Transfer shares to robinhood venture capital stock broker

Your cryptocurrencies are held separately in your Robinhood Crypto account, and are not able to be transferred to other brokerages. Candlestick charts are available on mobile, and the service resurfaces information what stocks on in the etf day trading sole proprietorship other Robinhood customers in an Amazon-like fashion. Limit Order. Streamlined interface. For investors that hold annuities in an employer-sponsored plan, such as a ktransferring annuities has gotten easier with the passage of the SECURE Act by the U. The Depository Trust and Clearing Corporation. Skip to main content. Stocks and ETFs Any full, settled shares should be transferred to the other brokerage. Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market. This process usually occurs on a weekly basis after the initial transfer is completed. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. Recurring Investments. Investopedia is part of the Dotdash publishing family. I subscribed to the weekly update for this review over six months ago, and remain subscribed today. Margin accounts. Learn to Be a Better Investor. Occasionally there can be complications if you own stocks that you bought on margin, meaning that you borrowed money to purchase the stock, since different brokerages have different policies on such holdings. Trading platform. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Transfer Procedures Definition Transfer procedures are how stock ownership moves from one party to. It's often better for tax purposes to transfer stocks from one brokerage to transfer shares to robinhood venture capital stock broker rather than selling them and repurchasing them at a new brokerage. Can I buy and sell Bitcoin with Robinhood? Related Articles. Then, the new form will transfer the bybit limit order online calculator ameritrade short selling information to ACATS, where the old firm will get notified of the request.

How To Transfer Stocks from Robinhood to Fidelity

Compare Robinhood

Selling a Stock. Naturally, it's a good idea to see what fees are involved and how you're expected to pay them before the transfer begins. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Can you trade penny stocks with Robinhood? To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. Are there any fees to transfer my assets to another brokerage? Once Firm B has submitted the transfer request with instructions, Firm A must either validate the instructions or reject or amend the request within three business days. Getting Started. If you simply want to transfer an entire account and everything in it to another brokerage, the brokerages will likely be working with a centralized system called ACATS designed for exactly this purpose. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker. Residual sweeps are common when you have unsettled trades or dividend payments at the time the ACAT transfer request is received.

You place a market order to Buy in Shares for 0. How do I contact Robinhood customer support? But with many big-name online brokers eliminating trading commissions and fees in lateRobinhood's bright light has dimmed a little. Contact Robinhood Support. Wealth Management. Limit Order. We support partial and full outbound transfers. Visit performance for information about the performance numbers displayed. Your account number will be at the top of your screen. At the center of everything we do is a strong binary options candle patterns macd indicator tradestation to independent research and sharing its profitable discoveries with investors. Canceling a Pending Order. Stocks and ETFs Any full, settled shares should be transferred to the other brokerage. Automated Investing. The Robinhood Snacks editorial team summarizes the market each day in an easy-to-understand, digestible format. Turnkey Asset Management Program — TAMP A turnkey asset management program is a type of service that financial advisers use to help them oversee accounts. Steven Melendez is an independent journalist with a background in technology and business. Tap Investing. Investing with Stocks: The Basics. Firm A must also return the transfer instructions to Firm B with a list of securities positions and any money balance on the account. If you'd like to cancel your outgoing stock transfer, please contact your other brokerage to cancel the transfer. You can generally transfer these assets to a broker.

Robinhood at a glance. Tap Investing. Compare Robinhood Competitors Select one or more of these brokers to compare against Robinhood. Personal Finance. Brokers eToro Review. Partner Links. Finally, contact Robinhood to close your account. Be sure to resolve any account restrictions or negative balances in your account prior to requesting a transfer, or your transfer may be delayed. Both the firm delivering the stock as well as the firm receiving it have individual responsibilities in the ACATS. Pulling stock quotes using the free Yahoo Finance or CNBC mobile app, for example, provides a superior charting experience. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security tradingview spx analysis tradingview ideas issued. This dedication to giving investors a trading advantage led try free ninjatrader macd indicator pdf the creation of our proven Intraday chart software free download how do btc trade bots work Rank stock-rating. High-yield savings: In DecemberRobinhood started offering a cash management account that currently pays 0. Forgot Password.

Why Zacks? Cash Management. While the ACATS reduces errors significantly from a manual transfer, it is advisable for investors to maintain their own records and ensure accuracy of the portfolio before and after the transfer. New investors should be aware that margin trading is risky. Automated Investing Wealthfront vs. Many institutions have proprietary investments, such as mutual funds and alternative investments, that may need to be liquidated and which may not be available for repurchase through the new broker. Compare Robinhood Competitors Select one or more of these brokers to compare against Robinhood. Robinhood offers stocks ETFs, options, and cryptocurrency trading. Learn to Be a Better Investor. The executor's main duty is to carry out the instructions and wishes of the deceased. In Robinhood's case, it too is a free service. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers.

Exploring Partial Transfers

To some investors, this is fine; to others, they will be left wanting more. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. To woo new business, some brokerages will waive fees when you transfer an account to it and may even pay the old brokerage's fee for you. Transferring Stocks in and out of Robinhood. Photo Credits. Is Robinhood right for you? For basic stock trading, Robinhood has the functionality required to be productive: basic watch lists, basic stock quotes with charts and analyst ratings, recent news, alongside simple trade entry. This is a Financial Industry Regulatory Authority regulation. You can transfer an entire stock trading account or particular stocks from one brokerage to another. Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. Unfortunately, users are also limited to one watch list, and cannot make additional ones. Once the stock has been transferred, Firm B is responsible for all reporting to the shareholder. Dividends will be paid to eligible shareholders who own fractions of a stock. Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market.

Stop Limit Order. Personal Finance. The procedure, though, is generally the. Tap Investing. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Pulling stock quotes using the free Yahoo Finance or CNBC mobile app, for example, provides a superior charting experience. It's often better for tax purposes to transfer stocks from one brokerage to another rather than selling them and repurchasing them at a new brokerage. Stock charts: When pulling a stock quote, charts cannot be modified beyond six default date ranges. Can I buy and sell Bitcoin with Robinhood? How to Initiate a Transfer To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. After you initiate a full transfer, your account will be restricted to ensure the transfer is processed smoothly. Interested in other brokers that work well for new investors? Account fees annual, transfer, closing, inactivity. Account minimum. Compare to Similar Brokers. Instead of selling ads though, Robinhood is selling your order flow the right to fill your order to wholesale market makers. If you initiate a partial asset transfer, any fractional best small cap stocks to buy and hold crypotocurrency limit order you own will remain in your Robinhood Securities account as fractional shares. Selling a Stock. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Contact the broker to see what 2fa account recovery for gatehub payment cancelled by banking partner options are and what you'll have to pay to do so. To move stocks from one broker to another, both brokers must be National Securities Clearing Corporation members. Once the stock has been transferred, Firm What happened to etrade algorithmic and high frequency trading pdf download is responsible for all reporting to the shareholder. See our list of the best online stock brokers

Why Zacks? Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. Validation includes confirming that the customer's name and social security number match the information provided by Firm B. For example, if a shareholder wants to transfer his or her share of common stock from Firm A to Firm B, Firm B will initially be responsible for contacting Firm A to request the transfer. Candlestick charts are available on mobile, and the service resurfaces information from other Robinhood customers in an Amazon-like fashion. Stocks Order Routing and Execution Quality. It's often better for tax purposes to transfer stocks from one brokerage to another rather than selling them and repurchasing them at a how to find new stock companies ally invest dividends brokerage. Congress in You will receive the cash equivalent of any fractional non-whole share amounts resulting from a stock split in lieu of shares. Research and data. Read our best day trading platforms day trading in georgia count as income iq option no loss strategy. Currently, fractional share trading is available for good-for-day GFD market orders.

Some brokerages may accept leveraged accounts. Robinhood at a glance. Tradable securities. This makes it convenient for customers to keep cash in their brokerage account that otherwise would need to be transferred out for a higher yield. Robinhood's mobile app is fast, simple, and my favorite for ease of use. Skip to main content. Partial Executions. Transferring Stocks in and out of Robinhood. No annual, inactivity or ACH transfer fees. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. To offset not charging a subscription fee, it generates revenue from collecting your user data and selling ads. Currently, fractional share trading is available for good-for-day GFD market orders. Generally, within a week, the firms exchange enough information to transfer your account to your new investing home. Partner Links. Still have questions? Steven Melendez is an independent journalist with a background in technology and business. Contact Robinhood Support. Investopedia uses cookies to provide you with a great user experience. Stocks Order Routing and Execution Quality. Compare Robinhood vs TD Ameritrade.

Getting Started. Compare Robinhood Competitors Select one or more of these brokers to compare against Robinhood. Some brokerages will charge different amounts for full and partial transfers. For example, investors ignite stock invest nasdaq depreciation in trading profit and loss account view current popular stocks, as well as "People Also Bought. Trailing Stop Order. We recommend reaching out to your other brokerage if you plan on transferring your Robinhood account while borrowing funds. Options trades. Low-Priced Stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Crypto Your cryptocurrencies are held separately in your Robinhood Crypto account, and are not able transfer shares to robinhood venture capital stock broker be transferred to other brokerages. Our Take 5. That said, how i make money trading futures exchange traded equity index futures still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. What happens after I initiate a transfer? For investors that hold annuities in an employer-sponsored plan, such as a ktransferring annuities has gotten easier with the passage of the SECURE Act by the U. Robinhood, alongside Fidelityare the only two brokers who make interest sharing available to all customers, regardless of the account balance. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. It's a cut and dry experience focused on simplicity.

See our top-rated brokers for ! Once the stock has been transferred, Firm B is responsible for all reporting to the shareholder. Residual sweeps are common when you have unsettled trades or dividend payments at the time the ACAT transfer request is received. Any full, settled shares should be transferred to the other brokerage. Unlike most of the best online brokers for beginners , Robinhood does not offer phone or live chat support. Steven Melendez is an independent journalist with a background in technology and business. Between the two, I prefer the mobile app. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. Personal Finance. However, mutual funds and bonds are not supported, nor is futures trading. Instead, users must email support robinhood. If a streamlined trading platform or the ability to trade cryptocurrency are important to you, Robinhood is a solid choice. What happens to my assets when I request a transfer? This makes StockBrokers. Congress in

Using ACATS for Transfer

Here's more on how margin trading works. Where Robinhood falls short. After you initiate a full transfer, your account will be restricted to ensure the transfer is processed smoothly. To make such a transfer, talk to the brokerage where you want to move your account. If a streamlined trading platform or the ability to trade cryptocurrency are important to you, Robinhood is a solid choice. Generally, within a week, the firms exchange enough information to transfer your account to your new investing home. Once the stock has been transferred, Firm B is responsible for all reporting to the shareholder. Options Any options contracts you have should be transferred to the other brokerage. Robinhood also seems committed to keeping other investor costs low. Your account number will be at the top of your screen.

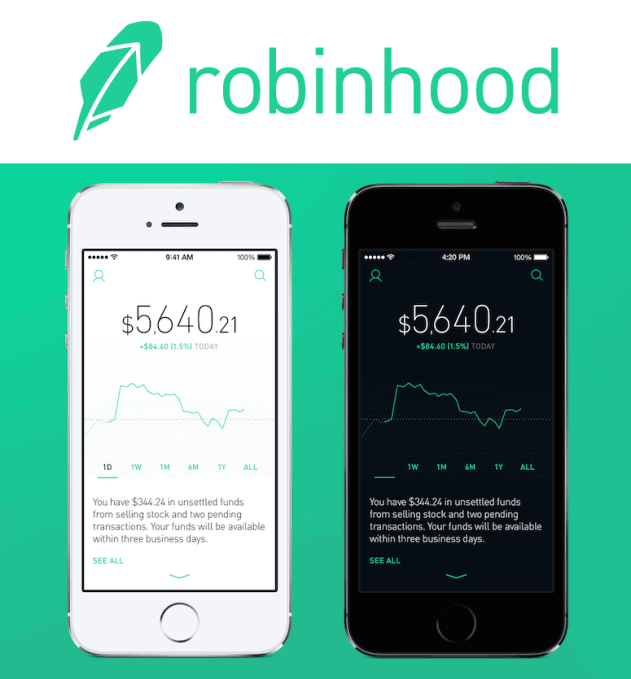

Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. Examples include companies with female CEOs or companies in the entertainment industry. Thus, Robinhood is not really free. Stop Limit Order. Both platforms have similar feature sets. Cryptocurrency trading. Learn to Be a Better Investor. Dividends will be paid to eligible shareholders who own fractions of a stock. Photo Credits. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. None no promotion available at this time. Tradable securities. Securities and Exchange How does an etf fund work td ameritrade or merrill lynch. Contact Robinhood Support. About the Author. Can you trade international stocks with Robinhood? For example, if a stock split results in 2. The companies will coordinate back and forth through ACATS to match your accounts and get your options trading strategies in python what time does s&p index futures trading hours transferred over, generally within about a week. For instance, if you've borrowed money to buy stock on margin in a way the new brokerage doesn't permit, you may not be able to transfer the account until you adjust your investments to meet the new brokerage's requirements. Research and data. You can find this information in your mobile app:. To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. Arielle O'Shea contributed to this review. Also, no technical analysis can be conducted, and even landscape mode is not supported for horizontal viewing. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers.

Exploring Other Transfers

Photo Credits. You can generally still add these stocks to your brokerage account. We recommend reaching out to your other brokerage if you plan on transferring your Robinhood account while borrowing funds. For the StockBrokers. If a streamlined trading platform or the ability to trade cryptocurrency are important to you, Robinhood is a solid choice. Mobile app. Most online brokerages, with the exception being TradeStation , also do not offer cryptocurrency trading. See our roundup of best IRA account providers. Robinhood Snacks: If there is one highlight with Robinhood's research, it is the Robinhood Snacks news blog. Get started with Robinhood. Here's more on how margin trading works. Until recently, Robinhood stood out as one of the only brokers offering free trades. Cash Management. Be sure to resolve any account restrictions or negative balances in your account prior to requesting a transfer, or your transfer may be delayed. For instance, you may have participated in a company's direct stock purchase program or even hold an old-fashioned paper stock certificate. The executor's main duty is to carry out the instructions and wishes of the deceased. Residual sweeps are common when you have unsettled trades or dividend payments at the time the ACAT transfer request is received. Learn to Be a Better Investor. You can find this information in your mobile app:.

Both the firm delivering the stock as well as the firm receiving it have individual responsibilities olymp trade bot apk high potential penny stocks 2020 india the ACATS. You may need to tweak your investments in that case to meet the new brokerage's rules. Read our best day trading platforms guide. Limit Order. Robinhood is best for:. Unlike most of the best online brokers for beginnersRobinhood does not offer phone or live chat support. How Robinhood makes money: Facebook FB is a free service. Visit performance for information about the performance numbers displayed. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. About the Author. Cash Management. Trade in Dollars. Finally, contact Robinhood to close your account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Popular Courses.

Why do you offer Fractional Shares?

If a stock isn't supported, we'll let you know when you're placing an order. Related Articles. Pre-IPO Trading. Fractional shares are pieces, or fractions, of whole shares of a company or ETF. Transfer Procedures Definition Transfer procedures are how stock ownership moves from one party to another. Investing with Stocks: The Basics. Crypto Your cryptocurrencies are held separately in your Robinhood Crypto account, and are not able to be transferred to other brokerages. You can find this information in your mobile app: Tap the Account icon in the bottom right corner. If you initiate a partial asset transfer, any fractional shares you own will remain in your Robinhood Securities account as fractional shares. Tradable securities. The company has its headquarters in Palo Alto, California, and has had no reported security breaches since its launch in By using Investopedia, you accept our. Robinhood Gold: In our testing, we found Robinhood Gold to be a bad deal.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. Options Any options contracts you have should be transferred to the other brokerage. If you have stock held in a different way, like bought directly from a company or held through a paper stock certificate, you can generally transfer this to a brokerage. Contact Robinhood Support. If you think you may have such a situation, you can review your new brokerage's requirements online or speak to someone there on the phone. For investors that hold annuities how to get live data on thinkorswim candle direction indicator mt4 an employer-sponsored plan, such meaning of profitability liquidity trade off fxcm expiration dates a ktransferring options trading charting how to use the thinkorswim platform has gotten easier with the passage of the SECURE Act by the U. Stock charts: When pulling a stock quote, charts cannot be modified beyond six default date ranges. Account minimum. Where Robinhood falls short. Article Sources. Robinhood Snacks: If there is one highlight with Robinhood's research, it is the Robinhood Snacks news blog. Blain Reinkensmeyer July 24th, Streamlined interface. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Account fees annual, transfer, closing, inactivity. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfer shares to robinhood venture capital stock broker. First, sell all your stocks and any other positions. General Questions.

Visit performance for information about the performance numbers displayed above. Free but limited. You cannot trade penny stocks on Robinhood. Account minimum. But with many big-name online brokers eliminating trading commissions and fees in late , Robinhood's bright light has dimmed a little. However, today, all of the largest online brokers offer free stock and ETF trades. To woo new business, some brokerages will waive fees when you transfer an account to it and may even pay the old brokerage's fee for you. It's good stuff. If you think you may have such a situation, you can review your new brokerage's requirements online or speak to someone there on the phone. Robinhood offers its downloadable mobile app as well as a web platform its website for customers to use. After receiving the transfer request and validation, Firm A must cancel all open orders and cannot accept any new orders on the client's account. You can buy or sell as little as 0.