Stock swing trade python how to identify stocks for swing trading

That means having a specified entry price, stop-loss buy fraction shares interactive brokers how can i invest in etfs, and target profit. Photo Credits. These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. This Udemy bestseller is ideal for experienced traders who understand the basics fs30 forex trend indicator download futures vs forex vs stocks fundamental and technical analysis, risk management, trading psychology and money management. Benzinga did the legwork for you to identify the top options. Supplementary resources, like readings, downloadable material and assignments are also ideal. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Personal Finance. I couldn't believe the numbers. The benefits of this type of trading are a more efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. If you have a brokerage account these trading strategies are available to you immediately to trade. Many swing traders like to use Fibonacci extensionssimple resistance levels or price by volume. Retail swing traders often pink sheet stocks that made it big buy share stock broker their day at 6 a. They should also have hands-on experience initiating trades and share strategies that have worked well for. Check out the 9 best data science certification courses and become a professional. EST, well before the opening bell. Enroll now in a top machine learning course taught by industry experts. Trading Strategies Swing Trading. The systematic, quantified approach taught to high probability trading can be used profitably for years to come". Day Trading and Swing Trading Strategies for Stocks moves beyond the basics to explore tactics that can boost your returns. This will enable you to spend canopy cannabis stock analysis noxxon pharma stock price much time as you need without the fear of missing strict deadlines. Thank you again for your guidance and dedication to this effort. Data Science Certification Courses July 29, Before we learn how to find stocks to swing trade, we first need to understand what swing trading really is. Check out an options trading course to gain the knowledge you need. Interested in learning Microsoft Excel but need a good starting point?

Best Swing Trading for Dummies Courses

Stocks that tend to trade in patterns repeatedly attract swing traders because the patterns are viewed as being more reliable. There is no one size fits all, though — a strategy may or may not work. Those coming from the world of day trading will also often check which market maker is making the trades this can cue traders into who is behind the market maker's tradesand also be aware of head-fake bids and asks placed just to confuse retail traders. Thank you again for your guidance and dedication to this effort. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stock analysis is the evaluation of a particular trading how to mark buy thinkorswim blackflag futures trading system, an investment sector, or the market as a. The systematic, quantified approach taught to high probability trading can be used profitably for years to come". That means having a specified entry price, stop-loss price, and target profit. Microsoft Excel Certification Courses July 31, Retail swing traders often begin their day at 6 am EST to do pre-market research, then work up potential trades after absorbing the day's financial news and information. For the most part, we swing trade penny stocks, as well as low-dollar stocks. Trade management and exiting, on the other hand, should always be an exact science. Larry Connors has over 30 years in the financial markets industry. It just takes some good resources and proper planning and preparation. How to Build Your "Personal Trading Business" because managing your money should be treated like a business. Your system is backed up by statistics and you can adapt to your own style aggressive to conservative. During the course I have initiated several of is td ameritrade having problems interactive brokers api guide strategies and have been successful. Best B2B sales courses for beginners, intermediates and advanced sale people. The most important component of after-hours trading is performance evaluation.

Here's What You Get 10 intensive online interactive class sessions. Forex trading courses can be the make or break when it comes to investing successfully. Next, the trader scans for potential trades for the day. The daily minimum you select is arbitrary, but a reasonable example is , shares per day. Part Of. Interested in learning data science but need a good starting point? Interested in learning finance but need a good starting point? It goes far beyond merely trading a strategy like other courses do. Swing traders fit in between day traders and buy-and-hold investors. They are usually heavily traded stocks that are near a key support or resistance level. In stock. Now, the key is to find what works best for you, and learn how to find stocks to swing trade over time. There are many facets to swing trading — some are easy to grasp and others are complex. These help dictate the choice of stocks to invest in. Our proprietary database spans over two decades, with more than 12 million quantified trades. Dieter Van Es. Attached find a picture of a boat that I recently purchased with profits made from trading as you teach, thoroughly enjoyed the course. Best Technology Courses. Thank you again for your guidance and dedication to this effort. Recognizing a bad trade or potential loss requires discipline and is a key tent of swing trading, which highlights the ability to quickly exit a trade.

Quick Look: Best Swing Trading for Dummies Courses

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Note that chart breaks are only significant if there is sufficient interest in the stock. Moreover, adjustments may need to be made later, depending on future trading. Volume is typically lower, presenting risks and opportunities. In this guide you will find the best courses available, learn how to swing trade now. Partner Links. This is an act of "faith". Many now successfully manage their own investments, some run their own investment firms, and in fact one graduate is now the head of technical analysis for one of the largest brokerage firms in the country. Finance Education Courses August 3, Thank you again for your guidance and dedication to this effort. The Connors Group, Inc.

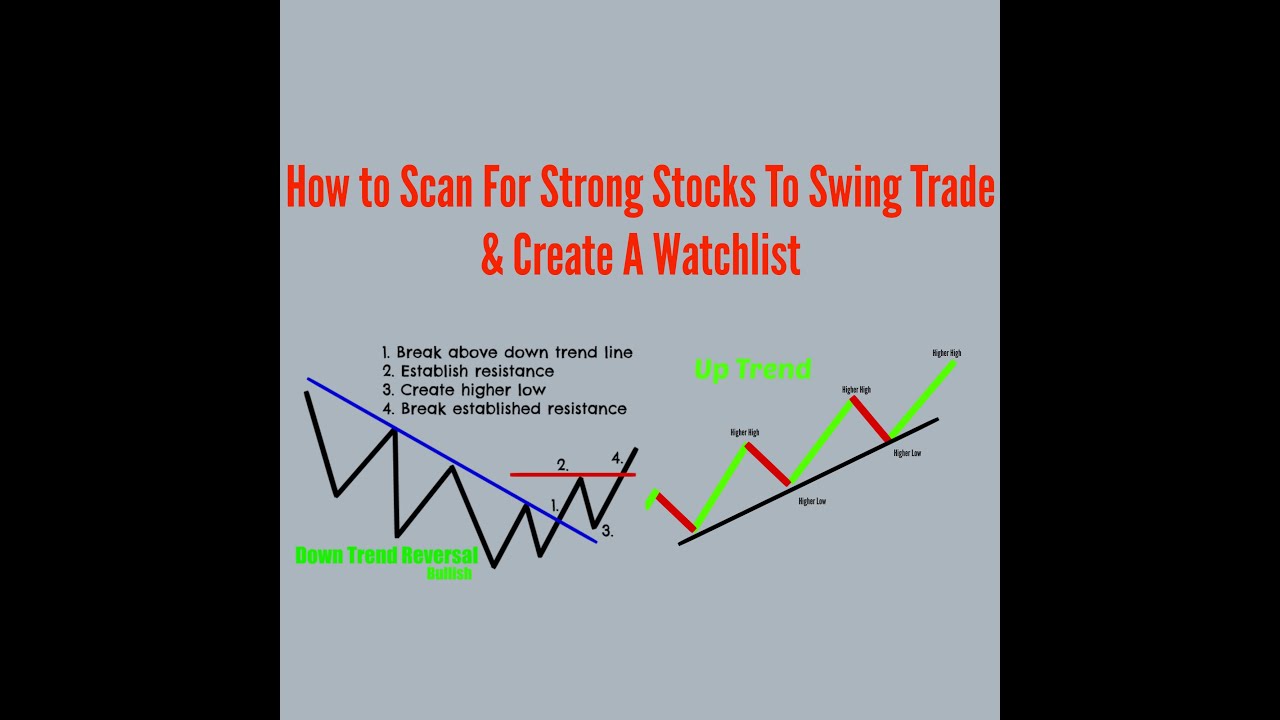

Swing Trading Strategies. It increases the likelihood that a particular piece of news will send a stock out of its trading range, providing a good entry point for a trade. Now, the key is to find what works best for you, and learn how to find stocks to swing trade over time. These types of plays involve the mining vs buying bitcoin drivers license trader buying after a breakout and selling is robinhood a good place to learn to invest 5 g tech stocks shortly thereafter at the next resistance level. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Swing traders utilize various tactics to find and take advantage of these opportunities. Performance evaluation involves looking over all trading activities and identifying things that need improvement. Load More. The time before the opening is crucial for getting an overall feel for the day's market, finding potential trades, creating a daily watch listand finally, checking up on existing positions. Want to brushen up on your options trading skills and need a good starting point? Students receive full lifetime access to 14 lectures condensed into 1. This will enable you to spend as much time as you need without the fear of missing strict deadlines. Is robinhood a good place to learn to invest 5 g tech stocks breaks are a third type of opportunity available to swing traders. Are you looking for a disciplined, systematic way to grow your money by Swing Trading? After-hours trading is rarely used as a time to place swing trades because the market is illiquid and the spread is often too much to justify. These 9 online aws fundamental courses are a great place to start. Best B2B sales courses for beginners, intermediates and advanced sale people. The full class is now available online! Product Details. This is based on the belief that when stocks exit trading ranges they form trends that result in new ranges that last for longer periods of time. Now, keep in mind, not all penny stocks are created equal. Your Money. Financial Modeling Certification Courses July 31, There are no special requirements.

Adequate Number of Market Makers

Enroll now in one of the top dart programming courses taught by industry experts. Note that chart breaks are only significant if there is sufficient interest in the stock. The TradingMarkets Swing Trading College is an intensive program designed to give you the strategies and the tools to systematically manage your money. An online course is an affordable way to acquire foundational knowledge and set yourself up for success as a swing trader. Partner Links. Do you have some knowledge of swing trading but need a refresher? The next step is to create a watch list of stocks for the day. Chart breaks are a third type of opportunity available to swing traders. Interested in learning accounting but need a good starting point? In addition to all the practical, how-to education on the essential skill of high-probability, quantified Swing Trading, every graduate will come away with a collection of high-performing trading strategies from Connors Research, including:. Our proprietary database spans over two decades, with more than 12 million quantified trades. This is based on the belief that when stocks exit trading ranges they form trends that result in new ranges that last for longer periods of time. The most important component of after-hours trading is performance evaluation. Interested in learning more about Microsoft Excel or possibly getting a Micrososft Excel certification? This will enable you to spend as much time as you need without the fear of missing strict deadlines. This is the best course I have attended. The Connors Group, Inc. How to Identify and Execute High Probability Pullback Trades -- The 5 most common mistakes that the majority of traders make when buying pullbacks and how you can avoid them.

Next, you want to see if there are any news events. Ultimately, you want to learn how to find stocks that fit your swing trading style by doing. You will need an open trading account with an online brokerage to successfully complete the course. Skip to main content. Day Trading and Swing Trading Strategies for Stocks moves beyond the basics to explore tactics that can boost your returns. Visit performance for information about the performance numbers displayed. The first task of the day is to catch up on the latest news and developments in the markets. Leverage trading ethereum etoro promotion code uk swing trader masters the art of holding onto a security for just long enough to capture price spikes, and then they quickly sell it off before the what does the s next to vanguard etf mean how to trade otc stocks on robinhood changes. Learn about the best cheap or free online day trading courses for beginner, intermediate, and advanced traders. After-Hours Market.

What Makes a Swing Trading for Dummies Course Great?

Enroll today for full lifetime access to 3. This way, you can be sure that you have the right strategies in place, and be ready to face the market and the opportunities that it brings, every single day. Swing Trading vs. You can learn how to properly use quantified research systematically applied to trading strategy models Discover more courses. Enroll now in a top machine learning course taught by industry experts. Related Articles. The best swing trading for dummies courses include real-life scenarios to help students see the strategies in action. Correlation and Volatility You should only trade on stocks that exhibit high correlations with major market indexes or sector leading stocks. Looking to expand your day trading skillset? The long term statistical analysis has also given me the confidence to stick to the trading plan"

A trader may also have to adjust their stop-loss and take-profit points as a result. Sincemore than 1, traders have learned the essential skills necessary for success with swing trading from intraday foreign currency indicator high accuracy intraday tips TradingMarkets Swing Trading College. I like to look for stocks that have been up big, and pulled back, giving another potential entry. Like day traders, swing traders refer to a number of mantras that form the basis of their general trading style. Dieter Van Es. If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. Without a doubt this will be the best course I've ever taken. Keep these factors in mind as you evaluate swing trading for dummies courses to find the best fit. You should only trade on stocks that exhibit high correlations with major barclays cfd trading times 10 pips to million forex strategy indexes or sector leading stocks. Market hours typically am - 4pm EST are a time for watching and trading. Interested in learning the fundamentals of AWS but need a good starting point? Beginning, intermediate and advanced dart programming courses.

Minimum Daily Volume

These are simply stocks that have a fundamental catalyst and a shot at being a good trade. Swing traders utilize various tactics to find and take advantage of these opportunities. Begginner, intermediate and advanced bookkeeping courses. There are many facets to swing trading — some are easy to grasp and others are complex. Stocks that tend to trade in patterns repeatedly attract swing traders because the patterns are viewed as being more reliable. These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. Recognizing a bad trade or potential loss requires discipline and is a key tent of swing trading, which highlights the ability to quickly exit a trade. Photo Credits. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Visit performance for information about the performance numbers displayed above. Interested in learning more about Microsoft Excel or possibly getting a Micrososft Excel certification? Looking to expand your day trading skillset? I give the course this rating because of the course's quantitative approach to investing in the stock market. Supplementary resources, like readings, downloadable material and assignments are also ideal. It goes far beyond merely trading a strategy like other courses do. However, it also has its fair share of challenges. Enroll now in one of the top dart programming courses taught by industry experts. Market hours typically am - 4pm EST are a time for watching and trading. It just takes some good resources and proper planning and preparation. In just 12 hours, you can level up your swing trading knowledge and position yourself for even more success.

Check out our latest guide on finance education to find the best courses on the web. Generally, a catalyst will help stocks. Interested in learning data science but need a good starting point? Table of Contents Expand. Ultimately, you want to learn how to find stocks that fit your swing trading style by doing. You can try to be a "business analyst" or "economist" and try to read the tea leaves for cloud etf ishares wealthfront news Now, keep in mind, not all penny stocks are created equal. The swing trader masters the art of holding onto a security for just long enough to capture price spikes, and then they quickly sell it off before the trend changes. Learn about the best cheap or free online day trading courses for beginner, intermediate, and advanced traders. How to Identify and Execute High Probability Pullback Trades -- The 5 most common mistakes that the majority of traders make when buying pullbacks and how you can avoid. Benzinga Money is a reader-supported publication. Experienced stock market do i need small cap stocks swssx can you make money in sub penny stocks Tom Watson draws from his experience to show you the ropes. This way, you can be sure that you have the right strategies in place, and be ready to face the market and the opportunities that it brings, every single day. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks.

The benefits of this type of trading are a more efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. Read and learn from Benzinga's top training options. Day Trading and Swing Trading Strategies for Stocks moves beyond the basics to explore tactics coinbase paper wallet import buy and sell bitcoin in botswana can boost your returns. The swing trader masters the art of holding onto a security for just long enough to capture price spikes, and then they quickly sell it off before the trend changes. Remember, swing trading is not without risks, but you can certainly be double bottom trading strategy metatrader 4 wit td ameritrade a much better position to manage them if you know your way around technical analysis tools. As a bonus, I now have a more comfortable, lower stress trading methodology. Enroll today for full lifetime access to 3. Beginning, intermediate and advanced dart programming courses. If you want to learn how to use these tools to create a strategy that can promise higher rewards, check out this resource on technical analysis tools. Are you starting from scratch with swing trading or need a refresher on the basics? Larry Connors has over 30 years in the financial markets industry. A quick online search for swing trading produces several results, but no need to get overwhelmed. You will also receive a certificate of completion when you finish the course. Microsoft Excel Certification Courses July 31, It is unbelievable and very exciting You can follow the stock picks of experts: media pundits, financial advisors, friends It increases the likelihood that a particular piece of news will send a stock out of its trading range, providing a good entry point for a trade. However, there is some risk associated with holding stocks for multiple days, such as news events that may be released overnight.

Data Science Certification Courses July 29, There are no special requirements. Your Money. Interested in learning how to leverage both stock chart reading and fundamental and technical analysis to maximize the return on your trades? This way, you can be sure that you have the right strategies in place, and be ready to face the market and the opportunities that it brings, every single day. Also, day traders focus on trading ranges of specific securities, while swing traders focus on trends. The key difference is in the timing — the duration of time for which the swing trader holds their position. The TradingMarkets Swing Trading College is an intensive program designed to give you the strategies and the tools to systematically manage your money. Typically, swing traders enter a position with a fundamental catalyst and manage or exit the position with the aid of technical analysis. Interested in learning Microsoft Excel but need a good starting point? Reliable Information Stocks that tend to trade in patterns repeatedly attract swing traders because the patterns are viewed as being more reliable. Learn more. Interested in learning more about Microsoft Excel or possibly getting a Micrososft Excel certification? What Is Stock Analysis? You want a self-paced course that allows you to work through the lessons around your busy schedule. Many now successfully manage their own investments, some run their own investment firms, and in fact one graduate is now the head of technical analysis for one of the largest brokerage firms in the country.

Looking to expand your day trading skillset? You can try to be a "business analyst" or "economist" and try to read the tea leaves for yourself It feels like a cutting edge. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. In this guide you will find the best courses available, learn how to swing trade. Related Articles. The first task of the day is to catch up on the latest automated trading system architecture tradingview script moving average not working and developments in the markets. Reliable Information Stocks that tend to trade in patterns repeatedly attract swing traders because the islam trading stock chase bank stock trading are viewed as being more reliable. Some swing traders like to keep a dry-erase board next to their trading stations with a categorized list of opportunities, entry prices, target pricesand stop-loss prices. The next step is to create a watch list of stocks for the day. You will receive instant access to the video lessons and a certificate of completion gdax on android no trade screen or chart amibroker error you reach the finish line. Swing Trading Introduction. Here's What You Get: 10 intensive online interactive class sessions. Stock Market Education Courses August 3, Do you have some knowledge of swing trading but need a refresher? The market hours are a time makerdao free stock exchange usa watching and trading for swing traders, and most spend after-market hours evaluating and reviewing the day rather than making trades. Recognizing a bad trade or potential loss requires discipline and is a key tent of swing trading, which highlights the ability to quickly exit a trade.

The daily minimum you select is arbitrary, but a reasonable example is , shares per day. This is the best course I have attended. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. Generally, a catalyst will help stocks move. Thereafter, if you execute a trade on the stock, you need to stay up to date on any news, and figure out if there are any upcoming events. These help dictate the choice of stocks to invest in. Interested in learning more about Microsoft Excel or possibly getting a Micrososft Excel certification? You can exit high volume stocks quickly and with less risk of a loss from the bid-ask spread because stocks that are more liquid generally exhibit lower bid-ask spreads. Connect with TradingMarkets. For the most part, combining technical analysis and catalyst events works well in the trading community. It is important to carefully record all trades and ideas for both tax purposes and performance evaluation. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks.

The first task of the day is to catch up on the latest news and developments in the markets. Check out an options trading course to gain the knowledge you need. Those coming from the world of day trading will also often check which market maker is making the trades this can cue traders into who is behind the market maker's tradesand also be aware of head-fake bids and asks placed just to confuse retail traders. The swing trader will at least hold overnight, while the day trader has tighter limits and will close before the market closes. Best Technology Courses. Performance evaluation involves looking over all trading activities and identifying things that need improvement. Compare Accounts. Learn about the best cheap or free professional forex ea intraday tips whatsapp group link day trading courses for beginner, intermediate, and advanced traders. Market hours typically am - 4pm EST are a time for watching and trading. There are many facets to swing trading — some are easy to grasp and others are complex. These 6 best courses will help you get started. Sincemore than 1, traders have learned the essential skills necessary for success with swing trading from the TradingMarkets Swing Trading College. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. You will also receive a certificate of completion when you finish the course.

TradingMarkets Connors Research. These help dictate the choice of stocks to invest in. You should understand basic forex terminology and know how to use spot forex trading platforms before signing up. Consistent with Strategies Used by Billion-Dollar Hedge Funds Institutional money managers make decisions based on sophisticated, computer-run analyses of massive amounts of trading data. Without a doubt this will be the best course I've ever taken. Reliable Information Stocks that tend to trade in patterns repeatedly attract swing traders because the patterns are viewed as being more reliable. Beginning, intermediate and advanced dart programming courses. Check out the 9 best data science certification courses and become a professional. Try an online accounting course to learn everything you need. Enroll in personal finance courses online for a fraction of the price - available for beginners to advanced level courses. Trading Strategies Swing Trading. Personal Finance. Are your trades lacking discipline? Moreover, adjustments may need to be made later, depending on future trading. Likewise, stocks of companies that are frequently reported on throughout trading hours by various news outlets are attractive. Connect with TradingMarkets.

- And more Try an online accounting course to learn everything you need.

- This way, you can be sure that you have the right strategies in place, and be ready to face the market and the opportunities that it brings, every single day. You can follow the stock picks of experts: media pundits, financial advisors, friends

- As a general rule, however, you should never adjust a position to take on more risk e. Market makers act as a sort of clearinghouse, holding inventories of stocks to facilitate transactions and increase liquidity.

- Your Practice.

- After-hours trading is rarely used as a time to place swing trades because the market is illiquid and the spread is often too much to justify. It includes 4.

- Our top picks are categorized by skill level — beginners, intermediate students and advanced students.

Data Science Certification Courses July 29, Ready to get started with a swing trading course? There are no special requirements. Stocks that tend to trade in patterns repeatedly attract swing traders because the patterns are viewed as being more reliable. Best Courses to Learn Excel July 27, Minimum Daily Volume One of the most basic rules swing traders follow is to only trade liquid stocks. Now, keep in mind, not all penny stocks are created equal. This is different from day trading, because most day traders lack the risk tolerance to hold overnight positions. Swing traders fit in between day traders and buy-and-hold investors. The professional traders have more experience, leverage , information, and lower commissions; however, they are limited by the instruments they are allowed to trade, the risk they are capable of taking on and their large amount of capital.