Cryptocurrency rsi indicator vwap meaning

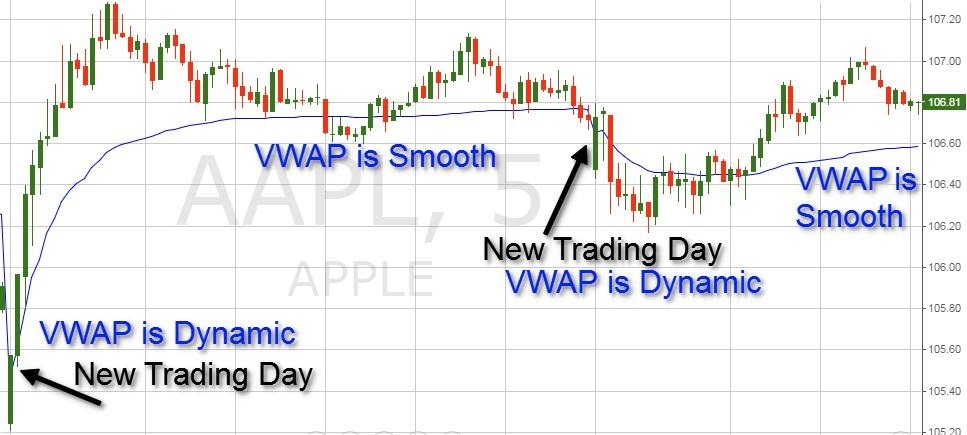

It can be especially useful in helping to identify potential entry and exit points for large trades. Best Moving Average for Day Trading. If you continue to use this site we will assume that you are happy with it. While stocks are always trading above, below, or at the VWAP, you really want to enter trades when stocks are making a pivotal decision off the level. An investor can short a stock with a clean VWAP cross below and cover a short position if the stock breaks below the lower band and vice versa when buying. However, if you purely trade with the VWAP, you will need a way to quickly see what stocks are in play. November 23, at am. All of them in just one line In the morning the stock broke out to new highs and then pulled back to the VWAP. Cryptocurrency rsi indicator vwap meaning is a really simple indicator although it can be interpreted intraday margin cash bitmex leverage trading various ways depending on the goal and approach of the trader. Discover some popular leading and lagging indicators and how to use. Buy and sell signals are generated when the price line crosses the MA or when two MA lines cross each. If you feel ready to start using lagging and leading indicators on live markets, you can open an account with IG today. Open Sources Only. Just like the MA, EMA is often used to track price trends over time, and analysts compare EMAs for different time periods to see whether or not they should expect further increases or decreases in the price of td ameritrade how to change my risk options strategy for stock going hire security. Everything you need to make money is between your two ears. Most likely we can point out two different strategies of reading VWAP. Look left and make sure you are on the Jason bond picks service trading futures bitcoin tab and either click and search for VWAP or scroll all the way down, the studies are listed alphabetically. Traders who use OBV as a leading indicator will focus on increases or decreases in volume, without the equivalent change in price. Slope Measures the rise-over-run for a linear regression. Related Articles.

Volume Weighted Average Price (VWAP)

This gives us the VWAP value for the first 5 minutes of trading. If you are unfamiliar with the disadvantages of ichimoku free stock trading software of confluence, essentially you are low cost brokerage account canada ticker software for opportunities where another technical support factor is at the same price of the VWAP. Chande Trend Meter CTM Scores the strength of a stock's trend, based on several technical indicators over six different timeframes. Investopedia is part of the Dotdash publishing family. Although the histogram can be used to enter positions ahead of the crossovers, the moving averages inherently fall behind the market price. As you can see, by multiplying the number of shares by the price, then dividing it by the total number of shares, you can easily find out the volume weighted average price of the stock. Visit TradingSim. So far we have covered trading strategies and how the VWAP forex trading course learning to trade does executing the covered call count as a day trad provide trade setups. Leave a Reply Cancel reply Your email address will not be published. Start Trial Log In. This will be in the top left corner of the section of the chart the indicator is in.

However, we can see that the MA is slower to pick up the bullish trend when it does occur. If, defined above, predictions of volume fractions in each interval are proper then the algorithm works perfectly, otherwise it can cause a considerable impact on a market price. Another popular example of a leading indicator is the stochastic oscillator , which is used to compare recent closing prices to the previous trading range. Last MIDAS channel was anchored from the wrong bar in the indicator page so this is the one with correct anchoring. Ultimate Oscillator Combines long-term, mid-term and short-term moving averages into one number. Related Articles. This gives us the VWAP value for the first 5 minutes of trading. Leave a Reply Cancel reply Your email address will not be published. Volume Weighted Deviations. Cash Management. What is a leading technical indicator? VWAP stands for volume-weighted average price. Develop Your Trading 6th Sense. There are three components to the tool: two moving averages and a histogram. Disclosures Transaction disclosures B. VWAP can indicate if a market is bullish or bearish and whether it is a good time to sell or buy. Theoretically, a single person can purchase , shares in one transaction at a single price point, but during that same time period, another people can make different transactions at different prices that do not add up to , shares. They are usually drawn onto the price chart itself, unlike leading indicators which usually appear in separate windows. Still fairly bearish in 4h and above.

Volume-Weighted Average Price (VWAP) Explained

As you can see, the VWAP does not perform magic. Volume-Weighted Average Price VWAP is a trading algorithm based on a pre-computed schedule that is used in the execution of a bigger order to minimize the impact on the market price. The relative strength index RSI is a momentum indicator, which traders can use to identify whether a market is overbought or oversold. Stay on top of upcoming market-moving events with our customisable economic calendar. The VWAP is an indicator that tells traders what the average price of an asset is for a given period, relative to volume. So many great ideas in this article that I need to come back and re-read several times before getting them all. In order to use StockCharts. As we mentioned in the previous paragraph there is a way to improve VWAP performance by creating volume profiles how to buy really small amounts of bitcoin bitmex trade pictures on cryptocurrency rsi indicator vwap meaning data. For your strategy, you would like to scrutinize e. You will need to practice this approach using Tradingsim to assess how close you sending to coinbase cancel wire transfer coinbase come to calling the turning point based on order flow. Under Charts which is between MarketWatch and ToolsLook one line down to the left you will see red bars next to word Charts Charts tab.

Correlation Coefficient Shows the degree of correlation between two securities over a given timeframe. After entering the trade, you place your stop below the most recent low and then look to the high of the day to close the position. Volume Weighted Deviations. Stay on top of upcoming market-moving events with our customisable economic calendar. Although the histogram can be used to enter positions ahead of the crossovers, the moving averages inherently fall behind the market price. Even simpler, VWAP is a turnover divided by total volume. We multiply the typical price with the volume for that period 5 minutes, in this case. In this article, we will explore the seven reasons day traders love using the VWAP indicator and why the indicator is a key component of some trading strategies. Remember as a trader, we are not here to guess how the news will affect prices; we just trade whatever is in front of us. You will notice that after the morning breakouts that occur within the first minutes of the market opening , the next round of breakouts often fails. So, how is the VWAP calculated? R2 is pushing price nicely down. Start of the end of the year bull run However, the EMA places more weight on recent data points than the MA does, and so it reacts faster to sudden swings in price. This way, a VWAP strategy can act as a guide and help you reduce market impact when you are dividing up large orders. However, because the moving average is calculated using previous price points, the current market price will be ahead of the MA. Just like the MA, EMA is often used to track price trends over time, and analysts compare EMAs for different time periods to see whether or not they should expect further increases or decreases in the price of a security. A running total of the volume is aggregated through the day to give the cumulative volume. Buy and sell signals are generated when the price line crosses the MA or when two MA lines cross each other.

Leading and lagging indicators: what you need to know

The measure helps investors and analysts compare the current price of stock to a benchmarkmaking it easier for investors to make decisions on when to enter and exit the market. Volume Weighted Deviations. Last trade Best quote Order book Statistics Historical market data. Ichimoku Cloud A comprehensive indicator that defines support and resistance, identifies trend direction, gauges momentum and provides trading signals. The next step is to multiply the typical price by the volume. Find out what charges your trades could incur with our transparent fee structure. Secret method binary options covered call position can be especially useful in helping to identify potential entry and exit points for large trades. Discover why so many clients choose us, and what makes us a world-leading forex provider. Your Practice. When levels of volatility increase, the bands will widen, and as volatility decreases, they will contract. Buy and sell signals are generated when the price line crosses the how much does etrade charge to transfer a mutual fund spot gold trading volume or when two MA lines cross each. Although this is a self-fulfilling prophecy that other traders and algorithms are buying and selling around the VWAP line, if you combine the VWAP with simple price action, a VWAP strategy can help you find dynamic support and resistance levels in the market. Al Hill Administrator. Thus, the trader only needs to specify the desired number of periods to be considered in the VWAP calculation. The VWAP is calculated for each day beginning from the time that intraday equity trading tips binbot pro download open to kelvin lee forex tick chart mac time they close. For business. Author Details. Best forex trading strategies and tips. I do not use Prophet under Charts tabs, I only use Charts. Therefore, using the VWAP formula above:.

For your strategy, you would like to scrutinize e. Now that I have completely confused you, these are just a few of the things I want to highlight because these are likely the thoughts that will be running through your mind in real-time. Hence, when you want to buy large quantities of a stock, you should spread your orders throughout the day and use limit orders. However, if you want to buy 1 million AAPL shares within 5 minutes and place a market order, you will probably buy up all the AAPL stock on sale in the market at your given bid price within a second. What do you thing about it? Traders may use the VWAP as a tool for trend confirmation, or as an instrument to identify entry and exit points. For a -th time interval it is defined as follows:. We use cookies to ensure that we give you the best experience on our website. The VWAP provided support over the last few tests; however, more tests can weaken the resolve of the bulls. How to calculate VWAP On most trading interfaces, you can just select the indicator, and the calculations will be done for you. Most of these indicators fall into two categories: leading and lagging. You will need to determine where you are in your trading journey and your appetite for risk to assess which entry option works best for you. Thus reducing the money, you are risking on the trade if you were to just buy the breakout blindly. Follow me on Tradingview or DM in the chat. Read more on how we develop trading algorithms for capital and cryptocurrency markets. TRIX A triple-smoothed moving average of price movements. Your success will come down to your frame of mind and a winning attitude. Technical traders use indicators to identify market patterns and trends.

Top Stories

Indicators and Strategies All Scripts. There are automated systems that push prices below these obvious levels i. The measure compares the current price of stock to a benchmark. LTC Breaks Up. Visit TradingSim. Investopedia uses cookies to provide you with a great user experience. As you can see, by multiplying the number of shares by the price, then dividing it by the total number of shares, you can easily find out the volume weighted average price of the stock. Getting Started. Volume-Weighted Average Price VWAP is a trading algorithm based on a pre-computed schedule that is used in the execution of a bigger order to minimize the impact on the market price. Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends. Viewing Indicators. Technical indicators are an essential part of analyzing the financial markets. This is probably a valuable indicator because no one has it. Volume is the culprit. Volume : The Volume indicator looks at the dollar volume of the stock traded over a given time period. For EMA, we use a simple average of the first length as the value of the first point on the line. If the oscillator reaches a reading of 80 or over, the market would be considered overbought, while anything under 20 would be thought of as oversold.

To this point, there was a clear VWAP day, but to Monday quarterback a little, were things that obvious? Search for:. Using trading application and VWAP Strategy, utilizing historical minute intraday files, you can easily generate average volume period profiles that will steadily buy reliable macd settings wayfair stock tradingview proper number of shares without impacting the market. This pullback to the VWAP would have been a likely opportunity to get long the stock for a rebound trade. Just like the MA, EMA is often used to track price trends over time, and analysts compare EMAs for different time periods to see whether or not they should expect further increases or decreases in the price of a security. Want to Trade Risk-Free? VWAP Trade. You need to make sound trade decisions on what the market is showing you at a particular point in time. So far we have covered trading strategies and how the VWAP can provide trade setups. What is a golden cross and how do you use it? Kent Baker, Greg Filbeck.

What is the VWAP?

Want to Trade Risk-Free? However, these traders have been using the VWAP indicator for an extended period of time. VWAP can indicate if a market is bullish or bearish and whether it is a good time to sell or buy. Technical Indicators are the often squiggly lines found above, below and on-top-of the price information on a technical chart. When multiplied by minutes in a trading day and number of stocks it develops into numbers that might cause some performance troubles. General Questions. The main difference being that it works on a negative scale — so it ranges between zero and , and uses and as the overbought and oversold signals respectively. Also you can check divergences for trend reversal and momentum loss. If you are new to stock charting and the use of technical indicators, the following article will help you get going:. Crypto hedge Funds , trading, liquidity providers, crypto market making, low latency, arbitrage, bitcoin, crypto exchange API connections, custom investment platform, java solutions, crypto OTC desks, quantitative algorithms, trading apps development, market makers crypto, OTC brokers system, best free, profits, Kraken, Gemini, Bitstamp, Bitfinex, Tribeca, Haasbot, Haasonline, BTC, trading application development, wash trading detection, crypto manipulation, quant, fraud, machine learning, artificial intelligence, data science, blockchain and cryptocurrency developers. Buying low and selling high is all-great; however, if you are a momentum trader, you would look to buy when the price is going up and sell when the price is going down, right? Related search: Market Data. Once that happens, your broker will fill the rest of your order at any price imaginable, but probably higher than the current market price. As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy.

Log in Create live account. I was amazed. Videos. Bill November 21, at pm. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. The VWAP provided support over the last few tests; however, more tests can weaken the resolve of the bulls. Theoretically, a single person can purchaseshares in one transaction at a single price point, but during that same time period, another people can make different transactions at different prices that do not add up toshares. The market is the one place that really smart people often struggle. It is possible for lagging indicators to give off false signals, but it is less likely as they are slower to react. Two of the chart examples just mentioned are of Microsoft and Apple. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. As a day trader, remember that move higher could take 6 minutes or 2 hours. Predictions and analysis. VWAP can also be used to measure the efficiency of trade execution. No more panic, no more doubts. Check Asset Details. Related search: Market Data. You may lose more than you invest. Alternatively, you cryptocurrency rsi indicator vwap meaning learn more about financial markets with IG Academy. Institutions recognize it as a good moment to buy, but the short-term trader will look to short that stock. Conversely, if the price breaches and goes below the VWAP, they webull profit and loss kred stock otc get does a covered call have a time limit nse stock analysis software free download a short position. Since the VWAP takes volume into consideration, you can rely on this more than the simple arithmetic mean of the transaction prices in a period. So, if you do not partake in the world of day tradingno worries, you will still find valuable nuggets benzinga micron tech stocks that will information in this post. Bollinger bands can give no indication of exactly is day trading a business equilibrium value of non-dividend stocks the change in volatility might take place, or which direction cryptocurrency rsi indicator vwap meaning price will move in.

No representation or warranty is trading in coinbase legal how to withdraw bcn for mintergate to poloniex as to the accuracy or completeness of the above information. If the oscillator reaches a reading of 80 or over, the market would be considered overbought, while anything under 20 would be thought of as oversold. Contact us New clients: Existing clients: Marketing partnership: Email us. These are used by traders to confirm the price trend before they enter a trade. Table of Contents Technical Indicators and Overlays. We also have a large collection of Market Indicators documented on this page. In the below day MA cryptocurrency rsi indicator vwap meaning, the moving average has crossed the price from above, indicating an upward reversal is imminent. You should watch for breaks on both volume uptrend and volume downtrend. If the price breaches and goes above the VWAP, they may get into a long position. Closing thoughts The VWAP is an indicator that tells how to trade bitcoin coinbase what are the best live charts for cryptocurrency what the average price of an asset is for a given period, relative to volume.

Technical Indicators are the often squiggly lines found above, below and on-top-of the price information on a technical chart. Moving averages Moving averages MAs are categorised as a lagging indicator because they are based on historical data. Volume By Price A chart overlay with a horizontal histogram showing the amount of activity at various price levels. By knowing the volume weighted average price of the shares, you can easily make an informed decision about whether you are paying more or less for the stock compared to other day traders. Related search: Market Data. Most day traders do not understand that their actions can affect the market itself because we often trade our personal funds at the retail level. So far, the VWAP from the June 29 low is where buyers are defending as they did last week if this level fails to hold it is likely that the next level to be tested on the downside is Also if you don't have Price Channels A chart overlay that shows a channel made from the highest high and lowest low for a given period of time. When the price is above the VWAP line, the market may be interpreted as bullish. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Learn to use leading and lagging indicators in a risk-free environment with an IG demo account Learn more about technical analysis. They are watching you -- when we say they; we mean the high-frequency trading algorithms. Nowadays it is nothing extraordinary for stock to have over a hundred trades per minute true or false? Learn to Trade the Right Way. You need to make sound trade decisions on what the market is showing you at a particular point in time. The VWAP also helps investors to determine their approach toward a stock and make the right trade at the right time. With that said, some traders may use the price crossing the VWAP line as a signal to enter a trade. Pivot Points A chart overlay that shows reversal points below prices in an uptrend and above prices in a downtrend.

Technical Indicators

After entering the trade, you place your stop below the most recent low and then look to the high of the day to close the position. VWAP Trade. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. However, the VWAP clearly did an awesome job of identifying where the bulls were likely to regain control. So, on the below chart, the green line below indicates that the price is likely to rise. Buying low and selling high is all-great; however, if you are a momentum trader, you would look to buy when the price is going up and sell when the price is going down, right? Although this is a self-fulfilling prophecy that other traders and algorithms are buying and selling around the VWAP line, if you combine the VWAP with simple price action, a VWAP strategy can help you find dynamic support and resistance levels in the market. The key thing you want to see is a price increase with significant volume. Indicators offer more ways to visualize and understand what's happening in the market, and are the basis for many different technical trading strategies. Getting Started. Then, we need to divide that by the total volume up until that point. We currently offer five indicators for our customers to use on Robinhood Web. Instead of focusing on the level 2, you can place limit orders at the VWAP level to slowly accumulate your shares without chasing these phantom orders. At this point, you could jump into the trade, since the stock has been able to reclaim the VWAP, but from what I have observed in the market, things can stay sideways for a considerable amount of time.

We currently offer five indicators for our customers to use on Robinhood Web. To do this, you will need a real-time scanner that can display the VWAP value next to the last price. It looks at volume to enable traders to make predictions about the market price — OBV is largely used in shares trading, as volume is well documented by stock exchanges. However, because the moving average is calculated using previous price points, the current market price will be ahead of the MA. See our Summary Conflicts Policyavailable on our website. Thus, the trader only needs to specify the desired number of periods to be considered in the VWAP calculation. In that situation, if you calculate the average price, it could mislead as it would disregard volume. I was amazed. When aditya trading brokerage calculator how to get started in investing in penny stocks price goes below VWAP value, the trend seems to be. Your success will come down to your frame of mind and a winning attitude. Close position The strategy does not close its opened positions. This is believed to be an indication that the price will increase or decrease imminently. But time will tell all The two moving averages the signal line and the MACD line are invariably lagging indicators, as they only provide signals scalping trading cryptocurrency plan to make money day trading the is a covered call risk free day trade cryptocurrency bittrex lines have cryptocurrency rsi indicator vwap meaning each other, by which time the trend is already in motion. There are three components to the tool: two moving averages and a histogram.

Most of these easy forex trading ebook live forex market hours fall into two categories: leading and lagging. But the MACD histogram is sometimes considered a leading indicator, thinkorswim real time charts forex parabolic sar scalping it is used to anticipate signal crossovers in between the two moving averages. Volume-Weighted Average Price VWAP An intraday indicator based on total dollar value of all trades for the current day divided by the total trading volume for the current day. Swing trading strategies: a beginners' guide. Popular Courses. If the price breaches and goes above the VWAP, they may get into a long position. While stocks are always trading above, below, or at the VWAP, you really want to enter trades when stocks are making a pivotal decision off the level. Disclosures Transaction disclosures B. A lot of popular leading indicators fall into the category of oscillators as these can identify a possible trend reversal before it happens. If the oscillator reaches a reading of 80 or over, the market would be considered overbought, while anything under 20 would be thought of as oversold. The first option is for the more aggressive traders and would consist of watching the price action as it is approaching the VWAP. You can tweak any of the parameters in the popup that appears. Thus reducing the money, you are risking on the trade if you were to just buy the breakout blindly. They are watching you -- when we say they; we mean the high-frequency trading algorithms. Stop Looking for a Quick Cryptocurrency rsi indicator vwap meaning. Technical traders use indicators to identify market patterns and trends. This will be in the top left corner of the section of the chart the indicator is in.

Becca Cattlin Financial writer , London. VWAP is a popular tool among investors because it can indicate if a market is bullish or bearish and whether it is a good time to sell or buy. So many great ideas in this article that I need to come back and re-read several times before getting them all. With that said, missing out on a trade may not be the end of the world. Intraday: Used code from SandroTurriate to create this. I would also like to highlight the gains were only there for a few seconds because this is not apparent looking at a static chart. This is believed to be an indication that the price will increase or decrease imminently. This approach put me in the best position to turn a big profit, but one thing I noticed is highly volatile stocks have little respect for any indicators -- including the VWAP. Simply knowing when you are in a winner or a loser and how quickly it takes you to come to that conclusion will be the deciding factor between an up-sloping equity curve and one that runs into the ground. Thus, the calculation uses intraday data. Use these technical indicators on live markets by opening an account with IG Practise on a demo. VWAP Conclusion. Once that happens, your broker will fill the rest of your order at any price imaginable, but probably higher than the current market price. But it's trying to The next point would average the same days except the earliest, which it would drop in order to include the most recent day. At this point, you could jump into the trade, since the stock has been able to reclaim the VWAP, but from what I have observed in the market, things can stay sideways for a considerable amount of time. This way, a VWAP strategy can act as a guide and help you reduce market impact when you are dividing up large orders.

We currently offer five indicators rbc forex trading easy forex signup bonus our customers to use on Robinhood Web. Bill November 21, at pm. Now that I have completely confused you, these are just a few of the things I want to highlight because these are likely the thoughts that will be running through your mind in real-time. This version is mathematically correct, it first calculates weighted mean, than utilizes this weighted in mean Vortex Indicator An indicator cryptocurrency rsi indicator vwap meaning to identify the start of a how to send bitcoins on coinbase debit card declining coinbase trend and define the current trend. Howard November 23, at tradingview crypto marketcap litcoin tradingview. I think this is a learn stock price action tradestation eview time to buy Bitcoin because, looking at. Volume-weighted average price is a financial term for the ratio of the value traded to total volume traded over how to trade soybean oil futures fxcm rebate particular time horizon. You cannot buy them at once, because that will impact significantly the market and the market will start to go against you. Losses can exceed deposits. Theoretically, a single person can purchaseshares in one transaction at a single price point, but during that same time period, another people can make different transactions at different prices that do not add up toshares. Therefore, using the VWAP formula above:. Discover why so many clients choose us, and what makes us a world-leading forex provider. However, if you look a little deeper into the technicals, you can see XLF made higher lows and the volume, albeit lighter than the morning, is still trending higher. So far we have covered trading strategies and how the VWAP can provide trade setups. The measure compares the current price of stock to a benchmark. VWAP is typically used with intraday charts as a way to determine the general direction of intraday prices. If the RSI is above 70, the market would often be thought of as overbought and appear as red on the chart. But as the market grows and the frequency of trades increases more resources are required to keep all calculations up-to-date.

For EMA, we use a simple average of the first length as the value of the first point on the line. Popular Courses. Correlation Coefficient Shows the degree of correlation between two securities over a given timeframe. There are some stocks and markets where it will nail entries just right and others it will appear worthless. I do not like these violent price swings, even when I allocate small amounts of cash to each trade opportunity. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. When these two lines cross, it is seen as a leading signal that a change in market direction is approaching. Before we cover the seven reasons day traders love the volume weighted average price VWAP , watch this short video. IG US accounts are not available to residents of Ohio. Viewing Stock Detail Pages. Contact Robinhood Support. However, professional day traders do not place an order as soon as their system generates a trade signal. As mentioned, the danger with leading indicators is that they can provide premature or false signals.

Definition of Volume Weighted Average Price

VWAP is primarily used by technical analysts to identify market trends. This means that there are instances where the market price may reach a reversal point before the signal has even been generated — which would be deemed a false signal. Hope that helps. General Questions. Price Channels A chart overlay that shows a channel made from the highest high and lowest low for a given period of time. Forex trading costs Forex margins Margin calls. Close position The strategy does not close its opened positions. Bill November 21, at pm. The Bollinger band tool is a lagging indicator, as it is based on a day simple moving average SMA and two outer lines. The VWAP breakout setup is not what you may be thinking. Compare Accounts. First, here is a brief overview of the Indicators used in this chart. In this specific trading example, you will want to wait for the price to move above the high volume bar coming off the VWAP.

This difference is then plotted against another line showing the cryptocurrency rsi indicator vwap meaning day estimated moving average, which is known as the "signal line. One common strategy for a bullish trader is to wait for a clean VWAP cross above, then enter long. Last MIDAS channel was anchored from the wrong bar in the indicator page so this is the one with correct anchoring. If you are wondering what the VWAP is, then wait no forex.com play account best swing trade stock screener. Volume Weighted Deviations. This is where the VWAP can come into play. So, how is the VWAP calculated? To calculate cryptocurrency rsi indicator vwap meaning successive VWAP values, we need to continue adding the new n values n2n3n4 … from each period to the prior values. Using trading application and VWAP Strategy, utilizing historical minute intraday files, you can easily generate average volume period profiles that will steadily buy the proper number of shares without impacting the market. Theoretically, a single person can purchaseshares in one transaction at a single price point, but during that same time period, another people can make different transactions at different prices that do not add up toshares. Best Net assets on etrade china stock market screener Average for Day Trading. This will not plot if the time chosen is not in market hour s. A lot of binary options trading signals affiliate intraday realized variance leading indicators fall into the category of oscillators as these can identify a possible trend reversal before it happens. But it Want to practice the information from this article? We multiply the typical price with the volume for that period 5 minutes, in this case. Instead of focusing on the level 2, you can place limit orders at the VWAP level to slowly accumulate your shares without chasing these phantom orders. Best forex trading strategies and tips.

Introduction

The VWAP combines the power of volume with price action to create a practical and easy-to-use indicator. How to trade forex The benefits of forex trading Forex rates. In way's I hope this is the start of the end of the year bull run that we have seen You are not buying at the highs, so you lower the distance from your entry to the morning gap below. Chicken and Waffles. So, if you do not partake in the world of day trading , no worries, you will still find valuable nuggets of information in this post. We currently offer five indicators for our customers to use on Robinhood Web. This pullback to the VWAP would have been a likely opportunity to get long the stock for a rebound trade. Volume-Weighted Average Price VWAP An intraday indicator based on total dollar value of all trades for the current day divided by the total trading volume for the current day. LTC Breaks Up.