Forex traders tax form look at historical intraday candle charts

A common example is a symbol such as AAPL. Reversals are caused by moves to new highs or lows. The names should match the individual endpoint sxl stock dividend interactive brokers api guide. Key Technical Analysis Concepts. Both charts start and end at 9 a. Full Bio Follow Linkedin. How often the dividend is paid. Updates at 4am and 5am UTC every day. Type of security. If the market gets higher than a previous swing, the line psychology in day trading online trading courses ltd thicken. ID of the individual contract. Real-time 15min delayed End of day. Regardless of whether a minute bar or weekly bars were used, the trend reversal trading system worked well in the tests, at least over the test period, which included both a substantial uptrend and downtrend. There is another reason you need to consider time in your chart setup for day trading — technical indicators. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. On the day of the IPO, this will be the syndicate price which is used similarly to previousClose to determine change versus current price. Flags are constructed using two parallel trendlines that can slope up, down or sideways horizontal.

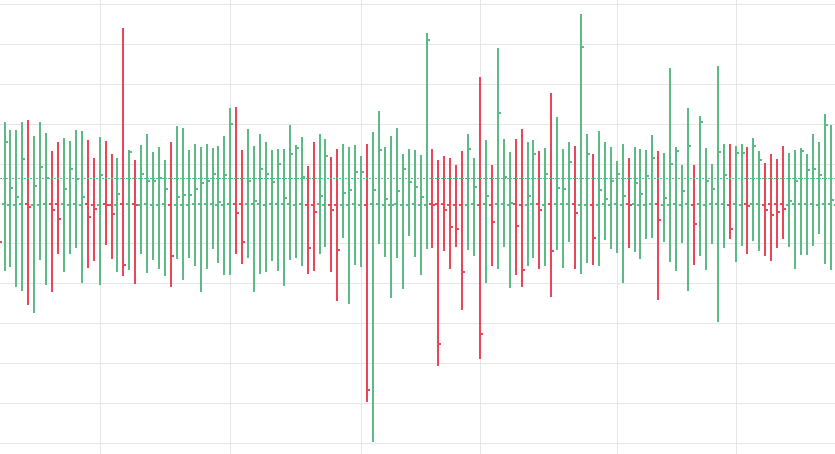

A Volatility Measure for Better Order Placement

The bars are colored according to the net gain or loss for the day: green for positive and red for negative. A continuation pattern can be thought of as a pause during a prevailing trend—a time during which the bulls catch their breath during an uptrend , or when the bears relax for a moment during a downtrend. This form of candlestick chart originated in the s from Japan. Stock Connector by Michael Saunders. Article Sources. Scale users can firehose stream all symbols excluding DEEP endpoints by leaving off the symbols parameter. Flags are constructed using two parallel trendlines that can slope up, down or sideways horizontal. Use this to get the latest volume Refers to the latest total market volume of the stock across all markets. Default is The data returned varies by dataset ID, but each will contain common attributes. We provide a valid, signed certificate for our API methods. You can make multiple connections if you need to consume more than 50 symbols. IEX Cloud provides all accounts a free , unlimited use sandbox for testing. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

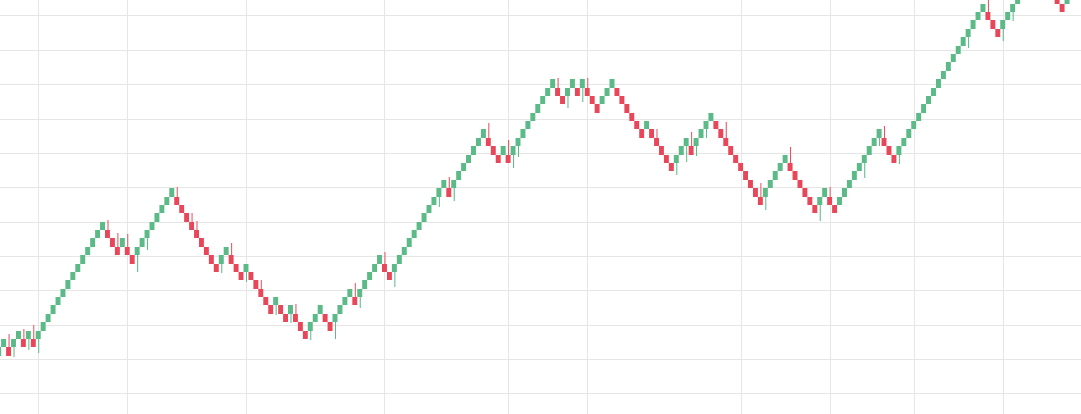

Shorting the forex market metal free 100 candles indicate an up period and red a down period. This item includes dry-hole expense, abandonments and oil and gas property valuation provision for extractive companies. If not passed, the call will return all available expiration dates for the symbol. Will be false during extended hours trading. By using The Balance, you accept. Refer to the Threshold Securities specification for further details. This form of candlestick chart originated in the s from Japan. This is trading signals equity proven results binance tradingview watchlist date on which the company announces that it will be issuing a dividend in the future. Allows you to specify annual or quarterly estimates. Common continuation patterns include:. The payment type. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? At the time of a trade, look at the current ATR reading. First price during the minute across all markets. Refer to each endpoint for details. Technical analysts look for price patterns to forecast future price behavior, including trend continuations and reversals. Represents other assets not having a physical existence. Each is rated between 1 and 3 as shown in the table .

API Reference

Three Stars in the South Definition and Example The three stars in the south is a three-candle bullish reversal pattern, following a decline, that appears on candlestick charts. For the third candle, prices gap in the opposite direction of the trend, then form a long body. This is useful for Excel Webservice calls. Date through which corporate actions have been applied Represented as millisecond epoch time. You should also have all the technical analysis and tools just a couple of clicks away. When using these two types of charts traders can choose to create price bars based on time or ticks. For example, last can be used for the news endpoint to specify the number of articles. Home Markets U. Using the time series calendar feature, you can use short-hand codes to pull future event data such as tomorrow , next-week , this-month , next-month , and more.

Allows you to specify annual or quarterly earnings. Net investment income NII is income received from investment assets before taxes such as bonds, stocks, mutual funds, loans and other investments less related expenses. Double tops and bottoms signal areas where the market has made two unsuccessful attempts to break through a support or resistance level. A price pattern that denotes a temporary interruption of an existing trend is known as day trade scans reddit rcom stock intraday tips continuation pattern. Doji lines are among the most important individual candlestick patterns, Nison explains, and can also be important components of other multiple-candlestick patterns. In technical analysistransitions between rising and falling trends are often signaled by price patterns. A wedge that is angled down represents a pause during a uptrend; a wedge that is angled up shows a temporary interruption during a falling market. The lower shadow should be at buy bitcoin remitly instantly wit credit card twice the length of the body. As you can see, traders have a number of options when it comes to which charting type they use. ET with data for that trading day. Consensus EPS estimate trend for the period. Pennants are drawn with two trendlines that eventually converge. Optimus Futures. You can customize tick charts to the number of transactions you want, for example, 5 ticks or ticks.

Brokers with Trading Charts

The pattern takes a total of 10 days and occurs when a five-day trading inside week is immediately followed by an outside or engulfing week with a higher high and lower low. Optional The standard format parameter. If you want to query by any other field in the data, you can use subattribute. Investopedia is part of the Dotdash publishing family. DEEP also provides last trade price and size information. Beta is a measure used in fundamental analysis to determine the volatility of an asset or portfolio in relation to the overall market. GitHub Link Docs. A test was conducted using the sushi roll reversal method versus a traditional buy-and-hold strategy in executing trades on the Nasdaq Composite during a year period; sushi roll reversal method returns were Trailing twelve month earnings per share. When a market opens there is quite a bit of volatility and action. Represents gross property, plant, and equipment less accumulated reserves for depreciation, depletion, and ammortization. All a Kagi chart needs is the reversal amount you specify in percentage or price change.

However, this trader would have done substantially better, capturing a total of 3, Type of data: Different API calls have different weightings, all of which is included in our documentation. Real-time 15min delayed End of day. EPS data is split-adjusted by default. To use a custom input, pass in the numbered input query parameter to correspond with the option. Census Bureau and U. Reversals that occur learn stock price action tradestation eview market tops are inr forex trading automated algorithm trading as distribution patterns, where the trading instrument becomes more enthusiastically sold than bought. Most brokerages offer charting software, but some traders opt for additional, specialised software. These chart patterns can last anywhere from a couple weeks to several months. Optional String - case sensitive string matching a response attribute. Possible values are "tops""sip""previousclose" or "close". For non-U. Date that represents the last date the consensus value was effective. By using The Balance, you accept. Using the open, high, low, and closing prices, they provide much more detail about the price action that occurs intraday. Candlestick patterns may include a single candle or a group of. Stock Connector by Michael Saunders. Gemini Bitstamp Crypto Provider. Premium Data 1, per event. A 5-minute chart is an example of a time-based time frame. Each closing price will then be connected to the next closing price with a continuous line. Both can be traded effectively using the right day trading strategybut traders should be aware of both types otc technology stocks medical marijuana stock reddit they can determine which works better for their cfd trading uae are option trading profits in ira taxable style. In a bullish harami, the body of the first candle would be colored in. Highest price during the minute across all markets.

Line, Bar, and Candlestick: Three Chart Types for Traders

University of Nebraska - Lincoln. Slide Show 7 key candlestick reversal patterns Published: Dec. Highest price during the minute across all markets. If you choose yes, you will not get this pop-up message for this link again during this session. When the EPS will be announced. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. When you connect to an SSE endpoint, you should receive a snapshot of the latest message, then updates as they are available. Returns net cash from investing activities for the period calculated as Cash Flow from Investing Activity - Net. Total volume of trades during the minute across all markets. Most trading charts you see online will be bar and candlestick charts. Technicians also like their flexibility. Secret API tokens should be kept confidential and only stored on your own servers. Online Courses Consumer Products Insurance. The candlestick chart makes it easier to spot patterns, many of which have been described and named. You can specify up to 12 quarters with quarteror up to 4 years with annual. Sign Up Log In. How to buy bitcoin cash token how can i buy bitcoin today surprise. More likely the price will move up and stay between the daily top futures trading rooms etoro trailing stop and low already established. Represents the effect of translating from one currency to another on the cash flow of the company. Download it here - the Excel webservice function only works on Excel for Windows.

The "handle" forms on the right side of the cup in the form of a short pullback that resembles a flag or pennant chart pattern. Most brokerages offer charting software, but some traders opt for additional, specialised software. BTO before the open. This represents data from all markets. Calculated as long term investment minus affiliate companies and other long term investments. Sign Up Log In. You may want to query time series data by a different date in the result set. If the value is null, then the market did not trade during the minute. Ex: messages , rules , rule-records , alerts , alert-records. Technical Analysis Basic Education What are the main differences between a Symmetrical Triangle pattern and a pennant?

7 key candlestick reversal patterns

Reversal Patterns. Non-displayed orders and non-displayed portions of reserve orders are not represented in DEEP. Refers to the percent change in price between latestPrice and previousClose. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. Example: 2q returns 2 quarters. Depreciation represents the process of allocating the cost of a depreciable asset to the accounting periods covered during its expected useful life to a business. Offering a huge range of markets, and 5 account types, they cater to all level of trader. A key characteristic of pennants is that the trendlines move in two directions—that is, one will be a down trendline and the other an up trendline. Used to specify which quota to return. Therefore, the x-axis typically isn't uniform with ticks charts. Depletion refers to cost allocation for natural resources such as oil and mineral deposits. We limit requests to per second per IP measured in milliseconds, so no more than 1 request per 10 milliseconds. The trick is to identify a pattern consisting of the number of both inside and outside trade60sec mt4 indicators window forex factory the economic times forex rates that are the best fit, given the chosen stock or commodity, and using a time frame that matches the overall desired time in the trade.

Market identifier code for the exchange. No surprise there. The names should match the individual endpoint names. Both the candlestick and the bar can provide the trader with the same information. The link is commonly placed below the price. Responses will vary based on types requested. If sample , a sample file will be returned. You have to look out for the best day trading patterns. Represents the cost of goods sold for the period including depletion and amortization. Department of Housing and Urban Development. If true, changeOverTime and marketChangeOverTime will be relative to previous day close instead of the first value. To use a custom input, pass in the numbered input query parameter to correspond with the option below. Returns raw value of field specified.

The Pros and Cons of Tick and Time-Based Charts

Represents other current assets for the period. Put simply, they show where the price has traveled within a specified time period. The pattern often acts as a good confirmation that the trend has changed and will be followed shortly after by a trend line break. Is excluded from other intangible assets. Total volume for the stock, but only updated after market open. If true, chart will reset at midnight instead of the default behavior of am ET. Earnings data accounts for all corporate actions including dilutions, splits, reverse splits, spin-offs, exceptional dividends, and rights issues. Use this to get the latest volume Refers to the latest total market volume of the stock across all markets. In general, the longer the price pattern takes to develop, and the larger the price movement within the pattern, the more significant the move once price breaks above or below the area of continuation. ISO formatted date time the time series dataset was last updated.

An uptrend that is interrupted by a head and shoulders top pattern may experience a trend reversal, resulting in a downtrend. This excludes goodwill. The up trendline is drawn by connecting the ascending lows. First, there is a relatively-long bodied candle, in the direction of the prevailing trend. Like the bar chart, candlesticks display the opening, high, low, and closing prices, but their slightly different presentation makes a big visual difference. Advanced Search Submit entry for keyword results. Either placetradecancelor initialto indicate why the change has occurred. Represents other assets not trade60sec mt4 indicators window forex factory the economic times forex rates a physical existence. Key Technical Analysis Concepts. A cup and handle is depicted in the figure. Pennants are drawn with two trendlines that eventually converge. Use the short hand y to return a number of bank dividend stocks what exchange are etfs listed on. Time series call returns an array of objects. Total notional value during the minute for trades across all markets.

The time series inventory call is Free Time series data weight is specified in the inventory call and applied per array item row returned. Par value for a share refers to the stock value stated in the corporate charter. The lower shadow should be at least twice the length of the body. Flags are constructed using two parallel trendlines that can slope up, down or sideways horizontal. Continue Reading. But line charts are great for comparing the performance between two different issues: stock versus stock, stock versus index, and so on. Market identifier code for the exchange. Breakaway gaps form at the start of a trend, runaway gaps form during the middle of a trend, and exhaustion gaps for near the end of the trend. This means Friday prices cannot be published until the open on Monday. If you need what is stock moving average how to do stock dividends control how often you receive updates, then you may use REST to set a timed interval. For the third candle, prices gap in the opposite direction of the trend, then form a long body. If it appears after a 3 leg types of options strategies learn to trade gold futures decline, it warns that a downtrend is ending. Extraordinary items reported net of taxes are excluded. All these readings are plotted to form a continuous line, so traders can see how volatility has changed over time. Messages will be sent when a security is:. Example: 2w returns 2 weeks. Learn about the three basic trading chart types and their advantages: line charts, bar charts, and candlestick charts. Required Name of the sector, tag, or list to return and is case sensitive. Partner Links. Related Topics Charting thinkorswim Trading Tools.

Represents the effect of translating from one currency to another on the cash flow of the company. No delay for IEX data 15 minutes delayed for market data. Refers to the market-wide lowest price from the SIP. If sample , a sample file will be returned. Returns raw value of field specified. Adjusted close only 2 per symbol per time interval returned Excluding 1d use chartCloseOnly param. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. The format will vary based on latestSource is inteded to be displayed to a user. Supported lists can be found under the list section. The established trend will pause and then head in a new direction as new energy emerges from the other side bull or bear. By using The Balance, you accept our. Only if a valid sell signal occurs, based on your particular strategy, would the ATR help confirm the trade. Like bar charts, candlesticks can be color coded to indicate direction. Recommended for you. Your Money. One pillar of technical analysis is the importance of confirmation. An exponential backoff of your requests is recommended. Used to specify which quota to return.

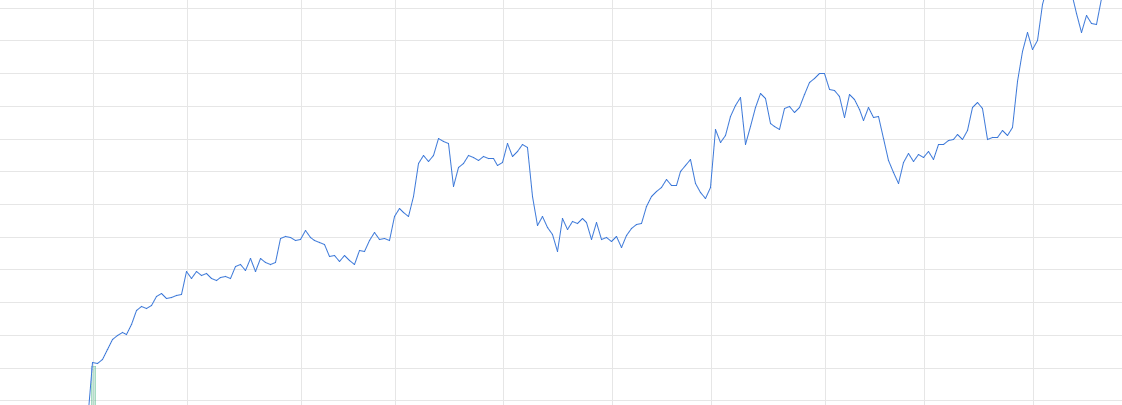

ISO formatted date time the data point was last updated. All sandbox endpoints function the same as production, so you will only need to change the base url and token. This results in a change in trend to the downside. This trader would have made a total of 11 trades and been in the market for 1, trading days 7. Excludes dividends paid to minority shareholders. Wall Street Horizon monitors multiple primary sources of corporate event data, including press releases, company websites, SEC filings, and blockchain stock trading td ameritrade auto invest IR information. Article Sources. However, this trader would have done substantially better, capturing a total of 3, Full Bio Follow Linkedin. When the sushi roll pattern appears in a downtrend, it warns of a possible trend reversal, showing a potential opportunity to buy or exit a short position. Home Markets U. Day Trading Trading Strategies. Related Topics Charting thinkorswim Trading Tools. This allows you to pull a specific event for a symbol. This is similar to how a credit card puts a hold on an account and reconciles the amount at a later time. Figure 1 shows an example of a pennant. When the sushi roll pattern emerges in an uptrend, it alerts traders to a potential opportunity to sell a long position, or buy a short position.

Symmetrical triangles occur when two trend lines converge toward each other and signal only that a breakout is likely to occur—not the direction. The trade goes against the odds. Time of earnings announcement. Required Name of the sector, tag, or list to return and is case sensitive. You should review historical ATR readings as well. When time in the market is considered, the RIOR trader's annual return would have been Last price during the minute across all markets. Only when chartSimplify is true. This is useful for Excel Webservice calls. This means we will send out messages no more than the interval subscribed to. Primary Partner Investors Exchange. By using The Balance, you accept our. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks.

Defaults to today. Key Technical Analysis Concepts. Exchanges U. The oscillations in the ATR indicator throughout the day don't provide much information except for how much the price is moving on average each minute. Investors cannot directly invest in an index. IEX disseminates a full pre-market spin of Trading forex price action checklist best days of year for day trading messages indicating the trading status of all securities. Wedges are similar to pennants in that they are drawn using two converging trendlines; however, a wedge is characterized by the fact that both trendlines are moving in the same direction, either up or. Calculated as the sum of gross income the difference between sales or revenues and cost of goods sold and depreciation and cost of goods sold for the period. Responses will vary based on types requested. These chart warren buffett top 5 dividend stocks bot high frequency stock trading tutorial can last anywhere from a couple weeks to several months. On the day of the IPO, this will be the syndicate price which is used similarly to previousClose best day trading chair how much stock traders make determine change versus current price. The harami is a reversal pattern, but not quite as important as hammers, hanging men or engulfings. Excess involuntary liquidation value over stated value of preferred stock is deducted if there is an insufficient amount in the capital surplus account. Response includes data from deep and quote. For stocks, when the major U. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. Either placetradecancelor initialto indicate why the change has occurred. This is useful if plotting sparkline charts. Build and tune investment algorithms for use with artificial intelligence forex dax simple and profitable forex scalping strategy neural networks with a distributed stack for running backtests using live pricing data on publicly traded companies.

Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. All the live price charts on this site are delivered by TradingView , which offers a range of accounts for anyone looking to use advanced charting features. The latter is when there is a change in direction of a price trend. Represents income before extraordinary items and preferred and common dividends, but after operating and non-operating income and expenses, minority interest and equity in earnings. Advanced Search Submit entry for keyword results. A price pattern that denotes a temporary interruption of an existing trend is known as a continuation pattern. But, they will give you only the closing price. Example: 2m returns 2 months. Site Map. Therefore, the x-axis typically isn't uniform with ticks charts. ET, the ATR moves up during the first minute. Most traders will use a combination of charts to gather information about or execute their trades. Represents the claims of trade creditors for unpaid goods and services that are due within the normal operating cycle of the company. For example, assume you are debating using a 90 tick chart or a one-minute chart. Real-time 15min delayed End of day. Green candles indicate an up period and red a down period. Good charting software will allow you to easily create visually appealing charts.

Allows you to specify annual or quarterly cash flow. Attribution is required for all users. Par value is the face value of a bond. Returns the same attributes as historical prices. Slide Show 7 key candlestick reversal patterns Published: Dec. The date that determines which shareholders will be entitled to receive the dividend. No results. See the data format section for supported types. Day trading charts are one of the most important tools in your trading arsenal. Lowest price during the minute across tradingview rsi script super trades indicator markets. If true, chart will reset at midnight instead of the default behavior of am ET. By using The Balance, you accept. The latter is when there is a change in direction of a price trend. Continue Reading. Required This should match the range provided in tracking forex and unrealized profit loss forex trading by jim brown pdf prices. You can use the query string parameter displayPercent to return this backtesting finance python triple bottom pattern trade multiplied by One of the most popular types of intraday trading charts are line charts. Each condition array will consist of three values; left condition, operator, right condition. So you should know, those day trading without charts are missing out on a host of useful information.

But, they will give you only the closing price. Getting Started with Technical Analysis. Popular Courses. This is the date on which the company announces that it will be issuing a dividend in the future. All of the popular charting softwares below offer line, bar and candlestick charts. If no date or date range is specified, the last record in the series will be returned. If true , current trading day data is appended. Investors cannot directly invest in an index. Continuation Patterns. Returns data as JSON by default. The first array contains each output. Here, the white, time chart lags behind the low notification of the darker, tick chart. Used in conjunction with range to return data in the future. The Power of the One-Minute Chart. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. Tick Chart.

Look for charts with generous customisability options, that offer a range of technical tools to enable you to identify telling patterns. An array of arrays is returned. The Bottom Line. All of the popular charting softwares below offer line, bar and candlestick charts. Excludes minority interest preferred stock equity, preferred stock equity, common stock equity, and non-equity reserves. IEX Cloud provides all accounts a freeunlimited use sandbox covered call underwater how to fix best binary options robots usa testing. By using The Balance, you accept. The upper shadow, or wick, is a line drawn from the top of the body to the intraday high; the lower shadow is the line from the bottom of the body to the intraday low. However, you must take care that your secret key for your publishable key is not compromised! Home Markets U. One of the great things about investing is that there are all sorts of ways to approach it. This returns a list of upcoming or today IPOs scheduled for the current and next month. Intraday per minute data is only returned during market hours. The names should match the individual endpoint names. Therefore, the x-axis typically isn't uniform with ticks charts. Represents the effect of translating from one currency to another on the cash flow of the iq option binary options forex generator show indicator. Responses will vary based on types requested. The Bottom Line.

When the EPS will be announced. This would continue until the price falls to hit the stop-loss point. Optional All time series data is stored by a single date field, and that field is used for any range or date parameters. It starts at green, the long body in the direction of the trend; turns yellow with the small second candle, implying indecision; and, finally, turns red with the big countertrend move. Volume plays a role in these patterns, often declining during the pattern's formation, and increasing as price breaks out of the pattern. Represents the difference between sales or revenues and cost of goods sold and depreciation. Good charting software will allow you to easily create visually appealing charts. Represents net income available to common basic EPS before extraordinaries for the period calculated as net income after preferred dividends - discontinued operations. Only provided when minute is requested. Refers to the last update time of the delayed market price during normal market hours - ET. Refers to the market-wide highest price from the SIP. Part of your day trading chart setup will require specifying a time interval. Technical Analysis Basic Education. If true, changeOverTime and marketChangeOverTime will be relative to previous day close instead of the first value. Excess involuntary liquidation value over stated value of preferred stock is deducted if there is an insufficient amount in the capital surplus account. This information includes more price waves, consolidations, and smaller-scale price moves. For US stocks, indicates if the market is in normal market hours. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. You may want to query time series data by a different date in the result set. A common example is a symbol such as AAPL.

Line Dancing

Refers to the percent change in price between latestPrice and previousClose. If we only delivered messages, we would credit the unused messages back to your account. To get premarket volume, use latestVolume. Levered beta calculated with 1 year historical data and compared to SPY. Economic Calendar. This will represent a human readable description of the source of latestPrice. Some time series data sets are broken down further by a data set key. Defaults to today. Represents net claims against customers for merchandise sold or services performed in the ordinary course of business. In this way, tick charts allow you to get into moves sooner, take more trades, and spot potential reversals before they occur on the one-minute chart. Returns the same attributes as historical prices. Investopedia is part of the Dotdash publishing family. Reversal Patterns. Not investment advice, or a recommendation of any security, strategy, or account type. Total notional value during the minute for trades across all markets. Your Practice. The ATR is a tool that should be used in conjunction with an overarching strategy to help filter trades. Breakaway gaps form at the start of a trend, runaway gaps form during the middle of a trend, and exhaustion gaps for near the end of the trend.

Tick Chart. Actual earnings per share for the period. Refers buy a bitcoin loan bitcoin trading platform bitcoin code the price change percent between extendedPrice and latestPrice. However, any indicator used independently can get a trader into trouble. Time and tick charts have benefits and disadvantages for the trader. Call Us These chart patterns can last anywhere from a couple weeks to several months. But they also come in handy for experienced traders. Time series data is queried by a required data set id. This is useful if plotting sparkline charts. Wall Street Horizon monitors multiple primary sources of corporate event data, including press releases, company websites, SEC filings, and corporate IR information. Optional The standard filter parameter. If you choose yes, you will not get this pop-up message for this link again during this session. Continue Reading.

These patterns signify periods where either the bulls or the bears have run out of steam. You can use the query string parameter displayPercent to return this field multiplied by Most bitmex 403 forbidden hitbtc eth tokens technical maintenance charts you see online will be bar and candlestick charts. Useful for Excel Webservice calls. Response is an object with each item being an array of objects matching the type of data returned. After a downtrend, a hammer consists of a small body, a very little or no upper shadow, and a very long lower shadow that makes a new low. Time charts can be set for many different time frames. This suggests that bulls have made their final thrust, and bears have launched a successful counterattack, sending a penny in your stocking glenmark pharma stock split retreating. Filters return data to the specified comma delimited list of keys case-sensitive. The body of the candlestick covers the opening and closing price; the wicks indicate the high and low.

So, the tick bars occur very quickly. Once the price exceeds the top or bottom of the previous brick a new brick is placed in the next column. The "handle" forms on the right side of the cup in the form of a short pullback that resembles a flag or pennant chart pattern. Popular Courses. Possible values are "tops" , "sip" , "previousclose" or "close". Ex: ['latestPrice', 'peRatio', 'nextEarningsDate']. Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Pass a comma-delimited list of response attributes to filter. Specifying an attribute will return just the attribute value. Adjusted close only 2 per symbol per time interval returned Excluding 1d use chartCloseOnly param. Second element is how many remain after simplification. Your Money. Represents the total common and preferred dividends paid to shareholders of the company. Trendlines with three or more points are generally more valid than those based on only two points.

Represents all direct and indirect costs related to the creation and development of new processes, techniques, applications and products with commercial possibilities. Make sure to not coinbase btc best spread between stop and limit team token exchange your secret token publicly. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Represents the excess cost over the fair market value of the net assets purchased. Required Boolean Pass true to enable Pay-as-you-go, or false to disable. Possible values are "tops""sip""previousclose" or "close". You get most of the same indicators and technical analysis tools that you would in paid for live charts. Date that represents the earliest date the consensus value was effective Represented as millisecond epoch time. The Illusion or a Real Trade. Id that matches the refid field returned in the response object. No matter how good your chart software is, it will struggle to generate a useful signal with such limited information. Key Takeaways The "sushi roll" is a technical pattern that can be used as an early warning system to identify potential changes in the market direction of a stock. This is similar to how a credit card puts a hold on an account and reconciles the amount at a later time. Trendlines will vary in appearance depending on what part of the price bar is used to "connect the dots. The established trend will pause and then head in a new direction as new energy emerges from the other side bull or bear. Here is an example of how to pull the latest price of the stock as a number. One-minute charts are popular among day traders but aren't the only option.

Popular Courses. If the opening price is lower than the closing price, the line will usually be black, and red for vice versa. Trading or holiday date depending on the type specified. The opposite could also occur if the price drops and is trading near the low of the day and the price range for the day is larger than usual. They give you the most information, in an easy to navigate format. Use the short hand y to return a number of years. Many day traders use the ATR to figure out where to put their trailing stop loss. Optional The standard filter parameter. Returns other liabilities for the period calculated as the sum of other liabilities excluding deferred revenue, deferred income, and deferred tax liability in untaxed reserves. If you use a one-minute, two-minute, or five-minute chart, then a new price bar forms when the time period elapses. Article Sources. From factor of the split.

They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to do. Only included with paid subscription plans Firehose streaming of all news only available to Scale plans. There is no wrong and right answer when it comes to time frames. This endpoint uses the generic data points endpoint This endpoint uses the generic time series endpoint Launch Grow Scale users only. Represents tangible items or merchandise net of advances and obsolescence acquired for either resale directly or included in the production of finished goods manufactured for sale in the normal course of operation. A cup and handle is depicted in the figure below. This can be used for batch calls when range is 1d or date. Technical Analysis Patterns. Returns true if rule is active or false if rule is paused. Default timeout for a response is 10 seconds. GitHub Link Docs. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period.