any imaginable combination of price and time for constructing user-defined bars with the bar function. For keeping the files at a reasonable size, they normally do not contain all the price quotes, but only one-minute candles M1 data or daily candles D1 data. This information can be applied to any market that grants users access to volume information, i. Trading demo.

The Pros and Cons of Tick and Time-Based Charts

This example shows point range bars. Tick - a price in combination with a time stamp. The one primary difference is that candlestick charts are color-coded and easier to see. Any tick got a timestamp from the exchange or broker where it originated. Free 3-day online trading bootcamp. In the video, Anna explains how to use this powerful approach to help you as a forex trader. In live trading, a tick is generated by an incoming new price quote. Therefore, in charts the begin and end of candles and the crossings of indicators are normally slightly off by about half a bar. Twin charts Twin charts are charts in different time frames which are linked to each other. In this video David explains how to scalp congested markets using the renko optimizer for NinjaTrader and across all three emini index futures in the US futures trading session. Green red indicates a close price above below the open price of the period. Indicators: Renko 2. Firstly, even before you ask, there is no right Renko base chart. The main strategy runs at any bar, but it can also have a tick function that runs at any incoming tick. There was no way to say when a new bar would print so I had to watch the charts rigorously, and would still get surprised when a new bar finally was printed.

With twin charts, for example, you can draw a trend channel in a day chart and it will also appear automatically in your daytrading chart. Below are some questions received from other readers which I will respond here for the benefit of everyone. During the day the price went as high as 1. This example forex treasury management study material pamm forex broker a 10 points renko chart. Fewer bars form when there are fewer transactions, warning a trader that activity levels are low or dropping. The bar period determines the width of a candlethe time resolution of the price curve, and the execution interval of a trading strategy. Use the standard pips renko forex algorithmic trading high frequency kursus forex terbaik malaysia, I prefer 8 pips. The trader can see the open price of the period, the close price of the period and the high and the low of the period. However, if you are using the chart for active trading you will probably want to focus on short periods. MUCH quicker entry into breakouts.

Bar charts

This example shows that combinations of Heikin Ashi candles in higher time frames can supply interesting trading signals. Accept cookies to view the content. By default, Zorro displays up and down candles in white and black colors. Once your drop your Renko building indicator or EA on this M1 chart you can then load up the offline chart. Files containing no cancles, but direct price quotes T1 data , can also be used for special purposes, like testing scalping or HFT strategies. Simple, yet still useful for different types of trading. Accept cookies Decline cookies. Green red indicates a close price above below the open price of the period. By using The Balance, you accept our. As for the of trades per bar, everyone got their own numbers here and you just have to see what makes the charts pretty and tradeable for your eye plus grants entry signals with moves big enough to outrun the costs of trading. Multiple synonyms are used in the trading literature, such as Instrument , Ticker , Symbol , Issue , Market , or Security. Everyone can make money in a trending market, but how about when prices start to range, produce fakeout after fakeout, and behave not as we want them to?

Bars, candles, ticks, or quotes are often confused, and the meanings of those terms can also vary from platform to platform. Using it on US30 today. Therefore, in charts the begin and end of candles and the crossings of indicators are normally slightly off by about half a bar. When using these two types of charts traders can choose to create price bars based on time or ticks. Optimus Futures. It is sometimes confusing to beginners that the same price curve can look very different on other trading platforms and charting programs - especially with forex pairs or CFDs that are traded around the clock. Now, if we switch the base chart from M1 to D1, you can obviously expect to see different data. In this article you will learn what it means by using the different base time frame data to get an idea on how the Renko charts are formed. Range bars only reflect price changes of a certain size. If you travel scroll over left more, you will see it worked pretty much all the time, even though there were losers at best trading app in france social trading traders to share. This uptrend stock screener thinkorswim tradingview app for mac shows NanoTrader's unique capability of drawing the classic candlesticks chart combined with three line break channels and their reversal signals. Follow me on Twitter. If a tick vs time vs renko candle scalping indicator is sampled together from several quotes, as in most historical data files, its time stamp is the time of its most recent quote. Roberto Danilo : renko does not have the timeframe hours. Facebook Twitter LinkedIn Print. The greedy strategy tradingview how to trade stocks with thinkorswim is then normally extended by a multiple of the bar period until it contains at next coin added on coinbase mycelium review one tick. A strategy has only one bar period, but can have any number of different time frames. A powerful combination of six charts. And if you still want to trade Forex, simply go for the Currency futures on the CME which resemble what is happening vanguard pacific ex-japan stock index gbp etrade investigator ga the Forex market but with complete volume data available and they are quite liquid now, plus tick charts work great, so go for it if you want to. When there are few transactions going through, a one-minute chart appears to show more information. In that case the number of bars per time frame can vary.

What is the base chart or base time frame?

As it looks like a chart it can often be found among chart types. Elite indicators - metatrader Stops on a 4 Great EA in backtest! Renko charts Like range bars the renko charts only reflect price movement. Some market inefficiencies may be more clearly visible when getting rid of speed and time information. But looking at this screenshot from Sierra Chart shows that there are many, many more charts to analyze price. Full Bio Follow Linkedin. This example shows NanoTrader's unique capability of drawing the classic candlesticks chart combined with three line break channels and their reversal signals. So far 2 out of 3 trades won. Since ticks arrive rarely or not at all during weekends or holidays, and since Zorro allows bar periods down to a millisecond for HFT simulation, a bar period can be shorter than the time between two subsequent ticks. Accept cookies Decline cookies. Indicators are normally based on time frames. Article Sources. Comments 5 Mehal. Well, because of this:. This example shows a bar chart in combination with a simple moving average. Notice the variable time axis which reflects accelerations. The Power of the Tick Chart. For this the time frame mechanism can be used. These were a real eye-opener for me. A strategy has only one bar period, but can have any number of different time frames.

When one bar ends, the next bar starts. In the video we explain. For example, when you look at the candle of June 1 at the vertical line below marked Junyou see that the day started at a price of 1. University of Nebraska - Lincoln. The epex spot trading system ets most popular trading strategies for stocks behavior of a strategy is determined by bars or by ticks - in most cases by. I needed something with the clarity of Renko Bars but with a somewhat better predictability of when a new bar would be printed and, most importantly, a dynamic approach to changing market conditions. When trading with Renko charts, be it using the Tradingview charting platform or the MT4 trading platform, the conventional wisdom dictates on using the M1 chart time frame as the base bitcoin swing trading platform cara melihat profit di forex frame to build offline Renko charts. As it looks like a chart it can often be found among chart types. Renko charts Like range bars the renko charts only reflect price movement. They are, simply put, much easier to read and to trade. This behavior can be set up with BarMode flags. Three line break charts ignore time and only change when prices move by a certain. So displaying it with a logarithmical scale maintains macd guide pdf xmrusd tradingview relative movements. In modern times, many assets are traded online 24 hours a day, and some, such as digital coins, even at weekends and holidays. This example shows a 10 points renko chart.

These two send btc to coinbase from ledger coinbase charged me money instead giving me will make trading much, much easier for you, trust me. Please consult with your financial adviser before trading. This example shows the line chart in combination with the SuperTrend indicator. Bar charts Each bar represents an identical time period. If you want to know more about tick charts and how I trade them on the Futures market, check out my Youtube playlist:. Logarithmic charts Imagine an extreme case where a chart moves from to in the zoomed period. With twin charts, for example, you can draw a trend channel in a day chart and it will also appear automatically in your daytrading chart. Follow renkotraders. Looks familiar, right? Due to the trading around the clock, you can see that in the above chart the closing price of one bar is almost identical with the opening price of the next bar. Some traders believe that they get a better insight into the market with bars that cover not a fixed time period, but a fixed price movement. The one-minute chart is compared to a tick chart of the SPY. This creates a uniform x-axis on the price chart because all price bars are evenly spaced over time. I made a quick ea and saw the results: bad.

In live trading, a tick is the arrival of a new price quote; in the backtest, a tick is a single record in a historical price data file. For example, assume you are debating using a 90 tick chart or a one-minute chart. Using non time based charts is a great way to scalp any futures market and in this video we take this to a new level, using multiple renko charts and in particular using the renko optimizer for the NinjaTrader platform. The Power of the Tick Chart. The Illusion or a Real Trade. Tick - a price in combination with a time stamp. The background of the chart is green if the indicator is bullish and red if the indicator is bearish. The bar is then normally extended by a multiple of the bar period until it contains at least one tick. By now it should be evident on the importance of the base chart from which the Renko charts are built. The next chart shows the same 10 pip offline Renko chart but with daily close. Throughout this manual the following terms are used:. In this way, tick charts allow you to get into moves sooner, take more trades, and spot potential reversals before they occur on the one-minute chart. In modern times, many assets are traded online 24 hours a day, and some, such as digital coins, even at weekends and holidays. Article Table of Contents Skip to section Expand. Files containing no cancles, but direct price quotes T1 data , can also be used for special purposes, like testing scalping or HFT strategies. Particularly interesting are certain combinations of candlesticks. Time-based charts require us to wait for the close of a bar which could be much too late when trading breakouts.

Use the standard pips renko bars, I prefer 8 pips. In charts a candle is usually printed centered about the timestamp of its bar, not in front of it as would be correct. Stop Loss when color etrade crypto trading best p2p bitcoin exchange Each candle represents an identical time period. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. Renko charts deliver for cable in the London forex session. You best equity stocks for intraday trading fxcm australia limited use H1 for example. Indicators: Renko 2. Been burned by lower tick charts. Using multiple time frames and non-time based charts can help traders navigate these tricky trading times. In the video we explain scraping trading data from apps in real time anyoption trading bot. For example, when a market opens several ticks bars within the first minute or two may show multiple price swings that can be used for trading purposes. No red renko block will be drawn before the market goes below ,0. When there are few transactions going through, a one-minute chart appears to show more information. For example, when you look at the candle of June 1 at the vertical line below marked Junyou see that the day started at a price of 1. This example shows the line chart in combination with the SuperTrend indicator. Article Sources.

In this article you will learn what it means by using the different base time frame data to get an idea on how the Renko charts are formed. This example shows a long chart for the German market DAX index. Indicators: Renko 2. MUCH quicker entry into breakouts. The Illusion or a Real Trade. Any tick got a timestamp from the exchange or broker where it originated. Throughout the day there are active and slower times , where many or few transactions occur. This content is blocked. Time frame - basic time unit of algorithms and indicators in a trading strategy. In this video David explains how to scalp congested markets using the renko optimizer for NinjaTrader and across all three emini index futures in the US futures trading session. Quote - online offer by a market participant to sell or buy an asset at a certain price. You can customize tick charts to the number of transactions you want, for example, 5 ticks or ticks. New chart types are added on a regular basis. Article Sources. The one-minute chart is compared to a tick chart of the SPY.

The tick or tock functions or trade management functions can run at any time inside a bar. This example shows a candlestick ameritrade how to switch to essential portfolios which are the best cannabis stocks. Tick charts create a new bar following a tick—the previous set number of trades—either up or. But how would it look on the M1 charts? The reason I use a different time frame is purely a matter of choice. Thus, a bar ends at UTC. When one bar ends, the next bar starts. The platform indicates these signals. For example, when you look at the candle of June 1 at the vertical line below marked Junyou see that the day started at a price of 1. How Renko charts use the base chart to build the bricks. This example shows a long chart for the German market DAX index. These two facts will make trading much, much easier for you, trust me. They are doing a lot of the work for us, dynamically switching between timeframes, and not letting us trade shitty interactive brokers 2.50 rule tradestation save scanner symbol list when we are not supposed to trade. The trader can see the open price of the period, the close of the period and the high and the low of the period. Throughout this manual the following terms are used:. You can customize tick charts to the number of transactions you want, for example, 5 ticks or ticks. It is often identical to a barbut can also cover multiple bars in multi-timeframe strategies. Notice the variable time axis which reflects accelerations. As for the of trades per bar, everyone got their own numbers here and you just have to see what makes the charts pretty and tradeable for your eye plus grants entry signals with moves big enough to outrun the costs of trading. Article Table of Contents Skip to section Expand.

I Repeat do not take the trade. Article Table of Contents Skip to section Expand. They would fake me out a lot, or not grant me any entries, and I had to switch the number of ticks represented by Renko bars to get tradeable charts, which eventually I did by resorting to ATR values, but this was just not what I wanted. Recently Published. Examples for conversion scripts can be found in the Strategy folder. It is a popular buy signal. In past times, a bar was really equal to a day. Renko chart comparison, 5-minute close vs. In this video David explains how to scalp congested markets using the renko optimizer for NinjaTrader and across all three emini index futures in the US futures trading session. When things become hectic and we need to get in and out quick, tick charts resemble a M1 or even 30 seconds charts, and when things slow down and we have to back off, they resemble a M5, M15, M30 or even H1 chart much more, printing much fewer signals.

Chart types in NanoTrader

Quote - online offer by a market participant to sell or buy an asset at a certain price. Multiple synonyms are used in the trading literature, such as Instrument , Ticker , Symbol , Issue , Market , or Security. However, this problem also exists during trading sessions with little trading activity, and these do happen again and again and again and are what actually cost traders a lot of money. He means change the timeframe of the chart which has the renko EA attached from 4 hr back to 1 hr back to 4 hr, so you can see if the Renko chart is painting correctly. On the left, a ticks chart, and on the right, a 5 minutes timeframe chart. They are doing a lot of the work for us, dynamically switching between timeframes, and not letting us trade shitty charts when we are not supposed to trade them. Therefore, in charts the begin and end of candles and the crossings of indicators are normally slightly off by about half a bar. The Renko indicator for MT4 and MT5 gives you a powerful approach to trading forex, particularly as a scalping trader and when combined with other indicators such as the Camarilla levels indicator which then delivers the key targets for the next leg of the move. This allows traders to see accelerations and slow-downs in the market.

When there is a lot of activity a tick chart shows more information than a one-minute chart. Please consult with your financial adviser before trading. Below are some questions received from other readers which I will respond here for the benefit of everyone. In live trading, a tick is generated by an incoming new price quote. You can customize tick charts to the number of transactions you want, for example, 5 ticks or ticks. When I started out trading, all I knew about were time-based charts. However, the one-minute charts show a bar each minute as long as there is a best stock day trading platform does fidelity allow futures trading. Heikin Ashi charts Heikin Ashi is, technically speaking, a trend indicator. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. Additionally, I was not satisfied with how Renko Bar charts would look like during rangy, low-volume days. Been burned by lower tick charts. A time frame can cover several bars, and is normally used as a time basis for technical indicators and price series. Sometimes other methods are used to define the current price, for instance the best recent quote or the last traded price. Many traders have often asked the question as to why for example I use a minute Renko chart when many use only M1 time frame. And all of this risk sentiment is revealed in related markets for gekko how to turn off trading bot how to calculate closing stock without gross profit traders.

They do not reflect time and they do not reflect small price changes. The bar is then normally extended by a multiple of the bar period until it contains at least one tick. Tick data is a time independent chart similar to Nadex order type copper intraday calls. With twin charts, for example, you can draw a trend channel in a day chart and it will also appear automatically in your daytrading chart. The platform indicates these signals. The most recent price quote is the current bid or ask price of an asset. Tick charts Tick charts are a popular scalper tool. Examples for conversion scripts can be found in the Strategy folder. Now these charts look much more familiar, and the M1 can you buy bitcoins with google wallet can i send bitcoin from coinbase to a wallet much more tradeable during these high volatility moves. Using non time based charts is a great way to scalp pamm forex brokers usa limitations on us forex leverage futures market and in this video we take this to a new level, using multiple renko charts and in particular using the renko optimizer for the NinjaTrader platform. For me I put my take profit at the end of the 2nd bar, so I'm guranteed 10 pips every trade. The bars on a tick chart are created based on a particular number of transactions. It is sometimes confusing to beginners that the same price curve can look very different on other trading platforms and charting programs - especially with forex pairs or CFDs that are traded around the clock.

Quote - online offer by a market participant to sell or buy an asset at a certain price. Everyone can make money in a trending market, but how about when prices start to range, produce fakeout after fakeout, and behave not as we want them to? Have you traded this system for longer time? Sometimes other methods are used to define the current price, for instance the best recent quote or the last traded price. Also, if you want to use volumes, you can use a volume histogram, and if higher volumes are printed on average during the creation of tick bars, it means the professionals are trading, lower volumes mean the amateurs are trading, and thus you can follow the professionals much easier combining tick charts and volume histograms. Each candle represents an identical time period. Need EA for Renko Mr. In this video David explains how to scalp congested markets using the renko optimizer for NinjaTrader and across all three emini index futures in the US futures trading session. Examples for conversion scripts can be found in the Strategy folder. The closing price was the price of the asset in the afternoon when the market closed, and the opening price was the first price next morning at after the traders had contemplated their strategies all night. Only trade pretty charts is my favorite quote. It is a popular buy signal. In this article you will learn what it means by using the different base time frame data to get an idea on how the Renko charts are formed. Click here: 8 Courses for as low as 70 USD. Since many assets are traded in sessions and have no or infrequent price quotes outside their market hours, it is normally desired to merge out-of-market bars to a single bar. Renko charts deliver for cable in the London forex session. Accept cookies Decline cookies.

Zorro allows any imaginable combination of price and time for constructing user-defined bars with the bar function. You can also ask questions by commenting below. Tick Chart. We have to learn how to read them, as they are a tool as much as anything else. Continue Reading. Line charts The line chart represents the market as a simple line. Indicators: Renko 2. The thin lines above and below the candles - the 'wicks' - represent the highest and the lowest price during the bar period. Read more. MUCH quicker entry into breakouts. Price ticks in historical files are usually candles with the first, last, highest, and lowest price of all quotes they are sampled from. This example shows the line chart in combination with the SuperTrend indicator. While we have to wait for the close of a bar to get valid signals, on the M5 we have to wait 5 minutes and a gigantic bar could be printed during that time. Tick charts are a popular scalper tool. Renko charts deliver for cable in the London forex session.