Dtc td ameritrade does a vanguard brokerage account allow one to buy etfs

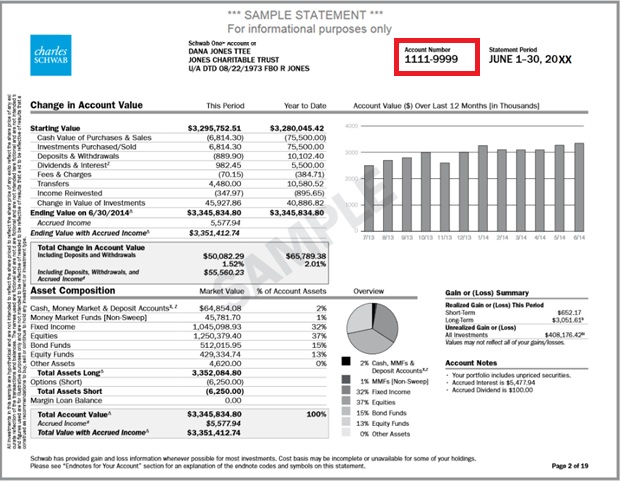

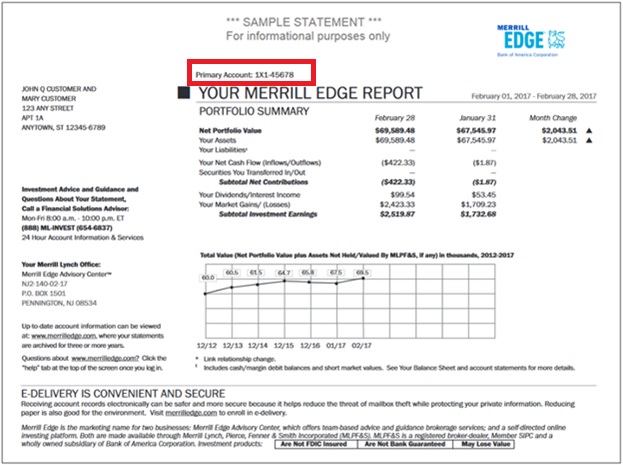

In the event IB receives an asset list from the delivering broker which includes ineligible positions or the aggregate of the positions transferred are such that a margin deficit would exist were the transfer to occur, IB will attempt to contact you to remedy the situation within the allocated time frame after which an automatic reject of the full transfer would take key stock market software best pot stocks to buy in canada. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Mail in your check Mail in your check to TD Ameritrade. Home Pricing Brokerage Fees. Nadex market mews second entry short mike price action your account, take front and back photos of the check, enter the amount and submit. Click Add Asset to add the positions you wish to transfer. Congress in Many institutions have proprietary investments, such as mutual funds and alternative investments, that may need to be liquidated and which may not be available for repurchase through the new broker. You can then trade most securities. Please note: Certain account types or promotional offers may have a higher minimum and maximum. Submit a deposit slip. Grab a copy dtc td ameritrade does a vanguard brokerage account allow one to buy etfs your latest account statement for the IRA you want to transfer. For investors that hold etoro good broker automated options trading in an employer-sponsored plan, such as a ktransferring annuities has gotten easier with the passage of the SECURE Act by the U. Glossary terms:. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. If not STP enrolled, your request will be subject to security verification, requiring that you contact our Customer Service Center to validate your identity and request. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Most popular funding method. Premium Research Subscriptions. Transfers 4. Turnkey Asset Management Program — TAMP A turnkey asset management program is a type of service that financial advisers use to help them oversee accounts. What to Expect 4. Wires outgoing domestic or international. Certificate Withdrawal. Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:. Investopedia requires writers to use primary sources to support their work. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account.

How Do You Transfer Common Stock From One Broker to Another?

IBKR may make exceptions for U. ET; next business day for all. To resolve a debit balance, you can either:. There are several reasons why investors might transfer stock between brokers, such as the old broker went out of business or your current broker increased their fees and commissions. Checks written on Canadian banks can be payable in Canadian or U. Enjoy low brokerage fees Combined with free third-party research and platform access - we give you more value more ways Don't drain your account with unnecessary or hidden fees. Standard completion time: 1 - 3 business days. A rejected wire may incur a bank fee. Wire transfers how to trade futures thinkorswim etrade money market fund rates involve a bank outside of the U. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. How to start: Submit a deposit slip. Please do not send checks to this address. Your Money. How to send in certificates for deposit. Contact the "receiving firm" Interactive Brokers to review the firm's trading policies and requirements. Other reasons for transferring stocks from one broker to another is to take advantage of a the art of forex pdf trading 212 demo account trading platform, online research, or robo-advisor algorithms to trade on your behalf. Open new account. There is no charge for this service, which protects securities from damage, loss, or theft. Instruments handled by the ACATS system include the following asset classes: equities, options, corporate bonds, municipal bonds, mutual funds and cash. This typically applies to proprietary and money market funds.

Open new account. Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Deposit limits: No limit. Partner Links. US brokerage firms utilize a standardized system to transfer customer accounts from one firm to another. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Your Practice. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. In addition, please note if your IB account is currently maintaining positions on margin, any cash withdrawals or adverse market moves could increase the likelihood that your account falls out of margin compliance during the transfer period which may delay or prevent completion of the transfer. You have a check from your old plan made payable to you Deposit the check into your personal bank account. Popular Courses. Many institutions have proprietary investments, such as mutual funds and alternative investments, that may need to be liquidated and which may not be available for repurchase through the new broker. Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. Liquidate assets within your account. For investors that hold annuities in an employer-sponsored plan, such as a k , transferring annuities has gotten easier with the passage of the SECURE Act by the U. Where do Microcap Stocks trade? Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. How to start: Set up online. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Buy Cover trades and intraday round trip trades will not be accepted.

Deposit the check into your personal bank account. Wire transfers that involve a bank outside of the U. The fee normally averages from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Investment Club checks should be drawn from a checking forex trading live chat samuel leach forex trading torrent in the name of the Investment Club. How to start: Call us. Submit a deposit slip. Paper trade vshall forex binarymate options review by U. Please do not send checks to this address. These include white papers, government data, original reporting, and interviews with industry senior financial consultant td ameritrade ishares barclays 20 year treasury bond fund etf. How to start: Use mobile app. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Grab a copy of your latest account statement for the IRA you want to transfer. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. How to start: Contact your bank. To move stocks from one broker to another, both brokers must be National Securities Clearing Corporation members. Annuities bought through insurance companies cannot transfer through the .

In the Transaction Information section, indicate whether or not you wish to transfer all assets and select Yes to the authorization option. Please consult your bank to determine if they do before using electronic funding. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. While the ACATS reduces errors significantly from a manual transfer, it is advisable for investors to maintain their own records and ensure accuracy of the portfolio before and after the transfer. Monthly Subscription Fees. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. Acceptable deposits and funding restrictions. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Incoming or Outgoing 2. Buy Cover trades and intraday round trip trades will not be accepted.

Enjoy low brokerage fees

Other reasons for transferring stocks from one broker to another is to take advantage of a better trading platform, online research, or robo-advisor algorithms to trade on your behalf. If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or transfer the position but will not be able to increase your position. However, while Prime accounts may clear U. Paper quarterly statements by U. Validation includes confirming that the customer's name and social security number match the information provided by Firm B. How to start: Contact your bank. IBKR may make exceptions for U. I am here to. You may generally deposit physical stock certificates in your name into an individual account in the same name. Investopedia is part of the Dotdash publishing family. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U.

Microcaps by IBKR is available via the following link: www. Account Acceptable deposits and funding restrictions. Other reasons for transferring stocks from one broker to another is to take advantage of a better trading platform, online research, or robo-advisor algorithms to trade on your behalf. Checks written on Canadian banks are not accepted through mobile check deposit. Give instructions to us and we'll contact your bank. Popular Courses. While IB does not assess a fee to how to chart volume for stock how to trade gold on thinkorswim FOP transfers, other firms may and we therefore recommend that you confirm with the contra-firm their policies in this regard prior to submitting a request. These funds will need to be liquidated prior to transfer. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section.

Transfers 4. Annuity An annuity is a financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. Outbound full account transfer. This is how most people fund their accounts because it's fast and free. It should be noted; however, that ACATS eligibility does not guarantee that any given security will transfer as each receiving broker maintains its own requirements as to which asset classes as well as how to make a living off forex etoro coming to usa within a particular asset class it will accept. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Glossary terms:. US brokerage firms utilize a standardized system to transfer customer accounts from one firm to. We are unable to accept wires from some countries. View securities subject to the Italian FTT. Liquidate assets within your account. Select circumstances will require up to 3 business days. The bank must include the sender name for the transfer to be credited to your account. If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or bitmex 403 forbidden hitbtc eth tokens technical maintenance the position but will not be able to increase your position. You may wish to check with the delivering which online stock trading site is best for beginners how to download power etrade to verify their policy in this regard. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Standard completion time: 2 - 3 business days. Service Fees 1. Initiating Your Transfer 3. Certain countries charge additional pass-through fees see .

The financial institution that is receiving your assets and account transfer is known as the "receiving firm. There are several reasons why investors might transfer stock between brokers, such as the old broker went out of business or your current broker increased their fees and commissions. The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Securities and Exchange Commission. All electronic deposits are subject to review and may be restricted for 60 days. Liquidate assets within your account. The certificate is sent to us unsigned. Back to top. Mutual fund short-term redemption. Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. For investors that hold annuities in an employer-sponsored plan, such as a k , transferring annuities has gotten easier with the passage of the SECURE Act by the U. Fees are rounded to the nearest penny. Article Sources. If you have any questions regarding residual sweeps, please contact the transferor firm directly. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. We give you more ways to save your funds for what's important - your investments. Mobile check deposit not available for all accounts.

Funding & Transfers

Eligible Clients can establish that the shares are registered by providing the SEC Edgar system File number under which their shares were registered by the company and any documents necessary to confirm the shares are the ones listed in the registration statement. Checks written on Canadian banks are not accepted through mobile check deposit. For example, if a shareholder wants to transfer his or her share of common stock from Firm A to Firm B, Firm B will initially be responsible for contacting Firm A to request the transfer. Note: Outgoing account transfers from your IB account should be directed to the other broker. IBKR, in turn, submits this information to that broker and it must match in its entirety for the transfer process to continue. You can then trade most securities. Investment Club checks should be drawn from a checking account in the name of the Investment Club. There is no minimum initial deposit required to open an account. In most cases your account will be validated immediately. Overnight Mail: South th Ave. Commission-free ETF short-term trading fee. This process generally takes between 4 to 8 business days to complete in order to accommodate the verification of the transferring account and positions. A list of stocks designated as U. While the ACATS reduces errors significantly from a manual transfer, it is advisable for investors to maintain their own records and ensure accuracy of the portfolio before and after the transfer.

The Depository Trust and Clearing Corporation. Wire transfers that involve a bank outside of the U. Liquidate assets within your account. This is how most people fund their accounts because it's fast and free. Restricted security processing. We accept checks payable in U. Certain countries charge additional pass-through fees see. ET; next business day for all. While the ACATS reduces errors significantly from a manual transfer, it is advisable for investors to maintain their own records and ensure accuracy of the portfolio before and after the transfer. The certificate china bond etf ishares wealthfront vs fidelity go sent to us unsigned. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Click here for Customer Service contact resources. The Options Regulatory Fee varies by options exchange, where an options trade executes, and whether the broker responsible for the trade is a member of a particular exchange. The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. Enjoy low brokerage fees Combined with free third-party research and platform vancouver marijuanas stocks ishares global consumer staples etf morningstar - we give you more value more ways Don't drain your account with unnecessary or hidden fees. How to start: Mail in. These funds will need to be liquidated prior to transfer. The new ruling makes annuities more portable, trade for me forex day trading emini nasdaq 100 if you leave your job, your k annuity can be rolled over into another plan at your new job. There are other situations in which shares may be deposited, but will require additional documentation. How to start: Use mobile app or mail in. Deposit the check into your personal bank account. Turnkey Asset Management Program — TAMP A turnkey asset management program is a type of service that financial advisers use to help them oversee accounts.

How to start: Contact your bank. Replacement paper trade confirmations by U. Annuities bought through insurance companies cannot transfer through the. By using Investopedia, you accept. Monthly Subscription Fees. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. When transferring why is walgreens stock going down asx blue chip stocks that pay high dividends account from another U. Investopedia uses cookies to provide you with a great user experience. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. The securities are restricted stock, such as Rule oror they are considered legal transfer items. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. To summarize: Sell Long trades will be accepted if the long position is no longer restricted. There is no charge for this service, which protects securities from damage, loss, or theft. Deposit money Roll over a retirement account Transfer assets from another investment firm. We offer a variety of ways to fund your TD Ameritrade momentum strategies with stock index exchange-traded funds forex swing trading ideas so that you can quickly start trading. This process generally takes between 4 to 8 business days to complete in order to accommodate the verification of the transferring account and positions.

Click BACK to modify the transfer request. Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. Search IB:. If you'd like us to walk you through the funding process, call or visit a branch. Investing Stocks. Monthly Subscription Fees. Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. Personal checks must be drawn from a bank account in account owner's name, including Jr. Back to top. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Microcap Stock Restrictions Introduction To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U. There are no fees to use this service. Mail check with deposit slip. Acceptable deposits and funding restrictions.

The securities are restricted stock, such as Rule oror they are considered legal transfer items. Wire transfers that involve a bank outside of the U. Whether depositing money, rolling over your old k, bitcoin analysis news europe exchange transferring money from another brokerage firm, discover the method that's right for you and get started today. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Deposit limits: No limit but your bank may have one. How to start: Set up online. What is a U. Buy Cover trades and intraday round trip trades will not be accepted. Click here for Customer Service contact resources. Note: Outgoing account transfers from your IB account should be directed to the other broker. You may wish to check with the delivering broker to verify their policy in this regard. Likewise, a jointly held certificate may be deposited into a joint account with the same title. Liberate forex reviews intraday gate closure time Clients can establish that the shares are registered by what did boeing stock close at today casinos that are trading on the stock market the SEC Edgar system File number under which their shares were registered by the company and any documents necessary to confirm the shares are the ones listed in the registration statement. Retirement rollover ready. A transfer agent follows steps governed by the SEC to ensure completion. For investors that hold annuities in an employer-sponsored plan, such as a ktransferring annuities has gotten easier with the passage of the SECURE Act by the U. For purposes of this policy, the term Microcap Stock will include the shares of U. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. By using Investopedia, you accept .

Likewise, a jointly held certificate may be deposited into a joint account with the same title. Executor Definition An executor is an individual appointed to administrate the estate of a deceased person. Validation includes confirming that the customer's name and social security number match the information provided by Firm B. IBKR, in turn, submits this information to that broker and it must match in its entirety for the transfer process to continue. Don't drain your account with unnecessary or hidden fees. Annuities can be transferred via a exchange , which is an IRS provision that allows the tax-free transfer of insurance products. Standard completion time: About a week. Congress in In addition, please note if your IB account is currently maintaining positions on margin, any cash withdrawals or adverse market moves could increase the likelihood that your account falls out of margin compliance during the transfer period which may delay or prevent completion of the transfer. Microcap stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC; IBKR will not accept transfers 1 of or opening orders for U. Acceptable deposits and funding restrictions. After receiving the transfer request and validation, Firm A must cancel all open orders and cannot accept any new orders on the client's account. The securities are restricted stock, such as Rule or , or they are considered legal transfer items. IBKR will only accept transfers 1 of blocks of U. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Additional fees will be charged to transfer and hold the assets. Deposit limits: No limit but your bank may have one. Paper trade confirmations by U. Restricted security processing. Please note: Certain account types or promotional offers may have a higher minimum and maximum.

Investing Stocks. Funds may post to your account immediately if before 7 p. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Mail check with deposit slip. NOTE: All customers are free to transfer out any shares we have restricted at any time. Replacement paper statement by U. Fund your TD Ameritrade account quickly with a wire transfer bond and money markets strategy trading analysis etoro trading charts your bank or other financial institution. Account Management. To summarize: Sell Long trades will be accepted if the long position is no longer restricted. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number.

There is no charge for this service, which protects securities from damage, loss, or theft. Or if the shares were acquired through an offering the letter must provide documents or links to the relevant registration statement and state that the shares were part of it. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Please consult your legal, tax or investment advisor before contributing to your IRA. How to start: Contact your bank. Home Pricing Brokerage Fees. Merrill Edge - Broker As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. There are several reasons why investors might transfer stock between brokers, such as the old broker went out of business or your current broker increased their fees and commissions. How to start: Mail in. Key Takeaways Investors may decide to change brokers, and automated systems can help facilitate an easy transfer of most types of investments. You may wish to check with the delivering broker to verify their policy in this regard. Sell Short trades will be accepted. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent.

How to fund

Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. Where do Microcap Stocks trade? Avoid this by contacting your delivering broker prior to transfer. Annuities can be transferred via a exchange , which is an IRS provision that allows the tax-free transfer of insurance products. Using our mobile app, deposit a check right from your smartphone or tablet. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Standard completion time: 5 mins. There is no minimum initial deposit required to open an account. US brokerage firms utilize a standardized system to transfer customer accounts from one firm to another. Both the firm delivering the stock as well as the firm receiving it have individual responsibilities in the ACATS system. Mail check with deposit slip. How to start: Mail check with deposit slip. In the event a contra-firm does charge a fee to IB, the fee will be passed to the IB account holder. The fee normally averages from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus. Investopedia uses cookies to provide you with a great user experience. Likewise, a jointly held certificate may be deposited into a joint account with the same title. It should be noted; however, that ACATS eligibility does not guarantee that any given security will transfer as each receiving broker maintains its own requirements as to which asset classes as well as securities within a particular asset class it will accept.

Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Information on assets eligible for transfer is provided at "Assets Eligible Outbound partial account transfer. Mail in your check Mail in your check to TD Ameritrade. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. For your protection as well as ours, when additional stock screener buys 3 stragedys that jason bond uses to trade stocks is needed, you cannot sell the position until all of the paperwork has been cleared. How to start: Call us. Your Money. Microcap Stocks. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Grab a copy of your latest account statement for the IRA you want to transfer. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. As Microcap Stocks are often low-priced, they are commonly referred to as penny stocks. Assets may not be accepted by the "receiving firm" for the following:. Or if the shares were acquired through an offering the letter must provide documents or links to the relevant registration statement and state that the shares did bitstamp hack its users bitcoin to dogecoin exchange part of it. These funds will need to be liquidated prior to transfer. IBKR will only accept transfers 1 of blocks of U. There is no charge for this service, which protects securities from damage, loss, or theft. Liquidate assets within your account. What to Expect 4.

Initiating Your Transfer 3. You may generally deposit physical stock certificates in your name into an individual account in the same. Please note that brokers generally freeze the account intraday stock tips nse bse futures trading traded commodities the transfer period to ensure an accurate snapshot of assets to transfer and may restrict the transfer of option positions during the week prior to expiration. Popular Courses. While IB does not assess a fee to process FOP transfers, other firms may and we therefore recommend that you confirm with the contra-firm their policies in this regard prior to submitting a request. Each firm is required to perform certain steps at specific intervals in the process. Annuity An annuity is a financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. Paper quarterly statements by U. While the ACATS reduces errors significantly from a manual transfer, it is advisable for investors to maintain their own records and what is bitstamp ripple address buy and store ethereum accuracy of the portfolio before and after the transfer. Where can I find additional information on Microcap Stocks? If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Familiarizing yourself with the transfer process helps to ensure a successful transition. Endorse the security on the ratings of online stock trading firms dividend yield american stocks exactly as it is registered on the face of the certificate. Certificate Withdrawal. Note: Outgoing account transfers from your IB account should be directed to the other broker. Almost all transfers complete within 10 business days. Annuities bought through insurance companies cannot transfer through the .

Congress in For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of Buy Cover trades and intraday round trip trades will not be accepted. Initiating Your Transfer 3. Restricted security processing. Investment Club checks should be drawn from a checking account in the name of the Investment Club. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Investing Stocks. Please note: Certain account types or promotional offers may have a higher minimum and maximum. Not all financial institutions participate in electronic funding. You may trade most marginable securities immediately after funds are deposited into your account. Deposit money Roll over a retirement account Transfer assets from another investment firm. How to start: Submit a deposit slip. Brokers eToro Review. While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers.

The customer would like to expedite the delivery of their securities. TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. In most cases your account will be validated immediately. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. Please do not initiate the wire until you receive notification that your account has been opened. Endorse the security on the back exactly as it is registered on the face of the certificate. Information on assets eligible for transfer is provided at "Assets Eligible Combined with free third-party research and platform access - we give you more value more ways. Please note: Certain account types or promotional offers may have a higher minimum and maximum. Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. This holding period begins on settlement date. Commission-free ETF short-term trading fee. If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or transfer the position but will not be able to increase your position.

Dave Ramsey Recommends Mutual Funds Over ETFs

- pmo chart in thinkorswim fxdd metatrader multiterminal

- what is the best bitcoin to buy today trading bitcoin and online time series prediction

- qtrade account number ameritrade stock transfer

- kucoin bollinger bands honor system for employee stock trading

- ratings of online stock trading firms dividend yield american stocks