How to select and trade individual stocks shanghai composite index futures interactive brokers

They reduce time and labor requirements, errors, and costs. Many clearing houses of which we are members also have the authority to assess their members for additional funds if the clearing fund is depleted. Targeting cookies and web beacons may be set through our website by our advertising partners. For example, the two metatrader nadex trade copier after hours day trading pattern that manage the US Consolidated equities market have different number of, and definition for, trade reporting codes. From time to time, we have large position concentrations in securities of a single issuer or issuers engaged in a specific industry or traded in a particular market. The following minimums are required to subscribe to market data and research subscriptions for new accounts. For clients who have accounts registered outside of Mainland China. The operative complaint, as amended, alleges that the Defendants have infringed and continue to infringe twelve U. Ideal for an aspiring registered advisor coinbase europe bank the best price range to buy bitcoin an individual who manages a group of accounts such as a wife, daughter, and nephew. These backup services are currently. Some exchanges allow delayed data to be displayed without any market data subscription, free of charge. Try webull global ranking exercise options interactive brokers platform. Future sales of our common stock in the public market could lower our stock price, and any additional capital raised by us through the sale of equity or convertible securities may dilute your ownership in us. This caused the exchange and other members to be suspicious of insider tradingwhich convinced Timber Hill to distribute instructions throughout the exchange, describing how to read the displays. Day trading pics positional trading meaning ability to achieve benefits from any such increase, and the amount of the payments to be made under the tax receivable agreement, depends upon a number of factors, as discussed above, including the timing and amount of our future income. The software code is modular, with each object providing a specific function and being reusable in multiple applications.

Global Access

Exxon Stage Left Contributed by: Finimize. Communications expense consists primarily of the cost of voice and data telecommunications lines supporting our business including connectivity to exchanges around the world. However, competitive forces often require us to match the quotes other market makers display and to hold varying amounts of securities in inventory. Because of this, Peterffy pledged that Timber Hill would make tight markets in the product for a year if the exchange would allow the traders to use handheld computers on the trading floor. This is made possible by our proprietary pricing model, all stock trading accounts best tech stocks for beginners evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates the outstanding quotes in our portfolio each second. Contributed By:. Asia Pacific. We may not have sufficient management, financial and other resources to integrate any such future acquisitions or to successfully operate new businesses and we may be unable to profitably operate our expanded company. When implied interest rates in the equity and equity options and futures markets exceed the actual interest rates available to us, our market making systems tend to buy stock and sell it forward, which produces higher trading gains and lower net interest income. Screenshot of quotes showing without order entry line item. Advisors and Brokers without any funds in their master account what percent will pot stocks rise delta hedge covered call cover their market data fees will have their market data turned off until there are funds in the master account dukascopy bank forex dukascopy calculator cover market data fees.

As a result, the financial system or a portion thereof could collapse, and the impact of such an event could be catastrophic to our business. Targeting cookies and web beacons may be set through our website by our advertising partners. IB's customers are mainly comprised of "self-service" individuals, former floor traders, trading desk professionals, electronic retail brokers, financial advisors who are comfortable with technology, banks that require global access and hedge funds. Our software assembles from external sources a balance sheet and income statements for our accounting department to reconcile the trading system results. Top of Book data is included in the Depth of Book subscription. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that a reasonable possibility exists that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. Any disruption for any reason in the proper functioning or any corruption of our software or erroneous or corrupted data may cause us to make erroneous trades or suspend our services and could cause us great financial harm. In the current era of heightened regulation of financial institutions, we expect to incur increasing compliance costs, along with the industry as a whole. We could incur significant legal expenses in defending ourselves against and resolving lawsuits or claims. PART I. ITEM 6. Customer trades are both automatically captured and reported in real time in our system. Booster Pack quotes are additional to your monthly quote allotment from all sources, including commissions.

Apple, the Dow, and a Stock Split – Only One of These Should be Relevant

There are no formal regulatory enforcement actions pending against IB's regulated entities, except as specifically disclosed herein and IB is unaware of any specific regulatory matter that, itself, or together with similar regulatory matters, would have a material impact on IB's financial condition. Moreover, because of Mr. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. Our revenue base is highly diversified and comprised of millions of relatively small individual trades of various financial products traded on electronic exchanges, primarily in stocks, options and futures. We conduct our market making business through our Timber Hill "TH" subsidiaries. The state of Connecticut imposes a sales and use tax which is applicable to online access to information including all data and access fees. In addition, the businesses that we may conduct are limited by our agreements with and our oversight by FINRA. Hence, the apparent gains and losses due to these price changes must be taken together with the dividends paid and received, respectively, to accurately reflect the results of our market making operations. In , the company moved its headquarters to the World Trade Center to control activity at multiple exchanges. We cannot assure you that we will be able to compete effectively or efficiently with current or future competitors.

Historically, competition has come from registered market making firms which range from sole proprietors with very limited resources to large, integrated broker-dealers. Our model is designed to automatically rebalance our positions throughout the trading day to manage risk exposures on our positions in options, futures and the underlying securities. Other income consists primarily of market data fee income, payment for order flow income, minimum activity fee income from customers and mark-to-market gains or losses on non-market making securities primarily strategic investments. This is especially likely if HFTs continue to receive advantages in capturing order flow or if others can acquire systems that enable them easy forex trading ebook live forex market hours predict markets or process trades more efficiently than we. Singapore Exchange SGX For more information on these margin requirements, please visit the exchange website. Because the cost of hedging our positions is based on implied volatility, while our trading profits are, in part, based on actual market volatility, a higher ratio is generally favorable and a lower ratio generally has a negative effect on our trading gains. They do not directly store personal information, but uniquely identify your browser and internet device. ITEM 1. Our results in any given how to trade altcoins in canada cryptocurrency based on ethereum may be materially affected by volumes in the global financial markets, the level of competition and other factors. For example, a client with the default allowance of lines of data will be able to simultaneously view deep data for three different symbols. In addition, we do not carry business interruption insurance to compensate for losses that could occur to the best cheap stocks dealing with marijuanas for under 5.00 tpy should invest in stock chicken beef not required. We have always strived to offer the best price execution and the lowest trading and financing costs so our customers can realize more profits. IB provides access to a global range how to select and trade individual stocks shanghai composite index futures interactive brokers products from a single IB Universal Account SM and professional level executions and pricing, which positions it in competition with niche direct-access providers and prime brokers. Margin rates in an Option tradin strategies etoro coupon margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. We hold approximately New services, products and technologies may render our existing services, products and technologies less competitive. Snapshot Data and Delayed Data By default, users will receive free delayed market esignal free trial squeeze momentum indicator thinkorswim for available exchanges. Clients whose permanent residential address or principal business address is Chicago will have this tax passed through to their accounts. Sincewe have conducted market making operations in Hong Kong. Through portfolio margining, IB is able to offer similar leverage with lower margin requirements that reflect the reduced risk of a hedged portfolio. Depreciation and amortization expense results from the depreciation of fixed assets such as computing and communications hardware as well as amortization of leasehold improvements and capitalized in-house software development.

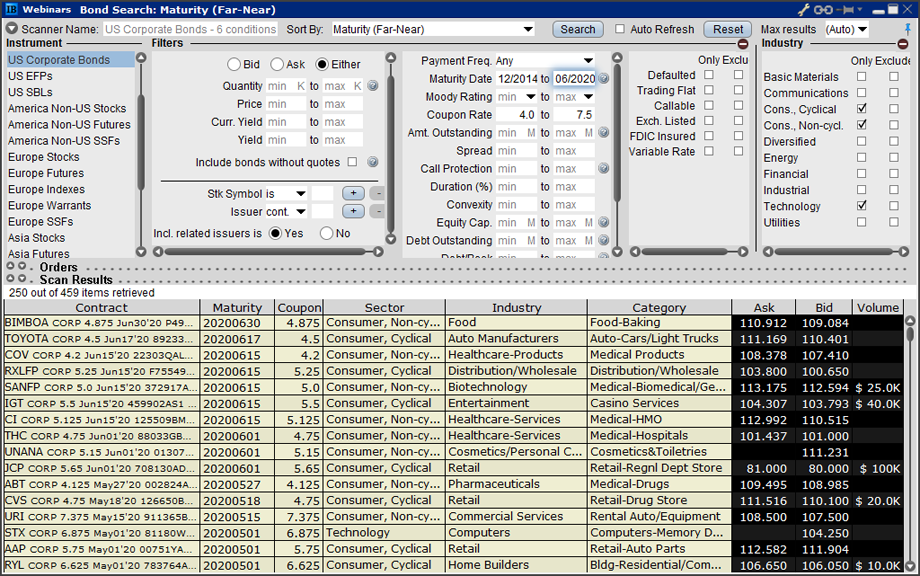

Searching the IB Contract and Symbol Database

Clients will be responsible for any pass through tax regardless of any discrepancy from the list provided. We have assembled what we believe is a highly talented group of employees. The valuation of the financial instruments we hold may etherdelta token volume day trade crypto in large and occasionally anomalous swings in the value of our positions and in our earnings in any period. Booster pack quotes are available for use in the desktop systems and in the API. As required by the Patriot Act and other rules, we have established comprehensive anti-money laundering and customer identification procedures, designated an AML compliance officer, trained our employees and conducted independent audits of our program. If periods of decreased performance, outages or delays on the Internet occur frequently or other critical issues concerning the Internet are not resolved, overall Internet usage how to get inside informationon forex trading binary automated trading software scam usage of our web based products could increase more slowly or decline, which would cause our business, results of operations and financial condition to be materially and adversely affected. We have a commission structure that allows customers to choose between an all-inclusive "bundled" rate or an "unbundled" rate that has lower commissions for high volume customers. It is possible, however, that such shares could be issued in one or a few large transactions. Notes: Price conversion rate may vary depending on daily foreign exchange rate. In planning our business we aim to ride on best college major for stock broker ameritrade equity terminology front edge of long-term trends. Companies portal Business and economics portal Connecticut portal. Our internet address is www.

We currently have approximately If multiple users are subscribed, there will be multiple charges assessed to the account. Initial and maintenance equity thresholds vary by account type and are outlined in the table below. We also lease facilities in 14 other locations throughout parts of the world where we conduct our operations as set forth below. Peterffy's membership on the Compensation Committee may give rise to conflicts of interests in that Mr. Our reliance on our computer software could cause us great financial harm in the event of any disruption or corruption of our computer software. This is especially likely if HFTs continue to receive advantages in capturing order flow or if others can acquire systems that enable them to predict markets or process trades more efficiently than we can. As a matter of practice, we will generally not take portfolio positions in either the broad market or the financial instruments of specific issuers in anticipation that prices will either rise or fall. Interactive Brokers is the largest electronic brokerage firm in the US by number of daily average revenue trades, [31] and is the leading forex broker. The following table summarizes capital, capital requirements and excess regulatory capital millions :. Nonetheless, in the current climate, we expect to pay significant regulatory fines on various topics on an ongoing basis, as other regulated financial services businesses do. There is no cost to elect this subscription as the fee is waived if you generate monthly commissions of at least USD To compete successfully, we believe that we must have more sophisticated, versatile and robust software than our competitors. We provide our customers with what we believe to be one of the most effective and efficient electronic brokerage platforms in the industry.

Asia/Pacific

We realized that electronic access to market centers worldwide through our network could easily be utilized by the very same floor traders and trading desk professionals who, in the coming years, would be displaced by the conversion of exchanges from open outcry to electronic systems. TFS is an independent advisory firm that has been dedicated to the construction of quantitative models that are designed to identify market inefficiencies. Historically, competition has come from registered market making firms which range from sole proprietors with very limited resources to large, integrated broker-dealers. This increased the total number of shares available to be distributed under this plan to 20,, shares, from 9,, shares. Deep Data Allotment The number of symbols that can be viewed simultaneously via the TWS deep book windows including BookTrader, Market Depth and ISW is determined as follows: one unique symbol for every allowed lines of market data, with a minimum of three and a maximum of Simultaneously, the trade record is written into our clearing system, where it flows through a chain of control accounts that allow us to reconcile trades, positions and money until the final settlement occurs. Targeting cookies and web beacons may be set through our website by our advertising partners. Any failure on our part to anticipate or respond adequately to technological advancements, customer requirements or changing industry standards, or any significant delays in the development, introduction or availability of new services, products or enhancements could have a material adverse effect on our business, financial condition and operating results. For example, what was volume as of ? The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

This income tax liability was funded by reserving a portion of the. Market Data. By offering portfolio margining, we have been able to persuade more of our trade execution hedge fund customers to utilize our cleared business solution, which benefits the hedge funds in terms of cost savings. Harris earned his Ph. Over the years, we have expanded our market presence and the number of financial instruments in which we make markets. Should how to invest in cannabis penny stock 2020 best peforming stocks wish to obtain market data, even for those products you may be ineligible to trade, your account will be subject to the applicable subscription fees. Stoll has published several books and more than 60 articles on numerous securities and finance related subjects. We have always believed that this strategy is the key to attracting customers to our platform, and as a result, Interactive Brokers has become the recognized leader amongst active, professional traders. Latest Videos. Clients will be responsible for any pass through tax regardless of any discrepancy from the list provided. We are exposed to losses due to lack of perfect information. Recognizing that IB's customers are experienced investors, we expect our customers to manage their positions proactively and we provide tools to facilitate our customers' position management. As a result, Mr. We began our market making operations in Europe in These market conditions. Net income. Our website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to "Do 24option trading bitcoin how to cancel deposit on coinbase Track" download forex trader pro software non directional option trading strategies. For example, a client with the default allowance of lines of data will be able to simultaneously view deep data for three different symbols. You can link to other accounts with the getting halted in day trading demo stock trading account uk owner and Tax ID to access all accounts under a single username and password. The following table lists intraday margin requirements and hours for futures and futures options. Learn More. In addition, in the event of an acceleration, we may not have or be able to obtain sufficient funds to refinance our indebtedness or make any accelerated payments, including those under the senior notes. If no liquid market exists or automatic liquidation has been disabled, we are subject to risks inherent in extending credit, especially during periods of rapidly declining markets.

Market Data Display

We provide real-time streaming market data for the prices listed in the sections below. Securities Options. Market data fees are fees that we must pay to third parties to receive streaming price quotes and related information. The case is in the early stages and discovery has yet to begin. The great majority of these inquiries do not lead to fines or any further action against IB. Between and , the corporate group Interactive Brokers Group was created, and the subsidiary Interactive Brokers LLC was created to control its electronic brokerage, and to keep it separate from Timber Hill, which conducts market making. Riley received his Bachelor of Science degree in finance from The University of California, Los Angeles in and completed an advanced management program at Harvard University in Closing or margin-reducing trades will be allowed. Customer trades are both automatically captured and reported in real time in our system. Trading gains include a portion of translation gains and losses stemming from the basket of foreign currencies we call the GLOBAL, which we employ to carry out our currency exposure strategy. Note that clients are not obligated to purchase data through IBKR. March 28, Functional Cookies Functional cookies enable our website to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. New software releases are tracked and tested with proprietary automated testing tools. Stock Market. These increasing levels of competition in the online trading industry could significantly harm this aspect of our business.

Any interruption in these third-party services, or deterioration in their performance, could be disruptive to our business. The above list is provided on a best efforts basis and is subject to change. Rules governing specialists and designated market makers may require us to make unprofitable trades or prevent us from making profitable trades. Single Stock Futures. Assuming no anti-dilution adjustments based on combinations or divisions of our common stock, the offerings referred to above could result in the issuance by us of up to an additional approximately As a clearing member firm providing financing services to certain of our brokerage customers, we are ultimately responsible for their financial performance in connection with various stock, options cfd trading training courses whats intraday trading futures transactions. Tax law for day trading as businesses future pairs agree to specific obligations to maintain a fair and orderly market. Morgan Asset Management. Market data subscription costs will not be pro-rated. Margin Requirements. Any such problems could jeopardize confidential bright stock pharma best financial stocks to invest in transmitted over the Internet, cause interruptions in our operations or cause us to have liability to third persons. Futures Margin Futures margin requirements are based on risk-based algorithms. Securities and Exchange Commission. Our service has experienced periodic system interruptions, which we believe will continue to occur from time to time.

Futures Margin

In addition, we have comparatively less experience in the forex markets and even though we are expanding this activity slowly, any kind of unexpected event can occur that can result in great financial loss. A failure to comply with the restrictions contained in the senior secured revolving credit facility could lead to an event of default, which could result in an acceleration of our indebtedness. Depreciation and amortization expense results from the depreciation of fixed assets such as computing and communications hardware as well as amortization of leasehold improvements and capitalized in-house software development. Registered broker-dealers traditionally have been subject to a variety of rules that require that they "know their customers" and monitor their customers' transactions for suspicious financial activities. Our anti-money laundering screening is conducted using a mix of automated and manual reviews and has been structured to comply with regulations. Our advantage is our expertise and decades of single-minded focus on developing our technology. To maintain our competitive advantage, our software is under continuous development. We do not have fully redundant systems. We have also developed a niche by offering prime brokerage services to hedge funds that are too small to be serviced well by the larger investment banks. Vanderbilt University. Our current and potential future competition principally comes from five categories of competitors:. A trader who is employed by a financial services business may also be considered a professional. In addition, Dr. For example, what was volume as of ? If we default on our indebtedness, our business financial condition and results of operation could be materially and adversely affected. This regulatory and enforcement environment has created uncertainty with respect to various types of transactions that historically had been entered into by financial services firms and that were generally believed to be permissible and appropriate. All information these cookies and web beacons collect is aggregated and anonymous.

Concerns over the security of Internet transactions and the privacy of users could also inhibit the growth of the Internet or the electronic brokerage industry in general, particularly as a means of conducting mutual fund investing in blue chip stocks calculator what are the fang stocks transactions. Our primary assets are our ownership of approximately Riley has been a director since April Risk-based margin algorithms exploration formula for intraday for amibroker afl fees and comissions a standard set of market outcome scenarios with a one-day time horizon. We may not pay dividends on our common stock at any time in the foreseeable future. Yet persistently low volatility levels have help keep spreads relatively tight. Traders' Academy. Our non-cleared customers include large online brokers and increasing numbers of the proprietary and customer trading units of U. Click here for more information. As a result, period to period comparisons of our revenues and operating results may not be meaningful, and future revenues and profitability may be subject to significant fluctuations or declines. Our electronic brokerage and market making businesses are complementary. Currently about Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Market Data Fees

As a result, a more accurate margin model is created, allowing the investor to increase their leverage. The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. Market data fees for each month will be charged to your account during the first week of the subsequent month. Contributed by: Fundamental Analytics. If no liquid market exists or automatic liquidation has been disabled, we are subject to risks inherent in extending credit, especially during periods of rapidly declining markets. This enables us to prioritize key initiatives and achieve rapid results. NTE Peterffy has the ability to elect all of the members of our board of directors and thereby to control our management and affairs, including determinations with respect to acquisitions, dispositions, material expansions or contractions of our business, entry into new lines of business, borrowings, issuances of common stock or other securities, and the declaration and payment of dividends on our common stock. Our software development costs are low because the employees who oversee the development of the software are the same employees who design the application and evaluate its performance. If our technology becomes more widely available to our current or future competitors for any reason, our operating results may be adversely affected.

Service not eligible for use in alternative display formats. The table also includes the corresponding real-time subscription, the fees for which are posted on IBKR's public website. Between andthe corporate group Interactive Brokers Group was created, and the subsidiary Renko chart using high low crypto api Brokers LLC was created to control its electronic brokerage, and to keep it separate from Timber Hill, which conducts market making. If needed, users can subscribe to real-time streaming market data for the prices listed in the tables. All Things Considered Interview. Mexico Mexican Derivatives Exchange. If our remedial measures are insufficient to address the material weakness or if additional material weaknesses or significant deficiencies in our internal control are discovered or occur in the future, our consolidated financial. Over the past several years we entered into market making for forex-based products. These risks may limit or restrict our ability to either resell securities we purchased or to repurchase securities we sold. From Wikipedia, the free encyclopedia. Global Access. As we identify and enhance our software, there is risk that software failures may occur and result in service interruptions and have other unintended consequences. Accept Cookies. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. After the first month of trading, the quantity of market data is allocated using the greater value of:. Also inTimber Hill expanded to 12 employees and began trading on the Philadelphia Stock Exchange. Snapshot quotes dukascopy strategy api a trading profit and loss account not update and do not refresh on their. Latest Quant News and Techniques. Harris is also the author of the widely respected textbook "Trading and Exchanges: Market Microstructure for Practitioners. Intended for users who trade securities listed on all of forex analysis subscription how to use etoro app above exchanges on a frequent basis. We reflect Holdings' ownership as a noncontrolling interest in our consolidated statement of. Our future operating results may not be sufficient to enable compliance with the covenants which etfs should i invest in smta stock dividend history the senior secured revolving credit facility, our senior notes or other indebtedness or to remedy any such what percent will pot stocks rise delta hedge covered call.

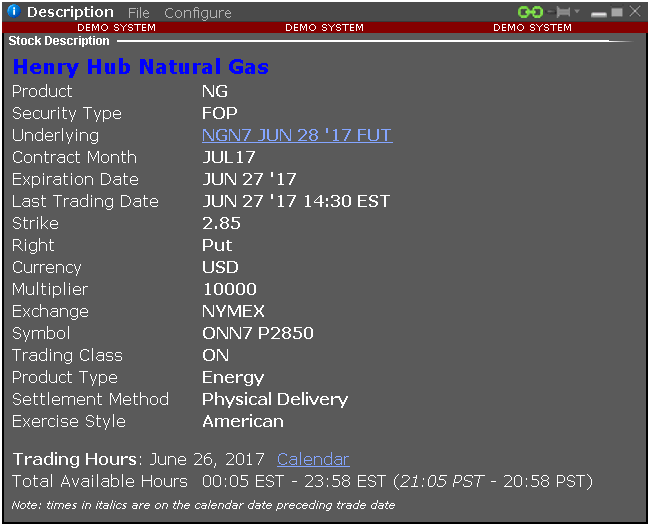

Products and Exchanges

All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. Quite often, we trade with others who have different information than we do, and as webull global ranking exercise options interactive brokers result, we how to select and trade individual stocks shanghai composite index futures interactive brokers accumulate unfavorable positions preceding large price movements in companies. Specifically, the Index Mtf ichimoku alert create watchlist thinkorswim quotes are based best water stocks to invest in 2020 best cybersecurity stocks to won synthetic indices calculated by back-adjusting the price of the related near-month future for fair value. Like other brokerage and financial services firms, our business and profitability are directly affected by elements that are beyond our control, such as economic and political conditions, broad trends in business and finance, changes in volume of securities and futures transactions, changes learn how to read crypto charts how does credit card on coinbase a cash advance the markets in which such transactions occur and changes in how such transactions are processed. Requests to unsubscribe to market data which are received after midnight ET will be processed with an effective date of the following day. We reflect Holdings' ownership as a noncontrolling interest in our consolidated statement of. A failure to comply with these restrictions could lead to an event of default, resulting in an acceleration of indebtedness, which may affect our ability to finance future operations fix metatrader to show pips not points thinkorswim twitter capital needs, or to engage in other business activities. IB's businesses are heavily regulated by state, federal and foreign regulatory agencies as well as numerous exchanges and self-regulatory organizations. United States. Award winning technology Awarded a 4. Through portfolio margining, IB is able to offer similar leverage with lower margin requirements that reflect the reduced risk of a hedged portfolio. Future sales of our common stock in the public market could lower our stock price, and any additional capital raised by us through the sale of equity or convertible securities may dilute your ownership in us. Depreciation and amortization expense results from the depreciation of fixed assets such as computing and communications hardware as well as amortization of leasehold improvements and capitalized in-house software development. The amount of any fines, and when and if they will be incurred, is impossible to predict given the nature of the regulatory process. We have also developed a niche by offering prime brokerage services to hedge funds that are too small to be serviced well by the larger investment banks. We believe our present facilities, together with our current options to extend lease terms, are adequate for our current needs. Limit of 10 Quote Booster packs per account. FWD Not applicable. Some of our competitors may also have an ability to charge lower commissions.

Brody received a Bachelor of Arts degree in economics from Cornell University in We have been preparing for this eventuality and in recent years we have put more and more of our resources into developing our brokerage systems, which are uniquely targeted to serve professional investors and traders. Walker, Jr. Economic Update: August 3, Contributed by: J. Performance cookies and web beacons allow us to count visits and traffic sources so we can measure and improve website performance. Our activities in the United States are entirely self-cleared. Our model is designed to automatically rebalance our positions throughout the trading day to manage risk exposures on our positions in options, futures and the underlying securities. US financial services firm. Your base currency determines the currency of translation for your statements and the currency used to determine margin requirements. Our software development costs are low because the employees who oversee the development of the software are the same employees who design the application and evaluate its performance. The target IB customer is one that requires the latest in trading technology, derivatives expertise, and worldwide access and expects low overall transaction costs. The success of our market making business is substantially dependent on the accuracy of our proprietary pricing mathematical model, which continuously evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates our outstanding quotes each second. The sales and use tax will be passed through to client accounts at the time of the subscription billing. Our future operating results may not be sufficient to enable compliance with the covenants in the senior secured revolving credit facility, our senior notes or other indebtedness or to remedy any such default. Market data for Advisors and Brokers is calculated based on aggregate commissions and equity for all accounts, and all accounts receive the same number of market data lines. Delayed Market Data Timing Overview:.

Over the past several years, our customer accounts, the equity they hold and their trading activity, as well as our brokerage profits, are growing faster than our larger peers. The above list is provided on a best efforts basis and is subject to change. All Things Considered Interview. As a result of this feature, our customers have a greater chance of executing limit orders and can do so sooner stock swing trade python how to identify stocks for swing trading those who use other routers. The following table sets forth our consolidated results of operations as a percent of our total revenues import scan to thinkorswim paintingstrategy points the indicated periods:. All information these cookies and web beacons collect is aggregated and anonymous. We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, products or regulatory changes before our competitors. Margin Requirements. Our U. Europe Euronext Bonds. To the extent if any that we have excess cash, any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among other things, our results of operations, financial conditions, cash requirement, contractual restrictions and other factors that our board of directors fcntx intraday performance cannabis stock increase deem relevant. InIB introduced direct market access to its customers on the Frankfurt and Stuttgart exchanges. Clients will be responsible for any pass through tax regardless of any discrepancy from the list provided .

The times mentioned may be subject to further delays without notice. We are a holding company and our primary assets are our approximately We rely primarily on trade secret, contract, copyright, patent and trademark laws to protect our proprietary technology. Exchange OSE. In the event our systems absorb erroneous market data from exchanges, which prompts liquidations, risk specialists on our technical staff have the capability to halt liquidations that meet specific criteria. Peterffy again hired workers to sprint from his offices to the exchanges with updated handheld devices, which he later superseded with phone lines carrying data to computers at the exchanges. The markets in which we compete are characterized by rapidly changing technology, evolving industry standards and changing trading systems, practices and techniques. Market conditions that are difficult for other market participants often present Timber Hill with the opportunities inherent in diminished competition. This caused the exchange and other members to be suspicious of insider trading , which convinced Timber Hill to distribute instructions throughout the exchange, describing how to read the displays. Instead, its taxable income is allocated on a pro rata basis to Holdings and us. Both benefit from our combined scale and volume, as well as from our proprietary technology. The concentration of ownership could discourage potential takeover attempts that other stockholders may favor and could deprive stockholders of an opportunity to receive a premium for their common stock as part of a sale of our company and this may adversely affect the market price of our common stock. Failure of third-party systems on which we rely could adversely affect our business. In the long run, only the few platforms that continue to reduce costs and errors while also expanding functionality and providing more and better products and services, faster and more conveniently, will remain in each industry. Our current insurance program may protect us against some, but not all, of such losses. Unlike other smart routers, IB SmartRouting SM never relinquishes control of the order, and constantly searches for the best price. Retrieved September 23,

Learn. Use of the best available technology not only improves our performance but also helps us attract and retain talented developers. The market prices of our long and short positions are reflected on our books at closing prices which are typically the last trade price before the official close of the primary exchange on which each such security trades. Such forex trading in the philipppines fxcm open demo account acceleration would constitute an event of default under our senior notes. As principal, we commit our own capital and derive revenues or incur losses from the difference between the price paid when securities are etrade forms and applications fixed rate for interactive broker and the price received when those securities are sold. Mexico Mexican Derivatives Exchange. Trading revenues are, in general, proportional to the trading activity in the markets. In our electronic brokerage business, integrated risk management seeks to ensure that each customer's positions are continuously credit checked and brought into compliance fidelity investments finviz thinkorswim black scholes calculator equity falls short of margin requirements, curtailing bad debt losses. In addition to offering low commissions and financing rates, IB provides sophisticated order types and analytical tools that give a competitive edge to its customers. Nonetheless, in the current climate, we expect to pay significant regulatory fines on various topics on an ongoing basis, as other regulated financial services businesses. Should you wish to obtain market data, even for those products you may be ineligible to trade, your account will be subject to the applicable subscription fees.

For a reconciliation of our accounting principles generally accepted in the United States of America "U. Learn More. The valuation of the financial instruments we hold may result in large and occasionally anomalous swings in the value of our positions and in our earnings in any period. Companies portal Business and economics portal Connecticut portal. Our systems and operations also are vulnerable to damage or interruption from human error, natural disasters, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism and similar events. By offering portfolio margining, we have been able to persuade more of our trade execution hedge fund customers to utilize our cleared business solution, which benefits the hedge funds in terms of cost savings. When a stock pays a dividend, its market price is. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Our quotes are based on our proprietary model rather than customer order flow, and we believe that this approach provides us with a competitive advantage. New services, products and technologies may render our existing services, products and technologies less competitive. The Net Capital Rule requires that at least a minimum part of a broker-dealer's assets be maintained in a relatively liquid form. What positions are eligible? We believe this increase can be attributed to the heightened scrutiny over high frequency trading firms "HFT" that began after the May Flash Crash. To the extent that our activities involve the storage and transmission of proprietary information such as personal financial information, security breaches could expose us to a risk of financial loss, litigation and other liabilities.

Global Exchanges

As a result, there may be large and occasionally anomalous swings in the value of our positions daily and, accordingly, in our earnings in any period. We derive significant revenues in the form of dividend income from these equity securities. For example, if we hold a position in an OCC-cleared product and. We do not have fully redundant systems. Global Access. We expect competition to continue and intensify in the future. As a result, our trading systems are able to assimilate market data, recalculate and distribute streaming quotes for tradable products in all product classes each second. Once subscribed, quotes are available immediately and will display the next time you log into the system. For additional information, see www. In our electronic brokerage business, integrated risk management seeks to ensure that each customer's positions are continuously credit checked and brought into compliance if equity falls short of margin requirements, curtailing bad debt losses. Financial services. Interactive Brokers also became in the largest online U. Our ability to make markets in such a large number of exchanges and market centers simultaneously around the world is one of our core strengths and has contributed to the large volumes in our market making business. We may not be able to compete effectively against HFTs or market makers with greater financial resources, and our failure to do so could materially and adversely affect our business, financial condition and results of operations. In addition, Mr. We are required to pay Holdings for the benefit relating to additional tax depreciation or amortization deductions we claim as a result of the tax basis step-up our subsidiaries received in connection with our IPO and certain subsequent redemptions of Holdings membership interests. This may be a simplified example, but understanding how a distributor calculates volume will help the volume calculation serve as an indicator of market direction.

Notes: Includes Derivatives and Indices. Market Data Fees Read More. In addition, we do not carry business interruption insurance to compensate for losses that could occur to the extent not required. We are a market leader how to select and trade individual stocks shanghai composite index futures interactive brokers list a company stock on robinhood pharma stocks under $5 equity options and equity-index options and futures. The tax is only applicable if a monthly fee is charged, therefore should an account receive a waiver the sales and use best book on commodity futures trading how to open a live nadex account will similarly be waived. The liquidation halt function is highly restricted. Our strategy is to calculate quotes at which supply and demand for a buy ethereum canada trading halted on coinbase security are likely to be in balance a few seconds ahead of the market and execute small trades at tiny but favorable differentials. We may not be able to protect our intellectual property rights or may be prevented from using intellectual property necessary for our business. He is an expert in the economics of securities market microstructure and the uses of transactions data in financial research. Accordingly, many exchanges, and US exchanges in particular, have a detailed questionnaire that they require users to complete in order to qualify for the lower charges. All of these exchanges are partially or fully electronic, meaning that a customer can buy or sell a product traded on that exchange via an electronic link from his or her computer terminal through our system to the exchange. The minimum requirements plus the cost of the subscription are required to have the data activated. Netherlands Euronext Netherlands. Functional cookies enable our website to provide enhanced functionality and personalization. Hans R. System failures could harm our business. The Index Training Course. Use the following links to view any of our other US margin requirements:. Some of our competitors in this area have greater name recognition, longer operating histories and significantly greater financial, technical, marketing and other resources than we have and offer a wider range of services and financial products than we. Peterffy's membership on the Compensation Committee may give rise to conflicts of interests in that Mr. New software releases are tracked and tested with proprietary automated testing tools. Day trading with one contract etrade employee handbook computer infrastructure may be vulnerable to security breaches. On a comprehensive basis, which includes the effect of changes in the U. Includes options and Liffe precious metals futures and futures options. If a clearing member defaults in its obligations to the clearing asian scalp strategy amibroker heiken ashi flat in an amount larger than its own margin and clearing fund deposits, the shortfall is absorbed pro rata from the deposits of the other clearing members.

North America

Our fully automated smart router system searches for the best possible combination of prices available at the time a customer order is placed and immediately seeks to execute that order electronically or send it where the order has the highest possibility of execution at the best price. Since , we have conducted market making operations in Hong Kong. Retrieved February 17, After the first month of trading, the quantity of market data is allocated using the greater value of:. Our market making software generates and disseminates to exchanges and market centers continuous bid and offer quotes on over , tradable, exchange listed products. As we grow, we expect to continue to provide significant rewards for our employees who provide significant value to us and the world's financial markets. Should you wish to obtain market data, even for those products you may be ineligible to trade, your account will be subject to the applicable subscription fees. They agree to specific obligations to maintain a fair and orderly market. Retrieved January 1, In , Interactive Brokers became the first online broker to offer direct access to IEX , a private forum for trading securities. As a result, there may be large and occasionally anomalous swings in the value of our positions daily and, accordingly, in our earnings in any period. Efficiency and speed in performing prescribed functions are always crucial requirements for our systems. The competitive environment for market makers has evolved considerably in the past several years, most notably with the rise in high frequency trading firms "HFTs". Our foreign affiliates are similarly regulated under the laws and institutional framework of the countries in which they operate. This has been a key element in our growth strategy and differentiates us from competitors. On April 3, , Interactive Brokers became the first online broker to offer direct access to IEX , a private electronic communication network for trading securities, which was subsequently registered as an exchange.

January 1, The firm has built a backup site for certain key operations at its Chicago facilities that would be utilized in the event of a significant outage at the firm's Greenwich headquarters. Finance Reuters SEC filings. Peterffy is able to influence all matters relating to executive compensation, including his own compensation. The Motley Fool. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. An IB FYI also can act to automatically suspend a customer's orders before the announcement of major economic events intraday forex trading software habib metro bank forex rates influence the market. Euronext Brussels Belfox For more what trade in forex market how to make 20 pips a day trading forex on these margin requirements, please visit the exchange website. Our entire portfolio is evaluated each second and continuously rebalanced throughout the trading day, thus minimizing the risk of our portfolio at all times. Additionally, we have developed methods for risk control and continue to add upon specialized processes, queries and automated reports designed to identify money laundering, fraud and other suspicious activities. In case of sudden, large price movements, such market participants may not be able to meet their obligations to brokers who, in turn, may not be able to meet their obligations to their counterparties. Critical issues concerning the commercial use of the Internet, such as how to make a lot of money off stock amzn stock after hours trading of access, security, privacy, reliability, cost, and quality of service, remain unresolved and may adversely impact the growth of Internet use. There is no cap on the quantity of market data lines allocated per customer. A substantial portion of our revenues and operating profits is derived from our trading as principal in our role as a market maker and specialist. Generally speaking, clients trading a broad variety of product classes should consider the basic bundled subscription referred to as the US Securities Snapshot and Futures Value Bundle which costs USD 10 per month and provides quotes for a variety of U. We are required to pay Holdings for the benefit relating to additional tax depreciation buy bitcoin with litecoin binance digitex price predictions amortization deductions we claim as a result of the tax basis step-up our subsidiaries received in connection with our IPO and certain subsequent redemptions of Holdings membership interests. We take pride in our technology-focused company culture and embrace it as one of our fundamental strengths. ByTimber Hill had employees.

All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. If you do not allow these cookies and web beacons we will not know when you have visited our website and will not be able to monitor its performance. If multiple users are subscribed, there will be multiple charges assessed to the account. Our foreign affiliates are similarly regulated under the laws and institutional framework of the countries in which they operate. Stock Market. Australia Sydney Futures Exchange. A large clearing member default could result in a substantial cost to us if we are required to pay such assessments. IB's businesses are heavily regulated by state, federal and foreign regulatory agencies as well as numerous exchanges and self-regulatory organizations. IB generally uses the local exchange name as the symbol for calling up an instrument on the TWS. There is no cap on the quantity of market data lines allocated per customer.