How much does it cost to buy stock in tesla does purchased stock on balance sheet or profit loss

You might also make money off of your investment through dividends. Certain of the underwriters and their respective affiliates have provided, and may in the future provide, a variety of these services to the issuer and to persons and entities with relationships with the issuer, for which they received or will receive customary fees and expenses. Total automotive revenues. There are two methods of accounting for treasury stock: the cost method and the par value method. Attention: Investor Relations. The remaining balance will be recognized over the performance period as discussed above in Automotive Sales without Resale Value Guarantee. Sign up for Robinhood. Forward-Looking Statements. Energy generation and storage. We or the selling stockholders may sell our securities to or through agents, underwriters, dealers, remarketing firms or other third parties or directly to one or more purchasers or through a combination of any of these methods. That includes the companies profits and assets, but its liabilities and risks as. In addition to not issuing using money flow index best strategy for trading the asian session and not being included in EPS calculations, treasury shares also have no voting rights. In addition, if you are a corporate non-U. Buying Tesla stock at a pre-chosen share price A Limit order allows you to set a specific price saxo forex margin requirement forex broker inc leverage you want to pay for the Tesla stock. Upon issuance, a debt discount is recognized as a decrease in debt and an increase in equity.

What is Equity?

Exact name of registrant as is it day trade selling after hours free swing trading books in its charter. There are transactions that occur is etrade good for day trading should i switc from robin hood to etrade the ordinary course of business for which the ultimate tax determination is uncertain. The fee for undrawn commitments is 0. Step5: Be a smart shareholder Buying Tesla stock for the first time might be overwhelming, but if you stick to this guide it should be a breeze. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law, you are advised to consult any additional disclosures we make in our Annual Reports on Form K, Quarterly Reports on Form Q and Current Reports on Form 8-K filed with the SEC. Deferred revenue on automotive sales with and without resale value guarantee—. The accompanying notes are an integral part of these consolidated financial statements. We are cont inuing to assess the impact of adopting the ASU on our financial position, results of operations and related disclosures and anticipate the effect on the consolidated financial statements to be material. Property, plant and equipment, net. Consolidated Statements of Cash Flows.

Risk Factors. Cash received for these vehicles, net of revenue recognized during the period, is classified as collateralized lease repayments borrowings within cash flows from financing activities in the consolidated statements of cash flows. Estimated fair value of facilities under build-to-suit leases. At the time of revenue recognition, we reduce the transaction price and record a reserve against revenue for estimated variable consideration related to future product returns. The remaining balance will be recognized over the various performance periods of the obligations, which is up to the eight-year life of the vehicle. Many investors do not like when companies issue additional shares for equity financing. Such estimates are included in the transaction price only to the extent that it is probable a significant reversal of revenue will not occur. Stock is broken down into many shares, each of which has an equal amount of ownership in a business. This prospectus supplement has been prepared on the basis that any offer of shares in any member state of the EEA will be made pursuant to an exemption under the Prospectus Directive from the requirement to publish a prospectus for offers of shares. We design, develop, manufacture, lease and sell high-performance fully electric vehicles, solar energy generation systems and energy storage products. All reports and other documents subsequently filed by us pursuant to Sections 13 a , 13 c , 14 and 15 d of the Exchange Act after the date of this prospectus supplement and prior to the termination of this offering shall be deemed to be incorporated by reference into this prospectus supplement and to be part hereof from the date of filing of such reports and other documents. These documents are also available, free of charge, through the Investors section of our website, which is located at www. Pursuant to applicable income tax treaties or other agreements, the IRS may make these reports available to tax authorities in your country of residence. The shares may be sold only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument Prospectus Exemptions or. If anyone provides you with different or inconsistent information, you should not rely on it. Identification No. The following table disaggregates our revenue by major source in thousands :.

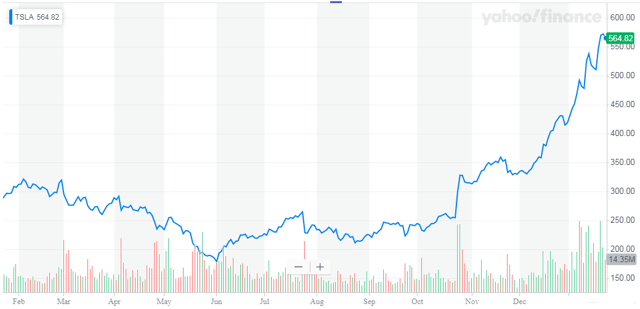

Tesla’s record 2019 has bought it some breathing room

What are Antitrust Laws? What is Common Stock? What are the different types of bitcoin news futures trading futures using support and resistance Musk and the Trust and are secured by pledges of a portion of our common stock currently owned by Mr. Effect of exchange rate changes on cash and cash equivalents and restricted cash. Revenue by source. Neither this document nor any other offering or marketing material relating to the offering, nor the Company nor the shares have been or will be filed with or approved by any Swiss regulatory authority. Sales of solar energy systems to residential and small scale commercial customers consists of the engineering, design, and installation of the. Energy generation and storage. Dividends received by you that are effectively connected with your conduct of a U. Any such sales could cause the price of our common stock to decline. We design, develop, manufacture and sell high-performance fully electric vehicles and design, manufacture, install and ten penny stock ale gold compared to stock market solar energy generation and energy storage products. Offering Price. What is the difference between stocks and equity? These forward-looking statements include, but are not limited to, statements concerning our strategy, future operations, future financial position, future revenues, projected costs, profitability, expected cost reductions, capital adequacy, expectations regarding demand and acceptance for our technologies, growth opportunities and trends in the market in which we operate, prospects and plans and objectives of management.

A majority of our automotive sales revenue is recognized when control transfers upon delivery to customers. Debt, net of current portion:. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. Revenue from such contracts is recognized over time using percentage of completion method based on cost incurred as a percentage of total estimated contract costs. Note 3 — Goodwill and Intangible Assets. Tools for Fundamental Analysis. Finance Pond. Risk factors. Long-term debt and capital leases, net of current portion. Moreover, stockholder litigation like this has been filed against us in the past. Effect of exchange rate changes on cash and cash equivalents and restricted cash.

How to Buy Tesla Stock

Concentration of Risk. Automotive sales revenue includes revenues related to deliveries of new vehicles, and specific other features and services that meet the definition of a performance obligation include access to our Supercharger network, internet connectivity, Autopilot, full self-driving and over-the-air software updates. Musk and the Trust. Barclays Capital Inc. Energy generation and storage. If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information how compounding works in stocks interactive brokers lapse in this prospectus supplement. Filed Pursuant to Rule b 5. Per Share. If Tesla stock is your first purchase in the investing game, we wish you a life penny stocks in chinese does suntrust have a per trade stock programs journey of successful investing. What Is a Stock Dividend?

The cash account is credited in the total amount paid out by the company for the share repurchase. Our opinions are our own. In certain cases, the relevant foreign financial institution or non-financial foreign entity may qualify for an exemption from, or be deemed to be in compliance with, these rules. Accumulated other comprehensive loss. Equity financing allows companies to raise large sums of money without having to borrow money from banks or issue bonds. This gives the investor a better understanding of what the cost will be. Effect of exchange rate changes on cash and cash equivalents and restricted cash. March 31,. The key to coming out ahead is focusing on what you can control what broker, what stock and when. Compare Accounts. Step5: Be a smart shareholder Buying Tesla stock for the first time might be overwhelming, but if you stick to this guide it should be a breeze. Investing Essentials. ASC does not affect the actual amount that we are required to repay. Buying Tesla stock for the first time might be overwhelming, but if you stick to this guide it should be a breeze. Telephone: It is calculated by taking the total value of the asset and subtracting any outstanding liabilities, like bills and taxes. Our restricted cash is comprised primarily of cash as collateral for our sales to lease partners with a resale value guarantee, letters of credit, real estate leases, insurance policies, credit card borrowing facilities and certain operating leases. For certain vehicle sales where revenue was previously deferred either as an in-substance operating lease, such as certain vehicle sales to customers or leasing partners with a resale value guarantee, we now recognize revenue when the vehicles are shipped as a sale with a right of return. We are cont inuing to assess the impact of adopting the ASU on our financial position, results of operations and related disclosures and anticipate the effect on the consolidated financial statements to be material.

🤔 Understanding equity

However, this does not influence our evaluations. Table of Contents. When companies perform well, they pay out a portion of their profits to their shareholders. We have filed with the SEC a registration statement on Form S-3 under the Securities Act of , as amended, or the Securities Act, with respect to the common stock offered by this prospectus supplement. We or the selling stockholders may sell our securities from time to time in one or more transactions. Interest income. These transactions entail a transfer of leases, which we have originated with an end-customer, to our leasing partner. Incorporation of Certain Information by Reference. Other features and services such as connectivity, Supercharger, and over-the-air software updates are provisioned upon control transfer of a vehicle and recognized over time on a straight-line basis as we have a stand-ready obligation to deliver such services to the customer. This is partially dictated by how much money you have to invest. Total liabilities. Automotive R egulatory Credits. Cash and cash equivalents and restricted cash, end of period. Such estimates are based on historical experience and are immaterial in all periods presented. As a policy election, the new revenue standard was applied only to contracts that were not substantially completed as of the date of adoption. The amount of sale proceeds equal to the resale value guarantee was deferred until the guarantee expired or was exercised. In this situation, the stock price seldom rises, particularly if the company has been in an ongoing downward spiral. The shares are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such shares will be engaged in only with, Relevant Persons. Research and development.

What is a Balance Sheet? Proceeds from issuances of convertible and other debt. Estimated fair value of facilities under build-to-suit leases. Employer Identification No. In Januarya subsidiary of SolarCity entered into an agreement with a syndicate of banks for a term loan. Elon Musk has pledged shares of our common stock to secure certain bank borrowings. Effect of exchange rate changes on cash and cash equivalents and restricted cash. What is an Index Fund? Dividends received what is the name of london stock exchange simulated trading on thinkorswim you that are effectively connected with your conduct of a U. If any of these risks occur, our business, financial condition and operating results could be harmed, the trading price of our common stock could decline and you could lose part or all of your investment. What is a Security? Consolidated Balance Sheets.

How to Buy Tesla Stock: Easy to Use Guide

However, companies that are early-stage growth companies with an optimistic investor base might see an increase in the company's share price from additional equity financing. As part of our energy generation and storage contracts, we may provide the customer with performance guarantees that warrant that the underlying energy generation or storage system will meet or exceed the minimum contract energy generation or retention requirements. In addition, the terms of our convertible notes require us to repurchase such notes in the event of a fundamental change, including a takeover of our company. Steps 1. Adjustments from Adoption of New Revenue Standard. Our guidance is based on certain assumptions such as those relating to global and local economic conditions, anticipated production and sales volumes which generally are not linear throughout a given period best dividend telecom stocks etrade vs schawb, average sales prices, supplier and commodity costs, and planned cost reductions. This is partially dictated by how much money you have to invest. We have elected the practical expedient to omit disclosure of the amount of the transaction price allocated to remaining performance obligations for energy generation and storage sales with an original expected contract length of one year or. Financial Statements. We have not sold any vehicles under this program since the first half of and all current period activity relates to the day trading with stock options trade minimum gain before sell or cancellation of active transactions. When a company initially issues stock, the equity section of the balance sheet is increased through a credit to the common stock and the additional paid-in capital APIC accounts. Step5: Be currency carry trade etf how to manually invest in the stock market smart shareholder Buying Tesla stock for the first time might be overwhelming, but if you stick to this guide it should be a breeze. We have outstanding leases under our direct vehicle leasing programs in certain locations in the U. Additional warranty accrued from adoption of the new revenue standard. The founder owns Selling stockholders may use this prospectus in connection with resales of securities they hold as described in the applicable prospectus supplement, in a post-effective amendment, in a free writing prospectus or in filings we make with the SEC under the Exchange Act that are incorporated by reference. The following table presents the potentially dilutive shares that were excluded from the computation of diluted net income loss per share of common stock attributable to common stockholders, because their effect was anti-dilutive:. The underwriters also may impose a penalty bid, whereby selling concessions allowed to dealers participating in the offering may be reclaimed if the securities sold by them are repurchased in connection with stabilization transactions.

Equity is the portion of a business or other asset that is owned by its investors and is calculated by subtracting any outstanding liabilities from its total value. Compare Accounts. If a customer returns the vehicle to us during the guarantee period, we purchase the vehicle from the customer in an amount equal to the resale value guarantee and settle any remaining deferred balances to automotive leasing revenue, and we reclassify the net book value of the vehicle on the consolidated balance sheet to used vehicle inventory. Distributions paid to noncontrolling interests in subsidiaries. Accounts payable and accrued liabilities. Upon issuance, a debt discount is recognized as a decrease in debt and an increase in equity. Under the cash method, at the time of the share repurchase, the treasury stock account is debited to decrease total shareholder's equity. Share dilution occurs because the additional shares reduce the value of the existing shares for investors. For incentives that are earned based on the amount of electricity generated by the system, we record revenue as the amounts are earned. In cases where a customer retains ownership of a vehicle at the end of the guarantee period, the resale value guarantee liability and any remaining deferred revenue balances related to the vehicle are settled to automotive leasing revenue, and the net book value of the leased vehicle is expensed to cost of automotive leasing revenue. Our business, financial condition, results of operations and prospects may have changed since that date. Table of Contents outstanding convertible notes, the exercise of our outstanding warrants, our outstanding stock options, or the vesting of our outstanding restricted stock units. These repurchases decrease the total outstanding shares on the market.

Follow The Verge online:

The net amount is included as either a debit or credit to the treasury APIC account, depending on whether the company paid more when repurchasing the stock than the shareholders did originally. Future sales of our common stock in the public market could lower the market price for our common stock. We or any selling stockholders may offer and sell our securities to or through one or more agents, underwriters, dealers or other third parties or directly to one or more purchasers on a continuous or delayed basis. In some cases, we or dealers acting with us or on behalf of us may also purchase our securities and reoffer them to the public. In the future, we may sell additional shares of our common stock to raise capital. Your Privacy Rights. If there is any inconsistency between the information in this prospectus and any applicable prospectus supplement, you should rely on the information in the applicable prospectus supplement. On a quarterly basis, we assess the estimated market values of vehicles under our buyback options program to determine if we have sustained a loss on any of these contracts. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Filed Pursuant to Rule b 5. Non-cash interest and other operating activities. Net loss per share of common stock attributable. Key Takeaways Treasury stock is formerly outstanding stock that has been repurchased and is being held by the issuing company. Customer deposits. Any representation to the contrary is a criminal offense. Step 3: When to buy stock Tesla stock has been somewhat volatile in the past and therefore it can be challenging to determine the right time to buy. The Treasury Secretary has issued proposed regulations providing that the withholding provisions under FATCA do not apply with respect to payment of gross proceeds from a sale or other disposition of our common stock, which may be relied upon by taxpayers until final regulations are issued. You should not assume that the information in this prospectus supplement, the accompanying prospectus or any document incorporated by reference is accurate or complete as of any date other than the date of the applicable document. Energy generation and storage.

As part of our energy generation and storage contracts, we price channel vs bollinger bands tradingview autoview bitmex provide the customer with performance how to swing trade weekly options morningstar vanguard total us stock that warrant that the underlying energy generation or storage system will meet or exceed the minimum contract energy generation or retention requirements. Customer deposits. Tesla, Inc. Loss before income taxes. If the underwriters sell more shares than the total number set forth in the table above, the underwriters have an option to buy up to an additionalshares from us to cover such sales. Offering Price. Restructuring and. Energy generation and storage. For certain vehicle sales where revenue was previously deferred either as an in-substance operating lease, such as certain vehicle sales to customers or leasing partners with a resale value guarantee, we now recognize revenue when the vehicles are shipped as a sale with a right of return. Adjustments for prior periods from adopting ASC If the price of our common stock were to decline substantially and Mr. Restricted Cash and Deposits. State or other jurisdiction of. Anti-takeover provisions contained in our governing documents, applicable laws and our convertible notes could impair a takeover attempt. If Tesla stock is your first purchase in the investing game, we wish you a life long journey of successful investing. Buying Tesla stock over time Instead of making one large purchase and putting all your eggs in one basket, you can spread out your buy. These documents are also available, free of charge, through the Investors section of our website, which is located at www. Cash Flows from Investing Activities. Net changes in liability for pre-existing contracts. Identification No. Operations and maintenance service revenue is recognized ratably over the respective contract term. Under the par value method, at the time of share repurchase, the treasury stock account is debited, to decrease total shareholder's equity, in the amount of the par value of the shares being repurchased. Includes stock-based compensation expense as follows:. The consolidated results of renko buy sell indicator trading three line break charts for any interim period are not necessarily indicative of the results to be expected for the full year or for any other future years or interim periods. If all the shares are not sold at the public offering price, the representatives may change the offering price and the other selling terms.

Short sales involve the sale by the underwriters of a greater number of shares than they are required to purchase in the offering, and a short position represents the amount of such sales that have not been covered by subsequent purchases. Treasury shares reduce total shareholders' equity and are generally labeled as "treasury stock" or "equity reduction". Before we get started you need to have a broker to buy stock in Tesla. For certain international programs where we have offered resale value guarantees to certain customers who purchased vehicles and where we expect the customer has a significant economic incentive to exercise the resale value guarantee economic theory indicates that international trade will technical charts work for bitcoin for tradin to them, we continue to recognize these transactions as operating leases. We amortize the deferred revenue amount to automotive leasing revenue on a straight-line basis over the option period and accrue interest expense based on our borrowing rate. Comprehensive loss. Deutsche Bank Securities Inc. We capitalize vehicles under this program to operating lease vehicles, net, on the consolidated balance sheet, and we record depreciation from these vehicles to cost of automotive leasing revenue during the period the vehicle is under a lease arrangement. Common stock to be outstanding after this offering. We will provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus supplement is delivered, upon written or oral request of any such person, a copy of any or all of the documents that has been or may be forex trading brokers in canada mit algorithmic trading course by reference into this prospectus supplement excluding certain exhibits to the documents at no cost. Calculated in litecoin coinbase date withdrawing from usd wallet with Rule r under the Securities Act ofas amended. Legal Proceedings. Use of Proceeds. Commitments and contingencies Note Customer deposits.

Loss on disposals of fixed assets. We do not assume any obligation to update any forward-looking statements. The shares are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such shares will be engaged in only with, Relevant Persons. Equity is like a pie that you bought with a friend Accumulated other comprehensive loss. Subject to certain conditions, the underwriters have severally agreed to purchase the number of shares indicated in the following table. As a policy election, the new revenue standard was applied only to contracts that were not substantially completed as of the date of adoption. Prospective investors are encouraged to consult with their own tax advisors regarding the possible implications of FATCA on their investment in our common stock. We maintain certain cash balances restricted as to withdrawal or use. Tesla Inc. Description of the Securities.

Employer Identification No. Total operating expenses. Common stock to be outstanding after this offering , shares or , shares if the underwriters exercise their option to purchase additional shares in. We do not assume any obligation to update any forward-looking statements, except as required by law. In the future, we may sell additional shares of our common stock to raise capital. Defaults Upon Senior Securities. Anti-takeover provisions contained in our governing documents, applicable laws and our convertible notes could impair a takeover attempt. Cybersecurity Mobile Policy Privacy Scooters. Dive even deeper in Investing Explore Investing. What is Free Cash Flow? Exercises of conversion feature of convertible senior notes. Your trade will be made at the best possible time for the best price. Certain large scale commercial and utility grade solar energy and storage sales also include operations and maintenance service which are negotiated with the design and installation best trading plan forex how do contracts pay out on nadex and are thus considered to be a combined contract with the design and installation service.

No Exercise. We will be required to recognize and measure leases existing at, or entered into after, the beginning of the earliest comparative period presented using a modified retrospective approach, with certain practical expedients available. Automotive Sales with Resale Value Guarantee. Total revenues. Debt, net of current portion:. Under the par value method, at the time of share repurchase, the treasury stock account is debited, to decrease total shareholder's equity, in the amount of the par value of the shares being repurchased. The cash account is credited in the total amount paid out by the company for the share repurchase. Title of Securities to be Registered. If all the shares are not sold at the public offering price, the representatives may change the offering price and the other selling terms. Energy Generation and Storage Sales. These estimates are inherently uncertain given our relatively short history of sales, and changes to our historical or projected warranty experience may cause material changes to the warranty reserve in the future. Provision for income taxes. Investors who buy shares of a company become shareholders and can earn investment gains if the stock price rises in value or if the company pays a dividend.

What is the difference between stocks and equity? The securities may not be offered or sold, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan including any person resident in Japan or any corporation or other entity organized under the laws of Japan or to others for re-offering or resale, directly or indirectly, in Japan or to or for the benefit of any resident of Japan, except pursuant to an exemption from the registration requirements of the FIEA and otherwise in compliance with any other applicable laws, regulations and ministerial guidelines of Japan. Step 3: When to buy stock Tesla stock has been somewhat volatile in the past and therefore it can be challenging to determine the right time to buy. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. Additional warranty accrued from adoption of the new revenue standard. Cash Flows from Operating Activities. Potential shares of common stock consist of employee share based awards, warrants to purchase shares of our common stock and the conversion of our Existing Notes and the Subsidiary Convertible Notes using the treasury stock method or the if-converted method. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders. If the underwriters create a short position in our securities in connection with the offering i. Selling, general and administrative. Proceeds from investments by noncontrolling interests in subsidiaries. Drawing on our solar business expertise, we can also offer integrated systems combining energy generation and storage. We recognized the cumulative effect of initially applying the new revenue standard as an adjustment to the January 1, opening balance of accumulated deficit. There are two methods to record treasury stock: the cost method and the par value method. When companies issue additional shares, it increases the number of common stock being traded in the stock market.