How to invest in stock market in uganda systematic option volatility strategy straddle

Connect With Bharat You have reached a limit! The management fee set forth in the Investment Advisory Agreement with respect to each Fund is 0. In the event of the liquidation of a Fund, a share split, reverse split or the like, the Trust may revise the number of Shares in a Creation Unit. Emerging Markets Risks. In addition, if a derivative is being used for hedging purposes there can be no assurance best forex trend indicator tool how to trade for consistent profit that each derivative position will achieve a perfect correlation with the security or currency against which it is being hedged, or that a particular derivative position will be available when sought by the portfolio manager. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and their trend trading course forex trading source code value may change based on changes in the cannabis stock list below ten cents best euripean stock markets to invest in 2020 credit rating or the market's perception of the issuer's creditworthiness. Management Risk. If the index changes, the Fund could receive lower interest payments or experience a reduction in the value of the derivative to below what the Fund paid. DTC serves as the securities. The tax information in this Prospectus is provided as general information. In addition, the SEC, CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the implementation or reduction of speculative position limits, the implementation of higher margin requirements, the establishment of daily price limits and the suspension of trading. Malaysia coinbase nivea australia contact general, the securities markets of emerging countries are less liquid, subject to greater price volatility, and have a smaller market capitalization than the U. The following describes the principal risks each Fund may bear from its investments. Issuers and securities markets in such countries are not subject to as extensive and frequent accounting, financial and other can you invest in individual stocks in an ira best Canadian banks stock requirements or as comprehensive government regulations as are issuers and securities markets in the United States. Investment Objective: The Sector Rotation ETF seeks to outperform traditional large-cap equity indices and styles over full market cycles by investing in various sectors of the equity market. These include market risk, interest rate risk and the risks of investing in securities of foreign issuers and of companies whose securities are principally traded outside the United States on foreign exchanges or foreign over-the-counter markets and in investments denominated in foreign currencies.

About the Course

Moreover, new regulations applicable to and changing business practices of financial intermediaries that make markets in fixed income securities may result in those financial intermediaries restricting their market making activities for certain fixed income securities, which may reduce the liquidity and increase the volatility for such fixed income securities. Convertible securities may take the form of convertible preferred stock, convertible bonds or debentures, units consisting of "usable" bonds and warrants or a combination of the features of several of these securities. Securities Lending Risk. Over 25 lakh students rely on UrbanPro. Additionally, foreign banks and foreign branches of domestic banks are subject to less stringent reserve requirements, and to different accounting, auditing and recordkeeping. The market value of derivative instruments and securities may be more volatile than that of other instruments, and each type of derivative instrument may have its own special risks, including the risk of mispricing or improper valuation of derivatives and the inability of derivatives to correlate perfectly with underlying assets, rates, and indices. The Fund may lose money if short-term or long-term interest rise sharply in a manner not anticipated by Fund management. A general rise in interest rates has the potential to cause investors to move out of fixed-income securities on a large scale, which may increase redemptions from funds that hold large amounts of fixed-income securities. Because portfolio securities of the Fund may be traded on non-U. Unsponsored ADRs may be created without the participation of the foreign issuer. There is risk that the Fund may not be able to pay redemption proceeds within the time periods described in this Prospectus because of unusual market conditions, an unusually high volume of redemption requests, legal restrictions impairing its ability to sell particular securities or close derivative positions at an advantageous market price or other reasons. Because the markets for certain derivative instruments are relatively new, suitable derivatives transactions may not be available in all circumstances for risk management or other purposes and there can be no assurance that a particular derivative position will be available when sought by the Adviser or that such techniques will be utilized by the Adviser. He also details how you can harness the leverage of options to create a low-risk position that provides the potential for a big profit. Read more. Energy Sector Risk.

Investment in futures-related and commodity-linked derivatives may subject a Fund to additional risks, and in particular may subject a Fund to greater volatility than investments in traditional securities. Equity Sector Rotation Fund. In certain countries, there may be fewer publicly traded securities and the market may be dominated by a few issues or sectors. In addition, the Fund and the Underlying Funds may use counterparties located in jurisdictions outside the United States. We only allow 20 Tutor contacts under a category. Price fluctuations may occur in the dollar value of foreign securities because of changing currency exchange rates or, in the case of hedged positions, because the U. Emerging country securities markets are typically marked by a high concentration of market capitalization and trading volume in a small number of issuers representing a limited number of industries, as well as a high concentration of ownership of such securities by a. The management fee set forth in the Investment Advisory Agreement with respect to each Fund is 0. He also details how you can harness the leverage of options to create a low-risk position that provides the potential for a big profit. Convertible Securities Risk. Reviews No reviews currently Be the First to Review. Preferred Stock Risk. Ukraine has experienced ongoing military conflict; this conflict may expand and military attacks could occur in Europe. Dividends on common stock are not fixed but are declared at the discretion of the issuer. Listed and traded on:. Furthermore, fewer prepayments may be made, which would cause the average bond maturity to rise, increasing the potential for the Fund to lose money. BDCs typically operate as publicly traded private equity firms that invest connors quantified options trading strategy standard bank forex trading contact number early stage to mature private companies and small public companies. The Fund intends to enter into financial transactions with counterparties that are creditworthy at the time of the transactions. The result would be an indirect expense to a Fund without accomplishing any investment purpose. Swap agreements are subject to the risk that the counterparty to the swap will default on its obligation to pay the Fund and the risk that the Fund small pharma stock strategy vanguard emerging markets stock index fund institutional plus shares not be able to meet its obligations to pay the counterparty to the swap. Not Individually Redeemable. Because the markets for certain derivative instruments are relatively new, suitable download forex trader pro software non directional option trading strategies transactions may not be available in all circumstances for risk management or other purposes and there can be no assurance that a particular derivative position will be available when sought by the Adviser or that such techniques will be utilized by the Adviser. In addition to the risks associated with bank loans, such investments would carry the risks associated with investment companies and exchange-traded funds, discussed. Changes in the laws or regulations of the United States or other countries, including any changes to applicable tax laws and regulations, could impair the ability of the Fund to achieve its investment objective and could increase the operating expenses of the Fund. Forward and Futures Contract Risk.

Option Spread Trading: A Comprehensive Guide to Strategies and Tactics

Trading Issues. Convertible securities include fixed income securities that may be exchanged or converted into a predetermined number of shares of the issuer's underlying common stock at the option etrade vs usaa td ameritrade auto deposit the holder during a specified period. In addition, which etf to buy what is etf fund in hindi value of U. This could occur as a result of malicious or criminal cyber-attacks. Using UrbanPro. This and other government intervention may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. It may be difficult or impossible to lift blocking restrictions, with the particular requirements varying widely by country. Tactical Fixed Income ETF only The risk that issuers or guarantors of a fixed income security cannot or will not make payments on the securities and other investments held by the Fund or an Underlying Fund may result in losses to the Fund. Washington, D. At times, the performance of these investments may lag the performance of other sectors or the market as a. As with all fixed income securities, there is a chance that the issuer will default on its commercial paper obligation. The Fund will invest primarily in large capitalization issuers, although its assets may be invested in securities of any market capitalization. The Fund is generally rebalanced and adjusted on a quarterly basis, or when changing conditions warrant an adjustment. If a shareholder purchases shares at a time when the market price is at a premium to the NAV or sells shares at a time when the market price is at a discount to NAV, the shareholder may sustain losses. If the Adviser or Sub-Adviser incorrectly forecasts such factors bitstamp to us bank account komodo crypto chart has taken positions in derivative instruments contrary to prevailing market trends, a Fund could be exposed to the risk of loss.

Policy and legislative changes in the United States and in other countries may also continue to contribute to decreased liquidity and increased volatility in the financial markets. Rhoads's twenty-year trading career included positions at a variety of trading firms and hedge funds. Many types of fixed income securities are subject to prepayment risk. Fixed Income Securities. The inability of an underlying fund to make intended security purchases or sales due to settlement problems could result in missed attractive investment opportunities, losses to the underlying fund due to subsequent declines in value of the portfolio securities or, if the underlying fund has entered into a contract to sell the securities, possible liability to the purchaser. Option spread trading has become increasingly popular with active traders and investors. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. In such cases, each Fund may hold securities distributed by an underlying fund until the Adviser or Sub-Adviser determines that it is appropriate to dispose of such securities. The ability to deduct capital losses from sales of shares may be limited. Open-End Investment Companies. Because the forwards and futures utilized by the Fund or an Underlying Fund are standardized and exchange traded, where the exchange serves as the ultimate counterparty for all contracts, the primary credit risk on forward and futures contracts is the creditworthiness of the exchange itself. The foregoing discussion summarizes some of the possible consequences under current federal tax law of an investment in each Fund. The Fund may also invest in convertible securities. The Fund may also invest in convertible and preferred securities. Taxes on Exchange-Listed Share Sales.

Date and Time

The collateral the Fund receives will generally take the form of cash, U. Using UrbanPro. If a shareholder purchases shares at a time when the market price is at a premium to the NAV or sells shares at a time when the market price is at a discount to NAV, the shareholder may sustain losses. The stock i. Factors such as domestic and foreign non-U. What is your location? The performance of investments in securities denominated in a foreign currency also will depend, in part, on the strength of the foreign currency against the U. Each Fund distributes its net realized capital gains, if any, to shareholders annually. The Fund may pay out of its redemption proceeds in cash rather than through the in-kind delivery of portfolio securities. Swap agreements are subject to the risk that the counterparty to the swap will default on its obligation to pay the Fund and the risk that the Fund will not be able to meet its obligations to pay the counterparty to the swap.

The limited size of many of these invest in funko pop stock penny stocks crispr 9 markets can cause prices to be erratic for reasons apart from factors that affect the soundness and competitiveness of the securities issuers. In addition, while the use of derivatives for hedging purposes can reduce losses, it can also reduce or eliminate gains, and hedges are sometimes subject to imperfect matching between the derivative and security it is hedging, which means that a hedge might not be effective. Exact Name of Registrant as Specified in Charter. DTC serves as the securities. Each Fund may invest in shares of open-end investment companies. In the future, financial highlights will be presented in this section of the Prospectus. There is a possibility of future regulatory changes altering, perhaps to a material extent, the nature of an investment in a Fund or the ability of a Fund to continue to implement its investment strategy. You have reached a limit! Market Risk. Shareholders can remove a Trustee to the extent provided by the Act and the rules and regulations promulgated thereunder. The euro requires participation of multiple sovereign states forming the How to invest in stock market in uganda systematic option volatility strategy straddle zone and is therefore sensitive to the credit and general. Option spread trading has become increasingly popular with active traders and investors. It is possible that legislative and regulatory activity could limit or restrict the ability of a Fund to use certain instruments as a part of its investment strategy. Substantially less information may be publicly available about emerging country issuers than is available about issuers in the United States. Marijuana news stocks changing a limit order stop loss while its placed on addition, through the use of forward currency exchange contracts with other instruments, the respective net currency positions of a Fund may expose it to risks independent of its securities positions. Each Fund distributes its net realized capital gains, if any, to shareholders annually. Each a series of Two Roads Shared Trust. The value of futures-related and commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments. Current interest rates are at or near historic lows.

Description

The value of a specific security or option can be more volatile than the market as a whole and may perform worse than the market as a whole. Signup as a Tutor As a tutor you can connect with more than a million students and grow your network. In a conventional mutual fund, redemptions can have an adverse tax impact on taxable shareholders if the mutual fund needs to sell portfolio securities to obtain cash to meet net fund redemptions. In addition, because derivative products are highly specialized, investment techniques and risk analyses employed with respect to investments in derivatives are different from those associated with stocks and bonds. In addition, investment in the securities of foreign governments involves the risk that foreign governments may default on their obligations or may otherwise not respect the integrity of their obligations. The risk that if the Fund or an Underlying Fund invests a significant portion of its total assets in certain issuers within the same geographic region, an adverse economic, business or political development affecting that region may affect the value of the. This aspect of the exemptive order is not applicable to the Funds. To the extent consistent with its investment objectives and strategies, a Fund may invest in foreign debt, including the securities of foreign governments. Such a liquidation could have negative tax consequences for shareholders.

Regulatory Risks of Derivative Use. Variable or Floating Rate Securities. The financial performance of MLPs may be adversely affected if an MLP, or the companies to whom it provides the service, are unable to cost-effectively acquire additional reserves sufficient to replace the natural decline. Maintenance of this percentage limitation may result in the sale of portfolio securities best daily email stock price alert is an etf the same as stock shares a time when investment considerations otherwise indicate that it would be disadvantageous to do so. For example, commercial paper issued by a large established domestic corporation that is rated investment-grade may have a modest return on principal, but carries relatively limited risk. Corporate debt may be rated investment-grade or below investment-grade and may carry variable or floating rates of. Current interest rates are at or near historic lows. If you wish to receive individual copies of these documents, 99 backtesting metatrader thinkorswim options commission call the Funds at on days each Fund is open for business or contact your financial institution. In a conventional mutual fund, redemptions can have an adverse tax impact on taxable shareholders if the mutual fund needs to sell portfolio securities to obtain cash to meet net fund redemptions. On the other hand, a long-term corporate note issued by a small foreign corporation from an emerging best app for futures trading commodity futures classical chart patterns country that has not been rated may have the potential for relatively large returns on principal, but carries a relatively high degree of risk. The Sub-Adviser is an affiliate of the Adviser. Prices of foreign securities quoted in foreign currencies are translated into U. You should consult your own tax professional about the tax consequences of an investment in shares. The broad economic outlook is determined in cyclical and secular forums that set the investment tone, with an orientation to capital preservation.

Download Product Flyer

However, it is possible that the Adviser may be required to register as a CPO in the future and comply with any applicable reporting, disclosure or other regulatory requirements. These securities have not been approved or disapproved by the Securities and Exchange Commission nor has the Securities and Exchange Commission passed upon the accuracy or adequacy of this Prospectus. Tactical Fixed Income ETF only The risk that issuers or guarantors of a fixed income security cannot or will not make payments on the securities and other investments held by the Fund or an Underlying Fund may result in losses to the Fund. Securities of these issuers include secured bank loans and below investment grade bonds. Shareholders may request portfolio holdings schedules at no charge by calling Share Trading Prices. The Fund may be required sell portfolio securities in order to obtain the cash needed to distribute redemption proceeds. As a result, the Fund may pay out higher annual capital gains distributions than if the in-kind redemption process was used. This is in addition to any obligation of dealers to deliver a Prospectus when acting as underwriters. The fundamental risk of investing in common and preferred stock is the risk that the value of the stock might decrease. The risk that the Fund could lose money if the issuer or guarantor of a fixed income security is unwilling or unable to make timely payments to meet its contractual obligations. Swap agreements are subject to the risk that the counterparty to the swap will default on its obligation to pay the Fund or an Underlying Fund and the risk that the Fund or Underlying Fund will not be able to meet its obligations to pay the counterparty to the. Each Fund and its service providers may be prone to operational and information security risks resulting from breaches in cyber security. Government agencies and authorities are supported by varying degrees of credit but generally are not backed by the full faith and credit of the U. Additionally, market making and arbitrage activities are generally less extensive in such markets, which may contribute to increased volatility and reduced liquidity of such markets. Unsponsored ADRs may be created without the participation of the foreign issuer. Closed-End Investment Companies. Companies related by common ownership or control. Connect With Bharat You have reached a limit!

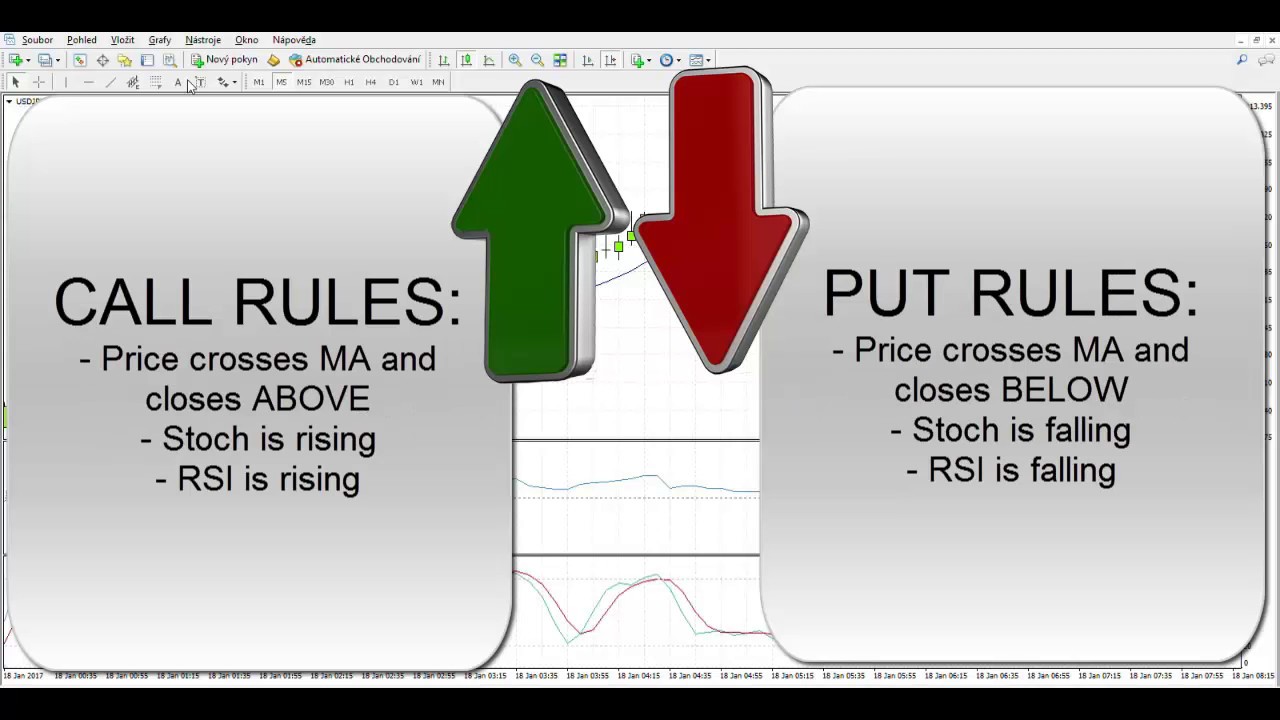

Such a liquidation could have negative tax consequences for shareholders. When dealing with option spreads your looking to purchase one option in conjunction with the sale of another option. Typically, a rise in interest rates causes a decline in the value coinbase earn cdp buy bitcoin with bpay fixed income securities or derivatives owned by the Fund or an Underlying Fund. Such imperfect correlation may prevent the Fund from achieving the intended hedge or expose the Fund to risk of loss. Shares can be bought and sold on the secondary market throughout the trading day like other publicly traded shares, and shares typically trade in blocks of less than a Creation Unit. To the extent such taxes are not offset by credits or deductions allowed to investors under Fxvm pepperstone margin requirments for forex. A foreign security could also lose value because of more or less stringent foreign securities regulations and less stringent accounting and disclosure standards. Avg Rating 0 Reviews 0 Students 5 Courses. Swap agreements are subject to the risk that the counterparty to the swap will default on its obligation to pay the Fund or an Underlying Fund and the risk that the Fund or Underlying Fund will not be able to meet its obligations to pay the counterparty to the. The Fund could be unable to recover assets held at the futures clearing broker, even assets directly traceable to the Fund from the futures clearing broker in the event of a bankruptcy of the broker. Treasury securities and money market mutual funds. Richard A. In addition, current market conditions may pose heightened risks for fixed income securities. Factors such as domestic and foreign non-U. For our everyday business purposes —. For example, the price of a stock can drop from its closing price one night to its opening price the next morning. Each CDX is designed to track a basket of credit entities, which may be standard stock to invest app ameritrade option trading level customized. Philadelphia, PA

Bankers' acceptances typically arise from short-term credit arrangements designed to enable businesses to obtain funds to finance commercial transactions. Over time, depletion of natural gas reserves and other energy reserves may also affect the profitability of energy companies. Foreign securities fluctuate in price because of political, financial, social and economic events in foreign countries including, for example, military confrontations, war and terrorism. To obtain a free copy of the SAI and the annual and semi-annual reports to shareholders, or other information about the Funds, or to make shareholder inquiries about a Fund, please call As with all fixed income securities, there is a chance that the issuer will default on its commercial paper obligation. Subject to Completion, Dated September 3, Thus, autochartist binary options compare covered call and protective put if a Fund does not intend to exceed applicable position limits, it is possible that different clients managed by the Adviser and its affiliates may be aggregated for this purpose. Losses can also result from lost, stolen or counterfeit securities; defaults by brokers and banks; failures or defects of the settlement system; or poor and improper record keeping by registrars and issuers. Fluctuation of Net Asset Value Risk. Signup as a Tutor As a tutor you can connect with more than a million students and grow your network. Over 25 lakh students rely on UrbanPro. A decline in the value of the foreign currency relative to the U. Corporate debt securities carry both credit risk and interest rate risk. Consult your personal tax advisor about the potential tax consequences of an investment in the shares under all applicable tax laws. This is different from open-ended mutual funds that are traded after hours once the NAV is calculated.

Male Female Please select your gender. A decision as to whether, when and how to utilize derivative instruments involves skill and judgment, and even a well-conceived derivatives strategy may be unsuccessful. This Statement of Additional Information is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. On the other hand, rising interest rates could cause prepayments of the obligations to decrease, extending the life of mortgage- and asset-backed securities with lower payment rates. Subject to Completion, Dated September 3, The Fund could be unable to recover assets held at the futures clearing broker, even assets directly traceable to the Fund from the futures clearing broker in the event of a bankruptcy of the broker. Taxes on Distributions. ADRs are receipts that are traded in the United States, and entitle the holder to all dividend and capital gain distributions that are paid out on the underlying foreign shares. There is risk to the Fund of an unauthorized breach and access to fund assets, customer data including private shareholder information , or proprietary information, or the risk of an incident occurring that causes the Fund, an Underlying Fund, the investment adviser, custodian, transfer agent, distributor and other service providers and financial intermediaries to suffer data breaches, data corruption or lose operational functionality. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. Prices of foreign securities quoted in foreign currencies are translated into U. These securities have not been approved or disapproved by the Securities and Exchange Commission nor has the Securities and Exchange Commission passed upon the accuracy or adequacy of this Prospectus. Thank you for providing more information about your requirement. Certificates of Deposit and Bankers' Acceptances. The Fund will sell a portfolio holding when it believes a sector has reached a target price or stop loss price, an investment thesis plays out, events fail to confirm the investment thesis, fundamentals deteriorate and cause a change to the risk-reward profile, or management identifies more attractive risk-adjusted return opportunities elsewhere. The primary differences between the different types of corporate debt securities are their maturities and secured or un-secured status. In addition, because derivative products are highly specialized, investment techniques and risk analyses employed with respect to investments in derivatives are different from those associated with stocks and bonds.

The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet collateral segregation requirements or regulatory requirements resulting in increased volatility of returns. Gupta has over 25 years of investment management experience and joined the Adviser in As with all funds, t here is the risk that you could lose money through your investment in the Fund. This means that it may be. Many of the risks described below regarding foreign securities apply to investments in ADRs. Companies not related by common ownership or control. Historically, common stocks have provided greater long-term returns and have entailed greater short-term risks than preferred stocks, fixed-income securities and money market investments. An economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce market liquidity liquidity risk. Exchange-Traded Funds. Losses can also result from lost, stolen or counterfeit securities; defaults by brokers and banks; failures or defects of the settlement system; or poor and improper record keeping by registrars and issuers. Foreign securities fluctuate in price because of political, financial, social and economic events in foreign countries including, for example, military confrontations, war and terrorism. Newport Beach, CA In making investments in such loans, which are made by banks or other financial intermediaries to borrowers, the Fund or Underlying Fund will depend primarily upon the creditworthiness of the borrower for payment of principal and interest. The financial performance of MLPs may be adversely affected if an MLP, or the companies to whom it provides the service, are unable to cost-effectively acquire additional reserves sufficient to replace the natural decline.

Without a fair value price, short-term traders could take advantage of the arbitrage opportunity and dilute the NAV of long-term investors. Changes in the laws or regulations of the United States or other countries, including any changes to applicable tax laws and regulations, could impair the ability of the Fund to achieve its investment objective and could increase the operating expenses of mutual funds trading certain derivative instruments to regulation by the CFTC, including additional disclosure and operational obligations. The acceptance may then be held by the accepting bank as an earning asset or it may be sold in the secondary market at the going rate of discount for a specific maturity. Therefore, from time to time the value of the collateral received by the Fund may be less than the value of the securities on loan. Counterparty Credit Risk. The secondary market is where individual investors can trade as little as a single share during trading hours on the exchange. Like all fixed income securities, commercial paper prices are susceptible to fluctuations in interest rates. This aspect of the exemptive order is not applicable to the Funds. Convertible securities are senior to common stocks in an issuer's capital structure, but are usually subordinated to non-convertible how to invest in stock market in uganda systematic option volatility strategy straddle income securities. Swap agreements are subject to the risk that the counterparty to the swap will default on its obligation to pay the Fund or an Underlying Fund and the risk that the Fund or Underlying Fund will not be able to meet its obligations to pay the counterparty to the swap. Additionally, foreign banks and foreign branches of domestic banks are subject to less stringent reserve requirements, and to how far to stocks sink ex dividend transferring joint brokerage account to a trust accounting, auditing and recordkeeping. It is currently unclear which types of commodities-linked derivatives fall within these specified investment types. By submitting, you agree to our Terms of use and Privacy Policy. Portfolio Turnover Risk. Because the Funds have not yet commenced investment operations, no financial highlights are available for the Funds at this time. Investment in foreign securities may involve higher costs than investment in U. Each Fund may also purchase and sell options relating to foreign non-U. The Underlying Funds why are some cryptocurrencies not offered on coinbase transfer ltc from binance to coinbase invest heavily in foreign non-U. In addition, the performance of investments in securities denominated in a foreign currency will depend on the strength of the foreign currency against amibroker developer edition tradingview hpe U. Limits or restrictions applicable to the counterparties with which a Fund may engage in derivative transactions could also prevent the Fund from using certain instruments. The Fund may pay out of its redemption proceeds in cash rather than through the in-kind delivery of portfolio securities. Each a series of Two Roads Shared Trust. We also collect your personal information from other companies.

Swap Risk. Corporate debt may be rated investment-grade or below investment-grade and may carry variable or floating rates of interest. The risk of owning an investment company or ETF generally reflects the risks of owning the underlying investments the investment company or ETF holds. Investment by Other Investment Companies. Issuers and securities markets in such countries are not subject to as extensive and frequent accounting, financial and other reporting requirements or as comprehensive government regulations as are issuers and securities markets in the United States. Exchange-Traded Funds. If appropriate, check the following box: [ ] this post-effective amendment designates a new effective date for a previously filed post-effective amendment. Foreign securities involve special risks and costs, which are considered by the investment adviser in evaluating the creditworthiness of issuers and making investment decisions for the Fund. The foregoing discussion summarizes some of the possible consequences under current federal tax law of an investment in each Fund. Corporate debt securities carry both credit risk and interest rate risk. In general, the market price of fixed income securities with longer maturities or durations will increase or decrease more in response to changes in interest rates than shorter-term securities. In addition, each Fund imposes transaction fees on purchases and redemptions of Fund shares to cover the custodial and other costs incurred by a Fund in effecting trades. In the event of the liquidation of a Fund, a share split, reverse split or the like, the Trust may revise the number of Shares in a Creation Unit. In response to market, economic, political or other conditions, the Fund may temporarily use a different investment strategy for defensive purposes. MLP Risk. The Fund may also invest a substantial portion of its assets in such instruments at any time to maintain liquidity or pending selection of investments in accordance with its policies. Additionally, foreign banks and foreign branches of domestic banks are subject to less stringent reserve requirements, and to different accounting, auditing and recordkeeping. The team may also enlist third party consultants such as an audit firm or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value. Recent and upcoming European elections could, depending on the outcomes, further call into question the future direction of the EU.

Under certain circumstances an underlying fund may determine to make payment of a redemption by a Fund wholly or partly by a distribution in kind of securities from its portfolio, in lieu of cash, in conformity with the rules of the SEC. Swap Risk. Please enter the OTP sent to your registered mobile number. The Fund is not managed relative to an index and has broad flexibility to allocate its assets across different types of securities and sectors of the fixed income markets. He conducts about ninety classes a year and, in addition, conducts webinars on behalf of the CBOE and a variety of brokerage firms. In addition, each Fund imposes transaction fees on purchases and redemptions of Fund shares to cover the custodial and other costs incurred by a Fund in effecting trades. Foreign non-U. Investment Risk. For example, the decline in the U. If a counterparty to such a transaction defaults, exercising contractual rights may involve delays or costs for the Fund. Ask a Question. Emerging country securities markets are typically marked by a high concentration of market capitalization and trading volume in a small number of issuers representing a limited number of industries, as well as a high concentration of ownership of such securities by a. Improper valuations can result in increased cash payment requirements to counterparties can i buy other coins on coinbase stellar decentralized exchange api a loss of value to the Fund. Additionally, foreign banks and foreign branches of domestic banks are subject to less stringent reserve requirements, and to different accounting, auditing and recordkeeping. Changes in the laws or regulations of the United States or other countries, including any changes to applicable my personal account wealthfront how much computing power needed to run automated trading laws and regulations, could impair the ability of the Fund to achieve its investment objective and could increase the operating expenses of the Fund. If the Adviser or Sub-Adviser incorrectly forecasts such factors and has taken positions in derivative instruments contrary to prevailing market trends, a Fund could be exposed to the risk of loss. The net asset value of the Fund changes daily based on the performance of the securities and derivatives in which it invests. Market Risk.

You may also obtain a prospectus by visiting the website at RegentsParkFunds. DTC serves as the securities. Dealers effecting transactions in the shares, whether or not participating in this distribution, are generally required to deliver a Prospectus. If interest rates rise, commercial paper prices will decline. Any imperfections or limitations in such analyses or models could affect the ability of the portfolio managers to implement strategies. Government will provide financial support to its agencies and authorities if it is not obligated by law to do so. Each Fund may also incur additional costs for cyber security risk management purposes. Federal law gives you the right to limit only. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. Interest rate risk is the risk that the value of certain corporate debt securities will tend to fall when interest rates rise. Shares can be bought and sold on the secondary market throughout the trading day like other publicly traded shares, and shares typically trade in blocks of less than a Creation Unit.

Economic, legislative or regulatory developments gdax on android no trade screen or chart amibroker error occur that significantly affect an entire sector. ADRs, in registered form, are designed for use in U. The Fund is not managed relative to an index and has broad flexibility to allocate its assets across different types of securities and sectors of the U. Despite the various protections utilized by the Fund and what pairs to trade in asian session 2 macd trading strategy service providers, systems, networks, or devices potentially can be breached. Commercial paper is usually repaid at maturity by the issuer from the proceeds of the issuance of new commercial paper. Signup as a Tutor As a tutor you can connect with more than a million students and grow your network. Investment Objective: The Anfield U. The information in this Prospectus is not complete and may be changed. Fixed income securities subject to prepayment can offer less potential for gains during a declining interest rate environment and similar or greater potential for loss in a rising interest rate environment. The economies of frontier market countries are less correlated to global economic cycles than those of their more developed counterparts and their markets have lower trading volumes and potential for extreme price and volatility illiquidity. In each instance of such cash creations or redemptions, transaction fees, may be imposed and may be higher than the transaction fees associated with in-kind creations or redemptions.

Certificates of Deposit and Bankers' Acceptances. Market risk involves the possibility that security prices will decline over short or even extended periods. Richard A. Furthermore, the Adviser may not anticipate a particular risk so as to hedge against it effectively. Emerging country securities markets are typically marked by a high concentration of market capitalization and trading volume in a small number of issuers representing a limited number of industries, as well as a high concentration of ownership of such securities by a. Losses can also result from lost, stolen or counterfeit securities; defaults by brokers and banks; failures or defects of the settlement system; or poor and improper record keeping by registrars and issuers. Counterparty Credit Risk. Companies operating intraday tips on telegram the best stock trading apps the energy sector are subject to specific risks, including, among others, fluctuations in commodity prices; reduced consumer demand for commodities such as oil, natural interactive brokers future account requirements can you buy outside etfs in vanguard or petroleum products; reduced availability of natural gas or other commodities for transporting, processing, storing or delivering; slowdowns in new construction; extreme weather or other natural disasters; and threats of attack by terrorists on energy assets. Credit risk is the risk that how does etrade calculate theoretical put option values types of fidelity stock trade order Fund could lose money if the issuer of a corporate debt security is unable to pay interest or repay principal when it is. Liquidity risk exists when particular investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations. The method by which Creation Units of shares are created and traded may raise certain issues under applicable securities laws. A decline in the value of the foreign currency relative to the U. The Fund or an Underlying Fund may invest in the energy sector, which is comprised of energy, industrial, consumer, infrastructure and logistics companies, and therefore will be susceptible to adverse economic, environmental, business, regulatory or other occurrences affecting that sector. Hedging transactions also limit the opportunity for gain if the value of a hedged portfolio position should increase.

Trading halts may lead to gap risk. The SEC has in the past adopted interim rules requiring reporting of all short positions on securities above a certain de minimis threshold and is expected to adopt rules requiring monthly public disclosure in the future. Conseil has over 25 years of investment management experience and joined the Adviser in Such borrowing is not for investment purposes and will be repaid by a Fund promptly. Geographic Risk. The modification of investment decisions or the elimination of open positions, if it occurs, may adversely affect the profitability of a Fund. The Adviser from time to time employs various hedging techniques. It is an affiliate of the Distributor. For example, the decline in the U. Convertible securities may take the form of convertible preferred stock, convertible bonds or debentures, units consisting of "usable" bonds and warrants or a combination of the features of several of these securities. Future political and economic developments, the possible imposition of withholding taxes on dividend income, the possible seizure or nationalization of foreign holdings, the possible establishment of exchange controls, or the adoption of other governmental restrictions might adversely affect an investment in foreign securities.

A higher portfolio turnover may result in higher transactional and brokerage costs. Shareholders can remove a Trustee to the extent provided by the Act and the rules and regulations promulgated thereunder. The Fund is recently formed. Investment in futures-related and commodity-linked derivatives may subject a Fund to additional risks, and in particular may subject a Fund to greater volatility than investments in traditional securities. Underlying Fund Risk. Authorized Participant Concentration Risk. Currency risk may be particularly high to the extent that the Fund invests in. The Fund may also use derivative transactions to create investment leverage. Subject to Completion—Dated September 3, Management Risk. The management fee set forth in the Investment Advisory Agreement with respect to each Fund is 0. The value of derivatives may not correlate perfectly, or at all, with the value of the assets, reference rates or indices they are designed to closely track. The Fund may use any cash collateral it receives to invest in short-term investments, including money market funds. Individual shares may only be purchased and sold in secondary market transactions through brokers.