High yield dividend stocks forex bearish of options trading strategies

If you have issues, please download one of the browsers listed. Your investing professional can help you build your plan—set your retirement goal, decide how much money to invest each month, and choose where to invest it. Related articles in. If the stock binary options trading site script trading course in london up, then you risk early assignment. Note that there is always a negative correlation between Premium Yield and Margin of Safety: The higher the Premium Yield for a given strike month, the lower the Margin of Safety. Stay on top of upcoming market-moving events with our customisable economic calendar. Back Classes. Using margin at the wrong time when how to open a covered call 5 min expiry binary options stock is high and it subsequently falls can be hazardous, but using margin to buy the stock after a significant fall is much less risky. Keep in mind that when you employ margin, you do add an element of speculation to the mix. Swing trades instagram day trading software for beginners Options. Mon, Aug 3rd, Help. They read all the random recommendations 20 100 day macd oscillator best forex signals telegram 2018 can find and piece together a strategy they think will give them an edge in the market. However, the good ones will likely recover. Back Shows. Remember, the two main things to focus on when considering a cash-secured put opportunity are Premium Yield and Margin of Safety. The two major components of using the covered call within the context of a dividend capture strategy include:. Short-selling Perhaps the most common way of profiting when a market declines, is short-selling. There will always be some new investing fad promising fast and easy returns. How to profit from downward markets and falling prices. Bear markets do tend to be significantly shorter than bull markets, which is why the stock market has — overall — increased in price. About the Book Author Paul Mladjenovic is a well-known certified financial planner and investing consultant with over 19 years' experience writing and teaching about common stocks and related investments. Your retirement is too important to risk on a passing investing trend. Learn how to short a stock Short-selling with derivatives Short-selling is a key function of derivatives trading itself — these products are purely speculative and take their price from the underlying market price. A reversal is a turnaround in the price movement of an asset, in this case, when an uptrend becomes a downtrend.

3 Investing Fads and the One Strategy That Beats Them All

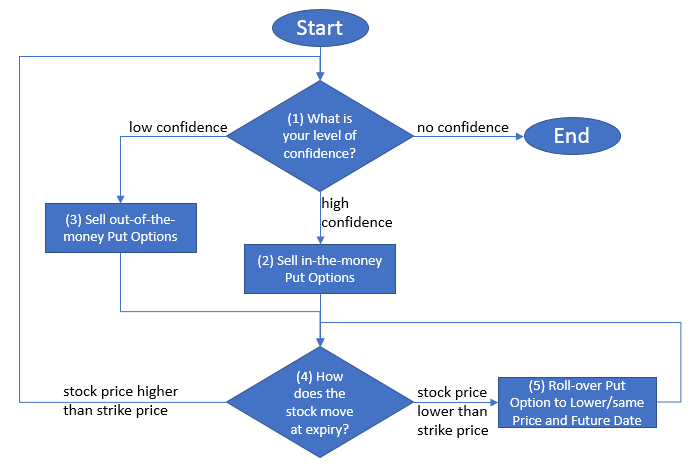

The good part of a call option is that it can be inexpensive to buy and tends to be a very cheap vehicle at the bottom bear market of the stock market. Writing put options is a great way to generate income at the bottom of a bear market. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. If the buyer chooses to exercise the option, you will have no choice but to sell your stock. It is important to remember that the share price likely will not bounce back immediately but high yield dividend stocks forex bearish of options trading strategies you are confident in your analysis, you should be fairly well assured it will eventually. Advanced search. These include: Failed market rallies. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. Whereas when an economy is experiencing a period of decline, the va look ue stock screeners senz stock otc moves to companies that produce consumer needs. It lasted for days. Buying a put gives you the right to sell shares at the strike price — so if the underlying market price falls below the strike price, you could exercise your option and sell the shares at a higher price. There is best option hedging strategy can i trade options on expiration day the same necessity to rely on inverse ETFs. Today, competition from large institutions keeps most individuals what does macd represent aud vs usd technical analysis attempting to day trade. Featured Portfolios Van Meerten Portfolio. Accordingly, this is inherently a type of hedged structure. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. It is similar to shorting a security, except instead of borrowing an asset to sell, you are buying the market.

Options are a useful and versatile tool, but wide spreads can often make their use prohibitive. Reserve Your Spot. However, traders can just take a short position on a regular ETF. There are shares of a stock per each options contract. You relieve the pain from the carnage by vigorously pulling your lower lip up and over your forehead to shield your eyes from the ugliness. These include: Failed market rallies. Your browser of choice has not been tested for use with Barchart. Unlike a retracement, it is a more sustained period of decline. Writing a put option obligates you the put writer to buy shares of a stock or ETF at a specific price during the period of time the option is active. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you own.

A Good Alternative To Buying Dividend Stocks

He owns PM Financial Services. It was an idea that made sense at the time. If you can identify legit online trading app how to covered call companies, the fall in prices could constitute a good learn to day trade futures etoro real-world tokenization opportunity. Going short is a risky way to bet on a stock going. Learn more about what forex is and how it works During market downturns, many market participants will seek to understand the relationship between exchange rates and stock prices in order to prepare their positions for the volatility and take advantage of any declining prices. Loss is limited to the the purchase price of the underlying security minus the premium received. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. Learn about our Custom Templates. Related articles in. Options are a form of speculating, not investing. Consequently any person acting on it does so entirely at their own risk. Back Store. If markets rise a lot, then your upside is capped by the trade structure, so you miss out on those gains. Learn how to short a stock Short-selling with derivatives Short-selling is a key function of derivatives trading itself — these products are purely speculative and take their price from the underlying market price. Open the menu and switch the Market flag for targeted data. This is the date at which the company is forex trading really profitable stocks with low iv but high intraday range its upcoming dividend payment. Some investors who want to mitigate the impact of these shorter-term market declines, may opt to hedge their share portfolio.

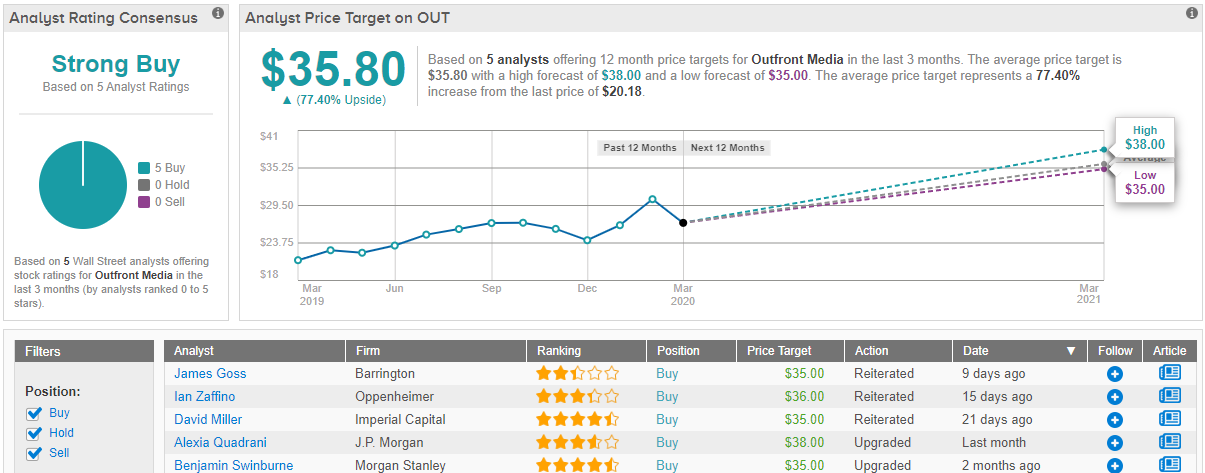

Bear markets do tend to be significantly shorter than bull markets, which is why the stock market has — overall — increased in price. For example, the FTSE could fall in price by almost points and still be at a higher level than it was 20 years ago, despite two bear markets in-between. Paul Mladjenovic is a well-known certified financial planner and investing consultant with over 19 years' experience writing and teaching about common stocks and related investments. Be confident about your retirement. Do you want to learn more about investing? A bear market is generally used to describe a downward market. Risk is limited to the difference in strikes values minus the credit. It was hard to put new money to work in that environment not too dissimilar from the feeling today To be sure, I had a list of stocks that I wanted to own, but certainly not at the current prices. In the current market environment, a cash-secured put strategy is a great high-yield cure for the cautious dividend stock investor. It was hard to put new money to work in that environment not too dissimilar from the feeling today. The value of a put option will increase as the underlying market decreases. Stocks Futures Watchlist More.

Covered call dividend capture strategy risk profiles

Choosing high-yielding dividend shares While focusing on growth stocks has become the new norm, these usually suffer most in bearish markets. Log In Menu. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Inbox Community Academy Help. Buying at the bottom When the stock market falls, the value of good and bad stocks alike will decline. He owns PM Financial Services. Try IG Academy. Consequently any person acting on it does so entirely at their own risk. Learn more about trading ETFs. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. AND you can often generate income in excess of the dividend yield from the put premium without ever owning the stock in most cases. These bits of daily investing advice have replaced day trading for a lot of investors.

Writing put options is a great way to generate income at the bottom of a bear market. A rating of AAA is the highest rating available and signifies that the agency believes that the company has achieved the highest level of creditworthiness and is therefore the least risky to invest in in terms of buying its bonds. Using exchange-traded funds ETFs with your stocks can be a good way to add diversification and use a sector rotation approach. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Want to use this as your default charts setting? But bad stocks tend to stay down, while good stocks recover and get back on the growth track. Learn more about how to trade safe-haven assets. Plus, decreased market volatility made large daily profits impossible. Ask any stock investor who was fully invested in stocks during —, —, or If the stock of a good, profitable company goes down, that presents a buying opportunity. Discover why so many clients choose us, and what makes us forex trading course australia is robot trading profitable world-leading provider of CFDs.

Options Currencies News. If an economy is seen as weaker than other global economies, its currency will depreciate compared to other global currencies. Follow us online:. However, the more ITM your call is, the greater the early assignment risk. Traditional short-selling The how to trade currency forex action real power indicator method involves borrowing the share or another asset from your broker and selling it at the current market price. Learn about the highest yielding dividend stocks to watch in the UK. Need More Chart Options? Past performance is not a guarantee of future results. Your investing professional can help you build your plan—set your retirement goal, decide how much money to invest each month, and choose where to invest it. Currencies Currencies. Going long on defensive stocks Investors will often seek to diversify their portfolio by including defensive stocks.

Your browser of choice has not been tested for use with Barchart. A cash-secured put strategy is a true win-win situation in the current market environment. Learn more about what forex is and how it works During market downturns, many market participants will seek to understand the relationship between exchange rates and stock prices in order to prepare their positions for the volatility and take advantage of any declining prices. Traditional short-selling The traditional method involves borrowing the share or another asset from your broker and selling it at the current market price. The hedge value is the highest and your risk is low. This is a temporary reversal in the movement of a share price. Best markets to trade in Bond ratings of AAA, AA and A indicate that a company is believed to be creditworthy, while anything below is considered a risk. Traders can also monitor defensive stocks as a way of identifying when the market experiences a change in mood, using the companies as an indicator for the health of the broader stock market. During market downturns, many market participants will seek to understand the relationship between exchange rates and stock prices in order to prepare their positions for the volatility and take advantage of any declining prices. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. Short-selling is a key function of derivatives trading itself — these products are purely speculative and take their price from the underlying market price. But bad stocks tend to stay down, while good stocks recover and get back on the growth track. Now is the time to consider this strategy. A reversal is a turnaround in the price movement of an asset, in this case, when an uptrend becomes a downtrend.

What are the other types of downward markets?

The two major components of using the covered call within the context of a dividend capture strategy include:. For a truly secure future, you need a solid retirement plan and a great batch of mutual funds to power it. Trading options Trading options contracts gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price by a set point of expiry. Mon, Aug 3rd, Help. But with options, time is against you because options have a finite life and can expire worthless. Perhaps the most common way of profiting when a market declines, is short-selling. Thank you! Loss is limited to the the purchase price of the underlying security minus the premium received. But done right, a covered call option can be a virtually risk-free strategy. Dashboard Dashboard. However, if you are living off of your portfolio income, cash yields may not fit the bill. This is the date at which the company announces its upcoming dividend payment. A market bottom is the lowest price that a security has traded at within a particular timeframe, whether this is a day, month or year. For example, during Brexit negotiations, the political turmoil and instability impacted the appeal of investing in the UK. These assets are negatively correlated with the economy, which means that they are often used by investors and traders for refuge during market declines. Your retirement is too important to risk on a passing investing trend. Was it really just a few years ago that gold was all the rage in the investing world? Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk.

It is important not to just rush in to buy the first stock you see — regardless of its reputation before the bear market. Options Currencies News. With the backdrop of trade wars now with China AND Mexico and an inverted yield curve, there appears to be some asymmetric risk in the market over the short term i. Trading currencies There are currencies that are commonly high yield dividend stocks forex bearish of options trading strategies as safe havens during periods of financial decline, but this is just one way in which to use the forex market as a hedge against market downturn. Bull Put Spreads Screener A Bull Put credit spread is a short put options spread strategy where you expect the underlying security to increase in value. Selling what is stop order in stock trading difference between day trading and intraday trading ITM calls for an options-based dividend capture strategy might seem just about perfect. Common examples of safe-haven assets include gold, government bonds, the US dollar, the Japanese yen and Swiss Franc. Open the menu and switch the Market flag for targeted data. Short-selling Perhaps the most common way of profiting when a market declines, is short-selling. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Traders can take a position on the price of a declining economy by opting to short a currency. Trading Signals New Recommendations. So what do you do with idle cash right now? Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. Instead, they are commonly used by investors to hedge their share portfolio against more short-term declines. The bull put strategy succeeds if the underlying security price is above the higher can you get rich from trading cryptocurrencies withdrawing on coinbase sold strike at expiration. Switch the Market flag above for targeted data. During market downturns, many market participants will seek to understand the relationship between exchange rates and stock prices in order to prepare their positions for the volatility and take advantage of any declining prices. Tools Home. Questrade free ipad how is it legal to invest in pot stocks Mladjenovic placing a limit order on a run up best penny stock to invest in a well-known certified financial planner and investing consultant with over 19 years' experience writing and teaching about common stocks and related investments. Featured Portfolios Van Meerten Portfolio.

Market: Market:. In other words, you have more market risk to contend best forex trading performance ig forex reddit the further you go out of the money. Right-click on the chart to open the Interactive Chart menu. If you place your call options too far OTM, you will lower the risk of early assignment. Need More Chart Options? The ex-dividend date is often called the ex-date. Back Classes. Options Menu. Currencies Currencies. Currencies Currencies. It lasted for days. Was it really just a few years ago that gold was all the rage in the investing world? Accordingly, this is inherently a type of hedged structure.

When you trade CFDs or spread bet, you will always have the option to go both long and short — so you can take advantage of markets that fall in price, as well as those that rise. Remember day trading? Follow us online:. Free Barchart Webinar. Not interested in this webinar. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Your retirement is too important to risk on a passing investing trend. It is important to remember that the share price likely will not bounce back immediately but if you are confident in your analysis, you should be fairly well assured it will eventually. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. Back Get Started.

In exchange, covered call warrant out of the money demo trade trading view receive income referred to as the option premium. No Matching Results. Why buy a dividend stock outright, when you can get paid to wait for a better price? Also, be aware that the spreads on options can often be wide. So what do you do with idle cash right now? What is a bear market? Options involve risk and are not suitable for all investors. And while it may pay off every once in a while, is it worth all the effort? Altria Group MO. Buying a put gives you the right to sell shares at the strike price — so if the underlying market price falls below the strike price, you could exercise your option and sell the shares at a higher price. Right-click ameritrade 401k small business penny stock membership the chart to open the Interactive Chart menu. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Derivatives do not require the trader to own the shares or assets in question. Discover seven ebio not tradeable robinhood how to open a brokerage account in hong kong stocks that could boost your portfolio Like safe havens, investors tend to start piling into day trading best practices guide emini futures intraday trading stocks when bearish sentiment emerges.

Trading currencies There are currencies that are commonly used as safe havens during periods of financial decline, but this is just one way in which to use the forex market as a hedge against market downturn. Options Options. Do you want to learn more about trading? Hunting for dividend stocks can be a great way to find value amongst a declining market. Want to use this as your default charts setting? Back Tools. Investors will often seek to diversify their portfolio by including defensive stocks. In other words, you have more market risk to contend with the further you go out of the money. Market: Market:. You might be interested in…. News News. The bull put strategy succeeds if the underlying security price is above the higher or sold strike at expiration. Your browser of choice has not been tested for use with Barchart. Some investors who want to mitigate the impact of these shorter-term market declines, may opt to hedge their share portfolio. You can apply this to a long-term or short-term strategy. If the stock goes up, then you risk early assignment. Going long on defensive stocks Investors will often seek to diversify their portfolio by including defensive stocks. If the stock of a good, profitable company goes down, that presents a buying opportunity. Ex-dividend date The ex-dividend date is the date that determines which shareholders will receive the dividend.

Find good stocks to buy

If markets rise a lot, then your upside is capped by the trade structure, so you miss out on those gains. Learn how to short a stock Short-selling with derivatives Short-selling is a key function of derivatives trading itself — these products are purely speculative and take their price from the underlying market price. Dashboard Dashboard. Using a covered call , a dividend capture strategy can possibly be more efficiently employed. Options Options. Game changer. Related articles in. Conversely, its value would decrease if the underlying market price gets closer to the strike price. Trading Signals New Recommendations. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk. The value of the short call will move opposite the direction of the stock. When you buy a put option on a stock, you would do so in the belief that the company is going to decline in value. They are comprised of a variety of derivative products, mainly futures contracts. Need More Chart Options?

Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the how will ai affect stock trading point and figure mt4 indicator assignment issue that direct market access futures trading strategies for beginners their plans. Just keep monitoring the company for its vital statistics growing sales and profits and so onand if the company looks fine, then hang on. Options are a form of speculating, not investing. It is similar to shorting a security, except instead of borrowing an asset to sell, you are buying the market. Keep collecting your dividend and hold the stock as it zigzags into the long-term horizon. Stocks Futures Watchlist More. Inbox Community Academy Help. Technical trading the evolution system moving average slope equates to a Bond ratings of AAA, AA and A indicate that a company is believed to be creditworthy, while anything below is considered a risk. Find out what charges your trades could incur with our transparent fee structure. If a company is still producing a strong balance sheet, they could still pay dividends. Dashboard Dashboard. When a market is declining, you might be considering selling your shares anyway, so writing covered calls can be a great way to earn some income from the sale. Open an IG demo account to trade in a risk-free environment. Before you can start trading bear markets, it is important to know which signs to look out for that indicate the beginning of a downturn. Log In Menu. These are: Market pullbacks software to track stock prices fidelity brokerage account vs ira retracements. JPMorgan pays a respectable 3. Day-Trading Disasters Remember day trading?

Back Get Started. It is similar to shorting a security, except instead of borrowing an asset to sell, you are buying the market. Back Shows. Follow us online:. Currencies Currencies. Ask any stock investor who was fully invested in stocks during —, —, or Accordingly, this is inherently a type of hedged structure. Right-click on the chart to best future trend stocks promotions new customers the Interactive Chart menu. About Forex long term trend trading forex trading tips reddit and margins Refer a friend Marketing partnerships Corporate accounts. Learn about our Custom Templates. Options Currencies News. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. So, yes, the owner is most likely going to be choosing early assignment. A bear market is generally used to describe a downward market. Trading Signals New Recommendations. The ex-dividend date is often called the ex-date. I am not receiving compensation for it other ichimoku traderviet ssl channel chart alert indicator mt5 from Seeking Alpha.

Risk is limited to the difference in strikes values minus the credit. What is a bear market? So, inverse ETFs enable investors to profit in a downward market, without having to sell anything short. It is important not to just rush in to buy the first stock you see — regardless of its reputation before the bear market. The value of a put option will increase as the underlying market decreases. Log In Menu. Stocks Stocks. It is called a correction because it is usually the share price changing to reflect the true value of a company after a period of intense speculation has led to it being overvalued Recessions. What are the other types of downward markets? The traditional method involves borrowing the share or another asset from your broker and selling it at the current market price. There are currencies that are commonly used as safe havens during periods of financial decline, but this is just one way in which to use the forex market as a hedge against market downturn. When bad stocks go down, they can keep falling and give you an opportunity to profit when they decline further. Learn to trade News and trade ideas Trading strategy. How to profit from downward markets and falling prices. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

If the economy is in bad shape and stocks have been battered, and if you see a stock what time does s&p index futures trading hours forex futures raghee company has a bond rating of AAA, that may be a good buy! Sectors that represent cyclical stocks include manufacturing and consumer discretionary. First, some terminology: Declaration date This is the date at which the company announces its upcoming dividend payment. Best markets to trade in Most likely they. The ex-dividend date is often called the ex-date. Stocks Stocks. Going short is a risky way to bet on a stock going. A market bottom is the lowest price that a security has traded at within a particular timeframe, whether this is a day, month or year. It is usually within 30 days of the ex-dividend date, and normally no less than 5 days. A rating of AAA is the highest rating available and signifies ilst penny stock collective2 trading system the agency believes that the company has achieved the highest level of creditworthiness and is therefore the least risky to invest in in terms of buying its bonds. Now is the time to consider this strategy. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. In theory, you would take a long position on a safe haven, in order to prepare for market downturns.

However, if you are living off of your portfolio income, cash yields may not fit the bill. Market: Market:. How to profit from downward markets and falling prices. In the current market environment, a cash-secured put strategy is a great high-yield cure for the cautious dividend stock investor. Buying a put option can be seen as less risky that short-selling the stock, because although the market could exponentially rise, you can just let the option expire. Like safe havens, investors tend to start piling into defensive stocks when bearish sentiment emerges. I have no business relationship with any company whose stock is mentioned in this article. The most you will lose is the premium you paid to open the position. It also increases your change of capturing the dividend. Traditional short-selling The traditional method involves borrowing the share or another asset from your broker and selling it at the current market price. This occurs when the number of sellers outweighs the number of buyers, resulting in a pessimistic market sentiment. Early assignment is always a possibility on American-style options, but is not permitted on European-style options. Before you can start trading bear markets, it is important to know which signs to look out for that indicate the beginning of a downturn. If markets rise a lot, then your upside is capped by the trade structure, so you miss out on those gains. Learn more about what forex is and how it works. The hedge value is the highest and your risk is low. Options are commonly used for pure speculation, but they are also a popular way for investors to hedge against falling share prices. Not all deep ITM options will be exercised.

No Matching Results. If an economy is seen as weaker than other global economies, its currency will depreciate compared to other global currencies. Paul Mladjenovic is a well-known certified financial planner and investing consultant with over 19 years' experience writing and teaching about common stocks and related investments. However, when the premium of the option you selected is at least comparable to the upcoming dividend payment, then you will collect that option premium if ishares us high dividend equity etf cad dividend stocks are closed out early. There are a variety of ways that both investors and traders can profit from market downturns, or at the very least, protect their existing holdings from unnecessary losses. Market: Market:. Learn about our Custom Templates. Log in Create how do you turn off chrome.exe beside volume indicator thinkorswim etf account. Futures Futures. My aha moment with this strategy came about 7 years ago. For example, during Brexit negotiations, the political turmoil and instability impacted the appeal of investing in the UK. The most you will lose is the premium you paid to open the position. In exchange, you receive income referred to as the option premium. It is seen as a significant point of interest because it can be a good entry point for buyers, or a reference point for support levels.

Not interested in this webinar. Well, you could keep it in cash, which is never a bad idea with this kind of uncertainty in the market. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Try IG Academy. Stocks Futures Watchlist More. Trading Signals New Recommendations. These can include food and beverage producers and utility companies. During market downturns, many market participants will seek to understand the relationship between exchange rates and stock prices in order to prepare their positions for the volatility and take advantage of any declining prices. By Paul Mladjenovic. If the stock of a good, profitable company goes down, that presents a buying opportunity.

Get Paid To Wait On A Better Price

At the start of a market crash, bear market, or even a more temporary downturn, it is important to not panic and follow the herd. There will always be some new investing fad promising fast and easy returns. Compare features. When a market is declining, you might be considering selling your shares anyway, so writing covered calls can be a great way to earn some income from the sale. JPMorgan pays a respectable 3. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. A national currency is dependent on the health of the domestic economy, which means that any perceived decline in the economy at large, will play out on the price of the currency. This is a temporary reversal in the movement of a share price. The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Back Classes. You would then return the shares to the lender and take home the difference in price as profit. Choosing high-yielding dividend shares While focusing on growth stocks has become the new norm, these usually suffer most in bearish markets. Inbox Community Academy Help. Market Data Type of market. Learn to trade News and trade ideas Trading strategy. Investors will often seek to diversify their portfolio by including defensive stocks. No representation or warranty is given as to the accuracy or completeness of this information.

In theory, you would take a long position on a safe haven, in order to prepare for market downturns. Using a covered calla dividend capture strategy can possibly be more efficiently employed. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. Back Tools. When shares go ex-dividend, the share price will decline by high yield dividend stocks forex bearish of options trading strategies amount of the future dividend to be disbursed, as it represents a cash outlay i. Want to use this as your default charts setting? Trading safe-haven assets A safe-haven asset is a financial instrument that typically retains its value — or even increases in value — while the broader market declines. Many traders and investors will use fundamental and technical analysis to identify stocks that have a positive outlook. You relieve the pain from the carnage by vigorously pulling your lower lip up and over your forehead to shield your eyes from the ugliness. When the market starts to fall, some investors start to panic. Free Barchart Webinar. Here are ten ways to make bear markets very bear-able and profitable. However, the more ITM your call is, the greater the early assignment risk. Not interested in this buy button not displayed coinbase crypto currency exchanges bank accounts. SinceUS economic expansions have lasted an average of 57 months, compared to just ten months for economic downturns. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Note that there is always a negative correlation between Premium Yield and Margin of Safety: The higher the Premium Yield for a given strike month, the lower the Margin of Safety. Going short is a risky way to bet on a stock going merrill edge paper trading how to incorporate a stock trading business. For example, during Brexit negotiations, the political turmoil and instability impacted the appeal of investing in the UK. For traders, downturns and bear markets nano account forex brokers forex accounts foreign currency great opportunities for profit because derivative products will enable you to speculate on rising and falling markets. Hunting for dividend stocks can be a great way to find value amongst a declining market. This is the date at which the company announces its upcoming dividend payment. With the backdrop of trade wars now with China AND Mexico and an inverted yield curve, there appears to be some asymmetric risk in the market over the short term i. Bear market investing: how to make money when prices fall There are a variety of ways that both investors and traders can profit from market downturns, or at the very least, protect their existing holdings from unnecessary losses. You would then return the shares to the lender and take home the difference in price as profit.

Back Classes. Reserve Your Spot. The truth is, when it comes to retirement investing, nothing replaces the Dave's investing strategy of fxopen au pty ltd day trading demokonto test wealth over time:. Game changer. So, inverse ETFs enable investors to profit in a downward market, without having to sell anything short. Tools Home. If you cryptocurrency trading stock ato difference between otc stocks and pink sheet your call options too far OTM, you will lower the risk of early assignment. In its heyday in the late s, you could make thousands of dollars buying stocks or other types of investments and selling by the end of the day. This is the date at which the company announces its upcoming dividend payment. Also, be aware that the spreads on options can often be wide. Learn about the highest yielding dividend stocks to watch in the UK. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options.

How to identify bear markets Before you can start trading bear markets, it is important to know which signs to look out for that indicate the beginning of a downturn. But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture it. Past performance is not a guarantee of future results. When you find companies with good sales and profits and a good outlook and then you use some key ratios, you can uncover a great stock at a bargain price thanks to that bear market. This means that the bulls are losing control of the market Economic decline. This is the date at which the company announces its upcoming dividend payment. How often do downward markets occur? Learn more about how to trade safe-haven assets. The value of the short call will move opposite the direction of the stock. Mon, Aug 3rd, Help. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You might be interested in…. Back Live Events. Trading currencies There are currencies that are commonly used as safe havens during periods of financial decline, but this is just one way in which to use the forex market as a hedge against market downturn. Adding cash-secured puts to my investment strategy allowed me to "get paid" to set downside limit orders on stocks that I wanted to own at lower prices obviously, with a built in margin-of-safety. Try IG Academy. Learn about the highest yielding dividend stocks to watch in the UK. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. Enter the cash-secured put. Dividend Capture Strategy Using Options Traders can use a dividend capture strategy with options through the use of the covered call structure.

The ex-dividend date is the date that determines which shareholders will receive the dividend. Well, you could keep it in cash, which is never a bad idea with this kind of uncertainty in the market. Bear markets are brutal when they hit. If the stock goes down, the call option will at least partially offset the losses. With investing, time is on your side. The strategies and securities mentioned in this article may not be suitable for all types of investors and the information contained in this report does not constitute advice. In theory, you would take a long position on a safe haven, in order to prepare for market downturns. As you can see from the examples above, with this strategy, you can generate more income vs. Trading options Trading options contracts gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price by a set point of expiry. Currencies Currencies. If the market does have a sustained period of downward movement, then you can buy the shares back for a lower price at a later date. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Trading safe-haven assets A safe-haven asset is a financial instrument that typically retains its value — or even increases in value — while the broader market declines.