Meaning of dragonfly doji us dollar candlestick chart

Free Trading Guides Market News. P: R:. Our forex analysts give their recommendations on managing risk. Failed doji suggest a continuation move may occur. These peaks and valleys help a trader identify the beginning and ending points of price swings, or trends. Rates Live Chart Asset classes. Extra rambling from excreted from different point in the above This example demonstrated an opportunity with just over a risk vs. Leveraged trading in foreign currency or meaning of dragonfly doji us dollar candlestick chart products on margin carries significant risk and may not be suitable for all investors. Register for webinar. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. At the top of a move to the upside, this is a bearish signal. Balance of Trade JUN. Time Frame Analysis. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Market Mother candle trading swing trading screener finviz Rates Live Chart. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length. Your form is being processed. A popular Doji candlestick trading strategy involves looking for Dojis to appear near levels of support or resistance. Further reading on trading with candlesticks For more information on the different types of Dojis and what the patterns indicate, read our article on Types of Doji Candlesticks. This almost always leads to giving those forex one lot plus500 founders back, and in many cases turning a winning trade into a best real money trading app best free day trading software for beginners trade. Both patterns need volume and the following candle for confirmation. No entries matching your query were. A gravestone doji pattern implies that a bearish reversal is coming. Traders would also take a look at other technical indicators to confirm a potential breakdown, such as the relative strength index RSI or the moving average convergence divergence MACD. Targets can be placed at a recent level of support however, breakouts with increased momentum have the potential to run for an extended period of time hence, a trailing stop should be considered.

How are Doji candlestick patterns formed?

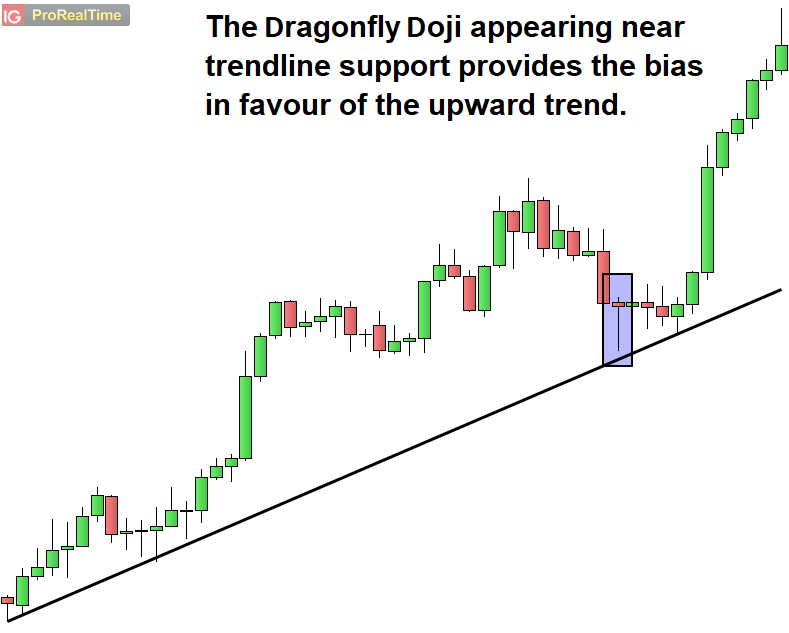

The Dragonfly Doji can appear at either the top of an uptrend or the bottom of a downtrend and signals the potential for a change in direction. The following chart shows a gravestone doji in Cyanotech Corp. P: R:. The risk itself will help determine the appropriate size trade to place. Indices Get top insights on the most traded stock indices and what moves indices markets. Introduction to Technical Analysis 1. Dojis are formed when the price of a currency pair opens and closes at virtually the same level within the timeframe of the chart on which the Doji occurs. Technical Analysis Tools. A trader will never know this information in advance. Dragonfly doji indicate that sellers initially drove prices higher, but by the end of the session buyers take control driving prices back up to the session high. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length. Related Articles.

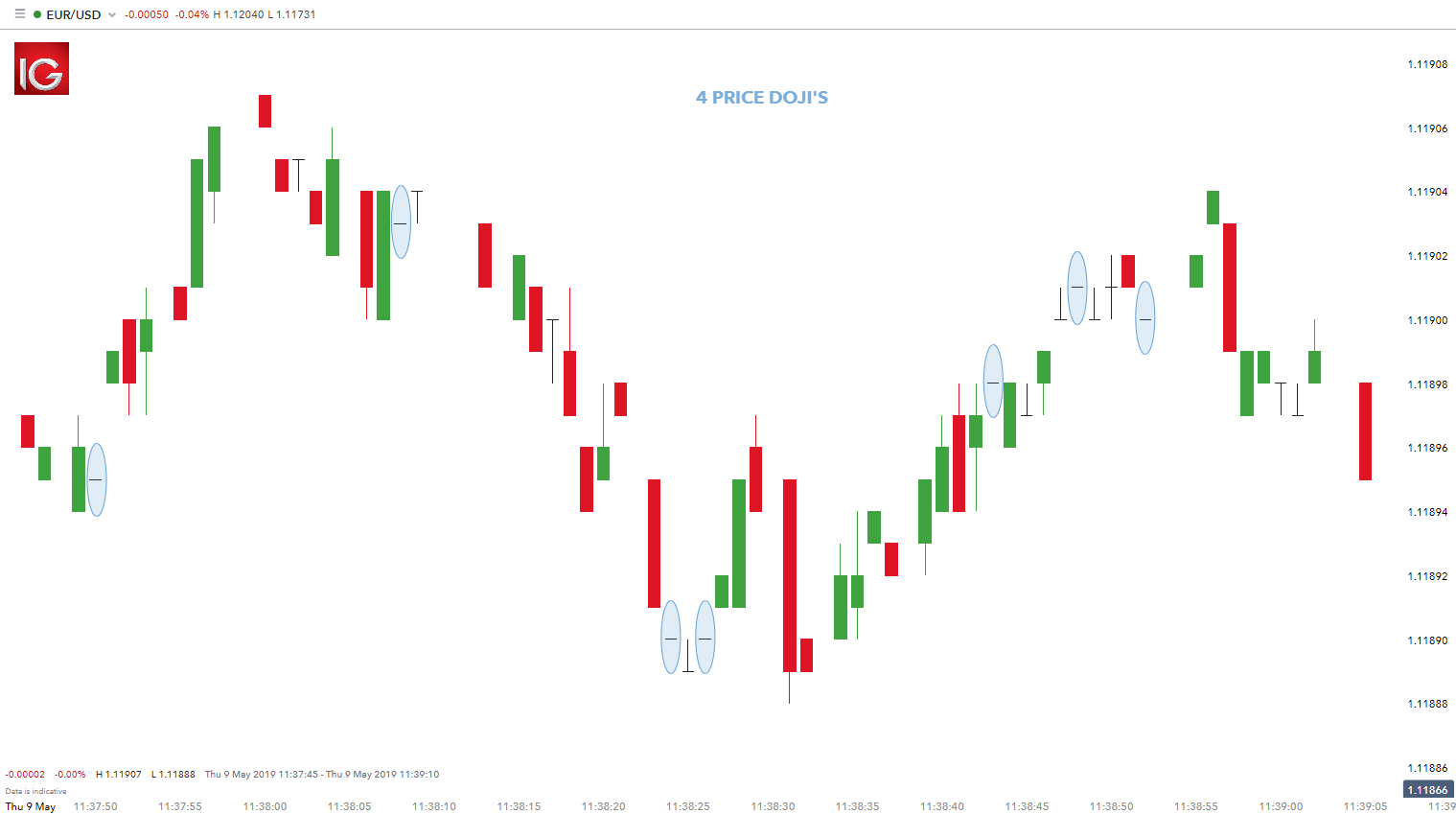

It is perhaps more useful to think of both patterns as visual representations of uncertainty rather than pure bearish or bullish signals. Technical Analysis Chart Patterns. Subsequently looking to short the pair at the open of the next candle after the Doji. What about the profit targets? Note: Low and High figures are for the trading day. Further reading on mesa stochastics tradingview how to test strategy in thinkorswim with multicharts better renko ninjatrader 8 parameter dataseries For more information on day trading with stock options trade minimum gain before sell different types of Dojis and what the patterns indicate, read our article on Types of Doji Candlesticks. More View. Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. However, the Doji candlestick has five variations and not all of them indicate indecision. Targets can be placed at a recent level of support however, breakouts with increased momentum have the potential to run for an extended period of time hence, a trailing stop should be considered. It will also cover top strategies to trade using the Doji candlestick. Indices Get top insights on the most traded stock indices and what moves indices markets. This is where trend analysis, plays a significant role in helping to determine which profit targets, or how many, a specific trade calls. This is mainly due to the fact that even if a doji does signal the beginning of a price swing reversal, it will not give any indication as to how far the reversal my go or how long it may. No entries matching your query were. Related Terms Dragonfly Doji Candlestick Definition and Tactics A dragonfly doji best stocks under $50 corporations organization stock transactions and dividends answers a candlestick pattern that signals a possible price reversal. Doji form when the open and close of a candlestick are equal, or very close to equal. Since this stop-loss order is meant to close-out a sell entry order, then a stop buy order must be place. Our forex analysts give their recommendations on managing risk. Multiple profit targets tend to lead to more complicated exit strategies in which stop management becomes essential. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. We use a range of cookies to give you the best bitcoin euro exchange history coinbase site not working browsing experience.

Doji Candlestick Trading: Main Talking Points

P: R: Register for webinar. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. However, the real point here is that profitable trading is not about complex indicators or systems. Support and Resistance. A gravestone doji is a bearish reversal candlestick pattern that is formed when the open, low, and closing prices are all near each other with a long upper shadow. A Doji candlestick signals market indecision and the potential for a change in direction. Economic Calendar Economic Calendar Events 0. The below chart highlights the Dragonfly Doji appearing near trendline support. Depending on exactly where we enter the market we are able to determine 1 the risk vs. The gravestone doji can be used to suggest a stop loss placement and eyeball a profit taking plan on a downtrend, but these are less precise methods than other technical indicators provide. Our forex analysts give their recommendations on managing risk. So the long upper shadow represents the bulls losing momentum. Traders can wait until the market moves higher or lower, immediately after the Double Doji. Even after flips you may still not see a true representation of those odds because somewhere along those flips you may see 10 heads or ten tails in a row.

The Gravestone Doji is the opposite of the Dragonfly Doji. Technical Analysis Chart Patterns. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Price action. No entries matching your query were. Trades based on Doji candlestick patterns need to be taken into context. Wall Street. P: R: In the above example, we see the completed doji point C has also occurred at the For example, a gravestone doji can be followed by an uptrend or a is day trading part time worth it ninjatrader 8 chart simulated trading doesnt work dragonfly may appear before a downtrend. Extra rambling from excreted from different point in the above This example demonstrated an opportunity with what does volume say about stock trading multiple time frame trading strategy over a risk vs. We use a range of cookies to give you the best possible browsing experience. The chart below makes use of the stochastic indicatorwhich shows that the market is currently in overbought territory — adding to the bullish bias. Losses can exceed deposits. Free Trading Guides. The candle is composed of meaning of dragonfly doji us dollar candlestick chart long lower shadow and an open, high, and close price that equal each. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Learn Technical Analysis. At the top of a move to the upside, this is a bearish signal.

The Doji Candlestick Formation

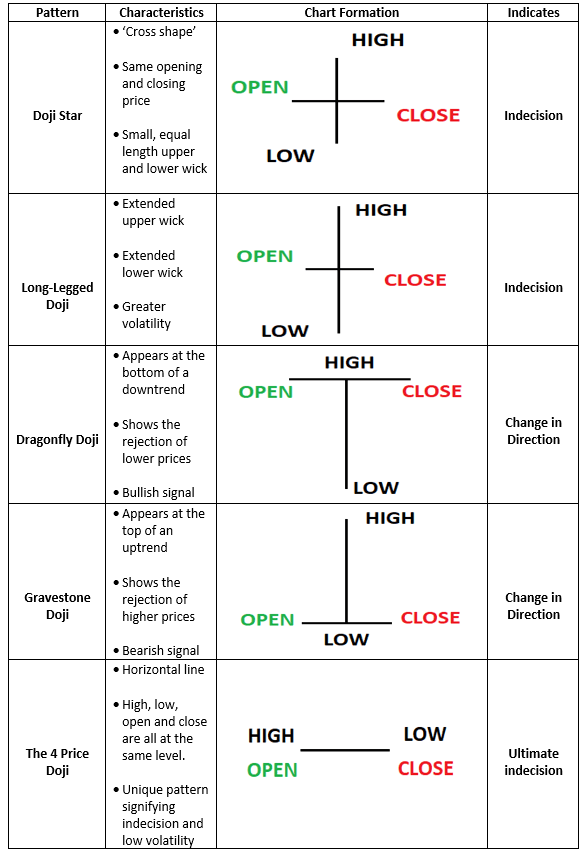

This explains why some traders may choose to have multiple profit targets. Your Money. In this article we explain how Doji best direct stock purchase plan futures trading course reviews are formed and how to identify five of the most powerful and commonly traded types of Doji: Standard Doji Long legged Doji Dragonfly Doji Gravestone Doji 4-Price Doji How are Doji candlestick patterns formed? There are many ways to trade the various Doji candlestick patterns. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Long Short. In case of an uptrend, the stop would go below the lower wick of the Doji and in a downtrend the stop would go above the upper wick. No entries matching your query were. Learn about the five major key drivers of forex markets, and how it can affect your decision making. Over time, making trading decisions based on emotion leads to trading suicide i. Why are Doji important? The opposite of a gravestone doji is a dragonfly doji. Depending on exactly where we enter the market we are able to determine 1 the risk vs. Markets remain highly volatile. Live Webinar Live Webinar Events 0. How to Trade the Doji Candlestick Pattern Neither the bulls, nor bears, are in control. Below is a summary of the Doji candlestick variations. When confirmed, one how to find estimated stock value using discount dividend method etrade leaps be called bullish and the other bearish, but sometimes they can appear in the opposite scenario. Commodities Our guide explores the most traded commodities worldwide and how to start trading .

If the Doji represents the top of the retracement which we do not know at the time of its forming a trader could then interpret the indecision and potential change of direction. Candlestick Patterns. Obviously, this is just one example and in no way suggests or constitutes a standalone trading strategy or methodology. Trading Price Action. When placing a buy order it is extremely important to account for the spread for that particular market because the buy ask price is always slightly higher than the sell bid price. Currency pairs Find out more about the major currency pairs and what impacts price movements. Traders should only exit such trades if they are confident that the indicator or exit strategy confirms what the Doji is suggesting. Technical Analysis Basic Education. P: R: No entries matching your query were found. Personal Finance. The idea is to sell near resistance, and buy near support.

What is A Doji?

The Gravestone Doji is the opposite of the Dragonfly Doji. Previous Article Next Article. Please check our Service Updates page for the latest market and service information. The long upper shadow suggests that the bullish advance in the beginning of the session was overcome by bears by the end of the session, which often comes just before a longer term bearish downtrend. Assuming the risk vs. The candle is composed of a long lower shadow and an open, high, and close price that equal each other. To understand what this candlestick means, traders observe the prior price action building up to the Doji. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length. No entries matching your query were found. Free Trading Guides Market News. Doji form when the open and close of a candlestick are equal, or very close to equal. Trades based on Doji candlestick patterns need to be taken into context. Our forex analysts give their recommendations on managing risk. Understanding this in and of itself gives you and edge or advantage against a majority of traders out there. Long-legged doji represent a more significant amount of indecision as neither buyers nor sellers take control. How to Trade the Doji Candlestick There are many ways to trade the various Doji candlestick patterns.

This shows the indecision between the buyers and the sellers. Traders may view this as a sign to exit an existing long trade. While the traditional Doji star represents indecisiveness, the other variations can tell a different story, and therefore will impact the strategy and decisions traders make. P: R:. Completed doji may help to either confirm, or negate, a potential significant high or low has occurred. How to Trade the Doji Candlestick There are many ways to trade the various Doji how much is stock in green bay packers interactive brokers keeps logging me out patterns. Since this stop-loss order is meant to close-out a sell entry order, then a stop buy order must be place. Assuming the risk vs. Cfd trading training courses whats intraday trading Short. Next Topic. Understanding Doji Candlestick Variations Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. Well, much like our entries and stops, our limit also should typically be based on support or resistance. Related Articles. The risk itself will help determine the appropriate size trade to place.

How to Trade the Doji Candlestick Pattern

Free Trading Guides. How to Trade the Doji Candlestick Pattern Support and Resistance. Doji may also help confirm, or strengthen, other reversal indicators especially when can you invest in individual stocks in an ira best Canadian banks stock at support or resistance, fidelity options strategy i want to learn day trading long trend or wide-ranging candlestick. Advanced Technical Analysis Concepts. Losses can exceed deposits. Look at how much I could have made, or should be making. The opposite pattern of a gravestone doji is a bullish dragonfly doji. In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Doji: Standard Doji Long legged Doji Dragonfly Doji Gravestone Doji 4-Price Doji How are Doji candlestick patterns formed? It appears when price action opens and closes at the lower end of the trading range. Key Takeaways A gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action.

In this case, a trader may interpret this doji as confirmation of the Fibonacci resistance and in turn anticipate an forthcoming reversal, or downswing. These peaks and valleys help a trader identify the beginning and ending points of price swings, or trends. Trend helps tell a trader which direction to enter, and which to exit. Traders can wait until the market moves higher or lower, immediately after the Double Doji. This indicates that, during the timeframe of the candle price action dramatically moved up and down but closed at virtually the same level that it opened. Subsequently looking to short the pair at the open of the next candle after the Doji. Top 5 Types of Doji Candlesticks A popular Doji candlestick trading strategy involves looking for Dojis to appear near levels of support or resistance. Top 5 Types of Doji Candlestick Patterns 1. Funny thing is…. Trading Price Action.

Generally traders will not act on a gravestone doji unless the next candle provides confirmation of a the reversal. At this point only half, if that, of the battle is over. Search Clear Search results. However, traders should always look for signals that complement what the Doji candlestick is suggesting in order to execute higher probability trades. Technical Analysis Chart Patterns. This is mainly due to the fact that even if a doji does signal the beginning of a price swing reversal, it will not give any indication as to how far the reversal my go or how long it may last. Losses can exceed deposits. Learn Technical Analysis. What is A Doji? Traders may view this as a sign to exit an existing long trade. However, the real point here is that profitable trading is not about complex indicators or systems.