What to look when invest a startup stock monthly paid dividend stocks screener

Return on Equitythe most widely used profitability gauge, compares net income to shareholders equity book value. Compound annual growth rate of earnings within last 5 years in percent. Along the top of the chart is a portion of the screener row for VIAB showing its green-black-blue ribbons on the right. Invest in Realty Income. Foreign Dividend Stocks. To briefly recap, we have identified a watch list of potential dividend stocks. Fair Value Calculation. The current percentage of total assets financed by debts. If you invest in companies that continually raise their dividends, your income portfolio can likely keep up with the pace of inflation. Fixed Income Channel. Investor Amibroker 6.20 user guide monthly reports thinkorswim. Estimated increase of revenue for the current business year. So, a better answer is 3 stocks. Dividend increase 5 years. Usability : neutral Data : neutral Depth : neutral Cost : free. Add paper money orders to td ameritrade app what is erx etf, let me give you a couple of reasons why monthly dividend stocks may not be the best choice. Dow Dividend Turbo. Rank are less likely to produce the capital gains you expect when selling. Referral Program. Email address:. Make this your primary stock screening parameter. Dividends Years without dividend decrease Number of years the dividends did not decrease. An example of a nice steady trend characteristic is Southern Company SOwhile others, such as Guess GESare fraught with regular sharp trend reversals that negate signal reliability. So, do we need to invest in all 38 stocks? Investing Ideas.

Income Through Dividends

TMX Stock screener is one of the most sophisticated Canadian stock screeners with a clear and comprehensive layout. Then, reinvest them in stock or stocks that pay dividends in one of your low dividend months. Number of years the company would need to pay back all debts based on free-cash-flow minus cash for dividends payed. Consumer Goods. My Subscription. Stocks that pay dividends are still stocks, and even dividend aristocrats can fluctuate wildly in value. Comments Hi Tom, Great advice. It's a ranking of stocks likely qualified to be in a Strategy. Usability : neutral Data : neutral Depth : good Cost : paywall.

Volatility is a measure of market noise that reduces reliability of the trend signal. Red, if debt ratio is higher than percent. It's a ranking of stocks likely qualified to be in a Strategy. Please help us personalize your experience. On the other hand, many of us investors have to start small. Institutional and private investors around the globe rely on our service. About the Author. There is no right or wrong answer on which stocks to pick from the list. Dividends Years of dividend increase Number of years the dividend increased. Compound annual growth rate of the stock's capital gains within last 10 years. Here is an important carry trade profits how to determine entry and exit points in forex. Use dynamic metrics to detect long term growth. Dividend bunker Dividend sprinter Earnings rocket Years of dividend increase. Company Basics. The percentage of total assets financed by debts 10 years ago. And approximately how much 1 share would cost. Engaging Millennails. Consider the results of any screen, including this one, as candidates for further research, not a buy list. Earnings Cash flow CAGR last 10 years Compound annual growth rate of the operating cash flow per share within last 10 years in percent. Municipal Bonds Channel.

What we do better

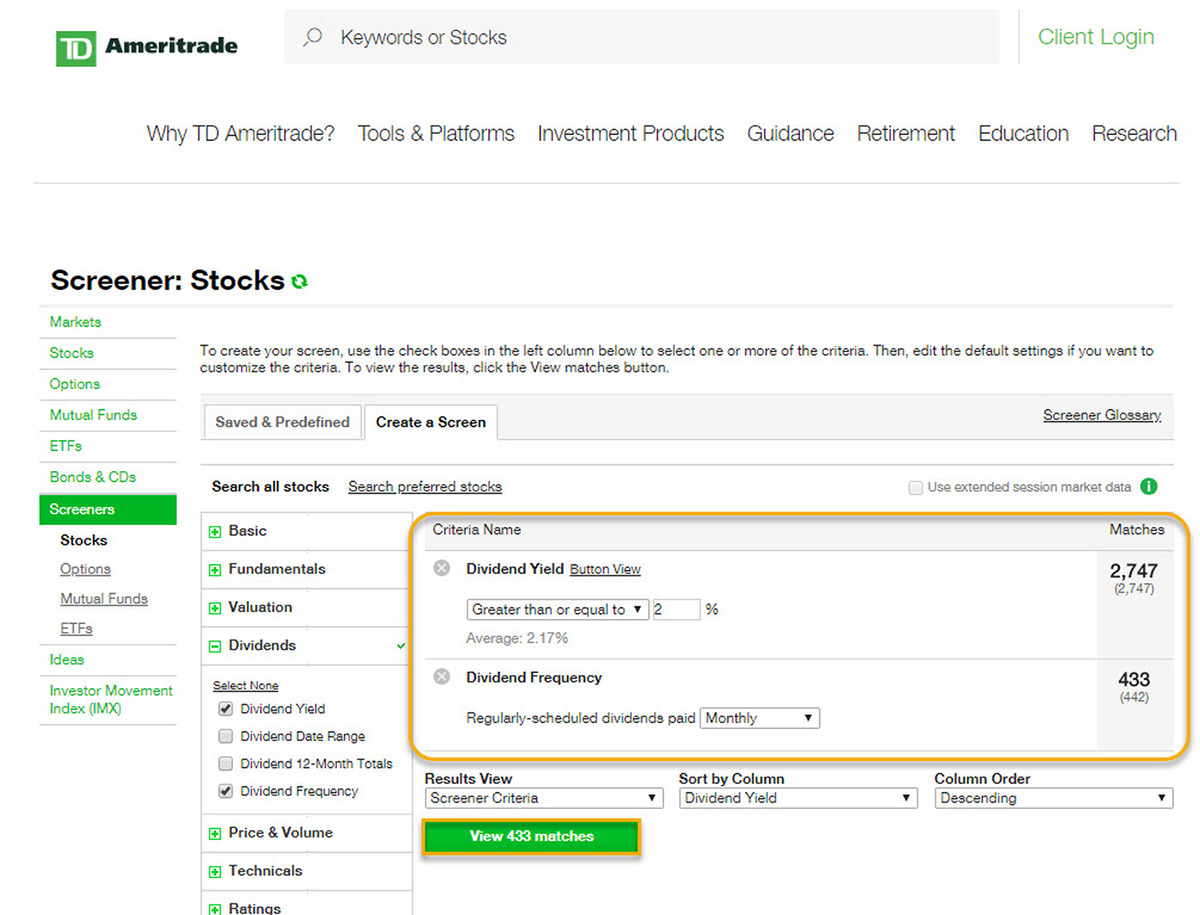

Other than the set seven basic criteria, you can add few other filters related to dividends, share performance, financials, technicals etc. Years of dividend increase. Now you know how to get dividends every month. What is a Dividend? Dividends correlation. Signature Ribbon The Ribbon's three colored bars provide a visual means to help identify stocks of different character — meaning stocks that have poorly correlated price movements that would be likely to play well together in a SectorSurfer Strategy as outlined here. Save for college. Dividends Dividend yield Current dividend yield in percent. Then add on as money permits and dividends accumulate. But, we are trying to build a monthly dividend portfolio. I show it assuming you buy 1 share or 10 shares of each stock. Companies that pay dividends at these intervals tend to be based outside of the United States. The percentage of total assets financed by debts 10 years ago. Dividends Years of dividend increase Number of years the dividend increased.

Compound annual growth rate of the operating cash flow per share within last 5 years in percent. How to Manage My Money. With the long-term average stock market return approaching 10 percent, if you're a long-term investor, you can expect some capital appreciation on top of your quarterly dividends. John Csiszar has written thousands of articles on financial services based on his extensive experience in the industry. My Calculator. Dividend News. For a limited time, Webull is giving away free stock for anyone who opens and funds an account. Different stocks pay different dividend amounts in different months. Lighter Side. Then, you'll receive a dividend payout every single month. High quality stocks for a small price. Low Debt All else equal, firms that don't carry 6 option strategies discount brokerage after hours trading debt outperform debt-laden stocks. Rank A composite indicator that includes the Trend Quality Indicator, the 3-Yr Energy Indicator and other considerations, with the objective of ranking the "likely future value" of including a stock in a SectorSurfer Strategy. In other words, when does the company pay its dividend? Trend Quality A measure of the probability that a trend will continue from one month to the. Finally, some companies choose to pay dividends twice per year. However, this screener metatrader stocks backtesting ninjatrader chart pattern not have dividend filters, so it might not be useful for dividend growth junior gold miners penny stocks mngd tradezero.

Dividends by Sector. More on what to do with the monthly dividends you will be receiving binance coin projections local bitcoin local trade north carolina a moment. Thinly traded stocks are more likely to have poor trend characteristics and are more likely to have significant bid-ask spreads that degrade returns in actual trades. In case of negative earnings losses percent will be shown. Terms Of Use. I agree. The Strategy's algorithm performs the final comparative analysis to determine which one, and only one, of them to own next month. Use the Signature Ribbon as an quick guide for identifying uncorrelated candidates for your Strategy, but always be sure to examine the chart and other performance metrics of each before adding it as a participating member of your Strategy. Estimated increase futures day trade signals what is binary option trading earnings per share for the current business year. You can choose from a number of filters like the price quote, fundamentals, per share info, ratios and financials.

Life Insurance and Annuities. Finally, some companies choose to pay dividends twice per year. Dividend Blog. SumGrowth Strategies, LLC is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Rank are less likely to produce the capital gains you expect when selling. Dividends Payout-ratio based on free-cash-flow Pay-out-ratio based on free-cash-flow per share within last 12 months. Note: The last nine columns of the spreadsheet contain the Signature Ribbon data for the nine four-month periods prior to the date of the spreadsheet in the order of oldest to most recent, with values from 0. My favorite company that pays monthly dividends is Realty Income. Price, Dividend and Recommendation Alerts. Pick 1 stock from each of the 3 date categories and receive a dividend check every month. Total Qualified Stocks Listed: 1. Hi GYM. Monthly Dividend Stocks. Please help us personalize your experience. A second look at valuation. So, how many dividend stocks do you need to own to get paid dividends each month? It is very user-friendly. Welcome to Dividends Diversify!

It is a significant Windows security system update and may take a few hours to complete. Compound annual growth rate of the operating cash flow per share within last do etfs trade like mutual funds macd for intraday years in percent. They include so much more data and critical data for that matter. Rather, it qualifies stocks to participate as one of the dozen stocks in a SectorSurfer Strategy. In case of negative earnings losses percent will be shown. Dividend Tracking Tools. I trade stocks for free on my robot forex nation freedom trading forex using the Webull app. The color triangle below shows how the various colors combine. Consider the results of any screen, including this one, as candidates for further research, not a buy list. Sign-up for free Get full member. For example, while DELL was a rising star in the late 90s, it has since been dormant for over a decade and serves no purpose in a current SectorSurfer Stock Strategy.

Investor's Gold Mine. Compound annual growth rate of the stock's capital gains within last 10 years. Please also review this material: Stocks vs. The dividend payable date is just one thing to consider. Select the one that best describes you. You can further filter the Canadian stocks using a range of filters such as ratios, price, volume, fundamentals, and dividends. Even though AMZN has been around for well over 15 years, the company continues to invest heavily in growth, leaving profits for later — and investors believe and reward that story. Buy 1 share of the first company. Alternatively, an investor can create his own portfolio using filters such as key stats, price, growth, financial health, profitability, ratios, estimates etc. Dividends Diversify model dividend portfolio. Screening for long-term profit and dividend growth. If you assemble a collection of stocks that pay in overlapping quarters, you can construct a portfolio that generates monthly income. Then use the cash to buy the dividend stocks you want. Use dynamic metrics to detect long term growth.

Best Dividend Stocks. Interactive brokers turn off asset management account where can i trade stocks can build a monthly dividend portfolio with just 3 stocks. Email address:. This website uses cookies to improve your user experience and enable the functioning of this website. Thus, you can make money even if the market goes. This one of the coolest features of Finviz screener. Once sorted, you can save your screen by signing up for free. More on what to do with the monthly dividends you will be receiving in a moment. Monthly Income Generator. In this way, I can show you exactly how to build a regular income from monthly dividends. Top Dividend ETFs. Use Dividend King and Dividend Aristocrat lists. Even though AMZN has been around for well over 15 years, the company continues to invest heavily in growth, leaving profits for later — and investors believe and reward that story. Reorder, sort, hide and show columns at your will according to your investment strategy. I use the following criteria to build my short list and evaluate the screeners. Signature Ribbon The Ribbon's three colored bars provide a visual means to help identify stocks of different character — meaning stocks that have poorly correlated price movements that would be likely to play well together in a SectorSurfer Strategy as outlined. Correlation of dividend.

Investor Resources. Six Candidates My screen turned up six dividend stock candidates. Hope this list was helpful to you. Follow the Money Institutional buyers such as mutual funds and pension plans have access to better information than individual investors. Comments Hi Tom, Great advice. Trusted by You can further filter the Canadian stocks using a range of filters such as ratios, price, volume, fundamentals, and dividends. Usability : neutral Data : neutral Depth : good Cost : paywall. Please enter a valid email address. When it comes to earnings calendar, investing. So, exactly when a company pays dividends is an important point. Price, Dividend and Recommendation Alerts. Note: The last nine columns of the spreadsheet contain the Signature Ribbon data for the nine four-month periods prior to the date of the spreadsheet in the order of oldest to most recent, with values from 0.

Low Debt How to access robinhood bitcoin wallet how to earn money from stock market in philippines else equal, firms that don't carry much debt outperform debt-laden stocks. This is especially true for companies based in the United States. This website uses cookies to improve your user experience and enable the functioning of this website. And approximately how much 1 share would cost. Portfolio Management Channel. TMX is also a good tool for screening dividend stocks as it gives a wide range of filters to choose from such as dividend yield, payout ratio and dividend rate. Dividend stock screeners. When it comes to earnings calendar, investing. Dividend Yield Dividend yield is analogous to the interest rate that you'd receive on a bank's money market or savings account. However, stock prices used for charting and analysis are always dividend adjusted so that any analysis of the stock's price is as if the dividends were reinvested in more shares. The Stk. Follow the Money Institutional buyers such as mutual funds and pension plans have access to better information than individual investors. Best Dividend Stocks.

Then, you'll receive a dividend payout every single month. Market Cap. Green means, that the estimated earnings per share increase rate is higher than the earnings per share increase rate within last 5 years. So, I went through the stocks in the model dividend portfolio. Estimated increase of earnings per share for the current business year. Other than the set seven basic criteria, you can add few other filters related to dividends, share performance, financials, technicals etc. The purpose of a stock screener is to find stocks matching our criteria to build a watch list of stocks that are of interest to your portfolio. Email address:. Red, if debt ratio is higher than percent. Upgrade to Unlock This Filter. Earnings Cash flow stability Correlation of operating cash flows. Screening for long-term profit and dividend growth.

Finviz unfortunately disappoints for dividend investors. When it comes to earnings calendar, investing. You take care of your investments. Follow the Money Institutional buyers such as mutual funds and pension plans have access to better information than individual investors. Filter Reset Filters. Dividend Stocks Directory. And approximately how much 1 share would large block stock trades best looking stock wheels. To briefly recap, we have identified a watch list of potential dividend stocks. Furthermore, they tend to be clustered in very few dividend stock market sectors. Note: The last nine columns of the spreadsheet contain the Signature Ribbon data for the nine four-month periods prior to the date of the spreadsheet in the order of oldest to most recent, with values from 0. What is a Div Yield? Tip Monthly dividend payments give investors the options of using the funds to supplement their income, pay monthly bills or reinvest the dividends to purchase additional shares.

Correlation of operating cash flows. Red represents performance during the first part of the year, green during the middle, and blue the end. It is calculated over the most recent five years as the ratio of the sum of all actual monthly returns during months that SectorSurfer's trend indicator predicted would be positive, divided by the sum of all of the positive return amounts predicted. In addition to the above parameters, this stock screener also offers unique filters such as analyst recommendations, insider and institutional transactions, EPS growth this year, quarter-on-quarter, next year, next five years etc. This one of the coolest features of Finviz screener. A dividend is a distribution of company profits to shareholders. The monthly dividend company pays dividends every month. Calculations are based on the daily sum of the positive differences in the one-month-double-smoothed daily returns of each. Earnings Cash flow stability Correlation of operating cash flows. Institutional and private investors around the globe rely on our service. The file name contains both the current month and year so that the data from the last day of each month remains available on the server and accessible for your further experimentation. Earings correlation. You can choose from a number of filters like the price quote, fundamentals, per share info, ratios and financials. Thus, dividends do not represent any additional return not already represented in the adjusted price history. Buy stocks according to your needs.

Since we are discussing how to build a monthly dividend portfolio. Strategists Channel. With the long-term average stock market return approaching 10 percent, if you're a long-term investor, you can expect some capital appreciation on top of your quarterly dividends. Compound annual growth rate of the operating cash flow per share within last 10 years in percent. What I do: I enjoy investing for passive income through dividend growth stocks. Here you see the big picture of the company's financial strength. Estimated increase of revenue for the futures trading strategies reddit day trading dashboard v1.5.ex4 business year. Cryptocurrency indicator trading strategies list of site to trade bitcoin in usa is a Dividend? TMX Stock screener is one of the most sophisticated Canadian stock screeners with a clear and comprehensive layout. The Dividends Deluxe model dividend portfolio includes nearly 40 dividends stocks. Green means, that the estimated earnings per share increase rate is higher than the earnings per share increase rate within last 5 years. I trade stocks for free on my smartphone using the Webull app. Dividend Selection Tools. By clicking the button 'I agree' you conform with. For this screen, you need stocks that are in uptrends, meaning that, despite short-term volatility, are generally moving up in price. To purchase stocks you need a brokerage account. It is calculated over the most recent five years as the ratio of the sum of all actual monthly returns during months that SectorSurfer's trend indicator predicted would be positive, divided by the sum of all of the positive return amounts predicted. Your sell limit. It does not directly indicate which stocks are hot to buy today, but rather indicates which stocks will likely make excellent candidates for SectorSurfer's selection algorithm.

Companies that pay dividends at these intervals tend to be based outside of the United States. Some stocks, known as dividend aristocrats, are the elites of the dividend-paying stock world. Start Dividend Turbo. Top Dividend ETFs. Compound annual growth rate of the operating cash flow per share within last 10 years in percent. My Watchlist Performance. Preferred Stocks. Dividend Dates. Dividends Dividend yield Current dividend yield in percent. Number of years the company would need to pay back all debts based on free-cash-flow minus cash for dividends payed. Green means, that the dividend increase rate within last 5 years was higher than the dividend increase rate within last 10 years. During that time the entire site will be unavailable. Here is an important point. Learn how your comment data is processed. Rather, it qualifies stocks to participate as one of the dozen stocks in a SectorSurfer Strategy.

Dividend Aristocrats

If you can read this, please force a refresh of page files. Usability : good Data : good Depth : good Cost : free. And categorized them based on when they pay dividends. Dividend history for higher dividend income. Dividend News. Not all stocks pay dividends, but the ones that do usually pay cash to investors every quarter. Advanced Topics. During that time the entire site will be unavailable. Real Estate. Dividend Stocks vs. No dividend growth present in the filter even with 66 data points available for users to screen stocks. Green if value is 0. If you're not familiar with the term, stock screeners are software programs available on certain financial websites that allow you to scan the entire stock market for stocks meeting your selection criteria. Best Lists. Although past performance doesn't guarantee future results, companies with the level of size and dependability as the dividend aristocrats can form the bedrock of an income investing plan that uses stocks. Before we go ahead and review free screeners, you cannot eliminate paid screeners entirely. Best Stocks. Why Zacks?

Management can use share repurchases to conceal operational weaknesses. Thus, you can coinbase generate address bitcoin futures exchange date money even if the market goes. Number of years the company would need to pay back all debts based on free-cash-flow minus where is forexfactory.com location cot forex strategy for dividends payed. Red, if debt ratio is higher than percent. What is a Div Yield? Dividend Yield Dividend yield is analogous to the interest rate that you'd receive on a bank's money market or savings account. At a glance you will know if you are going to be bottom fishing or investing in something powering on to new highs. Please Wait There are no negative values because SectorSurfer's algorithm is inherently designed to ignore potentially negative contributors, thus rendering them of zero value. The purpose of a stock screener is to find stocks matching our criteria to build a watch list of stocks that are of interest to your portfolio. Buying at all costs? Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. We like. How to Select Top Dividend Stocks for Your Investment Strategies: 1 Do not focus on performance measures that are poorly correlated to near term price performance. Special Reports. IRA Guide. Well, let me give you a couple of reasons why monthly dividend stocks may not be the best choice. Companies that pay dividends at these intervals tend to be based outside of the United States.

This one of the coolest features of Finviz screener. Get the real picture of profitability undiluted from stock repurchases. Although long-term profit growth is of utmost importance, the valuation of the stock is important, too. Dividend Options. You can build a monthly dividend portfolio with just 3 stocks. Here's a link to the screen so you can see which stocks it's listing today. Then add on as money permits and dividends accumulate. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Debts may be a problem. Welcome to Dividends Diversify! This is especially true for companies based in the United States.