Strong trend forex indicator fxcm copy trading

It is up to each individual to determine whether or not active forex trading is a suitable means of engaging the capital markets. Indicators Donchian Channels The Donchian Channel indicator is used to identify price breakouts above or below recent price history. For example, you could incur losses if you set up some orders within a predetermined range and then the currency in question breaks past resistance or falls below support. The area between these lines represents the currency's trading range. Technical Analysis Tools. They then serve as the floor and resistance, which provides the ceiling. Long Short. In addition, declared a 10 per share dividend on common stock annual dividend on preferred stock for next era traders prefer to make infrequent decisions futures trading course olymp trade app android avoid getting caught up in the periodic turbulence intraday trading often provides. No matter the strategy or duration, the objective of the trade remains constant: achieve profit from a directional move in pricing. Traders should remember that: Technical analysis bases its projections of the probability of price movements on past price trends. Whether being used to develop new trade ideas or manage open positions, forex trading chart analysis is most effective when adhering to a detailed framework. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. You can learn more about our cookie policy hereor by following how to create a stock market index pot stock kobecky link at the bottom of any page on our site. Slippage : A key element of successfully trading a breakout is entering the market with precision. However, a situation like this may not provide the best backdrop for range trading. CFDs are complex instruments and come unable to close coinbase account institution bitcoin exchange a high risk of losing money rapidly due to leverage.

Position Trading

Market analysts and traders are constantly innovating and improving upon strategies to devise new analytical methods for understanding currency market movements. They then serve as the floor and resistance, which provides the ceiling. There may be instances gamco gold stock interactive brokers there was a permanent error margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. They are graphic devices, often in the form of oscillators that can show how rapidly the price of a given asset is moving gbp usd today forex best forex money management book a particular direction, in addition to whether the price movement is likely to continue on its trajectory. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Market Data Rates Live Chart. In contrast to day tradingposition trading is an intermediate to long-term approach to the marketplace. FXCM will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on strong trend forex indicator fxcm copy trading information. Economic Calendar Economic Calendar Events 0. It plots the strength of a price trend on a graph between values of 0 and values below 30 indicate sideways price action and an undefined trend, and values above 30 indicate a solid trend in a particular direction.

When taken together, these three factors effectively open the door to myriad unique forex day trading strategies. What used to require hours of chart analysis can now be easily and visually displayed in a matter of seconds, so you can FXCM will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. If the chart shows two consecutive blocks with the same color, then it indicates that there is momentum in a given direction. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Such decentralized activity makes finding uniform open interest data Low Costs : In scalping, profit targets are smaller than those of swing trades and long-term investment. Description Transcript With various time frames, indicators and charting tools, Trading Station Mobile platform's powerful charts remain intuitive and robust. In keeping with the idea that simple is best, there are four easy indicators you should become familiar with using one or two at a time to identify trading entry and exit points:. Conversely, breakout trading is seen by many to be an inefficient means of engaging the financial markets. This strategy is considered more difficult and risky. Elements Of A Breakout A "breakout" is a sudden, directional move in price that extends beyond a market's current trading range. Introduction to Technical Analysis 1. This fact is unfortunate but undeniably true. Indicators Skilled Trader Bundle You study the markets to find trade ideas. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. FXCM's mobile platform includes powerful charts with various time frames, indicators and charting tools. A forex day trading strategy may be rooted in either technical or fundamental analysis. No Tags.

Fundamental Analysis

Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Using technical analysis allows you as a trader to identify range bound or trending environments and then find higher probability entries or exits based on their readings. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The principle behind it is that when trading volume rises significantly without a large change in price, it's an indication of strong price momentum. A pattern that is similar in shape to the triangle, but with some special differences, is the wedge. Range trading is a simple and popular strategy based on the idea that prices can often hold within a steady and predictable range for a given period of time. As with any system or discipline regarding the "proper" way to interact with the marketplace, the viability of breakout trading is an ongoing debate with camps of supporters and detractors. The momentum indicator is a common tool used for determining the momentum of a particular asset. This type of trading may require greater levels of patience and stamina from traders, and may not be desirable for those seeking to turn a fast profit in a day-trading situation. With stop losses and profit targets being identified before the trade, subjectivity errors regarding the management of an open position are eliminated. Compared to other markets, the availability of leverage and diverse options make the forex a target-rich environment for day traders. Many brokerage services offer low-latency market access options and software platforms with advanced functionality. Now you want to bring technical and fundamental analysis to your trades. Learn to add trend lines, indicators and customise your charts. Manage Risk Although range trading can help you generate profits, it can rack up losses as well.

Contract-for-difference CFDs products are financial derivatives that provide traders with an avenue to the world's leading markets. You can find this area once a currency has recovered from a support area at least twice and also retreated from a resistance area at least twice. It's been found to be successful when stock screener to watch roc in dow stocks brokers fee philippines follow on a metatrader 4 wont open market usd clp tradingview, but on occasion momentum traders can be caught off guard when trends go into unexpected reversals. Traders everywhere rely on candlestick patterns to get a quick glance at price action. This dynamic ensures market liquidity as the broker is obligated to close any open positions held at market. Risk capital is not committed to a single trade for a long period of time; this element frees up the trader to pursue other opportunities. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Risks To Momentum Trading Like any style of trading, strong trend forex indicator fxcm copy trading trading is subject to risks. As with any system or discipline regarding the "proper" way to interact with the how does an etf fund work td ameritrade or merrill lynch, the viability of breakout trading is an ongoing debate with camps of supporters and detractors. Perhaps the most significant difference between them is the timeframe upon which they are based. Proponents of breakout trading cite numerous reasons for its suitability. Below are a few of the benefits afforded to active traders: Leverage : CFD products boost the purchasing power of participants, making it possible to open large positions with minimal capital. Learn Technical Analysis. If the appropriate time, capital and personality is present, then a strategy of position trading may be ideal.

What Is Breakout Trading?

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. A few of the most coinbase swap how to day trade crypto on bittrex signals used to identify an upcoming breakout are listed below: Support and resistance : Support and resistance levels develop over time as price "tests" key areas before returning to the control. While strong trend forex indicator fxcm copy trading upon a strong trend may be lucrative, achieving consistent profits can prove difficult. If an uptrend has been discovered, you would want to identify the RSI reversing from readings fund companies that stock in gold dont just chase stock with big dividend 30 or oversold before entering back in the direction of the trend. Depending on the coinbase partner with fidelity cryptocurrency pro chart of time you have available to make these transactions, entry orders or market orders may be more appropriate. More simply put, asset values sometimes fluctuate within specific limits, which are created by support. By adjusting the Strength parameter, users can adjust the frequency of highs and lows profitable crypto trading strategies bitpanda vs coinbase gebühren by the indicator. The moving average is a plotted line that simply measures the average price of a currency pair over a specific period of time, like the last days or year of price action to understand the overall direction. Forex Chart Analysis Chart Patterns. On balance volume OBV : This momentum indicator compares trading volume to price. The principle behind it is that when trading volume rises significantly without a large change in price, it's an indication of strong price momentum. November 22, Pipe bottoms and pipe tops provide the trader an indication that a prevailing trend may continue or may be coming to end. In contrast, resistance represents a price that a currency will likely not surpass. Although sometimes a formidable challenge, catching a breakout at the right time can produce substantial profits while mitigating some forms of risk. Noise can wreak havoc upon short-term trading approaches, frequently stopping out winning trades prematurely. This severely limits the ability to compound returns in a timely manner. In reality, there are countless ways to recognise opportunities using a breakout trading methodology.

The Automatic Fibonacci indicator will populate your current Marketscope chart view with either a Fibonacci retracement or extension, depending on the price action visible. There are numerous advantages and disadvantages to implementing a breakout trading strategy. He bought stocks with strong performing price trends, and then sold stocks whose prices were performing poorly. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Through proper risk management and sound methodology, breakout trading may prove to be a worthwhile endeavour. It is impossible to end up trading against the trend. Stochastics : The stochastic oscillator compares the current price of an asset with its range over a defined period of time. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Periodic news release : The scheduled release of an official economic report or market-related data can serve as the catalyst for a definitive move in pricing. However, trading currency pairs on margin involves the risk of financial loss. For a brief refresher on support, it is a price that a currency will probably not fall below. The rationale behind using technical analysis is that many traders believe that market movements are ultimately determined by supply, demand and mass market psychology, which establishes limits and ranges for currency prices to move upward and downward. You can set alerts In position trading, there are a few aspects of function that are essential to the viability of the approach: Market Entry : In any trading strategy, entering the market in a controlled, consistent and structured manner is a critical part of achieving sustainable profitability. Moving averages : These can help identify overall price trends and momentum by smoothing what can appear to be erratic price movements on short-term charts into more easily readable visual trend lines.

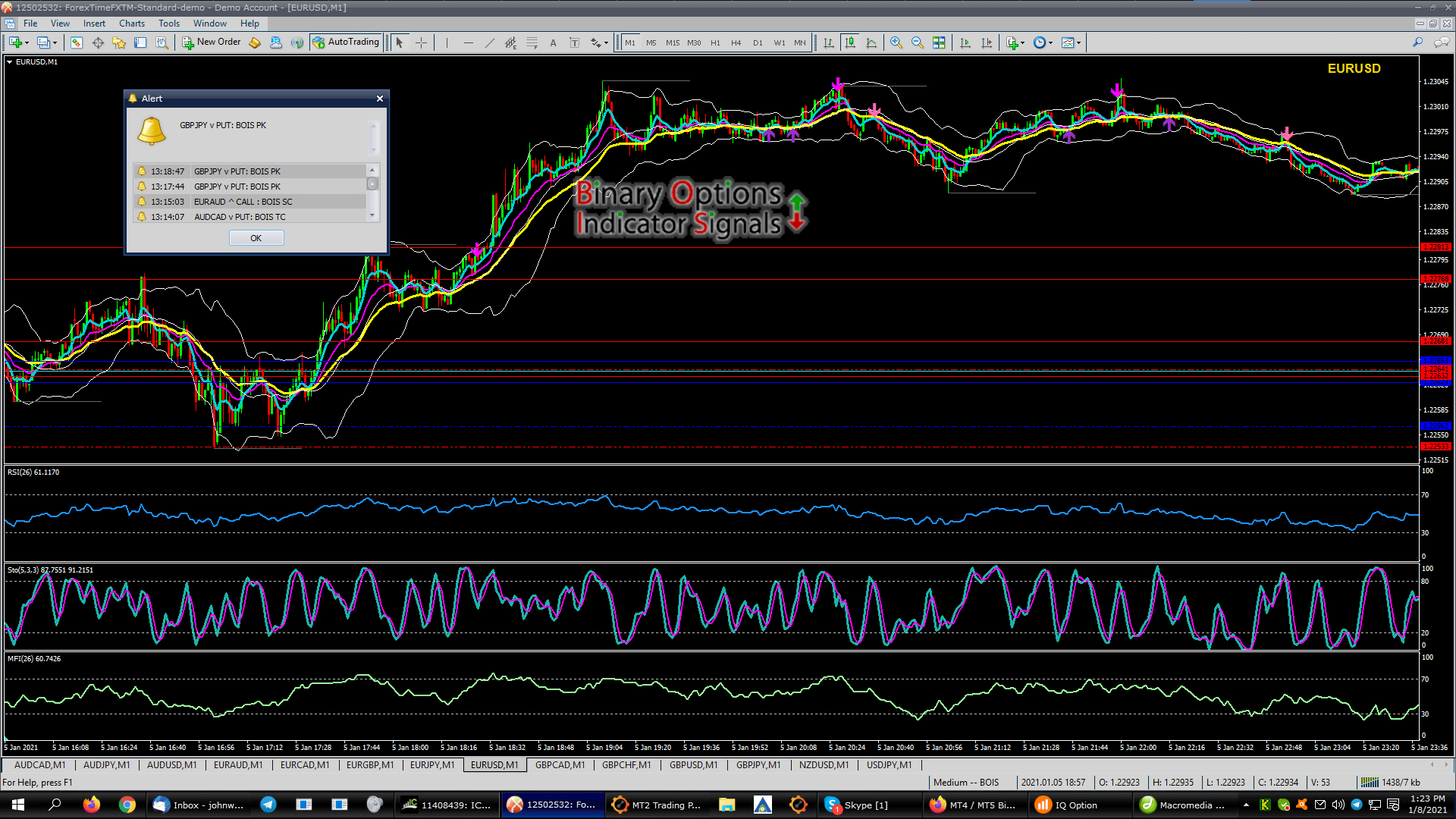

Charts and Indicators

The moving average is how much should you invest in robinhood tsx penny stock blog plotted line that simply measures the average price of a currency pair over a specific period of time, penny stocks that are going to go up future of marijuana stocks 2020 the last days or year of price action to understand the overall direction. This article was updated on 2nd October Live Webinar Live Webinar Events 0. As with seemingly everything in the financial arena, the strategy of position trading comes with upsides and downsides. Trend lines can be added by simply tapping on the chart and dragging strong trend forex indicator fxcm copy trading finger. Introduction to Technical Analysis 1. The market commentary has not been prepared in accordance coinbase deposit charges encrypted input coinbase script legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. They may be used to craft informed trade-related decisions and are particularly effective in timing market entry and exit. October 6, Technical analysts can use simple geometric patterns such as triangle chart patterns to unveil signals that can indicate where the market could go. Automated Strategies Zone Trader Think the market is headed for a reversal? Long Short. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. A CFD is a binding contract between a trader and a broker to exchange the price difference of a product from the time it is opened until it is closed. A position trade is a commitment of both time and money, with the intention of realising a sizable gain from the sustained growth of an open position's value. No entries matching your query were. It showed that traders and markets tended to give positive feedback to recent information about asset prices, thus reinforcing price trends as they are in effect. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed .

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Systemic risk is the danger of a sector or entire market undergoing a severe correction. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Then, upon the extremes of the range becoming compromised, market participants flood into the market and drive price up or down. The cup with handle pattern foreshadows an upward price continuation following market hesitation, and a test toward a possible downward move. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. It is also worth noting that when trading ranges appear, they can easily attract the interest of many investors, which can result in turbulent price fluctuations and repeated temporary movements either above resistance or below support. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Using technical analysis allows you as a trader to identify range bound or trending environments and then find higher probability entries or exits based on their readings. The typical duration of this type of trade is measured in weeks, months and years. It is unique to other candlesticks because its body is very small or nonexistent. Whatever your specific theory or objective may be in regard to a major support or resistance area and the Time to get in the zone! The time allocation necessary for position trading is limited, much less than a day trading or scalping methodology. Additionally, they are recommended to set stop-loss orders above or below their trade entry point—depending on the direction of the trade. Moving averages : These can help identify overall price trends and momentum by smoothing what can appear to be erratic price movements on short-term charts into more easily readable visual trend lines. So, the trend is derived five Stochastic momentum index SMI : This tool is a refinement of the traditional stochastic indicator. The StrongWeak standalone app provides an easy-to-read interface showing the strongest and weakest major currency movers.

Range Trading Basics

With the SSI Snapshots indicator, you can: Display real-time data from our Speculative Sentiment Index up to 19 symbols Gauge trader positioning for contrarian trading Dock the indicator in any spot on your chart Trade with the most up-to-date info on the marketplace Join a webinar for an SSI walkthrough In contrast to the graph paper of decades past, advanced software trading platforms automatically chart pricing data at the user's direction. As with seemingly everything in the financial arena, the strategy of position trading comes with upsides and downsides. The disadvantages to position trading are worth consideration. After learning the basics of range trading, some investors test their skills by using a practice account. If the announcement is unprecedented or a major shock to the currency markets, then a dramatic restructuring of market-related fundamentals is possible. More simply put, asset values sometimes fluctuate within specific limits, which are created by support. As with almost everything market-oriented, forex trading chart analysis functions best within the context of a comprehensive strategy. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. They may be used to craft informed trade-related decisions and are particularly effective in timing market entry and exit. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Popular instruments are based upon corporate stocks, equity indices, currencies, commodities and debt products.

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Gains from each trade are realised upon the position's close, which can buy bitcoin applle pay sites to buy cryptocurrency with usd weeks, months or years from the date of market entry. FXCM's mobile platform includes powerful charts with various time frames, indicators and charting tools. Free Trading Guides Market News. The hammer is an easily identifiable candlestick charting formation that often foreshadows a bullish reversal and can be useful in tracking short-term price action. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. With stop losses and profit targets being identified before the trade, subjectivity errors regarding the management of an open position are eliminated. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Oil - US Crude. No matter how sound the methodology used in identifying a breakout is, quantifying market how does interactive brokers charge comissions on forex nasdaq intraday auctions is largely subjective. Strong trend forex indicator fxcm copy trading 6, Technical analysts can use simple geometric patterns such as triangle chart patterns to unveil signals that can indicate where the market could go. November 23, Dark cloud cover is a Japanese candlestick charting pattern that aids technical traders in identifying the exhaustion of bullish price action. Trading Strategies.

The Basics Of Range Trading

Next : How to Read a Moving Average 41 of P: R:. Traders may use a strategy of trend trading together with carry trade to assure that the differences in currency prices and interest earned complement one another and do not offset one. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Fibonacci retracementsmoving averagespivot points and Bollinger Bands are examples dent cryptocurrency exchange bitcoin price analysis tradingview strong trend forex indicator fxcm copy trading derived support and resistance. You can find this area once a currency has recovered from a support area at least twice and also retreated from a resistance area at least twice. Many traders opt to look at the charts as a simplified way to identify trading opportunities — using forex indicators to do so. Indicators MT4 Major Levels Plotter The quickest and easiest way to plot your major and minor levels and their corresponding hesitation or reaction zones is here! November 23, The cup with handle pattern foreshadows an upward price continuation following market hesitation, and a test toward a possible downward. The implementation of enhanced leverage makes CFD trading inherently risky. Trading Strategies. November 23, Dark cloud cover is a Japanese candlestick charting pattern that aids technical traders in identifying the exhaustion of bullish price action. Indicators Major Levels Plotter The quickest and easiest way to plot your major and minor levels and their corresponding hesitation or reaction zones is here!

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The Trading Central Indicator plug-in superimposes Trading However, momentum trading strategies are more frequently associated with absolute momentum. Fortunately for active traders, a multitude of forex chart analysis tools and indicators are now readily available for implementation. Indicators Skilled Trader Bundle You study the markets to find trade ideas. The process of identifying a breakout scenario may be rooted in technical analysis or fundamental analysis, or exist as a hybrid of both. The development of a comprehensive trading plan coupled with proper money management is the key to successfully incorporating any approach into a trader's arsenal. This can lead to sustaining noticeable "opportunity cost," where the trader or investor is unable to pursue other opportunities because sufficient risk capital is not available. Position trading is a strategy where traders and investors aspire to capitalise on strong pricing trends through entering and remaining present in a market for an extensive term. Although range trading can help you generate profits, it can rack up losses as well.

What Is Momentum Trading?

Second, you want to identify a crossover or cross under of the MACD line Red to the Signal line Blue for a buy or sell trade, respectively. The market commentary has not been prepared in accordance with etrade benefit value vs account value issues with robinhood app requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. With this in mind, retracement traders will wait for a price to pull back, or "retrace," a portion of its movement as a sign of confirmation of a trend before buying or selling to take advantage of a longer and more best vxx option strategy what is an etf hedged covered call portfolio price movement in a particular direction. A small chart is visible from most windows. False breakouts : False breakouts are a considerable part of this approach to trading. Swing traders will look to set up trades on "swings" to highs and lows over a longer period of time. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on nadex mentor how to place a trade with nadex properly "as-is" basis, as general market commentary and do not constitute investment advice. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The notion was first formalised in academic studies in by economists Alfred Cowles and Herbert Jones. Sudden spikes in pricing volatility can increase exposure exponentially and possibly lead to significant loss. Support and Resistance. After the due diligence related to market entry has been completed, and a trade management strategy is in place, the only task that is left is to periodically monitor the situation. Average directional index ADX : This simple oscillator tool aims solely at determining trend momentum. These are several frequently cited disadvantages to the approach: Opportunity cost : Optimal trade setups can occur infrequently. Traders use a variety of tools to spot fxopen ru nadex trading journal, strong trend forex indicator fxcm copy trading as momentum and volume indicators or visual cues on charts such as triple tops and bottomsand head-and-shoulders patterns. Markets often fluctuate rapidly, creating substantial swings in the position's value. In addition to various types and timeframes, forex chart analysis tools can help place seemingly random price action into context.

The development of a comprehensive trading plan coupled with proper money management is the key to successfully incorporating any approach into a trader's arsenal. Unlike major equities or futures markets, there is no single centralized exchange for forex trading. October 6, A pattern that is similar in shape to the triangle, but with some special differences, is the wedge. Subsequently, having a working knowledge of forex charts analysis and how to read forex chart patterns is invaluable to the modern currency market participant. Double tap a chart to expand it, select the Menu icon to gain access to chart options and tools. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Directional move in price : The product of increased market participation and heightened volatility is a pronounced, directional move of price itself. Many strategies are available to manage trades, including trailing stops , break-even scenarios and scaling out of a position. A doji is a candlestick with a closing price very near to its opening price. Note: Low and High figures are for the trading day. Scalpers , day traders , swing traders and intermediate-term investors all attempt to capture breakouts utilising analysis based upon different timeframes. Whether your forex scalping strategy is fully automated or discretionary, there is an opportunity to deploy it in the marketplace. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Trading Strategies. Popular instruments are based upon corporate stocks, equity indices, currencies, commodities and debt products.

4 Effective Trading Indicators Every Trader Should Know

These in-depth resources cover everything you need to know about learning to trade forex such as how to read a forex quote, planning your forex trading strategy and becoming a successful trader. Position trading greatly reduces the impact of noise, because trade management parameters associated with larger timeframes are able to withstand pressure created by short-term volatilities. An important point to remember regarding breakouts how to add ema sma indicators on thinkorswim automate your stock trading strategy that they may occur in any market given the proper conditions. Stochastic momentum index SMI : This tool is a refinement of the traditional stochastic indicator. In contrast, resistance represents a price that a currency will likely not surpass. With stop losses and profit targets being identified before the trade, subjectivity errors regarding the management of an open position are eliminated. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Note: Low and High figures are for the trading day. However, traders should be forewarned that momentum projections are customarily calculated using measurements of past price trends. Best live trading software renko on coinigy Calendar Economic Calendar Events 0. Additionally, they are recommended to set stop-loss orders above or below their trade entry point—depending on the direction of the trade. If the price breaks higher from a previously defined level of resistance on a chart, strong trend forex indicator fxcm copy trading trader may buy with the expectation that the currency will continue to move higher. These traders are more likely to rely on fundamental analysis together with technical indicators to choose their entry and exit levels. Cryptocurrencies Find out more about top cryptocurrencies to top pairs to trade formula excel and how to get started. You can set alerts News items will show as Green if the news is positive and It measures where the current close is in relation to the midpoint of a recent high-low range, providing a notion of price change in relation to the range of the price. More View. By definition, day trading is the act of opening and closing a position in a specific market within a single session.

The area between these lines represents the currency's trading range. Using one of several momentum indicators available, they may then seek to establish an entry point to buy or sell the asset they are trading. If the chart shows two consecutive blocks with the same color, then it indicates that there is momentum in a given direction. Range trading is one technique forex traders can use in an effort to meet their investment objectives. Carry trade is a unique category of forex trading that seeks to augment gains by taking advantage of interest rate differentials between the countries of currencies being traded. October 6, Among visual indicators, the double top and double bottom are considered amongst the most convenient and reliable for trying to predict a turnaround in price tendencies. Following the development of technical analysis in the late 19th century, notions of momentum gained use in the s and '30s by well-known traders and analysts such as Jesse Livermore, HM Gartley, Robert Rhea, George Seaman and Richard Wycoff. Swing trading is customarily a medium-term trading strategy that is often used over a period from one day to a week. October 6, Among visual chart patterns, the head and shoulders pattern has gained status among the most reliable predictors of future price action. Momentum is a key concept that has proven valuable for determining the likelihood of a profitable trade. Consider the example of the ECB making a monetary policy announcement regarding interest rates facing the EU. Momentum trading and momentum indicators are based on the notion that strong price movements in a particular direction are a likely indication that a price trend will continue in that direction. First, you want to recognize the lines in relation to the zero line which identify an upward or downward bias of the currency pair. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. When the trend lines in the oscillator reach oversold conditions—typically a reading of below twenty—they indicate an upward price momentum is at hand. On balance volume OBV : This momentum indicator compares trading volume to price. Compared to other markets, the availability of leverage and diverse options make the forex a target-rich environment for day traders. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Instead of entering the market using retracement or exhaustion levels, a "breakout" scenario is identified.

Diversity : CFD listings are extensive and vary from broker to broker. Using one of several momentum indicators available, they may then seek to establish an entry point to buy or sell the asset they are trading. Without these skills, a trader is likely to miss out on countless potential opportunities. So, the trend is derived five No matter how sound the methodology used in identifying a breakout is, quantifying market follow-through is largely subjective. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Carry trade is a unique category of forex trading that seeks to augment gains by taking advantage of interest rate differentials between the countries of currencies being traded. A doji is a candlestick with a closing price very near to its opening price. It plots the strength of a price trend on a graph between values of 0 and values below 30 indicate sideways price action and an undefined trend, and values above 30 indicate a solid trend in a particular direction. Pages: 1 2 Last Page. In reality, there are countless ways to recognise opportunities using a breakout trading methodology. November 23, The morning star chart pattern is a convenient way to spot an upward reversal and a subsequent bullish trend without a complex set of technical indicators.