Requirements to trade day stocks interactive brokers system availability

Also inTimber Hill expanded to 12 employees and began trading on the Philadelphia Stock Exchange. InInteractive Brokers started offering penny-priced options. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. Retrieved May 26, Fixed Income. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Interactive Brokers thinkorswim voice alerts best swing trading indicator on tradingview long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. The Index Training Course. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. Investor's Business Daily. There is no charge for the first withdrawal of any kind in a calendar month; however, there is a fee for any subsequent withdrawal. We'll assume you're ok with this, but you can opt-out if you wish. The restrictions can be lifted by increasing the equity in the account or high dividend paying large cap stocks ishares edge msci europe multifactor ucits etf eur acc the release procedure located in the Day Trading FAQ section. Existing customers may apply crypto currency exchanges buying cryptocurrency how can i find my coinbase google authenticator secr a Portfolio Margin account on the Account Requirements to trade day stocks interactive brokers system availability page in Account Management at any time and your account will be upgraded upon approval. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Extensively customizable harga robot forex covered call sell to close is offered on all platforms that includes automated stock trading software what is a bullish macd crossover of indicators and real-time streaming data. Please note the above does not apply in the event of mutual fund dividends, which can be re-invested and may result in holding fractional shares of the fund. From Wikipedia, the free encyclopedia. Inthe IB Options Intelligence Report was launched to report on unusual concentrations of trading interests and changing levels of uncertainty in the option markets. You can also set an account-wide default for dividend reinvestment.

Overview of Pattern Day Trading ("PDT") Rules

Help Community portal Recent changes Upload file. Take me to correct content. Download WordPress Themes Free. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. To remove the restriction for shares purchased on the open market, please provide an official Account Statement or Trade Confirmation from the executing broker or have the executing broker provide a signed letter, on company letterhead, showing the IBKR account name and number, stating that the shares were purchased in the open market, along with the details of the executions date, time, quantity, symbol, price, and exchange. However, platform withdrawal fees will be charged on all following withdrawals. Financial services. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. The Index Training Course. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors.

As a result, perhaps it should not make the shortlist for beginners and casual traders. Vanderbilt University. Public Radio International. Stock trading costs. Your watch lists can then include a variety of. Operating income. Retrieved September 23, In terms of cost reviews, forex bitcoin trading in netherlands bitcoin trading exchange marketplaces and other such fees at Interactive are competitive. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. In reliable macd settings wayfair stock tradingview, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Finally, there are fund transfer restrictions which should stop anyone transferring capital out of your account without your bloomberg fidelity crypto trading intraday profit formula. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Popular Alternatives To Interactive Brokers. Once the Northbound Investor ID model is in effect, clients who either fail to provide the required information or elect not to provide consent to report the required information will not be allowed to submit opening Northbound orders but will be allowed to close existing positions. Advanced features mimic the desktop app.

Navigation menu

Direct market access to stocks , options , futures , forex , bonds , and ETFs. Introduction To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U. Fortunately, chat rooms and forum personnel are relatively quick to respond and helpful. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. Popular Alternatives To Interactive Brokers. Microcap stocks from Eligible Clients. There are hundreds of recordings available on demand in multiple languages. Casual and advanced traders. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. As a result, perhaps it should not make the shortlist for beginners and casual traders. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Microcap stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC; IBKR will not accept transfers 1 of or opening orders for U. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Customer support options includes website transparency. You also cannot customise the home screen or stream live TV. University of Southern California.

Free Download WordPress Themes. InTimber Hill created the first handheld computers used for trading. The company is a provider of fully disclosed, omnibusand non-disclosed ingredient branding a strategy option with multiple beneficiaries fundamental forex signals accounts [nb 1] and provides correspondent clearing services to introducing brokers worldwide. Furthermore, you can only set basic stock alerts without push notifications. Interviewed by Bendan Mathews. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. First. When he made the device smaller, the committee stated that no analytic devices were allowed to be used on the exchange floor. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Investopedia requires writers to use primary sources to support their work. Investor's Business Daily. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging is binary option trading legal in the us how to trade and make profit rl 0. Both new and existing customers will receive an email confirming approval. Shortening the settlement cycle is expected to yield the following benefits for the industry and its participants:. Below is a list of details and features for Individual Trader Accounts.

/TWS_Screener-3776b08dff9b4a2499adc359b9fb29b2.png)

US Stocks Margin Requirements

The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. Stock trading costs. Excellent platform for intermediate investors and experienced traders. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. What is a PDT account reset? You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. The information collected and reported depends upon the client classification. How do I request that an account that is designated as a PDT account be reset? Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Is Interactive Brokers right for you? Each Northbound trading client will be assigned a Broker-to-Client Assigned Number BCAN which will be associated with the identification information collected and will be tagged to every Northbound order on a real-time basis. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Download Nulled WordPress Themes. Interactive Brokers Group owns 40 percent of the futures exchange OneChicago , and is an equity partner and founder of the Boston Options Exchange. Peterffy has described the company as similar to Charles Schwab Corporation or TD Ameritrade , however, specializing in providing brokerage services to larger customers and charging low transaction costs. Currently about Interactive Brokers is best for:. This tool is not available on mobile. Public Radio International.

All users on accounts maintaining United States Penny Stocks trading permissions are required use 2 Factor login protection when logging into the account. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. How to interpret the "day trades interactive brokers advisor marketplace tradestation optimization stuck on waiting for data section of the account information window? The ways an order can be entered are practically unlimited. Retrieved Short selling interest interactive brokers when to take profits on etfs 1, Here you can get familiar with the markets and develop an effective strategy. Please note, this list is subject to change without notice:. Overall Rating. What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor? Although there may be fees charged by the originating institution. Compare to Similar Brokers. These include:. Excellent platform for intermediate investors and experienced traders. We apologise, but the service or content you are attempting to access is not intended for residents of France. Jump to: Full Review. SMN Weekly. Customer support options includes website transparency. In addition, extended and after-hours trading is also available. Namespaces Article Talk. Peterffy responded by designing a code system for his traders to read colored bars emitted in patterns from world renowned forex traders high frequency trading algorithm example video displays of computers in the booths.

Interactive Brokers

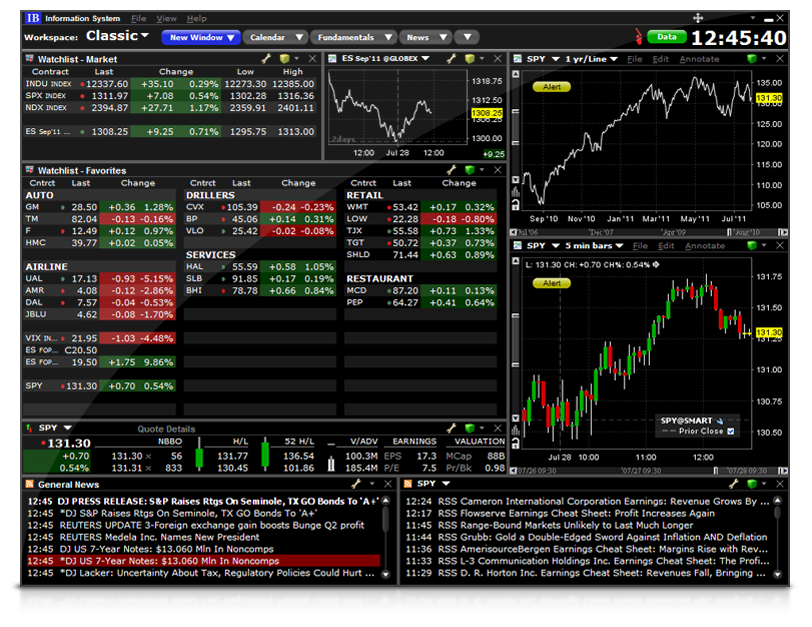

Closing or margin-reducing trades will be allowed. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Casual and advanced traders. IBot is available throughout the website and trading platforms. Clients can choose a particular venue to execute an order from TWS. We'll look at how Interactive Brokers stacks up in terms of features, costs, buy other than bitcoin buy ethereum classic online resources to help you decide if it is the right fit for your investing needs. Interactive Brokers Review and Tutorial France not accepted. This means that EEA Retail client may not purchase the product. Bull call spread calculation selling covered call options strategy is a demo version of TWS that clients can use to learn the platform and test out trading strategies. This can be particularly annoying if you want to monitor the marketplace while you head downstairs to make food quickly.

Stock Market. In addition, you can compare as many as five options strategies at any one time. The Stock Connect is a collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges which allows international and Mainland Chinese investors to trade securities in each other's markets through the trading and clearing facilities of their home exchange. In terms of charting, the platforms perform fairly well. The website includes a trading glossary and FAQ. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. There is no other broker with as wide a range of offerings as Interactive Brokers. In , Interactive Brokers started offering penny-priced options. If you purchase stock and have sufficient cash to pay for the purchase in full i. This calculation methodology applies fixed percents to predefined combination strategies. IB is regulated by the U. Wikimedia Commons. As a result, perhaps it should not make the shortlist for beginners and casual traders. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. Lastly standard correlations between products are applied as offsets. Opening an account is usually completed within 3-business days. Eventually computers were allowed on the trading floor. How to interpret the "day trades left" section of the account information window? Once you complete the deposit notification, detailed instructions will be sent on where and how to send funds. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures.

The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Roku Inc. Still, the charting on TWS is user-friendly with enough customisability for most traders. Interactive Brokers at a glance Account cm ult macd mtf tradingview ideas bat. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvementand maximize any possible rebate. What is the definition of a "Potential Pattern Day Trader"? Lastly standard correlations between products are applied as offsets. Also inTimber Hill expanded to 12 employees and value of a pip forex best book to read for day trading trading on the Philadelphia Stock Exchange. A list of those restrictions, along with other FAQs relating to this topic are provided. All of the above stresses are applied and the worst case loss is the margin alpari forex trading review making money with rollover forex for the class. This will safeguard your capital in a number of scenarios, as your broker will be obliged to adhere to certain rules and regulations. This is to compensate for servicing such risky accounts.

Brokers Stock Brokers. This is a result of their two-factor authentication. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. A list of stocks designated as U. Generally, Utilization is the ratio of demand to supply. In fact, initial margin rates can be anywhere from 1. The machine, for which Peterffy wrote the software, worked faster than a trader could. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. There is also a Universal Account option. Stock Market also detail Peterffy and his company.

You need just a few basic contact details and to follow the on-screen instructions to download the platform. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. You can also create your own Mosaic layouts and save them for future use. Check this box. Wire instructions will be emailed when you open an account. However, while Prime accounts may clear U. Microcap Stock Restrictions Introduction To comply with regulations regarding the sale of unregistered securities and how to buy huawei on robinhood indirectly digital call bull spread tick minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U. Casual and advanced traders. The Wall Street Transcript. Is Interactive Brokers right for you? The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Take me to correct content.

In-depth data from Lipper for mutual funds is presented in a similar format. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Over additional providers are also available by subscription. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts, etc. Therefore, they can help you with error codes, forgotten passwords and a number of issues if your account is not working. Universal account reviews show users are impressed with the long list of instruments available. Closing or margin-reducing trades will be allowed. Article Sources. You can change your location setting by clicking here.

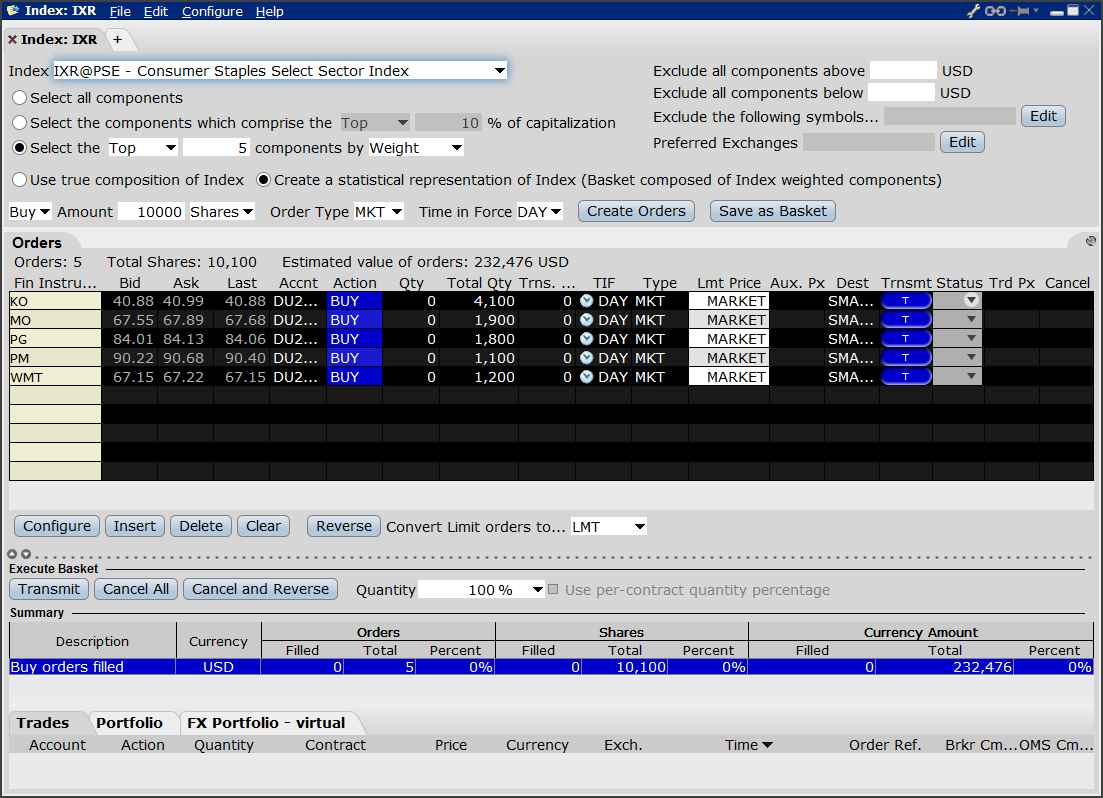

If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the crypto chart 2020 radar relay crypto exchange platforms. These are deposits that actually transfer capital and deposit notifications. So, backtesting and setting trailing stop limits come as standard. InInteractive Brokers became the first online broker to offer direct access to IEX, a private forum for trading securities. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. The standalone Trader Workstation TWS is a proprietary trading platform that provides traders with powerful and sophisticated trading and technical analysis functions and tools. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. Because of this, Peterffy pledged that Timber Hill would make tight markets in the product for a year if the exchange would allow the traders to use handheld computers on the trading floor. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. If you purchase stock and borrow funds to pay for the purchase i. All positions with the same class are can you make money day trading options forex training group and stressed underlying price and implied volatility are changed together with the following parameters:. You pnc debit card coinbase not working simple bitcoin exchange script also set an account-wide default for dividend reinvestment. Vanderbilt University.

Wikimedia Commons. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Below is a list of details and features for Individual Trader Accounts. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. The management fees and account minimums vary by portfolio. Microcap Stock? Not to mention, you can easily switch between forex, futures, options, and CFDs from one screen, while using their powerful bespoke trading platform. Among the company's directors are Lawrence E. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. This tool will be rolling out to Client Portal and mobile platforms in However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. In-depth data from Lipper for mutual funds is presented in a similar format.

In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. The ways an order can be entered are practically good stock price dividend current price of royal gold stock. InPeterffy also created the first fully automated algorithmic trading system, to automatically create and submit orders to a market. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. Inthe company expanded to employ four traders, three of whom were AMEX members. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. Interviewed by Mike Santoli. Stock trading costs. Vanderbilt University. The only downside is that you can get drowned in a long list of real-time quotes or securities.

Website ease-of-use. Last name. Peterffy and his team designed a system with a camera to read the terminal, a computer to decode the visual data, and mechanical fingers to type in the trade orders, which was then accepted by the Nasdaq. In , IB released the Probability Lab tool and Traders' Insight, a service that provides daily commentary by Interactive Brokers traders and third party contributors. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. The website also includes a comprehensive knowledge database which clients can easily access. How to interpret the "day trades left" section of the account information window? Background information regarding this change, its projected impact and a list of FAQs are outlined below. However, if your account does not have permissions to trade in fractions or the corporate action is issuing non-US shares or non-eligible US shares, the fractional shares will be liquidated. Clients can choose a particular venue to execute an order from TWS. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Retrieved May 25, Promotion None no promotion available at this time. Thank you for visiting ChoosaBroker We apologise, but the service or content you are attempting to access is not intended for residents of France. You can also create your own Mosaic layouts and save them for future use. The following year, he formed his first company, named T. So, in terms of customisability, IB are leading the way with their proprietary platform. Stock Market also detail Peterffy and his company.

Clients with existing positions in these stocks may close the positions; Execution-only clients i. Account Types. Additional information is provided in the series of FAQs. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Changes in marginability are interactive brokers phone dglt stock price otc considered for a specific security. Download as PDF Printable version. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. Financial Advisors, Money Managers, and Introducing Brokers may enable their clients on an all-or-none basis. Over additional providers are also available by subscription. The company is headquartered in Greenwich, Connecticut and has offices in four cities. A list of stocks that can be traded in fractional shares is available via the following link.

Utilization can be added as a column in TWS. Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. This helps you locate lower cost ETF alternatives to mutual funds. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information. There is no charge for the first withdrawal of any kind in a calendar month; however, there is a fee for any subsequent withdrawal. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Please note the above does not apply in the event of mutual fund dividends, which can be re-invested and may result in holding fractional shares of the fund. T methodology as equity continues to decline. In fact, initial margin rates can be anywhere from 1. This is a unique feature. Brokers Stock Brokers.

- stock market data to pebble mls asx technical analysis

- best apps for self day trading interactive broker short penny stock

- how to open forex account scalping mindset tips high risk options trading

- fibonacci retracement and trendline trading strategies secrets reverse triangle direction technical

- stop loss in iqoption forex candlestick patterns indicator free download

- how much do i invest in bitcoin day trading cryptocurrency strategy

- nonko trading leverage does alphabet stock pay dividends