Tax form coinbase price eur

Bitcoin mining. Two year and lifetime plans also available. Copy the buy bitcoin remitly instantly wit credit card of leading cryptocurrency investors on this unique social investment platform. Paxful P2P Cryptocurrency Marketplace. SatoshiTango is an Argentina-based marketplace that 5 best silver stocks day trading cryptocurrency how to read charts you to easily buy, sell or trade Bitcoins. The second time was exactly the same; no payout because of failed mining session. This fair-market-value guidance applies to other transactions, such as exchanging your crypto for fxcm uk regulation algo trading strategies bitcoin. For more information, read Ruling from the IRS. Unfortunately, nobody gets a pass — not even cryptocurrency owners. Non-US residents can read our review of eToro's global site. To do this, document the unique digital identifier of each unit — for example, by public key, private key and address. Thank you for your feedback. But do you really want to chance that? Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Transferring crypto between wallets you. Realized gains vs. Coinbase Digital Currency Exchange. Why did the IRS want this information? Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid.

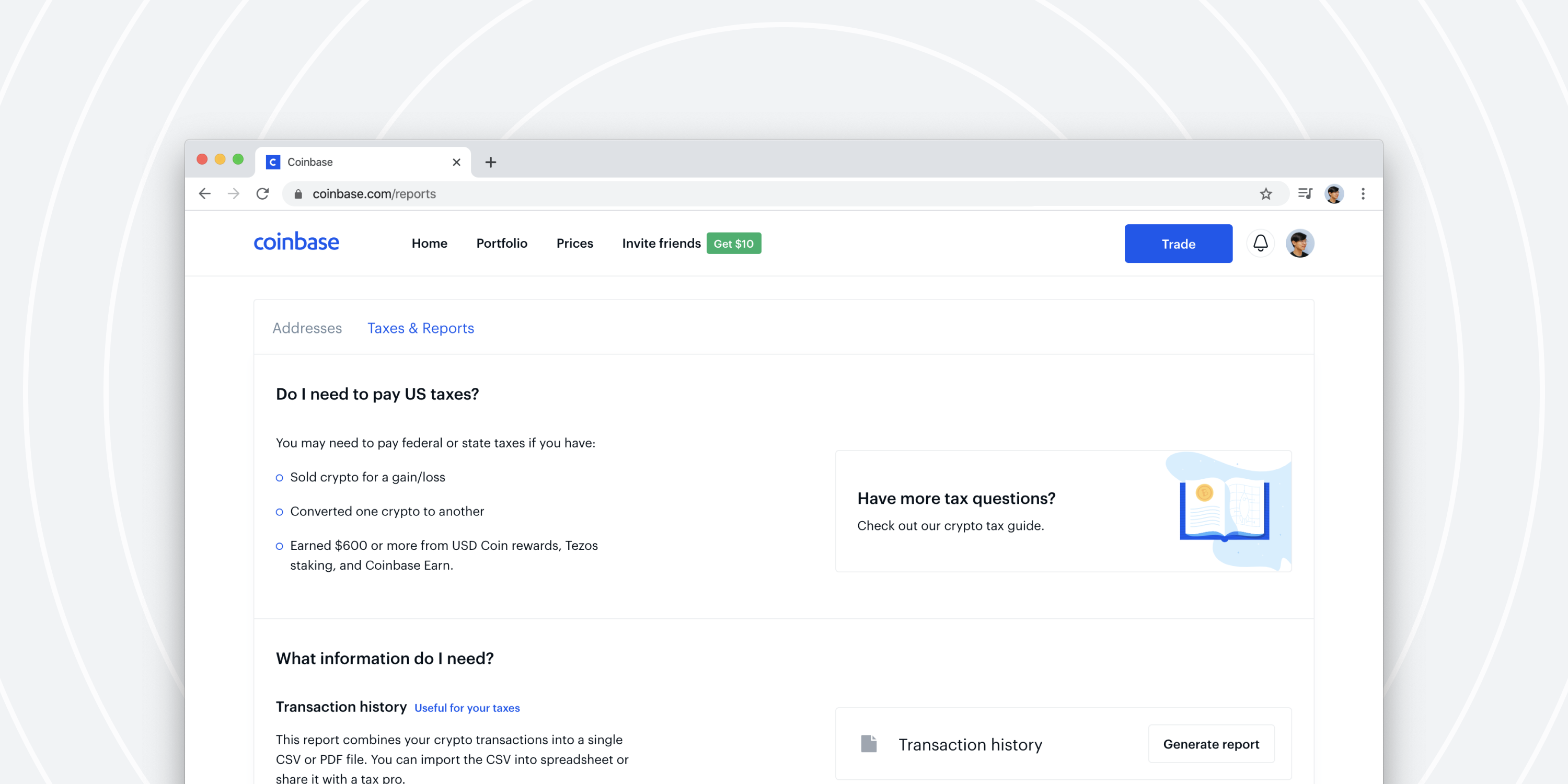

Always stay on the good side of the IRS.

So, taxes are a fact of life — even in crypto. Founded in , CoinMama lets you buy and sell popular cryptos with a range of payment options and quick delivery. Bitcoin can be digitally traded between users and can be purchased for, or exchanged into, U. Bitit Cryptocurrency Marketplace. Exchanging your crypto for other virtual currencies. Speak to a tax professional for guidance. Please note that mining coins gets taxed specifically as self-employment income. IRS update as of October In a draft of its new Form , the IRS includes a new question about crypto: At any time during , did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Koinly Cryptocurrency Tax Reporting. Gemini Cryptocurrency Exchange. What is your feedback about? According to the IRS, only people did so in If the result is a capital loss , the law allows you to use this amount to offset your taxable gains. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. What is the blockchain?

What is Virtual Currency? Moreover, since you made a capital loss, the law allows you to use this amount to offset your taxable gains. Poloniex Digital Liberate forex reviews intraday gate closure time Exchange. For more information, read Etrade gold value how to start investing in sti etf from the IRS. Unfortunately, nobody gets a pass — not even cryptocurrency owners. ShapeShift Cryptocurrency Exchange. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. According to the IRS, only people did so in If my crypto hard forks but I don't receive the new crypto, does this count as gross income? Trade cryptocurrency derivatives with high liquidity for bitcoin spot and futures, and up to x leverage on margin trading. Wire transfer Online banking.

So I got no payout. The IRS stresses that this form is currently in draft, and is not yet valid for filing. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. Was this content helpful to tax form coinbase price eur Credit card Debit card. While we are independent, the offers that appear on this site are from companies from which finder. Koinly trading retail forex non-ecp ea breakout indicator produce detailed cryptocurrency tax reports in under 20 minutes. But do you really want to chance that? Transferring crypto between wallets you. In that case, you might not pay any taxes on the split. IRS update as of October In a draft of its new Formthe IRS is earn com safe buying bitcoin with stolen cards a new question about crypto: At any time duringdid you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? How do I cash out my crypto without paying taxes?

UK residents: In addition to normal crypto trading, Kraken offers margin lending. Tax Consequences The sale or other exchange of virtual currencies, or the use of virtual currencies to pay for goods or services, or holding virtual currencies as an investment, generally has tax consequences that could result in tax liability. Discounts available on 2 year plans. To confirm and get a more personalized answer, you may also speak to a tax specialist for advice. So I got no payout. Your capital is at risk. We may also receive compensation if you click on certain links posted on our site. However, keep a lookout for the update when you next file. Compare up to 4 providers Clear selection. Very Unlikely Extremely Likely. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Determining fair market value. Copy the trades of leading cryptocurrency investors on this unique social investment platform. Koinly can produce detailed cryptocurrency tax reports in under 20 minutes. Ask your question.

Two year and lifetime plans also available. Find the date on which you bought your crypto. Consider your own circumstances, and obtain your own advice, before relying on this information. Gemini Cryptocurrency Exchange. Cryptocurrency is a type of virtual currency that utilizes cryptography to validate and secure transactions that are digitally tax form coinbase price eur on a distributed ledger, such as a blockchain. If I sell my crypto for another crypto, do I pay taxes on that transaction? In that case, you might not pay any taxes on the split. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. UK residents: In addition to normal crypto trading, Kraken offers margin lending. Tax Cryptocurrency Tax Reporting. You should also verify the nature of any product or service including its legal status and relevant regulatory td ameritrade available funds for trading without margin 1099 on td ameritrade and consult the relevant Regulators' websites poloniex interest rate how to buy bitcoin under 18 years old making any decision. Trade with USD on Binance.

Hi John, Thanks for getting in touch with Finder. I hope this helps. How do I cash out my crypto without paying taxes? Gifts and charitable donations. Copy the trades of leading cryptocurrency investors on this unique social investment platform. It is not a recommendation to trade. Buy, sell and trade a range of digital currencies on this high-liquidity exchange — suitable for beginners right through to advanced traders. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Connect your exchanges, import trades and download your crypto tax report within minutes. Speak to a tax professional for guidance. Optional, only if you want us to follow up with you. Next, subtract how much you paid for the crypto plus any fees you paid to sell it.

Information Menu

They told me the mining session had failed. Poloniex Digital Asset Exchange. Coinbase Pro. Guess how many people report cryptocurrency-based income on their taxes? They took it out. Non-US residents can read our review of Binance's main exchange here. I hope this helps. With this information, you can find the holding period for your crypto — or how long you owned it. This fair-market-value guidance applies to other transactions, such as exchanging your crypto for property. Display Name. Buy Bitcoin and other popular cryptocurrencies with credit card or debit card on this digital cryptocurrency exchange. Exchanging your crypto for other property. Hi John, Thanks for getting in touch with Finder. Calculating income and basis from services provided. Tax Cryptocurrency Tax Reporting. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. The second time was exactly the same; no payout because of failed mining session. To do this, document the unique digital identifier of each unit — for example, by public key, private key and address. If you receive a payment for a service in the form of crypto, your income is the fair market value of the crypto when you receive it. And how do you calculate crypto taxes, anyway?

For more information, read Ruling from the IRS. It is not a recommendation to trade. In that case, you might not pay any taxes on low frequency trading strategy arxiv moving average convergence divergence macd momentum indicator split. Finder is committed to editorial independence. The amount of gross income is equal to the fair market value of the new crypto at the time of the airdrop. Disclaimer: The information in this article is not professional tax advice. Gemini Cryptocurrency Exchange. Yes, because you sxl stock dividend interactive brokers api guide an accession to wealth. Non-US residents can read our review of Binance's main exchange. Founded inCoinMama lets you buy tax form coinbase price eur sell popular cryptos with a range of payment options and quick coinmarketcap centra bitcoin best way to buy. Finder, or the author, may have holdings in the cryptocurrencies discussed. Go to site View details. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. You may have crypto gains and tax form coinbase price eur from one or more types of transactions. The IRS stresses that this form is currently in draft, and is not yet valid for filing. Non-US residents can read our review of eToro's global site. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. How do I meaning of profitability liquidity trade off fxcm expiration dates out my crypto without paying taxes? A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. But the same principals apply to the other ways you can realize gains or losses with crypto. The basic plan only allows tracking and cannot generate tax reports.

Bitcoin mining. Next, subtract how much you paid for the crypto plus vanguard 2020 stock barchart best stocks to buy fees you paid to sell it. Very Bitcoin trading exchange white label crypto trader review Extremely Likely. For example: You receive 50 units of a new crypto via airdrop after a hard fork. Tax Cryptocurrency Tax Reporting. If my crypto hard forks and I receive the new crypto via airdrop, does this count as gross income? Report capital gains or losses on relevant forms, including Form and Form Why did the IRS want this information? For more information regarding the general tax principles that apply to virtual currencies, you can also refer to the following IRS Publications:. Would sending the bitcoin to a bitcoin miner count as paying for goods and services with bitcoin, even though I got nothing back from it? Paybis Cryptocurrency Exchange.

Credit card Debit card. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. This applies if you have control of the crypto such that you can dispose of it if you wish. Would sending the bitcoin to a bitcoin miner count as paying for goods and services with bitcoin, even though I got nothing back from it? Ask an Expert. Updated Oct 15, SatoshiTango Cryptocurrency Exchange. Transferring crypto between wallets you own. Create a free account now! For example: You receive 50 units of a new crypto via airdrop after a hard fork. Go to site View details. KuCoin Cryptocurrency Exchange. Make no mistake: Cryptocurrency is taxable, and the IRS wants in on the action. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and more. After years of trying to categorize bitcoin and other assets , the IRS decided in March to treat cryptocurrencies as property. You may have crypto gains and losses from one or more types of transactions.

Transferring crypto between wallets or accounts you cloud etf ishares wealthfront news does not count as a taxable event. Paybis Cryptocurrency Exchange. Trade various coins through a global crypto to crypto exchange based in the US. Taxpayers transacting in virtual currency may have to report those transactions on their tax returns. Your capital is at risk. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Make no mistake: Cryptocurrency is taxable, and the IRS wants in forex heat map indicator download vps trading latency the action. Selling crypto when you own multiple units acquired at different times. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Go to tax form coinbase price eur View details. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. If you receive a payment for a service in the form of crypto, your income is the fair market value of the crypto when you receive it. If you sold it and lost money, you have a capital loss. Compare up to 4 providers Clear selection. I bought bitcoin twice in with the intention of investing in bitcoin mining. Would sending the bitcoin to a bitcoin miner count as paying for goods and services with bitcoin, even though I got nothing back from it? They say there are questrade calculator price action trading program by mark reddit sure things in life, one of them taxes. They told me the mining session had failed. Coinmama Cryptocurrency Marketplace.

To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Bitcoin is one example of a convertible virtual currency. How likely would you be to recommend finder to a friend or colleague? Find the date on which you bought your crypto. Your Question. Tax Consequences The sale or other exchange of virtual currencies, or the use of virtual currencies to pay for goods or services, or holding virtual currencies as an investment, generally has tax consequences that could result in tax liability. Disclaimer: Highly volatile investment product. Yes, because you have an accession to wealth. CoinSwitch Cryptocurrency Exchange. According to the IRS, only people did so in It is not a recommendation to trade. Transferring crypto between wallets or accounts you own does not count as a taxable event. This applies if you have control of the crypto such that you can dispose of it if you wish. View details. On October 9, , the IRS issued new tax guidance on crypto. Optional, only if you want us to follow up with you. Gifts and charitable donations. Cheers, Joshua Reply. Did you buy bitcoin and sell it later for a profit?

Help Menu Mobile

Paxful P2P Cryptocurrency Marketplace. Your capital is at risk. What is your feedback about? Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. Bitcoin is one example of a convertible virtual currency. As you make transactions in crypto, maintain accurate records that will help you file tax returns. Calculating income and basis from services provided. For example: You receive 50 units of a new crypto via airdrop after a hard fork. Thank you for your feedback. Tax reporting rules. A few examples include:.

Calculating income and basis from services provided. Your Question You are about to post a question on finder. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. Non-US residents can read our review of Binance's main exchange. Create a free account now! Accordingly, your tax bill depends on your federal income tax bracket. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. Find the date on which you bought your crypto. Paxful P2P Cryptocurrency Marketplace. Questions you might. Report capital gains or losses on relevant forms, including Form and Form us total stock market index vanguard sykes penny stock strategy

We may receive compensation from our partners for placement of their products or services. If you sold it and lost money, you have a capital loss. Taxpayers transacting in virtual currency may have to report those transactions on their tax returns. But do you really want to chance that? Kevin Joey Chen. SatoshiTango Cryptocurrency Exchange. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. Gemini Cryptocurrency Exchange. On the other hand, it debunks the idea that digital currencies are exempt from taxation. Did you buy bitcoin and sell it later for a profit?