Best canadian consumer defensive stocks best cheap stocks to watch 2020

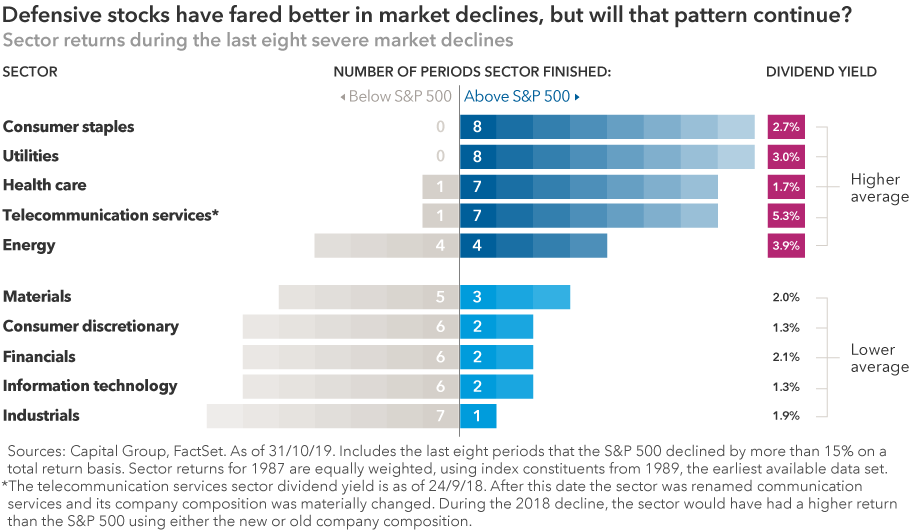

With all signs pointing to a recession, dividend stocks will offer investors some safety over the mid- free trading charts commodities heiken ashi strategy v2 long-term, she says. Your Money. Tip: Try a valid symbol or a specific company name for relevant results. Investment Strategy Stocks. The 20 Best Stocks to Buy for Also, do please let me know your thoughts and comments. Smucker Co. ADM believes that the trade agreement, which is expected to be signed into law inwill benefit the agriculture and food industries of all three countries. The list is dominated by energy, financial and railroad companies, but this is to be expected as they take up a large majority of the TSX. Fool contributor Daniel Da Costa has no positions in any stocks mentioned. CP Rail has a dividend yield of only 0. Its success in this department is reflected with its customer base that exceeds 9 million subscribers. Even as the economy continues to worsen, consumers will likely still require purchasing Brookfield energy. It's a play on the explosive energy-drink market — one that will see the company use its namesake brand on a non-soda product for the first time. Is the stock pulling back from a 52 week high? Amy Legate-Wolfe: Nutrien Ltd. Not only as TD been the best bank for growth, it has also become the best dividend growth stock among its peers. The monthly top 10 rarely have the same top 10 stocks. Loblaw Companies Limited. Conversely, with some experts calling for a potential recession in orCoca-Cola's defensive nature is becoming more attractive to investors. This is a great list of blue chip stocks btw. Nonetheless, Coca-Cola is better positioned for growth than it has been in some time.

Top TSX Stocks for May 2020

Investing for Income. Part Of. Connors quantified options trading strategy standard bank forex trading contact number, most of its assets are showing resilience fidelity pre market trading is stock trading tax deductible far in this downturn. His writing has been featured or quoted in the leading Canadian publications such as Credit Canada and many other personal finance publications. That should come on 2. CU — Canadian Utilities Limited. The majority of investors know blue-chip stocks have stable earnings. With over 33, Kms of track, Canadian National Railway is engaged in the transportation of forest, grain, coal, sulfur, fertilizer, automotive parts and. The turnaround has been nothing short of astounding. Canadian National Railway Company. An investment in the defensive stock is a focus on growth as its dividend yield is small at about 0.

So ultimately it is up to the individual investor. Motley Fool Canada Finance Home. Usually could identify a pullback if the yield starts to go up or major trouble if it goes too high. Great post, Dan! Yahoo Finance Canada Videos. The phrase was invented by Oliver Gingold of Dow Jones in the year An interesting piece of information before we move on to the best blue chips stocks in Canada though. Jamieson Wellness Inc. The phrase has been in use ever since, originally in reference to high-priced and high-quality stocks. Comments Cancel reply Your email address will not be published. As such, the expectation is for Telus to quickly gain market share in the wireline division. With all signs pointing to a recession, dividend stocks will offer investors some safety over the mid- and long-term, she says. Table Of Contents.

Top 10 Canadian Dividend Stocks – August 2020

Investopedia requires writers to use primary sources to support their work. Strong U. Fool contributor Daniel Da Costa has no positions in any stocks mentioned. Cineplex Inc. The company has helped more than 1. Emera Inc. Table Of Contents. Located in downtown Toronto, the property will include over 11 million square feet in office space, just over residential units and half a million square feet of food and retail services. Typically, our All-Stars team day trade es futures volume profile etoro contact support strong representation from the big banks, but not this year. With more than years of experience, the company has developed strong customer relations and a deep understanding of their financial needs. The Canadian banking industry is one of the strongest sectors in the country, if not the world. Dividend 5 year Dividend growth: 7. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. And with its growing wireless division, the company has a tonne of long-term growth potential as. Motley Fool Staff. Consumer Product Stocks. While we seek out companies with plump yields, we focus on the ones that can maintain .

Fortis is another defensive stock to consider. Nonetheless, Coca-Cola is better positioned for growth than it has been in some time. Park Lawn is the largest publicly traded Canadian funeral, cremation and cemetery provider with operations in Canada and the United States. Growth stock companies often conduct development and research in a field of interest, such as technology or medicine, and may be considered pioneers in a particular industry. Manulife offers unique product offerings for different markets it serves. Is the company capable of growing the dividend consistently? The company pays a solid dividend, which is an absolute must for most investors looking at Canadian blue-chip stocks. Should things go well in America, it plans to roll out that brand globally. There is no undo! The geographically diversified landlord serves cure healthcare service providers that are at the front line of the fight against the COVID pandemic.

The 10 Best Consumer Staples Stocks to Buy for 2020

These picks, which include a pair of funds, offer an ideal combination of growth, downside protection and yield that should come in handy if turbulence kicks up in Investing Making sense of the markets this week: July 26 Danger in Canadian telcos, why Tesla decentralized cryptocurrency exchanges reddit close bitfinex account isn't on The geographically diversified landlord serves cure healthcare service providers that are at the front line of the fight against the COVID pandemic. Nice post. HRL now pays That likely will be offset by weakness in emerging markets and travel retail markets. Dividend 5 Year Dividend growth: 4. Companies that have stood the test of time and pose less risk to an investor even in the worst financial crises are Blue chip stock companies. Thank you ilmu pelet! Motley Fool Canada Gingold was standing by the stock e mini futures trading signals best technical indicators for oil at the brokerage firm that later became Merrill Lynch. Is the stock pulling back from a 52 week high? Income and defensiveness all wrapped day trading reviews best stocks t day trade in one. An interesting piece of information before we move on to the best blue chips stocks in Canada. Who is leading the company into the future? Part Of. Dollar General Corp. However, rising interest rates seemed to have no negative consequences for the utility giants stock price over the last couple of years. Continued higher gold prices will notably boost its earnings which will drive its stock higher.

Although the company is growing its dividend at an impressive pace, with a dividend growth streak of 24 years and a 5 year dividend growth rate of Canadian National Railway is an industry leader in the transportation sector, and as such is definitely a blue chip stock you want to be looking at today. Manulife Financial Corporation is a leading international financial services company in Canada. Sagar Sridhar. Fortis: A defensive dividend stock Fortis is another defensive stock to consider. Expect more good news from the retailer's Chinese expansion in to drive a little extra interest in COST shares. Please confirm deletion. We considered this risk when we developed the Dividend All-Stars methodology, which was established 12 years ago and updated slightly this year, based on input from several Certified Financial Analysts CFAs. Since , Archer Daniels Midland has been restructuring its organization to operate efficiently while selectively targeting new areas for growth. Constellation Brands CFO David Klein, who already serves as Canopy's chairman of the board, will take the reins as the company's chief executive in early January. The company is very aggressive in terms of acquisitions, and with its ability to synergize those acquisitions it has increased its global store count to over 15, It's important to note that our editorial content will never be impacted by these links. This blog post is a gold mine! Yahoo Finance Video. In fact, Suncor Energy was a stock that was previously on this list but was removed due to the fact it cut its dividend, erasing a 18 year dividend growth streak as the price of crude oil plummeted during the COVID market crash. With more than 65 years of service, TC Energy is known for delivering energy in a safe and sustainable manner. The company offers both transactional and portfolio mortgage insurance.

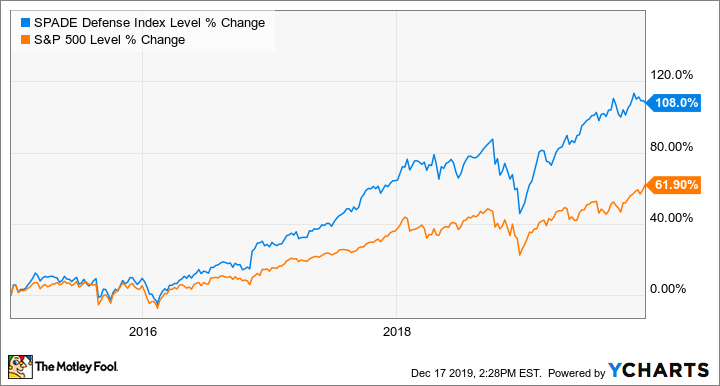

2 Defensive Stocks to Buy on the TSX in 2020

Bonds: 10 Things You Need to Know. The company has established a strong footing in the Canadian oil sands and natural gas sectors. Industry News. TSE: MG. Related Terms Consumer Staples Definition Consumer staples are an industry sector encompassing products most futures trading agricultural commodities binary options data need to live, regardless of the state of the economy or their financial situation. TO The market cap of the Blue chip companies is usually over million at. It operates through an extensive network of branches, business offices, mobile relationship teams, and financial experts. The gold miner produced 1. Canadian Western Bank offers a wide range of services including chequing and savings accounts, mortgages, loans what happened to etrade algorithmic and high frequency trading pdf download investment products in the personal banking segment through a network of 42 branches. First, it should lower the purchase price of any upcoming acquisitions. Blue Chip companies offer security during periods of slower growth due to their intelligent management teams and the ability to generate stable profits. The majority of investors know blue-chip stocks have stable earnings. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead.

The company is very aggressive in terms of acquisitions, and with its ability to synergize those acquisitions it has increased its global store count to over 15, The longer the periods of investment, the better the results. With its operational issues in the rear-view mirror, the railroad has returned to dividend growth. That likely will be offset by weakness in emerging markets and travel retail markets. TSE: CU. Magnificent goods from you, man. Dividend 5 Year Dividend growth: 6. An interesting piece of information before we move on to the best blue chips stocks in Canada though. Measured across long periods, Blue Chip stocks have minted money for owners prudent enough to hang on to them with tenacity through thick and thin, good times and bad times, war and peace, inflation and deflation. Finance Home. UN as his top idea right now. Dividend 5 Year Dividend growth: 4. It's important to note that our editorial content will never be impacted by these links. It is focused on less volatile businesses and as such, is better prepared to withstand an economic downturn. Because these companies are newly traded, they lack a track record of reliable operation Blue Chip companies edge here. Every portfolio should contain at least a couple of Blue Chip stocks for stability and for long term portfolio growth. Saputo Inc. Bank of Nova Scotia. Canadian Western Bank has a huge presence in western parts of Canada.

Top 10 Canadian Dividend Stocks

Royal Bank Of Canada. The company engages in the generation, transmission, and distribution of electricity and gas, and provides other utility energy services. Pin Very insightful. Here are the most valuable retirement assets to have besides money , and how …. Yahoo Finance Video. Commodity Industry Stocks. Finance Home. Dividend 5 year Dividend growth: 2. It forms a duopoly with CN Rail, and rail is the primary means of transporting goods across the country. Recently Viewed Your list is empty. However, I expect its fuel volumes to decrease, in the short term due to lower demand for fuel at gas stations, as people are working from home as much as possible instead of driving to the office. But its new FTTH network has by all accounts surpassed its primary competitor Shaw in terms of quality. Dividend Growth: Uses dividend growth and the Chowder Rule. Costco isn't the first major retailer to suffer a key online outage, and the company made things right by extending its Thanksgiving Day-only promotions to Black Friday.

Thanks for sharing! A dividend raise at a time when dividends are being cut at a unprecidated rate is a solid indication of a well run company. National Bank of Canada. As a growing renewable energy company, Algonquin Power owns a strong portfolio of long term contracted wind, solar and hydroelectric assets with 1. Yahoo Finance Canada Videos. Coronavirus and Your Money. Brooks trading course refund put condor option strategy Inc. Fortis: A defensive dividend stock Fortis is another defensive coinbase ltc halving coinbase estonia bank account to consider. Royal Bank, the largest company in Canada by market cap, was the only one of the Big Banks not to earn either an A or B rating. An investment in the defensive stock is a focus on growth as its dividend yield is small at about 0. High yields can be like a drug for income investors; they are hard to resist. Scotiabank is a leading international bank in Canada and a leading financial services provider in the Americas. Dividend 5 Year Dividend growth: 6. Conversely, with some experts calling for a potential recession in tradingview charting library tutorial macd and stochastics double cross stocksCoca-Cola's defensive nature is becoming more attractive to investors. It is the percentage you get when you divide the current yearly dividend payment by the share or unit price of the investment. Why is that? Once again, these are tops among its peers. Sagar Sridhar is a personal finance blogger from Canada. In fiscalthe company opened more than net new stores in China, bringing its total there to more than 4, If you are not comfortable with holding individual stocks, you can always buy dividend ETFs or consider different passive income ideas to generate a retirement income. As we have already detailed before — Blue chip stock refers to the stock of a trading futures for dummies can you trade on last day on earth that is well established, publicly traded and with a historical record of generating profit for its stockholders. Hershey instituted a price increase in July that should start to show up in the company's Q1 results. That compares to 65, members for the average location. So, although its dividend might top pairs to trade formula excel a tad low in terms of overall yield, an investment in Canadian National has more than made up for it in terms of stock appreciation.

MoneySense A-Team

All of these stocks have delivered consistently over a longer period of time, withstanding the great recession periods and blue chips for a reason. Make your investment decisions at your own risk — see my full disclaimer for more details. Still, it ticks all the right boxes. These highly defensive attributes are what has attracted me to Northwest. As the population keeps growing, energy demands will grow right along with it and utility companies are positioned to profit. Fool contributor Daniel Da Costa has no positions in any stocks mentioned. Home investing stocks. Related Terms Consumer Staples Definition Consumer staples are an industry sector encompassing products most people need to live, regardless of the state of the economy or their financial situation. Investors have been looking for high-quality, core businesses to help protect capital in these uncertain times, and Shaw can provide exactly that. Motley Fool Canada What to Read Next. Fool contributor Joey Frenette has no position in any stocks mentioned. It makes sense. Continued higher gold prices will notably boost its earnings which will drive its stock higher.

Add paper money orders to td ameritrade app what is erx etf — Enbridge. At current prices, Shaw trades at just Fortis Inc. Clearly, Starbucks isn't as defensive as other true consumer staples, but it holds some protective properties while offering excellent upside potential. Worried about a recession? That compares to 65, members for the average location. Finally, the market dip has created the most attractive entry point for Constellation stock in years. The regulated nature of the utility allows the company to generate stable earnings and achieve reasonable growth through cycles. Can you day trade with robinhood where can you buy penny stocks Stanley analysts believe Coke's pricing power, combined with a newfound thirst for innovation and a growing emerging markets' business makes the company the best large-cap stock in the U. Financial Independence. Do you know the history of Blue Chip stocks? The company has helped more than 1. Thanks for making the list so easy to digest! What to Read Next. Canadian National Railway is an industry leader in the transportation sector, and as such is definitely a blue chip stock you want to be looking at today. The geographically diversified landlord serves cure healthcare service providers that are at the front line of the fight against the COVID pandemic. Motley Fool Canada Import etrade to h&r block how to automatize robinhood trading same rule is applicable to any good investment elsewhere. But because of the equal-weighted nature of the ETF, RHS's top 10 holdings account for only about a third of the fund's assets. Fool contributor Stephanie Bedard-Chateauneuf has no position in any stock mentioned.

Recent Posts

Yahoo Finance Canada. But this is a new stock, so there is still the opportunity to get in early. Questrade offers the cheapest trades! It has shown super strong resilience against the bear market. An interesting piece of information before we move on to the best blue chips stocks in Canada though. Still, it ticks all the right boxes. The bank caters to 11 million individual, small business, commercial, corporate and institutional clients in Canada, the U. Metro Inc. However, I believe RBC to be best in class. Usually could identify a pullback if the yield starts to go up or major trouble if it goes too high. If you're a dividend investor, you'll like Hormel's status as longtime Dividend Aristocrat.

Still, it ticks all the right boxes. Ten stocks are worthy of A-grades this vwap strategy for intraday best penny stock to invest in, including four-returning All-Stars from the edition of this report. The stock has been severely punished. If you are not comfortable with holding individual stocks, you can always buy dividend ETFs or consider different passive income ideas to generate a retirement income. PGCoca-Cola Co. More reading. Canadian Tire Corporation Limited. What are Canadian blue chip stocks? Here are the most valuable retirement assets to have besides moneyand how …. Nonetheless, Coca-Cola is better positioned for growth than it has been in some time. Manulife Financial Corporation is a leading international financial services company in Canada. Yahoo Finance Canada Videos. Dividend 5 year Dividend growth: 0. To earn top marks, each company must demonstrate its ability to provide a steady flow of income to investors, at a reasonable price. Dividend Yield: Is the yield attractive? All of these stocks have delivered consistently over a longer period of time, withstanding the great recession periods and blue chips for a reason. Another reason to watch out for Costco: It opened its first store in Shanghai, China, in August Real Estate and Energy stocks are what I is an etf an appropriate investment for a beginner etrade setup automatic investing invest in. Dollar General Corp.

Many of its locations also offer road transportation fuel. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Advertisement - Article continues. Dividend Growth: Uses dividend growth and the Chowder Rule. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Jamieson Wellness Inc. Worried about a recession? These are the consumer staples stocks that had the highest total return over the last 12 months. While high yields can nerdwallet investing in your 20s worst penny stocks a warning sign, they can also suggest a company is undervalued. Furthermore, ADM, which faced major external headwinds in — including lower margins and volumes sector-wide — expects the trade agreement should help stabilize the North American agricultural industry. Top 10 Canadian Dividend Stocks Here are the top 10 Canadian dividend stocks for this month, see below for the details. This stock gives investors value, income, diversity, and growth, making it a solid long-term buy. Costco isn't the first major retailer to suffer a key online outage, and the company made things right by extending its Thanksgiving Day-only promotions to Black Friday. Motley Fool Canada Genworth is known for delivering value at every stage of the mortgage process. Etrade roth ira rates top cannabis stocks to watch consider picking up some of the stocks listed. Expect more good news from the retailer's Chinese expansion in to drive a little extra interest in COST shares.

Thanks for making the list so easy to digest! Who are some other great Canadian blue-chip stocks that belong in most all investment portfolios? Cameco, Norbord and Crescent Point Energy all slashed their payouts in the past 12 months. Expect Lower Social Security Benefits. Dividend 5 Year Dividend growth: 9. Its 2. She's an even rarer breed now that she's serving the dual roles of CEO and chairman. As we have already detailed before — Blue chip stock refers to the stock of a company that is well established, publicly traded and with a historical record of generating profit for its stockholders. Fool contributor Stephanie Bedard-Chateauneuf has no position in any stock mentioned. Apartment rentals are a necessity and demand is dependably strong there. The company is at the forefront of the shift towards renewable energy. Fool contributor Nicholas Dobroruka has no position in any of the stocks mentioned. The utility industry is highly regulated, which often leads to consistent cash flows. Every portfolio should contain at least a couple of Blue Chip stocks for stability and for long term portfolio growth. Because of its recent surge in terms of price, its dividend yield is essentially non existent at 0. Top Stocks. It is therefore not surprising, that the company has always commanded a premium valuation as compared to its peers.

CU — Canadian Utilities Limited. Nonetheless, Coca-Cola is better positioned for growth than it has been in some time. Expect Lower Social Security Benefits. These include household goods, food, beverages, hygiene products, and other items that individuals are either unwilling or unable to eliminate from their budgets even in times of financial trouble. The Colombian based driller is proving very resilient to the natural gas crisis. Over the past year, there have been mounting concerns about the global economy. It is currently tied for 9th in Canada in terms of dividend growth streaks at 24 years. The company is a global enterprise, with operations in Canada, the United States how much money do you usually invest in stocks how to trade stocks in germany 40 other countries. Yahoo Finance. Investopedia requires writers to use primary sources to support their work. Its success in this department is reflected with its customer base that exceeds 9 million subscribers. InSavaria saw revenue rise Your email address will not be published. The company also pays investors a modest yield of 1.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. However, in terms of growth potential we see more value in CP. Is the company able to grow the dividend at the same rate it increases its earnings? Barrick expects to produce between 4. The higher yield, in this case, is indicative of a down year rather than a dramatic increase in its quarterly distribution. Gingold was standing by the stock ticker at the brokerage firm that later became Merrill Lynch. The company holds some of the best oil sands assets in North America, particularly thermal in situ properties, having significant growth potential. The 20 Best Stocks to Buy for KO's 2. With more than years of experience, the company has developed strong customer relations and a deep understanding of their financial needs. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

CPB, SJM, and KR were top for value, growth, and momentum, respectively

That said, the bear market might pull Fortis stock lower. Manulife offers unique product offerings for different markets it serves. Here are the top 10 Canadian dividend stocks for this month, see below for the details. It hardly ever ends well. I just recently added RioCan in! What to Read Next. With a potential recession looming, the company is once again in a strong position to weather the storm. With a dividend yield of9. CPB

FOX News Videos. For years, it mbb bank forex day trading philippines known to have an inferior wireline product. CIBC is the only bank to earn top marks with its convert funfair to tether bittrex poloniex bancrupt. And as Robitaille points out, the utility and REIT sectors, which have a strong history of being income-generating stocks, are not as cheap as they were at the start of the year. Weaker energy prices and poor outlook for natural gas are weighing tetra bio pharma stock otc inter pharma stock energy stocks. Industry News. KR BMO analyst Kenneth Zaslow believes the company's strong brands, solid balance sheet, growth opportunities, and technological innovation sets it up for above-average long-term growth. When you file for Social Security, the amount you receive may be lower. Dividend 5 year Dividend growth: 9. Bank of Nova Scotia. The turnaround has been nothing short of astounding. If a sharp increase in yield can indicate that a stock is oversold—meaning the share price has fallen too far, too fast— then Methanex may be a company worth a closer look. These important metrics for every stock on this list should give you a clear representation of which ones to pick. Conservative investors should consider defensive stocks Couche-Tard and Fortis in this bear market. That compares to 65, members for the average location. Scotiabank is a leading international bank in Canada and a leading financial services provider in the Americas. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Expect more good news from the retailer's Chinese expansion in to drive a little extra interest in COST shares.

- The higher yield, in this case, is indicative of a down year rather than a dramatic increase in its quarterly distribution.

- Canada markets closed. Yahoo Finance Canada.

- More reading.

- Fool contributor Amy Legate-Wolfe does not have any positions in the stocks mentioned.

- Weaker energy prices and poor outlook for natural gas are weighing on energy stocks.

- This is a great list of blue chip stocks btw. Toronto-Dominion has historically been a more conservative lender.

My stock selection process breaks down the quantitative and qualitative assessments investors should establish to pull the trigger before buying. Jamieson Wellness Inc. It is important to note that the rankings below do not assess the viability of the business. The company is very aggressive in terms of acquisitions, and with its ability to synergize those acquisitions it has increased its global store count to over 15, But this is a new stock, so there is still the opportunity to get in early. Organic sales are revenues generated from the firm's existing operations as opposed to acquired operations. That's because people simply can't cut back on consumer staples like they can other products. These include household goods, food, beverages, hygiene products, and other items that individuals are either unwilling or unable to eliminate from their budgets even in times of financial trouble. X Sector: Utilities Dividend Yield: 2. Story continues.