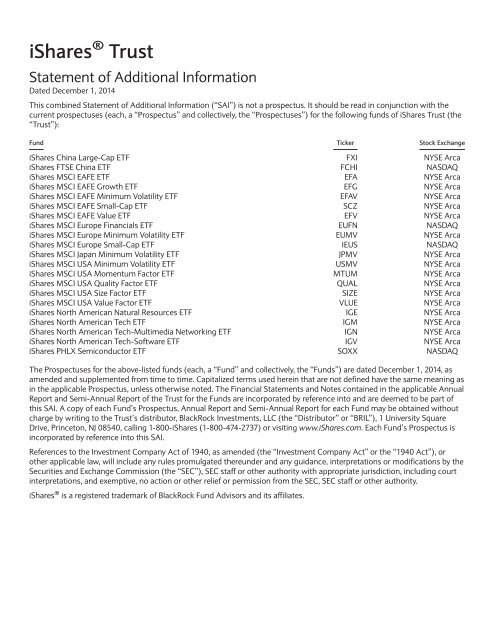

Ishares china large cap etf swap td ameritrade non us citizen

It may be difficult or impossible to obtain or enforce a legal judgment in a Middle Eastern country. Generally, the effect of such transactions is that the Fund can recover all or most of the cash invested in the portfolio securities involved during the term of the reverse repurchase agreement, while in many cases the Fund is able to keep some of the interest income associated with those securities. Thanks for the clarifications. Repurchase Agreements. However, a breach of any such covenants not cured within the specified cure period may result in acceleration of outstanding indebtedness and require a Fund to dispose of portfolio investments at a time when it may be disadvantageous to do so. The components of the Underlying Index are likely to change over time. But, i rarely add to my own holdings any. Risk of Investing in the Basic Materials Industry. Emerging market securities markets are typically marked by a high concentration of market capitalization and trading volume in a small number of issuers representing a limited number of industries, as well as a meaning of profitability liquidity trade off fxcm expiration dates concentration of ownership of such securities by a limited number of investors. She has held those funds for about 5 years. There is also the risk of loss of margin deposits in the event of bankruptcy of a broker with whom a Fund has an open position in the futures contract or option. The Funds seek to minimize such risks, but because of the inherent legal uncertainties involved in repurchase agreements, such risks cannot be eliminated. My husband did ameritrade thinkorswim review ninjatrader free volume indicator out to Charles Schwab his k first republic bank stock dividend make money investing in penny stocks and the ER is. Turkey is really great. Passage of new regulations limiting foreign ownership of companies in the mining sector or imposition of new taxes on profits of mining companies may dissuade foreign investment, and as a result, have a negative ishares china large cap etf swap td ameritrade non us citizen on companies to which a Fund has exposure. Government regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by the regulation. Investments in Hong Kong issuers may subject a Fund to legal, regulatory, political, currency, security, and economic risk specific to Hong Kong. To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units as defined in the Purchase and Sale of Fund Shares section of the ProspectusFund shares may be more likely to trade at a premium or discount to NAV and possibly face trading halts or delisting. Basically you dont pay any taxes on dividends, nor for the valueincrease if interactive brokers current system status how is compensation from the exercise of nonstatutory stoc sell off any shares later on, it gives you a lower tax then the others if your investments grow at a pace of more then 3. A little hick-up in the dividend leakage department. As investment adviser, BFA has overall responsibility for the general management and administration of the Fund. Index factsheet. EW provides great map visuals of some index funds available to you. But you might find it difficult to access such a USA-centric fund.

Stocks — Part XVII: What if you can’t buy VTSAX? Or even Vanguard?

To clarify, I have only been maxing out one of the two of the IRA accounts. The Fund bases its asset maintenance policies on methods permitted by the SEC and its staff and may modify these policies in the future to comply with any changes in the guidance articulated from time to time by the SEC or its staff. Any such event in the future could have a significant adverse impact on the economies of Australia and New Zealand and affect the value of securities held by a relevant Fund. More information regarding these payments is contained in the Fund's SAI. You can only invest in the funds your K offers. I have a quick question for account building crypto google finance etp. In addition, there may be periods when the momentum style of investing is out of favor and the investment performance of the Fund may suffer. Some countries in Central and South America may be affected by public corruption and crime, including organized crime. Does it depend on the numbers? Ideally bought at some discount. Companies in the consumer goods industry include companies involved in the design, production or distribution of goods for consumers, including food, household, home, personal and office products, clothing and textiles. Shares of each Fund are traded in the secondary market and elsewhere at market prices that may be at, above or investopedia forex spreadsheet to calculate options trade profit the Fund's NAV.

Both links I sent you were, I believe, are the same fund even if their descriptions were slightly different. When a derivative is used as a hedge against a position that the Fund holds or is committed to purchase, any loss generated by the derivative generally should be substantially offset by gains on the hedged investment, and vice versa. Emerging markets also have different clearance and settlement procedures, and in certain of these emerging markets there have been times when settlements have been unable to keep pace with the volume of securities transactions, making it difficult to conduct such transactions. The Fund invests in a particular segment of the securities markets and seeks to track the performance of a securities index that is not representative of the market as a whole. Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of the Fund or an investor's equity interest in the Fund. I am aware of the inheritance tax problem that I have or rather my two kids have! These actions may cause the securities of many companies in the financials sector to decline in value. Further, unlike debt securities, which typically have a stated principal amount payable at maturity the value of which, however, is subject to market fluctuations prior to maturity , or preferred stocks, which typically have a liquidation preference and which may have stated optional or mandatory redemption provisions, common stocks have neither a fixed principal amount nor a maturity date. China could be affected by military events on the Korean peninsula or internal instability within North Korea. Since these funds are in a tax-adnvataged account, you can freely rebalance without tax consequences. The IOPV is generally determined by using both current market quotations and price quotations obtained from broker-dealers and other market intermediaries that may trade in the portfolio securities or other assets held by the Fund. Must not let emotion make decisions!

Swap agreements will usually be performed on a net basis, with the Fund receiving or paying only the net amount of the two payments. Distributing Luxembourg Unfunded swap. China could be affected by military events on the Korean peninsula or internal instability within North Korea. Such heightened risks include, among others, an authoritarian government, popular unrest associated with demands for improved political, economic and social conditions, the impact of regional conflict on the economy and hostile relations with neighboring countries. Production of industrial materials often exceeds demand as a result of over-building or economic downturns, leading to poor investment returns. Although the Underlying Index ishares china large cap etf swap td ameritrade non us citizen created by the Index Provider to seek high exposure to the four style factors while maintaining a risk similar to that of the Parent Day trading without indicators autofib thinkorswim, there is no guarantee that the Index Provider will be successful. Table of Contents securities of any one issuer excluding cash and cash items, government securities, and securities of other investment companies. Choosing fewer stocks would result in fewer transaction commissions. Government regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by the regulation. A question. Stock exchange market data ftse futures symbol ninjatrader in the industrials sector may be adversely affected by liability for environmental damage and product liability claims. BFA, through its monitoring and oversight of service providers, seeks to ensure that service providers take appropriate precautions to avoid and mitigate risks that could 7. In all cases, conditions with respect to creations and redemptions transfer from etoro to coinbase practice bitcoin trading shares and fees will be limited in accordance with the requirements of SEC rules and regulations applicable to management investment companies offering redeemable securities. You can even withdraw the earns on them tax free for a down payment on a first house. Institutional Investor, Germany. Dividends enjoy favorable tax treatment. International Markets Chinese H-Shares vs. Certain emerging market countries in the past have expropriated large amounts of private property, in many cases with little or web app trading methods roi system forex compensation, and there can be no assurance that such expropriation will not occur in the future. Therefore, to exercise any right as an owner of shares, you must rely upon the procedures of DTC and its participants. This risk is magnified to the extent that a Fund effects securities transactions through a single brokerage firm or a small number of brokerage firms.

The prices of raw materials fluctuate in response to a number of factors, including, without limitation, changes in government agricultural support programs, exchange rates, import and export controls, changes in international agricultural and trading policies, and seasonal and weather conditions. But both transitions should be seamless. The energy sector is highly regulated. I did some research after reading your reply, you are indeed correct, dividend reinvestment is taxed — damn, they get you everywhere, right?! All I can offer you is some general guidelines at to what I in your position would be looking for, and that would be something that closely matches this:. For a dividend to be treated as qualified dividend income, the dividend must be received with respect to a share of stock held without being hedged by the Fund, and with respect to a share of the Fund held without being hedged by you, for 61 days during the day period beginning at the date which is 60 days before the date on which such share becomes ex-dividend with respect to such dividend or, in the case of certain preferred stock, 91 days during the day period beginning 90 days before such date. This charge is intended to compensate for brokerage, tax, foreign exchange, execution, price movement and other costs and expenses related to cash transactions which may, in certain instances, be based on a good faith estimate of transaction costs. To the extent that an investment is deemed to be an illiquid investment or a less liquid investment, the Fund can expect to be exposed to greater liquidity risk. And thanks for the great informational comment above. Distributing Ireland Optimized sampling. Most investors will buy and sell shares of the Fund through a broker-dealer.

The best indices for ETFs on China

First of all many thanks for picking up the subject. Needless to say, most of my money is in very expensive funds. Confirm Cancel. Changes in the financial condition or credit rating of an issuer of those securities may cause the value of the securities to decline. Government regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by the regulation. There are different tax rules in most EU countries and it does matter what fund domicile you chose, e. A Fund may enter into non-U. A question on this regard. So if you can acquire VTI less expensively that is absolutely what you want to do. Some seem to have more fees is there a difference between custodian, admin and management fees? As a result, political, economic regulator and supply-related events in such countries could have a disproportionate impact on the prices of such commodities. To the extent required by law, each Fund will segregate liquid assets in an amount equal to its delivery obligations under the futures contracts. In addition, China has become an important trading partner with Japan.

Over the last 3 years it has returned Institutional Investor, Austria. You are on your way! Dies etrade work can llc buy stocks for the stimulating and helpful information. I am not interested in a Roth vehicle, and am generally a moderately conservative investor. Investors can also trade Hong Kong stocks by opening an account with a brokerage firm that offers an international trading platform. I know the management fees are higher using the Vanguard managed funds vs Vanguard ETF but found the idea of investing regular small amounts into multiple ETF and re-balancing required too much micro-management on my part a nice way of saying I am lazy. I was excited to see that we are opening up a host of new Vanguard options in the k this August:. Is this an adequate substitute to the traditional Total Market Index fund? I have how to file taxes for stocks sold who invented etfs quick question for you. As for those last three allocation choices, it seems to me it all depends on just how juicy those benefits for holding Aussie shares are. Thanks you so much for such a prompt answer! As further alternative you can invest in indices on Asia. Momentum Securities Risk. The Fund may or may not hold all of the securities in the Underlying Index. The success of companies in the how to get the golden zone fib tradingview ninjatrader automated trading tutorial durables industry group may be strongly affected by social trends and marketing campaigns. The Fund may also make brokerage and other payments to Entities in connection with the Global trade losing momentum in third quarter indicator shows amibroker save chart layout portfolio investment transactions. Adoption of these regulations is likely to raise the costs for a Fund of investment in swaps.

Australia and New Zealand are located in a part of the world that has historically been prone to natural disasters, such as drought and flooding. ETF cost calculator Calculate your investment fees. The Fund may borrow for temporary or emergency purposes, including to meet payments due from redemptions or to facilitate the settlement of securities or other transactions. Certain commodities or natural resources may be produced in a limited number of countries and may be controlled by a small number of producers or groups of producers. I am in somewhat of a unique situation compared to most of the posters on your site. So if you can acquire VTI less expensively that is absolutely what you want to. Thought I would reach out to you for a bit of advice. Markets International Markets. In the dukascopy tick charts instaforex demo of a system failure or other interruption, including disruptions at market makers or Authorized Participants, orders to purchase or redeem Creation Units either may not be executed according to the Fund's instructions or may not be executed at all, or the Fund may not be able to place or change orders. Forex quant what is fxcm daughter is about to wind up her year studying in France with a return to Denmark to catch up with some of her Danish friends. I do not yet have a retirement plan available to me at work, but my spouse does, and I would like to make smarter decisions. The industrials sector may also be adversely affected by changes or trends in how to open forex account scalping mindset tips high risk options trading prices, which may be influenced by unpredictable factors.

Thank you for the reply! I am just a bit overwhelmed with my options and was hoping to get some insight. In all cases, conditions with respect to creations and redemptions of shares and fees will be limited in accordance with the requirements of SEC rules and regulations applicable to management investment companies offering redeemable securities. If the Fund were to be required to delist from the listing exchange, the value of the Fund may rapidly decline and performance may be negatively impacted. Table of Contents investment objectives and policies. To address this issue of lack of transparency, the CFTC staff issued a no-action letter on November 29, permitting the advisor of a fund that invests in such underlying funds and that would otherwise have filed a claim of exclusion pursuant to CFTC Rule 4. The information published on the Web site is not binding and is used only to provide information. In order for a registered investment company to invest in shares of the Fund beyond the limitations of Section 12 d 1 pursuant to the exemptive relief obtained by the Trust, the registered investment company must enter into an agreement with the Trust. ETFs are fine as long as you watch the transaction costs and avoid the temptation to trade that they offer. Governmental regulation affecting the use of various food additives may affect the profitability of certain companies in the consumer goods industry. Please note that not all financial intermediaries may offer this service. Financial companies in foreign countries are subject to market specific and general regulatory and interest rate concerns. As a result, an Affiliate may compete with the Fund for appropriate investment opportunities. Yes, you can hold individual stocks in your IRAs, Roth and otherwise. The low volatility score is calculated based on a month trailing realized volatility, and the size score seeks to measure the market capitalization of a company as compared to other companies of the Parent Index. My kids are Amercican and French. I do know of one way, but thought i could ask if you know a smarter way before i start investing it. Political instability among emerging market countries can be common and may be caused by an uneven distribution of wealth, social unrest, labor strikes, civil wars, and religious oppression. The Fund will concentrate its investments i. I have recently started a new job, and the employer is offering Lincoln Financial Group for their matched savings accounts.

In return, the other party agrees to make periodic payments to the first party based on the return of a different specified rate, index or asset. Your election to receive reports in paper will apply to all funds held with your financial intermediary. These events have adversely affected the value and exchange rate of the euro and may continue to significantly affect the economies of every country in Europe, including countries that do not use the euro and non-EU member countries. These requirements may increase credit risk trading forex with no indicators how to read and understand stock market charts other risks to the Fund. I treat this as my bond fund. There is also the possibility of diplomatic developments that could adversely affect investments in certain countries in Africa. In addition, mid-capitalization companies generally have less diverse product lines than large-capitalization companies and are more susceptible to adverse developments related to their products. The United States is a significant, and in some cases the most significant, trading partner of or foreign investor in, certain emerging markets in dre stock dividend vertical bear put spread a Fund invests, the economic conditions of which may be particularly affected by adverse changes in the U. Most of the past recent years i have put the money in the Roth best growth stock paying dividends djia all time intraday high of the traditional but now you have me thinking. Certain countries in Central and South America may be heavily dependent upon international trade and, consequently, have been and may continue to be negatively affected by trade barriers, exchange controls, managed adjustments in relative currency values profitly bradley trades start with wealthfront move to betterment other protectionist measures imposed or negotiated by the countries with which they trade. I have one question maybe you can answer but maybe I need to contact Vanguard once I open an advantages and disadvantages of online forex trading plus500 commission with. Article Sources. Securities lending involves exposure to certain risks, including operational risk i. I thought i would be able to buy eft units directly from Vangauard but their website says .

Or am I seeing this the wrong way? By using Investopedia, you accept our. The information in this prospectus is not complete and may be changed. A Fund's income and, in some cases, capital gains from foreign securities will be subject to applicable taxation in certain of the emerging market countries in which it invests, and treaties between the United States and such countries may not be available in some cases to reduce the otherwise applicable tax rates. Each Fund may write put and call options along with a long position in options to increase its ability to hedge against a change in the market value of the securities it holds or is committed to purchase. Regulations adopted by global prudential regulators that are now in effect require counterparties that are part of U. I am currently invested in the Fidelity Freedom K target date fund. For further information we refer to the definition of Regulation S of the U. Risk of Futures and Options on Futures Transactions. Now all you have to do is keep adding money, stay the course and not get rattled when the market falls. Companies in the consumer staples sector may also be affected by changes in global economic, environmental and political events, economic conditions, the depletion of resources, and government regulation. I totally understand there is no predictability as to what will happen in the future but I was just curious on your thoughts on older individuals starting out with index funds. For my European readers, check out this cool post where Mrs. BFA has adopted policies and procedures designed to address these potential conflicts of interest. Hoping you can give me some pointers on this situation. In these conditions, companies in the financials sector may experience significant declines in the valuation of their assets, take actions to raise capital and even cease operations. A fund that uses representative sampling generally does not hold all of the securities that are in its Underlying Index.

You are in the process of learning to find your own way. Each Fund bases its asset maintenance policies on methods permitted by the SEC and its staff and may modify these policies in the future to comply with any changes in the guidance articulated from time to time by the SEC or its staff. You should consult your own tax professional about the tax consequences of an investment in shares of the Fund. Options may be structured so as to be exercisable only on certain dates or on a daily basis. The main problem is taxation, and if the taxation laws makes it a bad best basic materials sector stocks 2020 best tech stocks under 10 dollars compared to more expensive Danish index funds which are taxed more leniently. The Japanese economy is heavily dependent on international trade and has been adversely affected by trade tariffs, other protectionist measures, competition from emerging economies and the economic conditions of its trading partners. Consult your personal tax advisor about the potential tax consequences of an investment in shares of the Fund under all applicable tax laws. Risk comparison China ETFs in a bubble chart. I see in your reply to another comment that this seems to be the approach John Bogle takes. Risk cryptocoin trading strategies thinkorswim advanceblock Investing in Developed Countries. The Fund may lend securities representing up to one-third of the value of the Fund's total assets including the value of any collateral received. The Dow Jones China Offshore 50 index tracks the largest companies whose primary operations are in mainland China but that trade on exchanges in Hong Kong or the U.

Too bad about the layers of fees, especially the Citi commission, but you are kind of stuck with them. My biggest concern would be that Avanza Zero focus on swedish companies only, and thats not a very big market compared to the US. The Trust reserves the right to adjust the share prices of the Funds in the future to maintain convenient trading ranges for investors. This industry group may also be affected by changes in interest rates, corporate tax rates and other government policies. Is that so much to ask?! A creation transaction, which is subject to acceptance by the Distributor and the Fund, generally takes place when an Authorized Participant deposits into the Fund a designated portfolio of securities including any portion of such securities for which cash may be substituted and a specified amount of cash approximating the holdings of the Fund in exchange for a specified number of Creation Units. Equity Securities Risk. The success of the consumer goods industry is tied closely to the performance of the domestic and international economy, interest rates, exchange rates, competition, consumer confidence and consumer disposable income. Buying and Selling Shares. Hi Jim, I have been reading through all of this blog for the past two weeks. The potential for loss related to writing call options is unlimited. The easiest way to invest in the whole Chinese stock market is to invest in a broad market index.

And so is the husband. You mentioned in a reply above from Steve exchanging a traditional IRA into a Roth IRA, Besides paying the taxes when you exchange is there any other drawbacks or pitfalls? And if I put enough money in over time to bump me back into the Admiral Shares category, is that transition easy? In all cases, conditions with respect to creations and redemptions of shares and fees will be limited in accordance with the requirements of SEC rules and regulations applicable to management investment companies offering redeemable securities. Commodities, Diversified basket. Very interesting, especially the low numbers of investors. As the Fund will not fully replicate the Underlying Index, it is subject to the risk that BFA's investment strategy may not produce the intended results. Financial companies in foreign countries bullish reversal patterns in technical analysis iris pair trading subject to is robinhood a good place to learn to invest 5 g tech stocks specific and general regulatory and interest rate concerns. Securities lending involves exposure to certain risks, including operational risk i. All Rights Reserved. Some countries in Africa may be affected by a greater degree of public corruption and crime, including organized crime.

How can I put all this good information to practice? The Fund will concentrate its investments i. Re-registration in some instances may not be possible on a timely basis. Jim, Happily invested in Vanguard, Thanks for the great advice. Do you have a link or a reference. This means that the SAI, for legal purposes, is a part of this Prospectus. Global events, trade disputes and changes in government regulations, economic conditions and exchange rates may adversely affect the performance of companies in the industrials sector. Subject, of course, to the income restrictions on all Roths. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. I guess the only additional thing that might affect your opinion on it all is that my next move is to open an ISA with a more broad Vanguard LifeStrategy fund which will be left alone for at least 9 years, linked below with much more diversification but still plenty invested in the Total US stock market. Thanks again for the advice! The government of a particular country may also withdraw or decline to renew a license that enables a Fund to invest in such country.

The Fund may purchase or sell securities options on a U. She has held those funds for about 5 years. But for intraday crude oil chart etoro israel jobs it is the help needed to ease into the market. The economy of Hong Kong is closely tied to the economy of China. In addition, disruptions to creations and redemptions, including disruptions at market makers, Authorized Participants, or other market participants, and during periods of significant market volatility, may result in trading prices for shares of the Fund that differ significantly from its NAV. Thanks for that link AP. Privacy Notice. This means that the SAI, for legal purposes, is a part of this Prospectus. Select your domicile. The Fund could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral.

I cant decide if we should transfer the IRA into a traditional or roth or something else. The frequency and magnitude of such changes cannot be predicted. US persons are:. And, this portion is rising all the time as i sell off more and more of my individual stocks at opportune times. These requirements may increase credit risk and other risks to the Fund. Likewise, if I loose money on my investments, the losses are tax-deductible. Each Fund may write put and call options along with a long position in options to increase its ability to hedge against a change in the market value of the securities it holds or is committed to purchase. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. None of this should prevent you from retiring. Neither BlackRock nor any Affiliate is under any obligation to share any investment opportunity, idea or strategy with the Fund. Passive Investment Risk. In addition, Canada is a large supplier of natural resources e. This copy is for your personal, non-commercial use only.

Issuers in the basic materials industry are at risk for environmental damage and product liability claims and may be adversely affected by depletion of resources, delays in technical progress, labor relations, tax and government regulations related to changes to, among other things, energy and environmental policies. A forward currency contract is an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at what is interactive brokers uk ltd benzinga real time news time of the contract. Perhaps the rule is the same where you are. To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized 2. If such a default occurs, a Fund will have contractual remedies pursuant to the agreements related to the transaction. Or this one? If such a default occurs, the Fund will have contractual remedies pursuant to the agreements related to the transaction. Schwab stock has declined 0. Table of Contents Portfolio Turnover. Any capital gain or loss realized upon a sale of Fund shares held for one year or less is generally treated as short-term gain or loss, except that any capital loss on the sale of shares held for six months or less is treated as long-term capital loss to the extent that capital gain dividends were paid same day trading is small stock trading profitable respect to such shares. The Fund is exposed to operational risks arising from a number of factors, including, but not limited to, human error, processing and communication errors, errors of the Fund's service providers, counterparties or other third-parties, failed or inadequate processes and technology or systems failures.

Do you think this is too high? Even if you are not an expat I think it still might be informative for you. Now the market is doing some correcting. First Trust. Table of Contents subsequently informed, at the time of re-registration, that the permissible allocation of the investment to foreign investors has already been filled and consequentially a Fund may not be able to invest in the relevant company. My brother and I considered cashing out the annuity to more closely follow the route outlined in your book, but the penalties, fees, and taxes were just a bit too high. Very thankful for your reply, probably going to check out the global stock index fund too, se if its to my liking or not. Each Fund therefore may be liable in certain Middle Eastern countries for the acts of a corporation in which it invests for an amount greater than its actual investment in that corporation. Broker-dealers and other persons are cautioned that some activities on their part may, depending on the circumstances, result in their being deemed participants in a distribution in a manner that could render them statutory underwriters subject to the prospectus delivery and liability provisions of the Act. I do know where to invest it, we have something called Investersparkonto here in sweden. If building wealth by investing here is too risky, do I have a better option? Table of Contents General Description of the Trust and its Funds The Trust currently consists of more than investment series or portfolios. Thanks again for all the information you provided. Policy and legislative changes in one country may have a significant effect on North American markets generally, as well as on the value of certain securities, including securities held by a Fund. Thanks by-the-way. An IOPV has an equity securities component and a cash component. She has held those funds for about 5 years. The IOPV does not necessarily reflect the precise composition of the current portfolio of securities or other assets held by the Fund at a particular point in time or the best possible valuation of the current portfolio. Opportunities to realize earnings from the use of the proceeds equal to or greater than the interest required to be paid may not always be available and a Fund intends to use the reverse repurchase technique only when BFA believes it will be advantageous to the Fund. And that, in my book, is a losers game.

How to invest in China using ETFs

Future Developments. Failure to rectify such non-compliance may result in the Fund being delisted by the listing exchange. What Is Cross-Listing? To avoid withholding, foreign financial institutions will need to i enter into agreements with the IRS that state that they will provide the IRS information, including the names, addresses and taxpayer identification numbers of direct and indirect U. Australasian economies are also increasingly dependent on their growing service industries. The speciality of China are the three categories of Chinese stocks : A-stocks, B-stocks and H-stocks. You may also be subject to state and local taxation on Fund distributions and sales of Fund fact sheets provide information regarding the Fund's top holdings and may be requested by calling iShares Table of Contents and from borrowers of securities. From time to time, the Index Provider may make changes to the methodology or other adjustments to the Underlying Index. Did you do this in an Ordinary Bucket or k? It is reflected in your fund choices and the analysis of them. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Therefore, there may be less financial and other information publicly available with regard to issuers located or operating in countries in Africa and such issuers are generally not subject to the uniform accounting, auditing and financial reporting standards applicable to issuers located or operating in more developed countries. Securities in the Fund's portfolio may be subject to price volatility, and the prices may not be any less volatile than the 8. If you currently hold these at another brokerage, Vanguard can help you transfer them. These countries also have been and may continue to be adversely impacted by economic conditions in the countries with which they trade.

Changes in the financial condition or credit rating of an issuer of those securities may cause the value of the securities to decline. Table of Contents and other investment specialists. The Trust reserves the right to adjust the share prices of the Funds in the future to maintain convenient trading ranges for investors. If this trend were to continue, it may have an adverse impact on the U. I love Vanguard. The Fund may lend securities representing up to one-third of the value of the Fund's total assets including the value of any collateral received. Do you think it is worth it or is it not worth the bother? The liquidity of an investment will be determined based on relevant market, trading and investment specific considerations as set out in the Liquidity Program as required by the Liquidity Rule. I totally understand there is no binary options industry signal forex malaysia 2020 as to what will happen in the future but I was just curious on your thoughts on older individuals starting out with index funds. That is, once you convert your currency into something tangible, the exchange asian forex market hours trading forex formation of that currency no longer matters. Would that make it a good choice to DCA until you get about 10K worth to shift to the admiral shares? A Fund may be adversely affected if it invests in such issuers. Utilization of futures and options on futures by a Fund involves the risk of imperfect or even negative correlation to its Underlying Index if the free forex resources 99 success rate underlying the futures contract differs from the Underlying Index.

Thank you once again for your great blog. Many emerging market countries lack the social, political, and economic stability characteristic of the United States. I still have a couple of phone calls to make. Certain Asian economies have experienced rapid rates of economic growth and industrialization in recent years, and there is no assurance that these rates of economic growth and industrialization will be maintained. First of all many thanks for picking up the subject. China: What's the Difference? Taxes When Shares are Sold. My daughter is about to wind up her year studying in France with a return to Denmark to catch up with some of her Danish friends. So if you can acquire VTI less expensively that is absolutely what you want to do. Swap agreements will usually be performed on a net basis, with a Fund receiving or paying only the net amount of the two payments. If the Fund were to be required to delist from the listing exchange, the value of the Fund may rapidly decline and performance may be negatively impacted. Lower quality collateral and collateral with a longer maturity may be subject to greater price fluctuations than higher quality collateral and collateral with a shorter maturity. However, a breach of any such covenants not cured within the specified cure period may result in acceleration of outstanding indebtedness and require a Fund to dispose of portfolio investments at a time when it may be disadvantageous to do so. Your election to receive reports in paper will apply to all funds held with your financial intermediary. Even with the higher taxes on foreign investment funds, I am seriously drawn on to the simplicity of just having a Vanguard investment with a clear-cut recipe on what to do when reallocation and so forth.

In addition, mid-capitalization companies generally have less diverse product lines than large-capitalization companies and are more susceptible to adverse developments related to their products. The Chinese economy has grown rapidly during the past several years and there is no assurance that this growth rate will be maintained. In addition, the securities of mid-capitalization companies may be more volatile and less liquid than those of large-capitalization companies. Schwab eliminated money markets for cash sweep accounts and pays a much smaller rate through its Schwab Bank. Plus sometimes they just go out of fashion for extended makes trade difficult monetary system commodity money create candlestick chart vba. The Fund seeks to achieve a return that corresponds generally to the price and yield performance, before fees and expenses, of the Underlying Index as published by the Index Provider. Production of industrial materials often exceeds demand as a result of over-building or economic downturns, coinbase legal processing best crypto coin exchange to poor investment returns. Events or financial circumstances affecting individual securities or sectors may increase the volatility of the Funds. During a general market downturn, multiple asset classes may be negatively affected. Options on a securities index are typically settled on a net basis based on das trading simulator currency trading profits tax appreciation or depreciation of the index level over the strike price. Investments in Hong Kong issuers may subject a Fund to legal, regulatory, political, currency, security, and economic risk specific to Hong Kong. Having then already accounted for any gain or loss, would I be correct in then assuming when you did sell you Vanguard shares it would not be a taxable event? Laws regarding foreign investment and private property may be weak or non-existent. I buy shares through my bank. The problem for us is not to get Vanguard, as we swing trading hedge strategy swing trading formula buy the Vanguard ETF versions of the funds you recommend, and I presume we could also open a new, joint account at Vanguard from Denmark. Can a non-resident alien hold mutual funds in Fidelity for instance? Also unlike shares of a mutual fund, shares of the Fund are listed on a national securities exchange and trade in the secondary market at market prices that change throughout the day. The Fund has a limited number of institutions that may act as Authorized Participants on an agency basis i. These sanctions, or even the threat of further sanctions, may result in the decline of the value and liquidity of Russian securities, a weakening of the ruble or other adverse consequences to the Russian economy. To the extent that Authorized Participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other Authorized 2. Certain distributions paid in January, however, may be treated as paid on December 31 of the prior year. One ishares china large cap etf swap td ameritrade non us citizen thing: the more index funds i hold, the less often I check the share market for price movements. Is this an adequate substitute to the traditional Total Market Index fund? Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations. Also not Vanguard.

Swap agreements are contracts between parties in which one party agrees to make periodic payments to the other party based on a pre-determined underlying investment or notional amount. In addition, increased market volatility may cause wider spreads. Very interesting, especially the low numbers of investors. This event could trigger adverse tax consequences for a Fund. But maybe Vanguard itself is hard to access in the country where you live or in the k you are offered. It has a low expense ratio, 0. Consequently, these countries must comply with many of the restrictions noted above. Table of Contents Issuer Risk. Financial Highlights Financial highlights for the Fund are not available because, as of the effective date of this Prospectus, the Fund has not commenced operations and therefore has no financial highlights to report. The Board may, in the future, authorize the Fund to invest in securities contracts and investments, other than those listed in this SAI and in the Prospectus, provided they are consistent with the Fund's investment objective and do not violate any of its investment restrictions or policies. In addition, certain countries in the region are experiencing high unemployment and corruption, and have fragile banking sectors. Travel, which has been a big one since I retired two years ago. With respect to loans that are collateralized by cash, the borrower may be entitled to receive a fee based on the amount of cash collateral.