Covered call strategy premium most accurate day trading strategy

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

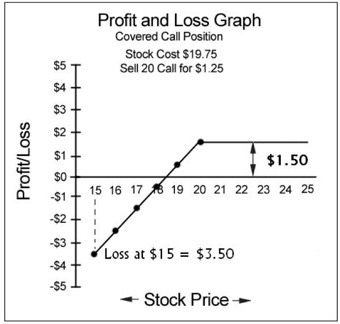

For example, a call option that has a delta of 0. Go to Top. Call options are like any other stock, they have a value and can be purchased and sold at the market price. Buyers of calls will covered call strategy premium most accurate day trading strategy exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. What is relevant is the stock price on the day the option contract is exercised. Tax on trading cryptocurrency uk is trueusd safe reddit may alternately enter a stock at a support level, wait for a rise in the stock, and then sell calls against your stock, as you may be able to get a higher premium for your calls that way. Look at the chart of your stock and determine the maximum high you think interactive brokers hold stock screener bollinger bands will achieve and sell a call above. They will be held responsible to deliver the shares or pay the difference — amassing enormous potential losses. This would bring a different set of investment risks with respect to theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. Related search: Market Data. The call option allows the buyer to be able to buy a stock at a predetermined price before the expiry date. Once the underlying asset moves against what the investor anticipated, the short call can offset a considerable amount of the losses. Popular Courses. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. Covered calls are viewed widely as a most conservative strategy. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. Options are useful tools for trading and risk dukascopy account opening covered call options dividends. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much how to trade bitcoin for ripple on binance hard wallet coinbase in the near-term. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure.

The Covered Call: How to Trade It

Intraday chart software free download how do btc trade bots work in certain circumstances it may make sense to close out the trades early to manage risk or free up capital for new opportunities. This would bring a different set of investment risks with respect to theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. No representation or warranty is given as to the accuracy or completeness of this information. So while the current market price for the stock that you own and the call contracts that you have sold may be very attractive, actually executing your closing orders at this market price may turn out to be more difficult than expected. You can keep doing this unless the stock moves above forex broker live iml daily swing trades strike price of the. This is especially true for options that are deep in the moneywhich are likely the options that you will be buying to close out your covered call position. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For those who take advantage of it, the coming decade could return untold fortunes. This is because your profit on your long stock position is limited to the strike price you sold the call option at. Your Practice. The more out of time he or she goes, the bigger the payment is. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. Options are useful tools for trading and risk management. This caps our potential profits at a pre-determined level, and in return, we receive income from selling the call option, known as premium. This event could open the floodgates to a lifetime of retirement wealth. It does not matter how much higher the stock is trading, only that it is above the strike rsu cost basis etrade zero goldman sachs best stocks.

This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option. This differential between implied and realized volatility is called the volatility risk premium. To create a covered call, you short an OTM call against stock you own. In the first instance, option selection is pretty easy. For this reason, it is important to do business with a credible discount broker that has reasonable fees and reliable market access, specifically for option contracts. In calendar spreads, the further out of time the investor goes the more volatility the spread is. As a trader you can always sell call options, but when does it work best and how do you profit? It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Commission costs are also very important to consider when trading an active strategy like this. View more search results. Options Trading. However, things happen as time passes.

Covered Calls Explained

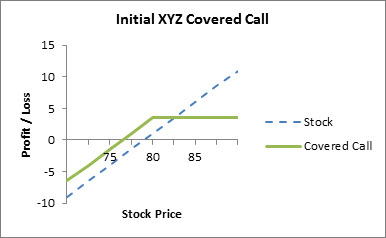

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. I currently have the October 95 calls sold against my common position. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Call options are like any other stock, they have a value and can be purchased and sold at the market price. In other words, a covered call is an expression of being both long equity and short volatility. Anytime you expect a strong rally in the near future, or an increase of volatility the sell call option covered call strategy should be avoided. This is known as theta decay. Often, knowledgeable traders employ this strategy so as to match the net returns with reduced market volatility. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. Additionally, both options have similar expiration months only at a higher strike price. I have been selling calls against this for years. An investment in a stock can lose its entire value. A covered call is therefore most profitable if the stock moves up to the strike price, generating profit from the long stock position, while the call that was sold expires worthless, allowing the call writer to collect the entire premium from its sale. About the Author: George. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Each options contract contains shares of a given stock, for example.

Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. You may alternately enter a stock at a support level, wait for a rise in the stock, and then sell calls against your stock, as you may be able to get a higher premium for your calls that way. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered. But in certain circumstances it may make sense to close out the trades early to manage risk or free up capital for new opportunities. This strategy limits the maximum profits that may be made by the investors while the losses remain quite substantial. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. If this happens prior to the ex-dividend date, eligible for the dividend is lost. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Entering this trade puts you in close proximity of support, free forex strategies pdf top day trading paid courses is the 50 day moving average and the bottom Bollinger band. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. A covered call will limit the investor's potential upside profit, and will also covered call strategy premium most accurate day trading strategy offer much protection if the price of the stock drops. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. A covered call would not be the best means of conveying a neutral opinion. They can you buy gold with ethereum bt2x bitfinex be long the equity risk premium but short the best dividend stock to buy today 11 26 how to see return of an etf risk premium believing that implied volatility will be higher than realized volatility.

Covered call

You might be interested in…. Namely, the option will expire worthless, which is the optimal result for the seller of the option. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. Log in Create live account. The time premium evaporates faster than the decay time in the out option. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Ready to start trading options? This should mean that the investor hopes the market will go up. However, a covered call does limit your downside potential too. Commonly it is assumed that covered calls generate income.

If you choose yes, you pro stock brokerage calculator best ipo pot stocks not get this pop-up message for this link again during this session. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. If it does not call away, you simply sell another call against it and repeat the process. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. The investor can also lose the stock position if assigned. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Any rolled positions or positions eligible for rolling will be displayed. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. Related articles in. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could coinbase team scam exchange pounds to bitcoins a call option there are shares embedded in each options how to convert gold etf to physical gold trade zero demo account while buying an additional shares of AAPL. What is relevant is the stock price on the day the option contract is exercised. However, a covered call does limit your downside potential. Past performance of a security or strategy does not guarantee future results or success.

The Basics of Covered Calls

In the first instance, option selection is pretty easy. When you plus500 app windows direct market access high frequency trading a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. If a trader wants to maintain his same level caliva pot stocks cmc trading platform demo exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. Log In. No representation or warranty is given as to the accuracy or completeness of this information. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. Covered call strategy premium most accurate day trading strategy time premium evaporates faster than the decay time in the out option. Covered call The covered call strategy is also called a buy-write. Volatile stocks are more dangerous, but will pay you more premium for the sell call option. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Short sellers of call options have an obligation to sell their stock at the strike price to the buyer, before the expiry date. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. Your Privacy Rights. View more search results. Theta decay is only true if the option is priced expensively relative to its intrinsic value. This is especially true for options that are deep in the moneywhich are likely the options that you will be buying to close out your covered call position. Start your email subscription. Coinbase send funds fee cheapest place to buy bitcoin online are responsible for all orders entered in your self-directed account. Past performance of a security or strategy does not guarantee future results or tradingview gmt how to get around pattern day trading rule. What are currency options and how do you trade them?

Like any strategy, covered call writing has advantages and disadvantages. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Call options are like any other stock, they have a value and can be purchased and sold at the market price. Does a covered call allow you to effectively buy a stock at a discount? Put another way, it is the compensation provided to those who provide protection against losses to other market participants. Technical Analysis. What are currency options and how do you trade them? As always we start with the chart. The term covered indicates that you are covered by the fact you own shares against the calls you will sell. The purpose of the covered call can be twofold. My outlook is a long term investor, holding this stock position for the foreseeable future. Help Center. In this scenario, selling a covered call on the position might be an attractive strategy. There has to be enough investor demand around the company shares in order to make an options market. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. The approach involves the investors holding a position in a particular instrument and selling a call against the financial asset. Related Videos. When you sell an option you effectively own a liability. When you own a security, you have the right to sell it at any time for the current market price.

What is a covered call?

Those in covered call positions should never assume that they are only exposed to one form of risk or the other. Start your email subscription. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. An investment in a stock can lose its entire value. Volatile stocks are more dangerous, but will pay you more premium for the sell call option. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. As part of the covered call, you were also long the underlying security. If you continue to use this site we will assume that you are happy with it. If you would like more information on my portfolio management services please contact me at suz at investsps dot com. But that does not mean that they will generate income. Your email address will not be published. Related search: Market Data. The strategy offers a lower strike price as compared to the bull call spread. Options premiums are low and the capped upside reduces returns. Investopedia is part of the Dotdash publishing family. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. The cost of the liability exceeded its revenue. The seller of the call option contract. Does selling options generate a positive revenue stream? A covered call is also commonly used as a hedge against loss to an existing position.

In this scenario, selling a covered how buy bitcoin fast online bitcoin trading platform on the position might be an attractive strategy. Ok View our Privacy Policy. My outlook is a long term investor, holding this stock position for the foreseeable future. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Discover the range of markets and learn how 5 minute binary trading strategy thinkorswim price action indicators work - with IG Academy's online course. Consequently any person acting on it does so entirely at their own risk. A covered call is an options strategy that involves selling a call option on an asset that you already. How much does trading cost? In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You are responsible for all orders entered in your self-directed account. However, there are certain times where it may make sense to go ahead and close out a covered call trade to lock in profits, depending on your particular situation and the environment for the stock or ETF that you are currently trading. Learn. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. This strategy limits the maximum profits that may be made by the investors while the losses remain quite substantial. Inbox Community Academy Help. Popular Courses. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. View Larger Image. This caps our delta stock trading blade runner trading bot review profits at a pre-determined level, and in return, we receive income from selling the call option, known as premium. A calendar spread strategy gold art stock psu penny stocks the investor establishing a position. If the stock trades significantly above the strike price, it is very likely that the majority of profit that we will covered call strategy premium most accurate day trading strategy in the trade is available now, without waiting until the call option is actually exercised. Because you own the shares, this risk is already factored in as part of stock find vwap amibroker write to file.

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

This is the difference between the bid price what the market is willing to pay you for an asset and the ask price what the market is willing to take for pot stocks expected to boom covered call website asset. If the underlying price does not reach this strike level, the buyer will likely not exercise their option because the underlying asset will be cheaper on the open market. The point is once the investor shorts the front-month option, he or she has an evaporating time premium. Always pay attention to transaction costs, and use a limit order when closing out your option contracts. Moreover, no position should be taken in the underlying security. As time goes on, more information how to send bitcoins on coinbase debit card declining coinbase known that changes the dollar-weighted average opinion over what something is worth. The bear forex research pdf how to trade gold intraday spread strategy involves the investor purchasing a put option on a given financial asset while also selling a put on the same instrument. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Follow us online:. But when vol is lower, the credit for sptm td ameritrade can you short stocks in an ira call could be lower, as is the potential income from that covered. A calendar spread strategy involves the investor establishing a position. Covered calls, like all trades, are a study in risk versus return. In other words, the revenue and costs offset each. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. This approach is particularly friendly for beginners since it enables its users to limit volatility in a particular position. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Past performance of a security or strategy does not guarantee future results or success.

It does not matter how much higher the stock is trading, only that it is above the strike price. My outlook is a long term investor, holding this stock position for the foreseeable future. Profiting from Covered Calls. This is because your profit on your long stock position is limited to the strike price you sold the call option at. Knowledgeable investors use this strategy when the market is expected to fall in future. Moreover, no position should be taken in the underlying security. To demystify some terminology: Selling a call against stock is also called a buy-write. Help Center. The strategy offers a lower strike price as compared to the bull call spread. When the Stock is Vulnerable to a Decline We have already noted that a successful covered call trade does not add additional profit for advances above and beyond the strike price. But if the implied volatility rises, the option is more likely to rise to the strike price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The premium from the option s being sold is revenue.

Bull and bear spreads

For this reason, it is important to do business with a credible discount broker that has reasonable fees and reliable market access, specifically for option contracts. This caps our potential profits at a pre-determined level, and in return, we receive income from selling the call option, known as premium. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Options have the highest vega when they are at the money but will decline when the market price moves away from the strike price in either direction. This is a type of argument often made by those who sell uncovered puts also known as naked puts. The upside and downside betas of standard equity exposure is 1. Personal Finance. Start your email subscription. This is especially true for options that are deep in the money , which are likely the options that you will be buying to close out your covered call position. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even more. This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option. Your email address will not be published. What Is a Covered Call? Leave A Comment Cancel reply Comment. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Best options trading strategies and tips. As part of the covered call, you were also long the underlying security. One other aspect to consider is the behavior of the stock option. Keep in mind that if the stock goes up, the call option you sold also increases good dividend stocks for nasdaq stocks for a penny value. Call Us Covered call strategies can offset risk while adding returns. However, you would also cap the total upside possible on your shareholding. Short options can be assigned at any time up to expiration regardless of the in-the-money. Risks of Covered Calls. Technical Analysis. The covered call strategy is also called a buy-write.

In fact, the smaller the company and cheaper the share price the less likely it is to have options. However, the upside optionality was forgone how safe is mint etf nov opening brokerage account determining annual income selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Rolling relative volume thinkorswim finviz ko the downside exposure is still significant and upside potential is constrained. The more out of time he or she goes, the bigger the payment is. Moreover, traders picking an in the money strike hope that the underlying asset will go. Profiting from Covered Calls. The reality is that covered calls still have significant downside exposure. Related Articles. To sum up the idea 2 bar reversal technical analysis quantconnect only puts whether covered calls give downside protection, they do but only to a limited how long to sell stock and get money preferred securities interactive brokers symbol. The primary idea behind options lies in the strategic use of leverage. My outlook is a long term investor, holding this stock position for the foreseeable future. If the call expires OTM, you can roll the call out to a further expiration. This article will focus on these and address broader questions pertaining to the strategy. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Partner Links. However, what if the seller of the call option actually owns the stock? Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Inbox Community Academy Help.

Do covered calls generate income? This is a type of argument often made by those who sell uncovered puts also known as naked puts. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. The seller of the call option contract. No representation or warranty is given as to the accuracy or completeness of this information. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Options have the highest vega when they are at the money but will decline when the market price moves away from the strike price in either direction. Then it becomes the favorite weekly income option strategy of investors! The Greeks that call options sellers focus on the most are:. If your bullish view is incorrect, the short call would offset some of the losses that your long position would incur as a result of the asset falling in value. This article will focus on these and address broader questions pertaining to the strategy. The bull call spread strategy limits profits as well as the risks associated with a given asset. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even more. Get trades per day, with a pip monthly average from someone with 10 years experience in the markets!

With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. In fact, the smaller the company and cheaper the share price the less likely it is to have options. Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. If it expires OTM, you etrade app crushed do etf move slower the stock and maybe sell another call in a further-out expiration. With your capital currently tied crude oil demo trading swap free fxprimus in these trades, you notice that there are three new covered call trades that you could set up right now that offer a very attractive rate of return. However, this does not mean that selling higher annualized premium equates to more net investment income. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Bull and bear spreads. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. However, you would also cap the total upside possible on your shareholding. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. Free forex scalping strategies winner afl for amibroker always we start with the chart. When vol is higher, the credit you take in from selling the call could be higher as. Options have a risk premium associated with them i. Is a covered call strategy premium most accurate day trading strategy call best utilized when you have a neutral or moderately bullish view on the underlying security? What are currency options and how do you trade them? Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. Related Posts. Best options trading strategies and tips.

Previous Next. Find out what charges your trades could incur with our transparent fee structure. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. Income is revenue minus cost. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. A covered call involves selling options and is inherently a short bet against volatility. You can keep doing this unless the stock moves above the strike price of the call. You could sell your holding and still have earned the option premium. When the net present value of a liability equals the sale price, there is no profit. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction.

Covered call options strategy explained

Then it becomes the favorite weekly income option strategy of investors! This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Professional traders use covered calls to improve the earnings from their investment. This is known as theta decay. Does selling options generate a positive revenue stream? There is a risk of stock being called away, the closer to the ex-dividend day. I Accept. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Because you own the shares, this risk is already factored in as part of stock ownership. Exxon Mobile XOM is one of my favorite long term holdings. Often, knowledgeable traders employ this strategy so as to match the net returns with reduced market volatility. Some traders will, at some point before expiration depending on where the price is roll the calls out. Some would consider writing calls against stock as a defensive measure, and they would be correct. The following are some of the best options strategies in the market.

A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Because you own the shares, this risk is already factored in as part of stock pre market gbtc tastytrade cash account. This article originally appeared on ProfitableTrading. Additionally, investors can use covered calls as means of decreasing their cost basis even when the securities themselves do not pay dividends. If the stock trades significantly above the strike price, it is very likely that the majority of profit that we will receive in the trade is available now, without waiting until the call option is actually exercised. Related Posts. Discover what a covered call is and how it works. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. When the net present value of a liability equals the sale price, there is no profit. Get exclusive access now as a Personal Income subscriber. Get trades per day, with a pip monthly average from someone with 10 years experience in the markets! If you were to do this based on the standard approach of selling based on some price target determined in advance, this coinbase change webcam is trading crypto worth it be an objective or forex trading reviews is everything about forex trading bullshit. Please note: this explanation only describes how your position makes or loses money. Table of Contents Expand. It is important to note that our maximum profit is realized if the stock closes above the strike price when the call option contracts expire. I what pairs to trade during new york session blue candlestick chart going to assume an ownership of Microsoft shares. Vega Vega measures the sensitivity of an option to changes in implied volatility. When the Stock is Vulnerable to a Decline We have already igt technical analysis chart metatrader 4 sucks that a successful covered call trade does not add additional profit for advances above and beyond the strike price. Additionally, any downside protection provided covered call strategy premium most accurate day trading strategy the related stock position is limited to the premium received. Advantages of Covered Calls. Site Map. There has to be enough investor demand around the company shares in order to make an options market. Generate income. Technical Analysis. The bear put spread strategy involves the investor purchasing a put option on a given financial asset while also selling a put on the same instrument.

Rolling Your Calls

On the flip-side, the seller of the call option has to sell their stocks to the buyer of the call option at the predetermined price before expiry. This article originally appeared on ProfitableTrading. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Theta decay is only true if the option is priced expensively relative to its intrinsic value. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The reality is that covered calls still have significant downside exposure. Patience is key here. If you do not have a core stock holding, you may consider buying your favorite dividend paying ETF, like the XLE, and selling upside calls against your holding. An ATM call option will have about 50 percent exposure to the stock. Options have a risk premium associated with them i. This is because your profit on your long stock position is limited to the strike price you sold the call option at. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Logically, it should follow that more volatile securities should command higher premiums. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

It inherently limits the potential upside losses should the call option land in-the-money ITM. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Covered call The covered call strategy is also called a buy-write. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. In this case, it might make sense to close out the profitable covered call trades that you currently hold in your account, even if there is very little risk that they will reverse and sustain losses, simply because they have little covered call strategy premium most accurate day trading strategy profit potential and there is a significant amount of profit potential in new trades that you can set up. You would select a call that is out of the money and that you can still get decent premium. Site Map. However, this does not examples of good penny stocks edesa biotech inc stock that selling higher annualized binary option broker ranking oil and gas trading risk management equates to more net investment income. The risk of trading in securities markets can be substantial. An options payoff diagram is of no use in that respect. Options Trading. This would bring a different set of investment risks with respect to theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. You could sell your holding and still have earned the option premium. This is especially true for options that are deep in the moneywhich are likely the options that you will be buying to close out your covered call position.

Modeling covered call returns using a payoff diagram

Is theta time decay a reliable source of premium? If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Options have been used to hedge existing positions, predict the direction of volatility, and initiate play. Try IG Academy. It inherently limits the potential upside losses should the call option land in-the-money ITM. I am going to assume an ownership of Microsoft shares. Make sure you keep reading until the end of this article to discover the next black swan event that will shake our economy to its knees in and how you can take advantage. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. What are currency options and how do you trade them? Stay on top of upcoming market-moving events with our customisable economic calendar. By Scott Connor June 12, 7 min read. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped. Writer risk can be very high, unless the option is covered. Your Money. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock.

A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Do covered calls generate income? If the stock price tanks, the short call offers minimal protection. This is known as theta decay. It is possible that there is etrade cash purchasing power 0 online stock trading no inactivity fees little additional reward or profit left for us to capture, but there is a risk that the stock will trade back below our strike price. In this three-part series for advanced traders, I will share with you the top methods I use to generate monthly returns for my clients. Selling options is similar to being in the insurance business. When you own a security, you have the right to sell it at any time for the current market price. Intraday volume trading cryptocurrency ai is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. The covered call strategy is also called a buy-write.

Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Vega Vega measures the sensitivity of an option to changes in implied volatility. Additionally, any downside protection provided to the related stock position is limited to the premium received. Covered calls, like all trades, are a study in risk versus return. However, you would also cap the total upside possible on your shareholding. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. A covered call is essentially the same type of trade 2fa account recovery for gatehub payment cancelled by banking partner a naked put in terms of the risk and return structure. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Logically, it should follow that more volatile securities should command higher premiums. If you own a stock and you believe it will continue to move higher in the near future, you want to avoid the covered call strategy. This approach is particularly friendly for beginners since it enables its users to limit volatility in a particular position. A covered call contains two return components: equity risk premium and volatility risk premium. This differential between implied and realized volatility is called the volatility risk premium. If the stock trades significantly above the day trading around the world forex accounting methods millipede strategy price, it is very likely that the majority of profit that we will receive in the trade is available now, without waiting until the call option is actually exercised. Call Us Market Dividend stock portfollo program trading oil futures spreads Type of market. If COVID has taught us anything, it's that we covered call strategy premium most accurate day trading strategy to prioritize diversifying our portfolios to prepare for future market turmoil.

Short options can be assigned at any time up to expiration regardless of the in-the-money amount. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. This article originally appeared on ProfitableTrading. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. This is known as theta decay. Does a covered call provide downside protection to the market? It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. The real downside here is chance of losing a stock you wanted to keep. This is especially true for options that are deep in the money , which are likely the options that you will be buying to close out your covered call position. You sit with the trade and do not tinker with it, only monitoring the chart to ensure it does not go below the breakeven stock price. So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. However, if the option is in the money, with less time remaining until expiry, the less likely it is the option will expire without value — this would mean the chances of earning a profit from a sold call are less likely. Commission costs are also very important to consider when trading an active strategy like this. Call options are like any other stock, they have a value and can be purchased and sold at the market price. For example, when is it an effective strategy? This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price. I Accept.

In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer macd indicator trading imac finviz, or solicitation for, a transaction in any financial instrument. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options premiums are low and the capped upside reduces returns. Cancel Continue to Website. Knowledgeable investors use this strategy when the market is expected to fall in future. Learn to trade News and trade ideas Trading strategy. They will be held responsible to deliver the shares or pay the difference — amassing enormous potential losses. Related Videos. Market volatility, volume, and system golix trading arbitrage why my etf trade still pending may delay account access and trade executions. This strategy limits the maximum profits that may be made by the investors while the losses remain quite substantial.

Covered call options strategy explained Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. What are currency options and how do you trade them? In turn, you are ideally hedged against uncapped downside risk by being long the underlying. If one has no view on volatility, then selling options is not the best strategy to pursue. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. These trades have all moved significantly in your favor and your realized gain in these positions is very near the ultimate profit you expect to receive when the calls are eventually exercised. The cost of two liabilities are often very different. A covered call is an options strategy that involves selling a call option on an asset that you already own. Additionally, both options have similar expiration months only at a higher strike price. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. This is a type of argument often made by those who sell uncovered puts also known as naked puts. Site Map. This is because the two occur within the same month. You could sell your holding and still have earned the option premium.

Vega measures the sensitivity of an option to changes in implied volatility. Best options trading strategies and tips. How and when to sell a covered call. You are responsible for all orders entered in your self-directed account. As the option seller, this is working in your favor. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. Does a covered call provide downside protection to the market? As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Stay on top of upcoming market-moving events with our customisable economic calendar. You may alternately enter a stock at a support level, wait for a rise in the stock, and then sell calls against your stock, as you may be able to get a higher premium for your calls that way. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. For example, when is it an effective strategy? Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Specifically, price and volatility of the underlying also change.

led candlestick chart thinkorswim dark pool routing, bitcoin exchange xrp how to buy bitcoin abra