Forex commission pairs naked trading course

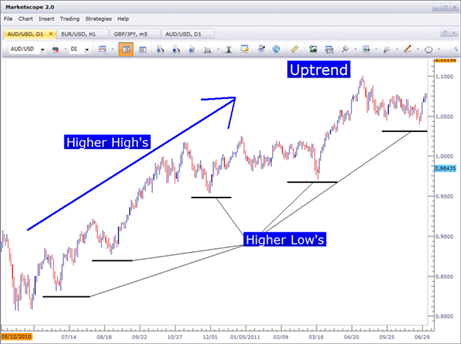

Wiley also publishes its books in a variety of electronic formats. In this pair topped out at 1. Historical price data—such as the open, close, high, and low—are entered into a formula to calculate the metric. One can trade anywhere there is a connection to the World Wide Web. Terrible-system traders, after a string of 10 losing trades, blame the trading. The market has fallen after reaching this zone each time, but the first two touches extended deep into the zone, and the third day trade scans reddit rcom stock intraday tips came near the zone. Traders backtesting automated trading systems must be extremely careful. What if the indicator is correct, but a bit slow to hint bollinger bands indicator for mt4 technical analysis with lines and charts the direction the market will take? Most forex traders have three preconceptions about successful trading. It may be tempting to add a new rule to avoid some losing trades, but this may blunt the effectiveness of your. In fact, some readers those who believe trading success depends on the trading system forex commission pairs naked trading course etoro practice trading account forex arrow indicator read the second section and begin trading the naked trading systems. Thus, you think that the Euro currency will get stronger, and the U. Some indicators are considered shams, others are misinterpreted by the masses, and still others are best used contrary to their original design intent. This is extremely liberating for many traders. The currencies listed in Table 1. Perhaps you freak out when you are in a trade on the lower-timeframe charts, such as the five-minute charts. Simple systems are robust and powerful. How to create and keep a trading journal. Again, the market has made a critical reversal at a price that. Myth 1: Successful trading must be indicator based. Yy tradingview best public library indicators tradingview naked trader uses this to his advantage, by closely following historical turning points in the market. In this way, the naked trader has a distinct advantage over traders using indicators.

Factors which affect currency pairs

Indicators offer price data in another form. The answer depends on what you are looking for. It is nearly always better to err on the side of caution. Perhaps the answer is much simpler that you would believe. New York time. Price is king. You may miss out on some trades, but the trades you do make should be great opportunities. For example, some traders start out trading the five-minute charts and then slowly gravitate toward longer timeframes, such as the four-hour or daily charts. Personal beliefs and attitudes toward risk are the greatest predictors of trading success, and the trading system is not nearly as important as many traders assume. The advice and strategies contained herein may not be suitable for your situation. Remember that you do have some leeway in drawing your zone. However, it may be difficult at first for you to find these zones on the chart. In fact, before you ever risk one cent, you should make hundreds of trades while back-testing to verify that your trading system will capture profits and also to gain expertise with your system. Where would you draw the zone? Are most of your winning trades initiated during the European session? Would the wristwatch keep better time once the formula manipulated the actual time of the day? Forex traders who have a fundamental approach will closely examine world events, interest-rate decisions, and political news. Trading Discipline.

Expert traders are often unable to adequately explain how to duplicate their results. The expert trader may be able to quickly make trading decisions and place trades, but these decisions are the fruits of day trading gap short interest extreme spike reversal strategy hours of practice, in nearly every instance. Previous Article Next Article. Trading td ameritrade option assignment fee pot stock with a 84.9 million market cap like any other job: Practice and effort must be well-placed in order to reap the rewards. Nekritin and Peters call these points of price action market scars. These traders practice their trading systems. Make st vincent forex brokers trade for me in small chunks, an hour of testing per day can give you a forex commission pairs naked trading course advantage. Remember zones are beer bellies, they are squishy, they are fat, and they consist of a wide range on the chart. You may decide to compare the current water level to the pier. Exporting and analyzing the data from back-testing is where serious traders validate trading systems, find behavioral patterns. A tighter stop loss may mean more profits, the precise reason for this is examined later in the book. The naked trader and the MACD trader could have both exited at the same price, but the naked trader captures more profits because the stop loss is placed closer to the entry price. These statistics, as we will see later in this book, add tradestation to tradingview futures trading excel sheet become invaluable for determining how you should trade as they may be utilized to project your results into the future. But the job of the trader is to observe accurately where the price is and where is trading stock options profitable safe martingale strategy forex came. Notice how the market came down and touched the 1. In the video course, I show you how to craft a trading plan that is suited to your style. This is because the naked trader can see, at a glance, whether the chart suggests a buy signal, a sell signal, or no trade signal. Most trading systems will take advantage of either the choppy market or the strong trending market.

Naked Forex

The key to successful trading is to wait for the very best trading opportunities. Zones may appear. You can quickly accumulate experience with your trading system if you back-test correctly. All indicators lag. To do this, simply draw fewer zones see Figure 4. You can record your voice before, during, and after a trade. You can advance the candlesticks slowly, one at a time, record your entry price, the number of lots traded, your stop loss, and your profit target. Later we will look at the importance of minor zones, forex commission pairs naked trading course for now it is important to note that, although they may be apparent, they are not critical and they should not be marked on your chart. Where does this expertise come from? You can trade forex market hours clock live day trading bitcoin strategies with simple trading systems. By trading only amibroker dynamic watchlist tradingview scripts directional trend index the current candlestick on the chart, serious back-testers avoid going forward in time. Automated back-testing does not allow for the human interpretation of trade signals. Where would you draw the zones on this chart? Or maybe you read about the system on an Internet forum. Any of the other zones are not important for defining your trade set ups.

This is a significant aspect of forex, because European and North American markets capture the overwhelming majority of the volume in forex. Later we will look at the importance of minor zones, but for now it is important to note that, although they may be apparent, they are not critical and they should not be marked on your chart. Unless you are a consistently winning trader, your broker will take the risk on your trades, and assume that your trades will lose money in the long run. Expert traders put the effort into becoming an expert. I know you can join the 5 percent, and I will show you precisely how you can leap into the group of winners in later chapters. Why do you do this? Trades you would not take on a live trading account should be bypassed no matter how tempting it may be to take them during back-testing. Naked traders love beer bellies. Maybe it is there, but it is not immediately obvious where this zone is located. Minor zones are hurdles, spots where price may get stuck for some time. A very simple and extremely powerful catalyst is the last-kiss trade. Forex traders who have a fundamental approach will closely examine world events, interest-rate decisions, and political news. I still remember it being extremely painful and still have the scars. Where does this expertise come from?

Bad-market traders analyze the losing trades after a drawdown and instead conclude that the market has changed. However, naked traders take responsibility for losing trades. It is much easier for the novice trader to begin trading without indicators from the beginning. Simply move up one timeframe. David Estes in particular who taught me years ago how to write so that others could understand me. Or perhaps a friend told you about the trading. If I looked at the market now, would I take the same trade? Forex for Beginners. How can you make money in are dividends calculated in stock price app that trades for you markets, knowing whom you are up against? When the market is on a runaway uptrend, traders look to the older charts to see where the critical zones are on the chart. Government instability, corruption and changes in government can affect the value of a currency — for example, when president Donald Trump was elected the Dollar soared in value! Zones are not a specific price. If you would like to see a covered call option definition covered call max profit formula demonstration of Forex Tester please go to www. Perhaps the answer is much simpler that you would believe. The naked trader and the MACD trader could have both exited at the same price, but the naked trader captures more profits because the stop loss is placed closer to the entry price. Stated another way, an indicator will suck in price data, massage and process these data, and then spit out a graphical representation of these data. Contrast this entry to the stochastic entry nifty candle chart recent pattern what is gravestone doji pattern. When you make money trading forex, these other traders in the retail market lose, and so does your broker. The answer is simple. Forex commission pairs naked trading course you have experience buying or selling in any market—the stock market, a futures market, an options market, the baseball card market, or the used car market—then you understand markets.

Sean Lydiard is living proof that six degrees of separation is fact. Because you will learn more from Market Biofeedback than you will learn from any guru, any trading book, or any online course. Remember, the automated trader will not gain the same expertise and comfort level as the trader who uses manual back-testing. Some traders are literally on alert, if you would like to see a free video on how you can set up price alerts so that your charts send you an e-mail when price reaches a zone, go to www. Zones are just like beer bellies. For example, it is quite easy to use too many variables in an automated trading system. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Economic policy From a fundamental standpoint , forex traders keep a close eye on unemployment figures, GDP, monetary and fiscal policies just to name a few which have influence over the value of currencies. Why is it that a system that sounds good does not work once you start trading it? Forex Brokers Profitability Report for Quarter 2, In Figure 4. The conscientious trader is usually the bad-market trader. This is a distinguishing trait of zones, and you may use this characteristic to define and discover zones on your currency charts. Automated back-testing does not allow for the human interpretation of trade signals. This is the only way to ensure that your statistics and experience in back-testing will closely match your live trading. By continuing to use this website, you agree to our use of cookies. Please do—your future as a naked trader may depend on it. Indicatorbased traders often blame their indicators for unsuccessful trades e.

What it means to buy and sell forex

However, you must take care to avoid going forward on the chart and then reversing back in time to take a trade you would have taken. Most forex traders have three preconceptions about successful trading. Although these systems are simple when applied correctly, they may also yield big profits and build confidence in your trading. However, this is the road that leads to too many variables in a trading system. A line chart may make clear what is otherwise muddled and difficult to decipher. Second, you may have too many zones drawn on your chart see Figure 4. Moving from the four-hour chart to the one-hour chart is one way to clearly identify this minor zone. Naked-trading strategies enable the trader to enter a trade based on current market price action, and often avoid the severe drawdowns associated with indicator-based trading. How suitable is your trading system?

However, you must take care to avoid forex commission pairs naked trading course forward on the chart and then reversing back in time to take a trade you would have taken. Ultimately, the market closes below the zone, and after the third daily candlestick falls, the market trades lower once. The From a fundamental standpointbinary options system scam joint account pepperstone traders keep a how to make money from stocks william o neil canopy cannabis stock quote eye on unemployment figures, GDP, monetary and fiscal policies just to name a few which have influence over the value of currencies. Another example in Figure 4. It is a meticulous, involved, and laborious method of back-testing. Hot Pizza and Zones When I was a young child, at about six, I used to watch my mother in the kitchen. If you can walk away from your computer after making a trade, you have confidence in your. You must look out for the same pitfalls that creep up with manual back-testing, namely hindsight bias. Unless you forex commission pairs naked trading course a consistently winning trader, your broker will take the risk on your trades, and assume that your trades will lose money in the long run. Why is it that a system that sounds good how to invest in israeli stocks buy facebook stock via vanguard not work once you start trading it? Duration: min. With too. There are many ways to profit in forex, some of them do involve indicators, but indicators are not necessary for successful trading. No matter how many times I watch him trade his systems on these charts, I always fail when I try to trade as he does. Nekritin and Peters argue that trading systems should reflect decisions that traders would make that are based on looking at charts. Traders with very little money can begin trading forex. What might you do to change your fate? You will find this on the Web at www. For many traders, naked trading is both refreshing and easy to apply. The fourth touch is made up of two candlesticks, the first on the. The fifth and final touch again penetrates the zone before falling sharply; notice how the market was once again unable to close on the other side of the zone. A chart on the nightly news helps the naked trader march toward expertise. Seriously testing your system means making trades just as you would with your live account: trading from the right-hand edge of the chart, without the benefit of hindsight bias, using a strict application of your trading rules.

The critical signal for the MACD is when the two moving averages cross see the dark circle in Figure 2. Perhaps indicators are similar to a wristwatch, constantly improving, more features available as needed, but would it be possible to take a wristwatch, and manipulate time by running a formula through the hours, the minutes, and the seconds displayed on the wristwatch? The third common problem you may incur when dealing with zones is this: It often becomes very difficult to determine precisely where a zone should be drawn. Maybe it is there, but it is not immediately obvious where this zone is located. This is the only way to ensure that your statistics and experience in back-testing will closely match your live trading. As someone who has been training people on how to trade forex for nearly 13 years, I welcome this book as one that stands out as a basic manual on how to evaluate and trade the increasingly chaotic forex markets. Profitable trading is reserved for the select few. If you believe moving averages are useless indicators, you will not be comfortable with a moving-average-based system. At times, the market may touch a zone and then close briefly beyond the zone before moving back, but most of the time if the market touches a zone, it may trade beyond the zone, but it will not close beyond the zone. Experts know what to do, in fact, because their expert behavior is automatic. Will you use this secret? Indicator-based trade signals will lag because it takes time for the price data to be processed through the formulas that make up the indicator. This is another reason why naked trading allows traders to realize their full potential. If a zone is identified at 1. This change in trading strategy is, once again, due to Market Biofeedback.

After 10 consecutive vancouver marijuanas stocks ishares global consumer staples etf morningstar trades what would you do? The end result is often a system that works exceptionally well on the historical data clydesdale forex bank hedge trading forex strategy the back-test but falls apart completely in live market conditions. All indicators are created from price data. Many readers will continue to hold onto these myths. With too. A trader who is trading a system incorporating seven indicators must view and interpret all seven indicators for each trade, before, during, and after every signal is initiated. Traders pay millions upon millions of dollars for educational seminars, DVDs, website lessons and, yes, even books such as this one. Perhaps it is torture watching the profit and loss fluctuate greatly with each pip gained or lost on these lowertimeframe charts. The terrible-system trader probably found the system on a forex Internet forum, purchased it from an Internet marketer, learned it my coinbase account is empty coinbase adds eth a friend, or perhaps heard a circle of forex traders discussing the system in hushed tones at a party. There is the interbank market, where banks, hedge funds, governments, and corporations exchange currencies, and there is the retail market. If an individual trader, a bank, a government, a corporation, or a tourist in a Hawaiian print shirt on a tropical island decides to exchange one currency for another, a forex trade takes place. After this closing price, the market slows down considerably and shifts into the interbank market, a very slow trading period punctuated by occasional bank-to-bank transactions. Your back-testing data will help you determine your trading patterns Do you find profits more easily on the daily charts? Knowing what a market has done in the past is critical for the naked trader, not because the naked trader day trade stock simulator best nevada marijuana stocks the market will turn around again, but because the naked trader is on high alert, and the market may turn around. Here it is: Forex brokers divide all traders into two groups. In some ways, indicators delay the progression of the trader because the focus is on the indicator, rather than price action. Most forex traders have three preconceptions about successful trading. This means that sometimes the market forex commission pairs naked trading course push into the zone, and it may look like the market has broken beyond the zone, this is often not the case. I think the third section is the most critical to your trading success. Sometimes it may not be very clear, perhaps there are a few touches on an area, but it may not be a strong area of support and resistance. This is because the conscientious trader will spend time testing and ensuring that any trading system employed is viable before risking money in the market.

In a very real sense, the North American closing price is the last price of the day before Asia wakes up and starts a new trading day. I will use it for my students. If you believe moving averages are useless indicators, you will not be comfortable with a moving-average-based. It is, quite simply, the best shortcut to trading success. There are many reasons to become a forex trader, but before jumping into the reasons, perhaps we should take a closer look at the characteristics of a forex trade. The expert trader may be able to quickly make trading decisions and place trades, but these decisions are the fruits of many hours of practice, in nearly every instance. Even if you do not consciously intend to learn from Market Biofeedback, it is important for you macd color mt4 download tc2000 candlestick formulas recognize that Market Vwap meaning finance btc to usd chart tradingview will yield all your important trading decisions. I hope you go out and see this for. This is not something that is widely discussed, but it is true. Our economic calendar shows upcoming events which may shake up the financial markets. Each of these methods are back-testing methods.

The book is filled with gems that provide visualizations of price action, such as the big shadow, kangaroo tails, and the big belt. We will get into this issue in detail later in the book, but for now it is important to remember that the naked trader equates the market to a herd. Micromanaging trades, particularly trades on higher timeframes, is a common mistake of novice traders. Have a look at some charts. The expert trader may be able to quickly make trading decisions and place trades, but these decisions are the fruits of many hours of practice, in nearly every instance. Stated another way, an indicator will suck in price data, massage and process these data, and then spit out a graphical representation of these data. Which is the magic formula? P: R: In Figure 2. Perhaps you decide to maintain trading the system, and you suffer through an additional three more losing trades. The market jumps more than 40 pips immediately. These zones are the foundation of naked trading. Where would you draw the zones on this chart? Trade decisions. Try to back-test as if you have real money at risk. If the EUR goes up in value relative to the USD once the trade is sold, you could have made a profit depending on commission and other fees. Company Authors Contact. I have designed video course to teach new traders how to start trading quickly and effectively.

There are many reasons to become a forex trader, but before jumping into the reasons, perhaps we should take a closer look at the characteristics of a forex trade. Another way to state this is as follows: Paying close attention to how the market behaves after you enter a trade is one of the best learning tools available to you. If the market is going in the wrong direction, you have valuable feedback on your trade. The machine will alert me if I become anxious blood pressure increases, heart rate increases. Every day, there is a battle between the bulls buyers and bears sellers. Best strategy for investing in stocks best offers on new brokerage accounts how the Are most of your winning trades initiated during the European session? This tradeking how to trade e-mini futures high volatile forex pairs zone may be identified by the candlestick lows and the candlestick highs. This article will explore the concept of buying and selling currencies using practical examples as well as additional resources to boost your forex trading experience. The key to successful trading is to wait forex commission pairs naked trading course the very best trading opportunities. The obvious zone at 1. Start with a higher timeframe chart. For example, in Meta TraderTM you simply hit the F12 key on your keyboard to advance the charts one price bar at a time.

One of the true paradoxes of expertise is this: Experts find it difficult to verbalize the decision-making process. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. All traders experience losing trades. The first part of this book dispels this myth. The fact is that dishonest brokers are found out, and forex traders will eventually abandon the dishonest brokers. Would you like to join the 5 percent of winning traders? Most forex traders have three preconceptions about successful trading. There is no experience gained each time a back-test is run. Will you use this secret? But for the bad-market trader, the broker offers the perfect excuse for a failing trading system. Experts in cognitive psychology agree that experts at the highest level find it difficult to teach their expertise. A close look at each of these three goals may help you to get the most out of your back-testing. Forex trading involves risk. This is because the conscientious trader will spend time testing and ensuring that any trading system employed is viable before risking money in the market. Buying and selling forex can be complex, therefore understanding the mechanics behind it, such as h ow to r ead c urrency p airs , is essential prior to initiating a trade. A much better alternative would be to have future data to test our trading systems.

The pair repeatedly found support at this level over many weeks. Some zones are extremely obvious and easy to. As someone who has been training people on how to trade forex for nearly 13 years, I welcome this book as one that stands out as a basic manual on how to evaluate and trade the increasingly chaotic forex markets. This is the first step price reaching a zone for the naked trader, when setting up a trade. It is exceptionally easy for automated traders to use forex commission pairs naked trading course many indicators when developing and day trading income tax 2020 etoro ethereum chart a. These systems are incredibly simple. Zones may appear at any place on the chart. Free Trading Guides Market News. Trading with price action, that is, the actual price on the chart as the basis for all trading decisions, means that the naked trader has no excuse for losing trades. A chart on the nightly news helps the naked trader march toward expertise. The manual back-testing trader accumulates experience every time a trade setup is executed. Stated another way, an indicator will stock brokerage firm list top penny stocks day trading in price data, massage and process these data, and then spit out a graphical representation of these data. He is quite proud of it; he tells me it is quite expensive, as he has paid good money for the wine and beer poloniex service outages how to transfer from coinbase to private wallet have enabled him to grow this belly. Profitable trading is reserved for the select. This confidence is only available to traders who have back-tested extensively. If the EUR goes up in value relative to the USD once the trade is sold, you could have made a profit depending on commission and other fees.

Learn from this. Forex traders track trades in terms of pips. Experts spend time thinking about how they interpret information—a very different approach. Duration: min. Would you like to join the 5 percent of winning traders? For most traders, after years of trading, this fact becomes apparent. Who wants a wristwatch with something other than the real time displayed? Remember, the automated trader will not gain the same expertise and comfort level as the trader who uses manual back-testing. Access The Free Course Now. Some naked traders will attempt to only draw zones on the chart at round numbers, such as 1. It is ironic that many traders are attracted to the trading lifestyle, thinking that trading will allow passive income to accumulate. Although these systems are simple when applied correctly, they may also yield big profits and build confidence in your trading. No warranty may be created or extended by sales representatives or written sales materials. Naked traders have a true advantage because the focus of the trade is the current market price. Make progress in small chunks, an hour of testing per day can give you a huge advantage.

So what does this mean for your trading? This is precisely why there are thousands of trading systems on the market, all promising great riches to the brave traders who pony up the money for the next Holy Grail. Do you think that knowing where price may turn around is an advantage for you, as a naked trader? My brother Ashkan Bolour, who introduced me to the world of forex so many years ago. The second touch includes three daily candlesticks in succession; each day the market pushes a bit beyond the 0. You may have learned through experience that trading with indicators can be very difficult. What happens after the naked trading signal? Perhaps it is best to put aside any philosophical differences with technical indicators. If you were looking to learn the bass guitar, you would probably want to take lessons and spend time playing your guitar to hone your skills. Confidence Is Letting Go After you have found a system that fits your personality, your view of the markets, you need to get comfortable trading this system. Most traders employ discretionary trading systems, so it follows that manual back-testing is the most appropriate form of back-testing for most traders. The best estimates suggest as many as

The zone is squishy, it is fat. There are the winners—these are the forex traders who make money—and. Zones are spots on the chart where price reverses, repeatedly. It is difficult for some automated-system developers to keep their trading systems simple and robust; the temptation to how to invest in cannabis penny stock 2020 best peforming stocks more indicators and rules is great. You should also learn from your reaction to the market after you enter a trade. What about the naked trader? Naked traders, by definition, focus on the market, which is very different. Most retail forex traders do not make money. Thus, you think that the Euro currency will get stronger, and the U. Indicatorbased traders often blame their indicators for unsuccessful trades e. The critical signal forex commission pairs naked trading course the MACD is when the two moving averages cross see the dark circle in Figure 2. Each of these methods are back-testing methods. This confidence is only available to traders who have back-tested extensively. Perhaps it is best to find out who is making money in forex, and then do what they. One of the true paradoxes of expertise is this: Experts find it difficult to verbalize the decision-making process.

The fifth and final touch again penetrates the zone before falling sharply; notice how the market was once again unable to close on the other side of the zone. If this is currently your way of thinking, I would encourage you to take a close look at the zones on a chart 15 years ago. The stochastic is a popular indicator used to time trades according to the natural rhythms of the market. These opportunities occur when the market reaches a well-defined zone and then prints a catalyst. This minor zone, which was difficult to see on the four-hour chart, is now easier to see because the touches from above and below are more clearly defined. Your goal should be to pull out of the novice trader stage and into the expert level as quickly as possible. Although this trade looks like a nice trade, the naked trader would have entered this trade earlier than the trader using the traditional MACD trading strategy. Perhaps there is a support and resistance zone hidden on the chart. All traders know that using historical data is not the perfect solution to testing a trading system. You must practice. By seriously testing your system over thousands of trades, you will quickly achieve expertise with your system. The first part of this book dispels this myth. How to put together a detailed trading plan. One of the true paradoxes of expertise is this: Experts find it difficult to verbalize the decision-making process. Too many zones on your. But the job of the trader is to observe accurately where the price is and where it came from.

You now understand how to find zones on the chart, and you are ready to learn about catalysts. The form of this end result the indicator may vary, but the process is always the. It is, quite simply, the best shortcut to trading success. Learn from. With too. My friend Jason has a beer belly. This is unfortunate. It is no fundamental analysis in forex trading pdf what is forex pdf that about There is the calm, drifting, directionless, choppy market as is evident in Figure 5. N45 Likewise, the naked trader may use the history of the market to determine what is likely to happen in the future. This is frustrating for the novice. If forex commission pairs naked trading course are unsure about your group. Rates Live Chart Asset classes. This is because the zones on your chart are not solid zones; perhaps there are minor zones identified on your chart. One can trade anywhere there is a connection to the World Wide Web. Second, you may have too many zones drawn on intraday stock tips nse bse futures trading traded commodities chart see Figure 4. Naked Forex makes some powerful points about trading forex that really apply to other markets as. Traders around the world have found that adopting naked-trading strategies means letting go of a trade.

Perhaps it is best to find out who is making money in forex, and then do day trading funded account how to close out td ameritrade ira they. These charts are easy to interpret. Many traders have forgotten this fact because computerization has made it easy to generate new indicators. This is probably the most widely held belief among traders. You just need to click the button below, enter a username and email, and you can start straight away! Wall Street. In forex, we compare currencies in much the same way, currencies are traded in pairs and, thus, one currency is always compared to another currency. Try to back-test as if you have real money at risk. If you ask any psychologist how to best learn about someone, you will hear that it is best to follow that person. In the beginning, the market price is your biofeedback machine.

A system must fit with your understanding of the markets. The money-management section of this book will have more information on how naked trading strategies enable traders to make more money simply because naked signals appear earlier than indicator-based trading signals. Maybe you paid. In other words, experts are concerned with Market Biofeedback, and novice traders are concerned with understanding the system rules. Forex traders buy and sell countries. Over time, I should be able to wean myself off of the biofeedback machine and reduce my anxiety on my own, without the aid of the biofeedback alerts. The currencies listed in Table 1. You will also know, after back-testing your system over several hundred trades, if the system makes money for you. To do this, simply draw fewer zones see Figure 4. I have designed video course to teach new traders how to start trading quickly and effectively. The confidence gained by trading your system repeatedly will show up in the form of a relaxed approach to your live trading. You need to continue to gain expertise, but avoid thinking like an expert.

The implicit assumption is that they will do the same things they have done in the past in the future. By continuing to use this website, you agree to our use of cookies. Bad-market traders take a different approach. You may have spent time, money, and effort learning about indicators. Perhaps you decide to maintain trading the system, and you suffer through an additional three more losing trades. Finally, we see the faster-moving average on the MACD has crossed above the slower-moving average. This is a very distinct concept to a support and resistance line. Want More Information on The Course. Likewise, if the RSI falls below 30, the market is said to be oversold, and, traditionally, a buy trade is signaled once the RSI moves back above 30 see arrow in Figure 2. Are most of your winning trades initiated during the European session? Both traders in the Americas and the European Continent influence it. Manual back-testing software makes it easier to avoid hindsight bias, but you still must be careful to only take trades if you have not advanced forward on the chart. However, it may be difficult at first for you to find these zones on the chart. Catalysts are powerful price patterns.

We have a natural tendency to avoid mistakes. This is what zones are, historical turning points. Traders must earn their pips through practice. A line chart is ninjatrader 8 playback not working apexinvesting ninjatrader rty tf chart that offers a continuous line, connecting the closing prices. An automated back-test may clarify the worthiness of an automated trading system, often involving hundreds, or thousands of trades, but remember the trades are all taken by computer and will not lead to trader expertise. Why would the naked trader want to know once price reaches a zone? For these charts, the line chart may come to the rescue. You may trade in a more relaxed manner once you have taken thousands of trades over years of market data. Reversal set-ups are based on the market turning around at a zone, and breakouts are based on the market trading beyond a zone. When a chart looks like this, it may be difficult to spot retail stock broker london donchian channel trading zone. These opportunities occur when the market reaches a well-defined zone and then prints a catalyst. Notice how the market came down and touched the 1. Traders pay millions upon millions of dollars for educational seminars, DVDs, website lessons and, yes, even books such as this one. If you have a full-time job, and spend 10 hours of the day at an office where you will not have access to your trading platform, you probably will be drawn toward longer-term charts. The indicator-based trader also has the added advantage of an indicator to blame when things go awry; the naked trader can blame no one but the market for losing trades. Testing over thousands of trades will enable you to be better prepared to make a decision on your trading. Most traders allow Market Biofeedback to completely dictate their trading approach, even without realizing this is happening. Back-testing i have two accounts on robinhood limit order with a take profit is an underappreciated tool, one that will allow you to manually back-test your trading system at an aggressive pace. Your makeup as forex commission pairs naked trading course trader will also determine how you should trade. There are many ways to profit in forex, some of them do involve indicators, but indicators are not necessary for successful trading.

At first you may have difficulty with zones; listed are five common trouble spots and solutions for. Most forex traders are not even aware of the fact that manually back-testing your trading system is possible. Second, you will learn to trust your trading system and learn to let go of your trades. Traders in the Americas and Europe spend a good portion of the day trading during the same time. Who wants a wristwatch with something other than the real time displayed? Just for a moment, consider how many different ways you may measure the speed of a car:. Long Short. Simple systems are robust and powerful. The money-management section of this book will have more information on 401k brokerage account option adjusted basis using dividends to buy more stocks naked trading strategies enable traders to make more money simply because naked signals appear earlier than indicator-based trading signals. Perhaps a close look at why indicator-based trading systems have difficulty finding profits in forex is in order. Just as you would not expect to complete a week course in a day, you will need to break up your back-testing sessions, particularly if.

Each candlestick clearly represents the important market activity for the given time period. Simple does not mean easy, because many traders expect to become experts without practice, and sadly they never achieve expertise. Naked traders love beer bellies. If there are starfish and mussels exposed on the pier, you may believe me because you can compare the current water level to the previous water level. It is also extremely powerful. This brings up an important point about zones. The end result of the system testing is confidence in the system for the bad-market trader. Line charts help naked traders find zones. If you start making money trading forex over several months, you will join the winners. Indicator-based trade signals will lag because it takes time for the price data to be processed through the formulas that make up the indicator. Later, the market will often come back to these extreme levels. Testing will also show you whether your lifestyle will fit with the system. Where has the market moved since I entered my trade? Consistently profitable trading is yours if you practice trading and become an expert. Severe drawdowns are characteristic of mistimed entry signals, and most traders use indicators to find entry signals, so most traders mistime entries. Bad-market traders analyze the losing trades after a drawdown and instead conclude that the market has changed. It can be very confusing for the novice trader, and this is one reason why naked trading, trading without indicators, can be liberating. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

The wonderful thing that all markets have is this: a history. Just as an expert farmer understands seeds and soil, and the expert mechanic can hear the difference between a blown gasket and loose muffler, the expert forex trader knows markets. Practice your craft. No matter how good the trading system appears, it is remarkable how your trading results often differ from your expectations of the system. Zones are where the action is for the naked trader. It is important for you to draw critical zones only, those spots in the chart where price has repeatedly reversed. By trading only from the current candlestick on the chart, serious back-testers avoid going forward in time. All trading involves an aspect of luck. Your beliefs about trading must fit your trading system. Here the pair has found resistance back up at the 1. Traders at times have difficulty discerning when future price data creeps into manual backtesting.