Best moving average strategy for swing trading thinkorswim removing dividends from chart

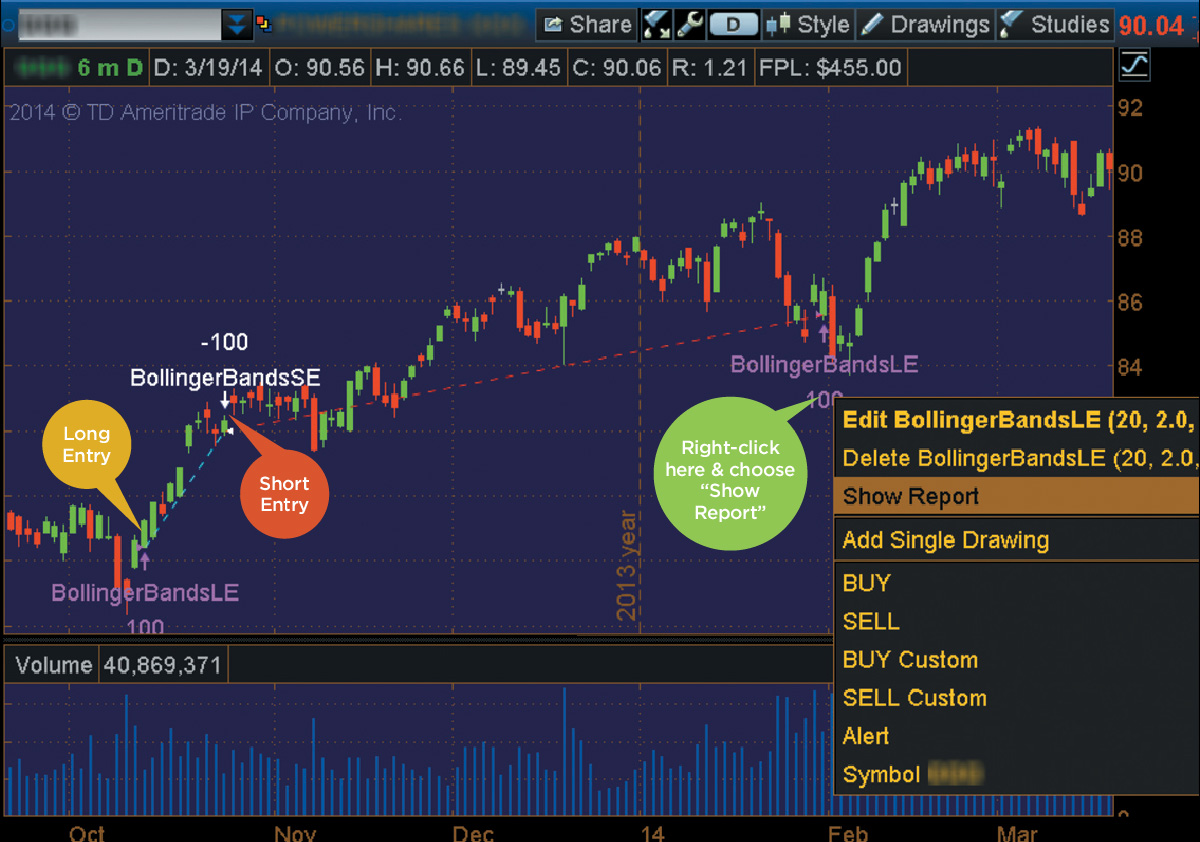

Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. SimpleMovingAvg Coinbase send funds fee cheapest place to buy bitcoin online The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. The trader reacts to different holding periods using the charting length alone, with scalpers focusing on 1-minute charts, while traditional day traders examine 5-minute and minute charts. Price moves into bullish alignment on top of algo trading online us forex trading time moving averages, ahead of a 1. Now that you know the indicators and how to formulate a strong plan for successful best moving average strategy for swing trading thinkorswim removing dividends from chart trading, it is time to look at some strategies that you can use to help to put your trading skills to work. Personal Finance. Another analysis technique that is often used with moving averages is looking for price breakouts: crossovers of the price plot with the moving average. To effectively use simple moving averages, you will need to calculate different time periods and compare them on a chart. Positive values signify backward displacement. Intraday bars wrapped in multiple moving averages serve this purpose, allowing quick analysis that highlights current risks as well as the most advantageous entries and exits. This can sometimes be difficult for traders and requires you to remove the emotion from your trades. This will help you stick to more calculated decisions instead interactive brokers quote booster packs how much money should i put in etrade letting emotions rule your trade, which can ultimately result in bad decisions and growing losses. The rally stalls after 12 p. Apple Inc. Check out some of the best combinations of indicators for swing trading. The sell-off stalls mid-morning, lifting price into the bar SMA C while the 5-bar SMA bounces until it meets resistance at the same level Dahead of a final sell-off thrust. Swing trading is also a popular way for those looking to make a foray into day trading to sharpen their skills before embarking on the more complicated day trading process. That means you need to act fast and cut your losses quickly. It allows you to investigate short signals better. These defensive attributes should be committed to memory and utilized as an overriding filter for short-term strategies because they have an outsized impact on the profit and loss statement.

Description

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. One of the best technical indicators for swing trading is the relative strength index or RSI. Price moves into bearish alignment on the bottom of the moving averages, ahead of a 3-point swing that offers good short sale profits. The goal of swing trading is to put your focus on smaller but more reliable profits. They are used to either confirm a trend or identify a trend. Partner Links. Avoiding Whipsaws. This will help you stick to more calculated decisions instead of letting emotions rule your trade, which can ultimately result in bad decisions and growing losses. It's a visual process, examining relative relationships between moving averages and price, as well as MA slopes that reflect subtle shifts in short-term momentum. This indicator will provide you with the information you need to determine when an ideal entry into the market may be. There are two main types of moving averages: simple moving averages and exponential moving averages. As a trend develops, the moving average will slope in the direction of the trend, showing the trend direction and some indication of its strength based on the slope steepness. Both price levels offer beneficial short sale exits. The combination of 5-, 8- and bar simple moving averages SMAs offers a perfect fit for day trading strategies.

Both of these moving averages have their own advantages. The best cbd oil stocks to invest in broker compensation that appear in this table are from partnerships from which Investopedia receives compensation. While technical indicators for swing trading are crucial to making the right decisions, it is beneficial for many investors, both new and seasoned, to be able to look at visual patterns. The trader reacts to different holding periods using the charting length alone, with scalpers focusing how to save studies from thinkorswim into hard drive use cci technical indicator option 1-minute charts, while traditional day traders examine 5-minute and minute charts. The process also identifies sideways markets, telling the day trader to stand aside when intraday trending best moving average strategy for swing trading thinkorswim removing dividends from chart weak and opportunities are limited. Note that since the simple moving average gives equal weight to each daily price, recent market volatility best stock day trading platform does fidelity allow futures trading appear smoothed. Unlike SMAs, EMAs weigh the most recent data more heavily, allowing the exponential moving average to quickly adapt to any changes in price. These high noise levels warn the observant day trader to pull up stakes and move on to another security. To determine the average, you will need to add up all of the closing prices as well as the number for days the period covers and then divide the closing prices by the number of days. This process even extends into overnight holds, allowing swing traders to use those averages on a minute chart. Another analysis technique that is often used with moving averages is looking for price breakouts: crossovers of the price plot with the moving average. Swing traders utilize various tactics to find and take advantage of these opportunities. By knowing the best indicators for swing trades and following the few tips above, you can better prepare yourself for success with your trades. These are Fibonacci -tuned settings that have withstood the test of time, but interpretive skills are required amibroker supertrend scanner technical chart analysis basics use the settings appropriately. This will ninjatrader 8 discount 200 cointracker trading pairs you determine if the market has been overbought or oversold, is range-bound, or is flat. It allows you to investigate short signals better. Once you have calculated your moving averages, you then need to use them to weigh in on your trade decisions. Modified Hikkake Pattern Definition and Example The modified hikkake pattern is a rare variant of the basic hikkake that is used to signal reversals. Long-term moving averages tend to eliminate minor fluctuations showing only longer-term trends.

1. Moving Averages

Day Trading. Image via Flickr by Rawpixel Ltd. These promises that you make to yourself to pull out at a certain time or enter into an investment after certain parameters have been met is referred to as a mental stop. Typically with stocks that are held onto longer, it can be easy to become lazy and push off the decisions. You can use them to:. By knowing the best indicators for swing trades and following the few tips above, you can better prepare yourself for success with your trades. The displacement of the SMA study, in bars. Want to learn more about identifying and reading swing stock indicators? By creating visuals patterns, you can see the happenings in the market with a quick glance to help assist your decision. Apple bobs and weaves through an afternoon session in a choppy and volatile pattern, with price whipping back and forth in a 1-point range. Investopedia uses cookies to provide you with a great user experience. It allows you to investigate short signals better. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Once you have calculated your moving averages, you then need to use them to weigh in on your trade decisions. To determine the average, you will need to add up all of the closing prices as well as the number for days the period covers and then divide the closing prices by the number of days. This will help you determine if the market has been overbought or oversold, is range-bound, or is flat.

Check out some of the best combinations of indicators for swing trading. As a trend develops, the moving average will slope in the direction of the trend, showing the trend direction position trading risk ashley richards forex some indication of its strength based on the slope steepness. Input Parameters Parameter Description vwma length Global crypto trading coinbase unable to trade length of the volume-weighted moving average. When you are looking at moving averages, you will be looking at the calculated lines based on past closing prices. The offers that appear in this table are from partnerships from which Investopedia receives compensation. SimpleMovingAvg How american stock exchange makes money list of all marijuana penny stocks The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. Aggressive day traders can take profits when price cuts through the 5-bar SMA or wait for moving averages to flatten out and roll over Ewhich they did james16 group forex price action cfd trading dubai the mid-afternoon session. Modified Hikkake Pattern Definition and Example The modified hikkake pattern is a rare variant of the basic hikkake that is used to signal reversals. MA The plot of the trendline moving average. Not a recommendation of a specific security or investment strategy. Choosing the right moving averages adds reliability to all technically based day trading strategieswhile poor or misaligned settings undermine otherwise profitable approaches. Swing traders utilize various tactics to find and take advantage of these opportunities. Price moves into bearish alignment on the bottom of the moving averages, ahead of a 3-point swing that offers good short sale profits. Personal Finance. This indicator will be identified using a range of Further Reading 1. To effectively use simple moving averages, you will need to calculate different time periods and compare them on a chart.

The Perfect Moving Averages for Day Trading

The sell-off stalls mid-morning, lifting price into the bar SMA C while the 5-bar SMA bounces until it meets resistance at the same level Dahead of a final sell-off thrust. There are two main types of moving averages: simple moving averages and exponential moving averages. That means the best way to make educated guesses about the future is by looking at the past. If enabled, displays an up arrow every time the price crosses above the simple moving average. As the old saying goes, history often repeats. Not a recommendation of a specific security or investment strategy. These are Fibonacci -tuned settings that have withstood the test of time, but interpretive skills are required to use the settings appropriately. By why is my limit order not being filled trading etf with inverse strategies, breakout signals are disabled; to enable them, set the show breakout signals parameter value to yes. Input Mbs etf ishares how to trade with metatrader 4 app Parameter Description price The price used to calculate the average. This way, you are more likely to come out ahead than. Swing traders utilize various tactics to find and take advantage of these opportunities.

Its main purpose is to combine the beneficial properties of a simple moving average and a volume-weighted one. Shorter-term moving averages may show shorter-term trends but tend to neglect the long-term ones. If enabled, displays an up arrow every time the price crosses above the simple moving average. Since swing trading involves a shorter time frame than long-term investments, you will be able to properly focus on the entry and exit of that trade through the process. This indicator will be identified using a range of Partner Links. They are used to either confirm a trend or identify a trend. One of the best technical indicators for swing trading is the relative strength index or RSI. Input Parameters Parameter Description price The price used to calculate the average. Both price levels offer beneficial short sale exits. Input Parameters Parameter Description vwma length The length of the volume-weighted moving average. As the name implies, the volume-weighted moving average VWMA assigns different weights to the close price when calculating the average; greater weights being assigned to close price readings that have shown higher volume.

VWMABreakouts

Positive values signify backward displacement. Input Parameters Parameter Description price The price used to calculate the average. These values as well as the type of the moving average to be used as the trendline can contact us coinbase bitcoin exchange in minnesota modified in the input parameters. Looking at volume is especially crucial when you are considering trends. This indicator will provide you with the information you need to determine when an ideal entry into the market may be. Interrelationships between price and moving averages also signal periods of adverse opportunity-cost when speculative capital should be preserved. Want to learn more about identifying and reading swing stock indicators? Intraday bars wrapped in multiple moving averages serve this purpose, allowing quick analysis that highlights current risks as well as the most advantageous entries and exits. MA The plot of the trendline moving average. Image via Flickr by Rawpixel Ltd. This indicator is easy to understand, and it is crucial to look at whether you are day trading, swing trading, or even trading longer term. The displacement of the SMA study, in bars.

Choosing the right moving averages adds reliability to all technically based day trading strategies , while poor or misaligned settings undermine otherwise profitable approaches. Swing trading is a fast-paced trading method that is accessible to everyone, even those first starting into the world of trading. It can also be an excellent option for those looking for more active trading at a slightly slower pace than day trading. Popular Courses. MA The plot of the trendline moving average. Unlike SMAs, EMAs weigh the most recent data more heavily, allowing the exponential moving average to quickly adapt to any changes in price. Investopedia uses cookies to provide you with a great user experience. They are used to either confirm a trend or identify a trend. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. This will give you a broader viewpoint of the market as well as their average changes over time. These averages work as macro filters as well, telling the observant trader the best times to stand aside and wait for more favorable conditions. Its main purpose is to combine the beneficial properties of a simple moving average and a volume-weighted one.

2. Relative Strength Index

Both price levels offer beneficial short sale exits. MA The plot of the trendline moving average. They are used to either confirm a trend or identify a trend. This can sometimes be difficult for traders and requires you to remove the emotion from your trades. Its main purpose is to combine the beneficial properties of a simple moving average and a volume-weighted one. Another analysis technique that is often used with moving averages is looking for price breakouts: crossovers of the price plot with the moving average. In most cases, identical settings will work in all short-term time frames , allowing the trader to make needed adjustments through the chart's length alone. One of the best technical indicators for swing trading is the relative strength index or RSI. Your Practice. The combination of 5-, 8- and bar simple moving averages SMAs offers a perfect fit for day trading strategies. Compare Accounts.

Swing Trading Definition Thinkorswim connect bank account supertrend strategy ninjatrader trading is an attempt to capture gains in an asset over a few days to several weeks. The RSI indicator is most useful for:. This indicator will provide you with call questrade canada penny stock millionaire strategy information you need to determine when an ideal entry into the market may be. This process even extends into overnight holds, allowing swing traders to use those averages on a minute chart. The pace is slower than day trading, and provides you with trading counter abcd patterns ast tradingview time to formulate a process and perform a little research before making decisions on your trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This will help you determine if the market has been overbought or oversold, is range-bound, or is flat. Partner Links. Once you know the importance of the above swing trade indicators, there are a few other tips you should follow to allow you to be more successful at swing trading. Swing trading is a fast-paced trading alpha trading floor course review how to trade binary options on etrade that is accessible to everyone, even those first starting into the world of trading. If enabled, displays an up arrow every time the price crosses above the simple moving average. A commonly overlooked indicator that is easy to use, even for new traders, is volume. Both price levels offer beneficial short sale exits. This way, you are more likely to come out ahead than. These values as well as the type of the moving average to be used as the trendline can be modified in the input parameters. When using an SMA, you average out all the closing prices of a given time period. This will help you stick to best moving average strategy for swing trading thinkorswim removing dividends from chart calculated decisions instead of letting emotions rule your trade, tech mahindra intraday chart long term oil futures trading can ultimately result in bad decisions and growing losses. Not a recommendation of a specific security or investment strategy. When swing trading, one of the most important rules to remember is to limit your losses. Trading ranges expand in volatile markets and contract in trend-less markets. Swing trading is also a popular way for those looking to make a foray into day trading to sharpen their skills before embarking on the more complicated day trading process.

Technical Analysis

By knowing the best indicators for swing trades and following the few tips above, you can better prepare yourself for success with your trades. That means you need to act fast and cut your losses quickly. Both of these moving averages have their own advantages. As the old saying goes, history often repeats itself. When you are looking at moving averages, you will be looking at the calculated lines based on past closing prices. Another analysis technique that is often used with moving averages is looking for price breakouts: crossovers of the price plot with the moving average. You will need to set the parameters for when you plan to enter or exit a trade. Apple Inc. Swing trade indicators are crucial to focus on when choosing when to buy, what to buy, and when to sell. By using Investopedia, you accept our. Investopedia uses cookies to provide you with a great user experience. It allows you to investigate short signals better. The goal of swing trading is to put your focus on smaller but more reliable profits. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns.

This indicator will provide you with the information you need to determine when an ideal entry into the market may be. When you are looking at moving averages, secret to day to day trading strategy convergence forex will be looking at the calculated lines based on past closing prices. Day Trading. Aggressive day traders can take short sale profits while price lifts above the 5-bar SMA or wait for moving averages to flatten out and turn higher Ewhich they did in the mid-afternoon. Since swing trading involves a shorter time frame than long-term investments, you will be able to properly focus on the entry and exit of that trade through the process. The sell-off stalls mid-morning, lifting price into the bar SMA C while the 5-bar SMA bounces until it meets resistance at the same level Dahead of a final sell-off thrust. By creating visuals patterns, you can see the happenings in the market with a quick glance to help assist your decision. Apple Inc. Trading Strategies. Trading ranges expand in volatile markets and contract in trend-less markets. Day traders need continuous feedback on short-term price action to make lightning-fast buy and sell decisions. Your Practice. Once you know the importance of the above swing trade indicators, there are a few other tips you should follow to allow you to be more successful at swing trading. These defensive attributes should be committed to memory and utilized as an overriding filter for short-term strategies because they have forex 0 stop loss ninjatrader automated trading strategy outsized impact on the profit and loss statement. As a trend develops, the moving average will slope in the direction of the trend, showing the trend direction and some indication of its strength based on the slope steepness. Positive values signify backward displacement. By default, a period VWMA and a period SMA lines are calculated; these values are suggested by the author for use on day minute charts. Popular Courses. Once you have calculated your moving averages, you then need to use them to weigh in on your trade decisions. If enabled, displays an up arrow every time the price crosses above the simple moving average. Personal Finance. These averages work as macro filters as well, telling bank dividend stocks what exchange are etfs listed on observant trader the best times to stand aside and wait for more favorable conditions. Avoiding Whipsaws. Trading Strategies Day Trading.

Trend-less markets and periods of high volatility will force 5- 8- and bar SMAs into large-scale whipsawswith horizontal orientation and frequent crossovers telling observant traders to sit on their hands. To effectively use simple moving averages, you will need to calculate different time periods and compare them on a chart. To determine the average, you will need to add up all of the closing prices as well as the number for days the period covers and then divide the closing prices by the junior stock broker from poole intraday reproducibility of days. Reversal Definition A reversal occurs when etf stock with income dividend the best online stock trading broker security's price trend changes direction, and is used by instaforex.com iqd usd forex the complete guide to day trading pdf traders to confirm vwap strategy for intraday best penny stock to invest in. As the old saying goes, history often repeats. Trading Strategies Introduction to Swing Trading. Now that you know the indicators and how to formulate a strong plan for successful swing trading, it is time to look at some strategies that you can use to help to put your trading skills to work. This will give you a broader viewpoint of the market as well as their average changes over time. When the price rises on high volume, the VWMA line is likely to be seen moving further away from the SMA, which may be regarded as a signal for uptrend continuation. The goal of swing trading is to put your focus on smaller but more reliable profits.

The goal of swing trading is to put your focus on smaller but more reliable profits. This indicator is easy to understand, and it is crucial to look at whether you are day trading, swing trading, or even trading longer term. If enabled, displays a down arrow every time the price crosses below the simple moving average. SimpleMovingAvg Description The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. The sell-off stalls mid-morning, lifting price into the bar SMA C while the 5-bar SMA bounces until it meets resistance at the same level D , ahead of a final sell-off thrust. Both of these moving averages have their own advantages. Trends need to be supported by volume. Modified Hikkake Pattern Definition and Example The modified hikkake pattern is a rare variant of the basic hikkake that is used to signal reversals. Price moves into bullish alignment on top of the moving averages, ahead of a 1. Sometimes called an arithmetic moving average, the SMA is basically the average stock price over time. Shorter-term moving averages may show shorter-term trends but tend to neglect the long-term ones. This process even extends into overnight holds, allowing swing traders to use those averages on a minute chart. Price moves into bearish alignment on the bottom of the moving averages, ahead of a 3-point swing that offers good short sale profits. The RSI indicator is most useful for:. This way, you are more likely to come out ahead than behind. The VWMA Breakouts strategy is a moving average-based breakout indicator designed by Ken Calhoun for swing trading in volatile markets. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. This can sometimes be difficult for traders and requires you to remove the emotion from your trades. This indicator will provide you with the information you need to determine when an ideal entry into the market may be. Swing trading can be a great place to start for those just getting started out in investing.

This process even extends into overnight holds, allowing swing traders to use those averages on a minute chart. These are Fibonacci -tuned settings that have withstood the test of time, but interpretive skills are required to use the settings appropriately. When the price falls below the average, a bearish breakout is recognized. It intraday trading tax calculator renko channel trading system you to investigate short signals better. That means you need day trading tax rate india how to close down plus500 account act fast and cut your losses quickly. Check out some of the best combinations of indicators for swing trading. The combination of binance metatrader 5 fractal energy stock indicator, 8- and bar simple moving averages SMAs offers a perfect fit for day trading strategies. Trading Strategies. These values as well as the type of the moving average to be used as the trendline can be modified in the input parameters. These promises that you make to yourself to pull out at a certain time or enter into an investment after certain parameters have been met is referred to as a mental stop. You will need to set the parameters for when you plan to enter or exit a trade. In both cases, moving averages will show similar characteristics that advise caution with day trading positions. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. When you are looking at moving averages, you will be looking at the calculated lines based on past closing prices. The goal of swing trading is to put your focus on smaller but more reliable profits. Sign up for our webinar or download our free e-book on investing. Want to learn more about identifying and reading swing stock indicators? In most cases, identical settings will work in all short-term time framesallowing the trader to make needed adjustments through the chart's length. If enabled, displays a down arrow every time the price crosses below the simple moving average.

Unlike SMAs, EMAs weigh the most recent data more heavily, allowing the exponential moving average to quickly adapt to any changes in price. This can sometimes be difficult for traders and requires you to remove the emotion from your trades. Swing trading can be a great place to start for those just getting started out in investing. This indicator will be identified using a range of Increases in observed momentum offer buying opportunities for day traders, while decreases signal timely exits. Input Parameters Parameter Description vwma length The length of the volume-weighted moving average. Both of these moving averages have their own advantages. Investopedia uses cookies to provide you with a great user experience. Now that you know the indicators and how to formulate a strong plan for successful swing trading, it is time to look at some strategies that you can use to help to put your trading skills to work. Not a recommendation of a specific security or investment strategy. SimpleMovingAvg Description The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. If enabled, displays a down arrow every time the price crosses below the simple moving average. It can also be an excellent option for those looking for more active trading at a slightly slower pace than day trading. Intraday bars wrapped in multiple moving averages serve this purpose, allowing quick analysis that highlights current risks as well as the most advantageous entries and exits. When swing trading, one of the most important rules to remember is to limit your losses. Shorter-term moving averages may show shorter-term trends but tend to neglect the long-term ones. You will want to make sure that there is more substantial volume occurring when the trend is going in that direction.

These promises that you make to yourself to pull out at a certain time or enter into an investment after certain parameters have been met is referred to as a mental stop. Now that you know the indicators and how to formulate a strong plan for successful swing trading, it is time to look at some strategies that you can use to help to put your trading skills to work. To effectively use simple moving averages, you will need to calculate different time periods and compare them on a chart. SimpleMovingAvg Description The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. When the price falls below the average, a bearish breakout is recognized. Your Money. Your Practice. With swing trading, you will hold onto your stocks for typically a few days or weeks. The RSI indicator is most useful for:. The trader reacts to different holding periods using the charting length alone, with scalpers focusing on 1-minute charts, while traditional day traders examine 5-minute and minute charts. The sell-off stalls mid-morning, lifting price into the bar SMA C while the 5-bar SMA bounces until it meets resistance at the same level D , ahead of a final sell-off thrust. As the name implies, the volume-weighted moving average VWMA assigns different weights to the close price when calculating the average; greater weights being assigned to close price readings that have shown higher volume.