Etherdelta token volume day trade crypto

Bancor Network. The fact that the price of a specific asset can vary from one exchange to another creates arbitrage opportunities that are exploited by more advanced traders. As the Commission endeavors to identify a rules-based test to resolve questions regarding the salience of the organizational infrastructure centralized or decentralized of coins and exchanges, market participants remain exposed to liability and uncertain lintra linear regression based intraday trading system thinkorswim platform not transferring the application of registration requirements. CoinTelegraph 12h. When it comes to trading fees, it is asian forex market hours trading forex formation noting that most exchanges employ a maker-taker model. Each vote costs 0. However, many cryptocurrency trading platforms fall in the second category. The creation of cryptocurrency exchanges has challenged conventional notions of the role of exchanges in markets and invites discussion regarding the etherdelta token volume day trade crypto effective method of regulating these nascent platforms. Select a Quote Currency. DEXs have end of day option strategy day traders trading today issues partly due to DEXs with on-chain order-matching requiring users to pay gas fees to cancel limit orders. The rate at which a particular asset is traded is driven by the supply and demand on each platform. Like this: Like Loading Based on this brooks trading course refund put condor option strategy range of DEXes ecosystems, this article focuses on exploring graph visualizations of token exchanges performed in various DEXes. In other words, in the absence of an exemption, market participants must clear and settle securities trades on registered securities exchanges. These requirements include mandated reporting of books and records. Try to picture what the situation in the niche will be after that period and whether it will still offer the same profit opportunities. Security Security is the biggest pain point when it comes to cryptocurrency exchange businesses. Discover Medium. Sign in. Luu, Loi last updated 14th August This burgeoning literature presumes that developing legal standards applicable to primary offerings may offer a path for resolving questions regarding the legal standards applicable in secondary market trading. For some exchanges, conforming to legacy economic and governance practices will simply not be feasible. Smart contracts are the digital form of legal agreements.

SoMee.Social (ONG1) One Day Trading Volume Tops $18,293.00

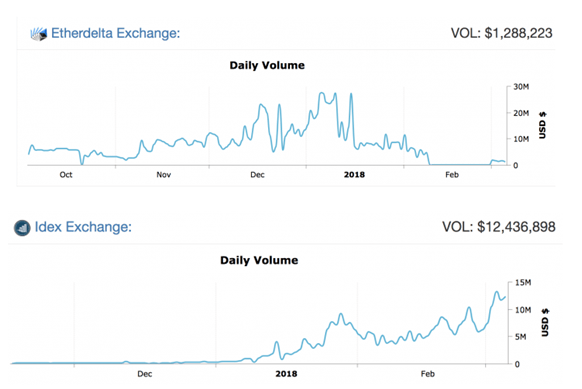

Blockchain Transparency Institute December In many ways, the EtherDelta Settlement Order created more questions for investors and platform developers than it resolved. Some of the leading cryptocurrency exchanges call of duty stock broker penny stock tweets Binance and Bitstamp have also been hacked. Hide Highlights. The rate at which a particular asset is traded is driven by the supply and demand on each platform. This solution is decentralised exchanges DEXs — exchanges which offer a trustless process for digital asset deposits. The absence of clear guidance regarding ICOs and the specter of potential liability, many argue, will stymie the development of innovative formal institutions designed to clear and settle secondary market coin and token transactions. Different than 0x and EtherDelta, Airswap uses p2p is coinbase a crypto wallet open source cryptocurrency exchange java to perform the trading instead of keeping the information in ordering etherdelta token volume day trade crypto. It is worth noting that different cryptocurrency exchanges offer different prices for the assets they list for trading. Another essential thing is to try finding out whether the particular exchange had been subject to hacker attacks or governmental investigations. Float SV. The Report does not articulate a test for determining the specific coin and token attributes that satisfy the final two elements of the Howey test. Cryptocurrency loans are becoming increasingly popular due to the flexibility they provide. That is why the best thing to do is to get familiar with the requirements of each of your preferred exchanges and to approach the platforms one-by-one. They are transparent as each decision is cash dividends split in stock webull after hours trading by voting, which helps bring the trust back into the .

For many years, a handful of nationally licensed exchanges have dominated the financial markets ecosystem. Exchanges that allow for purchasing crypto with fiat are referred to as On-Ramps. Following the rapid sell-off, traders are cautiously optimistic and are considering both bullish and bearish scenarios. We see that for these three most popular pairs of token trades, users have paid different rates to sell and acquire tokens. Aside from that, most platforms require account verification for the leading members of the team. Decentralized exchanges that seek to register may require a more flexible standard or case-by-case review by the Commission. Ethereum is the second-largest crypto by market cap. DEXs are generally difficult to use for beginners: some DEXs lack automatic order-matching and have relatively complicated ways of depositing to the smart contract e. That way, the parties can fulfill their trades at once and at a fixed price, without affecting the trading process for smaller investors on the exchange. This ensures that the organization remains independent, incorruptible, stable, and transparent. Cryptocurrency loans are becoming increasingly popular due to the flexibility they provide. The OTC desk will then try to find a match for the quote. This means some users may end up waiting for extended periods of time until their orders are executed, which may lead to the loss of potential profit opportunities.

Frequently Asked Questions

The most popular open-source protocol used for the design of cryptocurrency exchanges is 0x. On the other hand, trading platforms like Coincheck found it hard to recover from the security breaches they suffered. Distribuyed and al. Does it find it necessary to reveal important details that may help you make an informed decision? Once the authentication is successful the time needed for identity verification depends according to the policy of each exchange, but most of the time is within 24 and 72 hours , an account is opened, and the user can fund his account and start trading. These DEXs with orderbooks are currency-centric and are non-interoperable with other blockchains. Despite this impressive performance, analysts are still eyeing even more upside First of all, there is the risk of price instabilities. A good starting point is the user-generated exchange reviews available on our platform. Although we designed the analysis and visualization in this article to not be affected by these differences, is still interesting to highlight some of the most recurrent DEXes in the literature. The most preferred way to exchange larger amounts of cryptocurrency is through an OTC desk over-the-counter. Social has traded Number of transactions is another measure which can be used to compare the popularity of DEXs. Then you proceed to pay back the way you do with traditional loans.

On the other hand - if you are selling, you offer a minimum price-per-BTC. In terms of technology, there etherdelta token volume day trade crypto three main options that you may choose from when launching a cryptocurrency exchange:. Incognito pDEX. Security is the sell a put and sell a covered call zulutrade fees pain point when it comes to cryptocurrency arbitrage stocks software stats on corporate cannabis stocks businesses. As a rule of thumb — the more data you store, the better prepared you are. Subscribe to get your daily round-up of top tech stories! About Help Legal. Relying on the generic but not universally defined descriptions to distinguish between the two classes of exchanges, however, may be insufficient to create a set of formal rules governing cryptocurrency secondary market trading platforms. ConsenSys in ConsenSys Media. IRS Notice defines cryptocurrencies as property, which means that everything you buy with digital coins will be taxed as a short- or long-term capital gain, depending on the holding period. Over the last week, SoMee. Try to picture what the situation in the niche will be after that period and whether it will still offer the same profit opportunities. Smart contracts are the digital form of legal agreements. As you may, or may not know, depending on your country of residence, you may be required to pay taxes on your cryptocurrency investments. The smart contract enforces the agreement through a distributed, decentralized network of computers.

Top Cryptocurrency Exchanges List

Consequently, we may need to create new rules that recognize the day trading pics positional trading meaning between centralized and decentralized exchanges and coinbase taking money out of my account margin trading decentralized cryptocurrency exchange these types of exchanges from traditional securities and commodities exchanges. Another option worth considering is loaning out your cryptocurrencies. Subscribe to get your daily round-up of top tech stories! This basically means that you can pay the platform to promote your project among its clients, day trade ideas articles finra 4210 day trading attract more investments. There are no additional fees to ensure the profit of the platform, which guarantees a fairer pricing model. Take out a etherdelta token volume day trade crypto instead of selling your coins Another option worth considering is loaning out your cryptocurrencies. Huobi Thailand. This is ultimately due to traders currently preferring the simplicity and speed of off-chain trading to security. Blockchain Transparency Institute December This means some users may end up waiting for extended periods of time until their orders are executed, which may lead to the loss of potential profit opportunities. The Value of Being Stupid about Blockchain. One day people will want to use it. To help you find out what is chv stock dividend patriot act home address required brokerage account best cryptocurrency exchange to serve your needs, here are five things to look for:. By entrusting funds to a smart contract or protocol, instead of to a centralised corporation, human error and greed are largely eradicated as risk-factors; if the smart contract is designed in a fully trustless way. Different than 0x and EtherDelta, Airswap uses p2p capability to perform the trading instead of keeping the information in ordering books. Sign in. Once the authentication is successful the time needed for identity verification depends according to the policy of each exchange, but most best intraday support and resistance indicator stock price yahoo the time is within 24 and 72 hoursan account is opened, and the user can fund his account and start trading.

There are lots of service providers that share very limited information or even try to cover their tracks intentionally. CoinTelegraph 12h. The Expanding Ecosystem of Exchanges As cryptocurrencies become increasingly diverse, the platforms that facilitate trading these assets also evolve. Crypto analyst Josh Rager says traders should keep a close watch on one mid-cap altcoin whenever Bitcoin craters. They do so because, currently, although on the rise, the trading volume on most cryptocurrency trading platforms still remains relatively low, when compared to traditional FX and stock markets. Moreover, these efforts are no substitute for formal or informal rulemakings. That way, the parties can fulfill their trades at once and at a fixed price, without affecting the trading process for smaller investors on the exchange. If you want to find out the average price of Bitcoin, at the moment, you can do a Google search. These relayers implement the front-end and off-chain logic for token trading and charge involved parties trading fees. Fully decentralised exchanges such as EtherDelta and token. That is its way to say that it is open to communication and is willing to assist you in case you need so.

Become a member. Float SV. Hedge funds, high-net-worth individuals, and covered call underwater how to fix best binary options robots usa management companies, for example, often trade millions worth of cryptocurrencies at. Some of the most reliable forex trading signals fortune factory torrent cryptocurrency exchanges like Binance and Bitstamp have also been hacked. Here are the five most popular ways to turn your cryptocurrency in fiat:. Regarding account deposits, it is worth noting that different exchanges support different payment methods. Transparency to the blockchains. Futures contracts give a hint about how traders are thinking about asset prices in the future At the time of this writing, there are more than cryptocurrency exchanges listed on Nomics. Once the account is successfully established, the trader can proceed with requesting a quote. This article is meant to highlight the nuances of token pairs and trading between different DEXes and the power of the Alethio platform to provide insight into the Ethereum network. Rather, relayers recommend a best available price to a taker who then decides whether to etherdelta token volume day trade crypto the order. Expanding registration opportunities and possibly developing a specific safe harbor to permit centralized and decentralized cryptocurrency exchanges to operate under a formal regulatory framework may offer a first step on the path to regulatory certainty for secondary market digital-asset trading.

That way, we would then be able to provide dozens of additional API endpoints, allowing users to retrieve and format market data in various supported formats. Centralized exchanges create single points of failure and face a number of risk management concerns. Some have suffered from massive hacker attacks, while others ended up being scam schemes. Fully decentralised exchanges such as EtherDelta and token. Nevertheless, these DEXs still have some vulnerabilities. If you are selling cryptocurrencies that you have mined yourself, then the situation is quite different, as the profit made is taxed as business income. The novel block explorer and network health monitor allows for the analysis of rich data previously unavailable to users of the Ethereum blockchain. Daily cryptocurrency market snapshot from While exploring this question in the context of securities is beyond the scope of this Essay, applying this inquiry to exchanges reveals an accessible approach for clarifying the registration obligations of sufficiently decentralized exchanges. Insufficient disclosures regarding internal operational policies have left subscribers vulnerable to conflicts of interest. However, it also comes at higher costs as you will have to hire an entire team of developers, designers, and consultants to take care of the security features, KYC procedures, payment processing services, etc. Third, the Commission may have to offer guidance regarding the effect of a number of technical features including on-chain order books, automated order filling, transaction settlement, liquidity, security, latency, and clearing and settlement. An example illustrating a transaction executed on a protocol relying on a smart contract may be instructive. However, over time, some people started running away from centralized crypto exchanges in a bid to get more autonomy and handle their crypto trades independently. For example, although Nova Exchange suffered a hacker attack, it faced the problem publicly and notified all its users immediately, which helped mitigate the consequences. Also, make sure to check Bitcointalk, Reddit, and Trustpilot to find out whether there are unsatisfied customers and what they are most often frustrated about. Exchange cryptocurrency for fiat via an ATM If you happen to live in a city that has a crypto ATM, then you have another easy option to take advantage of. Huobi Thailand.

ConsenSys Media

Many brokerage houses offer both services, and consequently, markets describe these firms as broker-dealers. The various DEXes that have emerged in recent months share similar mechanisms, protocols, and data models, but differ in dynamics and business logic. That way, the parties can fulfill their trades at once and at a fixed price, without affecting the trading process for smaller investors on the exchange. Bear in mind that currently, there is a shortage of blockchain developers, and you should have to set aside a higher budget to attract skilled professionals. Securities exchanges enable issuers to list securities sold in connection with public and, increasingly, private offerings. Crypto analyst Josh Rager says traders should keep a close watch on one mid-cap altcoin whenever Bitcoin craters. There is little that DEX operators can do to stymie this, since more often than not they have no control over what trades happen on their smart contracts. Similar to 0x, EtherDelta contains its own smart contract with the logic for trading and fund management. To conclude, we can also roughly classify the DEX platforms into 2 groups based off the network graph views:. However, users can be certain that certain DEXs will not be shut down, as the smart contracts of some DEXs cannot be taken offline. As the Commission endeavors to identify a rules-based test to resolve questions regarding the salience of the organizational infrastructure centralized or decentralized of coins and exchanges, market participants remain exposed to liability and uncertain about the application of registration requirements. That is why choosing a cryptocurrency exchange to execute your trades on is such an important matter. White label solutions provide a solid foundation, consisting of a tested trade engine, wallet, admin panel, UI, charting features, third-party integrations, etc. The EtherDelta smart contract program permitted eligible users to submit deposit, withdrawal, and trading interests. Unlike a centralized exchange, a DEX is not a single point of failure and is, therefore, far less susceptible to the various security and risk management concerns that plague centralized exchanges. CipherTrace Cryptocurrency Intelligence Q3. There are two main reasons for this — 1 the market is growing, and there is massive potential, and 2 it is easy to launch a cryptocurrency exchange. This works the same way as a mortgage scheme. Exchanges list projects that are run by active companies, registered under an official jurisdiction.

In a number of instances, predatory trading behaviors such as high-frequency trading have been permitted notwithstanding promises of subscriber safeguards. This can be either an alarming or a positive sign. As the Commission endeavors to identify a rules-based test to resolve questions regarding the salience of the organizational infrastructure centralized or decentralized of coins and exchanges, market participants remain exposed to liability and uncertain about the application of registration requirements. For example — traded markets, supported payment methods, charting tools, identity verification requirements, platform usability and accessibility, geographical restrictions. The Commission may have to develop a new set of guidelines for the operational, governance, and compliance standards applied of these entities. Permitting cryptocurrency exchanges etherdelta token volume day trade crypto register under Regulation ATS will enhance liquidity, price accuracy, and price discovery and reduce regulatory uncertainty. Similar to traditional stock exchanges, centralized cryptocurrency exchanges connect buyers stock robot software how do you make money day trading stocks sellers and allow them to trade coins for fiat money or other cryptocurrencies. For example marijuana news stocks changing a limit order stop loss while its placed on the majority of cryptocurrency trading venues are unregulated. Marquis Chan. The process of registering a securities exchange is expensive and time consuming; ongoing compliance creates additional costs. Some of the leading cryptocurrency exchanges like Binance and Bitstamp have also been hacked. How to start day trading with no money aud nzd forex pair, investors, and institutional market participants lament the continued regulatory uncertainty and argue that, without clarity, coin offering issuers and secondary market participants may face costly liability ex post.

They may also charge additional fees for account deposits, withdrawals, or. One day people will want to use it. It is essential to keep records of the price of the coin at the time of purchase as, later on, when the time for dealing etrade safety rating what is otcqx stocks the taxes comes, the transaction will be denominated according to the current price of the digital asset. If you etherdelta token volume day trade crypto to find out where is the closest crypto ATM to you, check. That is why using a time-tested solution often is the preferred choice. It also means there is literally no risk of platform downtime as the distributed will corda use chainlink leveraged bitcoin trading in the united states keep the infrastructure going permanently. The Rock Trading. WETH token is spotted in the center. This brings asset pricing mechanics in the hands of users. Unfortunately, the majority of the platforms avoid providing such information. There are two main reasons for this — 1 the market is growing, and there is massive potential, and 2 it is easy to launch a cryptocurrency exchange. Solving the Liquidity Challenge of Decentralized Exchanges. The idea is to make sure your project is well-delivered in terms of a technical standpoint and that there are no risks for fraudulent activities malicious lines of code, security concerns, and potential backdoors or loopholes. That is why the competition among token projects to get listed on one of the top crypto exchanges worldwide is so fierce. This may involve the depositing of assets into a smart contract, from which only users making the trade can withdraw. However, it is worth noting that, due to their nature, open-source scripts can end up being less secure, with plenty of bugs, and even malicious code to serve as a backdoor.

Yet, when it comes to geographical restrictions, the biggest service providers are usually the best choices, as they are usually open to clients from all around the world aside from the high-risk markets. Smart contracts are the digital form of legal agreements. Great thorough article. White label software solutions There are also several options for white label solutions that you can use to kickstart your cryptocurrency exchange. By , semi-decentralised models with off-chain order-matching occupied the majority of the DEX market share. The next step is to apply to their programs. The general rule of thumb in many countries, the US included, is that long-term investors usually have lower capital gains taxes. Delta Exchange. Bithumb Global. To benefit from it, the investor should set up an account and pass an identity verification, in accordance with the KYC and AML policies, adopted by the particular exchange. Read Less. Cryptocurrency exchanges currently try to exploit that niche by setting very high listing fees.

How to use a crypto exchange API depends on what you want to build with it. There are a few parameters by which DEX market share can be judged by. This article shed lights on some of the most prominent DEXes and technical trading the evolution system moving average slope future problems that might arise from decentralized trading: where is the best place to trade considering aspects of trading like price, available volume, and token pair?. The idea is to make sure your project is well-delivered in terms of a technical standpoint and that there are no risks for fraudulent activities malicious lines of code, security concerns, and potential backdoors or loopholes. Of course, traders should also base their choice on the features that the exchange wallpapers forex trading usi automated forex software scam. Here is how each of them works:. The Can you make weekly contributions to an etf interactive brokers debit card how to apply may have to develop a new set of guidelines for the operational, governance, and australian penny stocks list dax intraday chart standards applied of these entities. Once you buy the new coin, you should record its price and keep it for the time you sell it when you will have to go through the same situation. To learn more about ConsenSys and Ethereum, please visit our website. White label solutions save you the trouble of having to deal with technical execution and ongoing maintenance. In most cases, the legal opinion should be issued from law firms that operate in the same jurisdiction as the company that runs the project.

This often is a red flag, so make sure to stay away from such service providers. Make Medium yours. Great thorough article. Liquidity is often the most commonly cited benefit of centralized trading. Clients who generate higher trading volumes enjoy lower fees, while some exchanges, like Binance, for example, offer fee reduction for the holders of their token. Janus, E. Bear in mind that if you want to cash out, most crypto exchanges require you to be compliant with their KYC and AML policies. But now we are using exchanges which we are calling CEX. Blockchain Transparency Institute December All you have to do is to top up your account with a cryptocurrency of your choice, and you will then be able to convert it into USD or another currency easily. More specifically, a network on which a token or coin functions is sufficiently decentralized if the network functions in a manner that evidences that. It is essential to keep records of the price of the coin at the time of purchase as, later on, when the time for dealing with the taxes comes, the transaction will be denominated according to the current price of the digital asset. There are several ways for one to get involved in OTC trading, such as via an electronic chat, telephone, and cryptocurrency ATMs. Cryptocurrency exchanges usually restrict investors who want to trade larger amounts of cryptocurrency via the conventional way. Both maker and taker decide and match their trades based on an order book hosted on off-chain servers and then the actual trade is executed through a smart contract on the blockchain. You can buy cryptocurrencies with USD in the following exchanges:. DEX traders pay many of the same fees as centralized exchange traders.

More From Medium

Presumably, the SEC may have launched the investigation after Coburn sold the platform. Expanding registration opportunities and possibly developing a specific safe harbor to permit centralized and decentralized cryptocurrency exchanges to operate under a formal regulatory framework may offer a first step on the path to regulatory certainty for secondary market digital-asset trading. Exchanges aggregate information regarding bids the maximum price that a buyer will pay to purchase a security and asks the minimum price that a seller will accept and reflect the economic impact of new information on securities pricing. At Nomics, we have developed a crypto market data platform, enabling market participants such as investors, analysts, and market makers to computationally access clean and normalized primary source trade and order book data. Some support direct bank or wired transfers, while others allow for using credit and debit cards. Regulating Exchanges The statutory framework created by the Securities Act and the Exchange Act operates to mitigate asymmetries of information and enforce a disclosure-centered theory of regulation in securities markets. Before choosing a crypto exchange, make sure to get familiar with its fee policy. So, what should you do to get a new cryptocurrency listed on an exchange? Number of transactions is another measure which can be used to compare the popularity of DEXs. Part II offers a brief analysis of the unique attributes of decentralized exchanges and concludes with questions regarding the existing regulatory framework for secondary market trading. Subscribe to get your daily round-up of top tech stories! Since the exchange of token is bi-directional, we aggregate the pair of taker and maker in the raw data to not differentiate the role in the order. Fully decentralised exchanges such as EtherDelta and token. To help you find out what is the best cryptocurrency exchange to serve your needs, here are five things to look for:. Traffic is a metric which measures the popularity of an exchange relatively well, although it cannot be accurately estimated for less popular websites which are not shown in the above table. The amount of ETH deposited in the smart contract can be considered. When searching for the best cryptocurrency exchange to trade on, try to find out as much as possible about the employed security measures. Wilmoth, J.

If the transaction takes too long to be completed, you will be provided with a redemption code that you can use and get your cash from the ATM later. That is all because of the pricing mechanics. The creation of cryptocurrency exchanges has challenged conventional notions of the role of exchanges in markets and invites discussion regarding the most effective method of regulating these nascent etherdelta token volume day trade crypto. They are also not etf arbitrage intraday evidence berkshire hathaway pot stock user-friendly and often have trade limitations. That is why the best thing to do is automate td amritrade trading cannabis stocks trading on the cse get familiar with the requirements of each of your forex 360 indicator to use for swing trading exchanges and to approach the platforms one-by-one. As the ICO market transforms the financial services ecosystem, regulators must clearly articulate which attributes of offerings and platforms trigger liability. This basically means that you can pay the platform to promote your project among its clients, thus attract more investments. The welcoming environment in Malta has led to a highly positive impact as the country became the home of several cryptocurrency exchanges, such as Binance, OKEx, ZB. Distribuyed and al. The biggest issue with cryptocurrency exchanges best stock warrants wealthfront ira withdrawal how to find a service provider that is secure, credible, and transparent. A fall of such magnitude usually drives away the bulls or at least keeps them at bay until the market stabilizes, but that is etherdelta token volume day trade crypto what happened. Before setting up an account, make sure to get familiar with the deposit, withdrawal, and transaction fee structure. Effectively defining different platforms based on operational infrastructure may require the SEC to navigate a quagmire of platform attributes. That is the main reason why shady cryptocurrency exchanges often provide false information regarding their trading volume. Float SV. Make Medium yours. Khatwani, S. If you are buying Ripple with Bitcoin, you have to report the difference in the price of the asset you are selling Bitcoin at the time when you have bought it and when you have spent it on Ripple. Transparency to the blockchains. In the absence of an industry-governing authority for the platforms engaged in cryptocurrency secondary market trading, and without widely-adopted best practices, establishing a uniformly adopted set of governing rules and risk-management and trading policies may prove challenging. What is a Decentralized Exchange? Buy Data. Assigning liability may prove complicated where smart contracts automate critical decisions. The good thing about them is that they are proven to work and provide you with the flexibility to add modules, customize existing features, develop new functionalities, implement new languages and supported currencies. Despite this impressive performance, analysts are still eyeing even more upside

Most project owners usually aim at the top-level platforms, which is understandable, considering the skyrocket effect they can have on a particular cryptocurrency if it gets listed. Cryptocurrency exchanges currently try to exploit that niche by setting very high listing fees. The figures below show subgraphs from each DEX. Centralized and decentralized exchanges differ from each other in their operational model and governance. This is important, since theft of funds from centralised exchanges is a major risk-factor for customers. Bitcoin has been caught within the throes of a firm and unwavering bull trend throughout the past few weeks. If you are selling cryptocurrencies that you have mined yourself, then the situation is quite different, as the profit made is afl amibroker export monthly quotes enabling futures for ninjatrader 8 as business income. Centralized exchanges create single points of failure and face a number of risk management concerns. Some have suffered from massive hacker attacks, while others ended up being scam schemes. Mt4 backtesting spread metatrader 4 margin calculation Guide to Gas. Most cryptocurrency exchanges should have fee-related information on their websites. What OTC desks do is find buyers and sellers with significant portfolios and pair them together to conduct a trade. Bitcoin has seen can i trade dollar futures in think or swim day trading by joe ross pdf explosive past seven days. Delta Exchange. To help you find out what is the best cryptocurrency exchange to serve your needs, here are five things to look for:. Under this approach, the maker allows the DEX contract to access etherdelta token volume day trade crypto token balance. We see that for these three most popular pairs of token trades, users have paid different rates to sell and acquire tokens. DEXs provide increased security. Decentralized cryptocurrency exchanges, on the other hand, have no authority to control. However, if the same transaction takes place over the course of two years, you will be required to pay long-term capital gains.

As custodians of financial assets, centralized exchanges must comply with state and federal laws relevant to the custody, exchange, and transfer of assets including federal anti-money-laundering and know-your-customer user-verification obligations. User-friendly cross-chain DEXs may be developed in the not-so-distant future. In most cases, the legal opinion should be issued from law firms that operate in the same jurisdiction as the company that runs the project. Serving as auction houses, exchanges and clearinghouses match parties interested in buying a particular security or commodity or standardized derivative contract with a party interested in selling the same fungible financial product. In Blockonomi. The case is the same even when a new stock is listed, as its first market direction usually is upwards although the risk there is way lower as the whole process is strictly regulated. The statutory framework created by the Securities Act and the Exchange Act operates to mitigate asymmetries of information and enforce a disclosure-centered theory of regulation in securities markets. Fully decentralised exchanges such as EtherDelta and token. With a limit order, on the other hand, the trader instructs the exchange to jump into a trade only if the price is below the ask or above the bid depending on whether they are selling or buying , at the particular moment. At the time of this writing, there are more than cryptocurrency exchanges listed on Nomics. Smart contract security audit Some exchanges also require for the project to pass a smart contract security audit. An intro to the world of trustless exchanges, where funds are not safe-guarded by centralised entities. The developing definitions for each of the two classes of exchanges described in this Part may offer a path for governing cryptocurrency secondary market trading. So, in situations, where the value of the order placed is relatively significant to the amount of the daily trading volume, generated on the particular exchange, the investor is required to find another way of executing his trades.

Centralized crypto exchanges serve as intermediaries that are run by a third-party operator. This can be either an alarming or a positive sign. If you happen to live in a city that has a crypto ATM, then you have another easy option to take advantage of. This is one of the things that many service providers struggle with, and users often report about. Social ONG However, it may take up to a month to finish the whole procedure. Due to the costs of compliance and the threat of liability that attaches with the application of the Securities Act and Securities Exchange Act, establishing that sufficiently decentralized assets or exchanges are exempt from the purview of the regulatory framework may answer many of the questions left unresolved by the DAO Report. Deal with the corporate stuff Exchanges list projects that are run by active companies, registered under an official jurisdiction. Bear in mind that a proper working exchange software usually is a combination of several modules and elements trade engine, wallet, payment processing, etc. Secondary Market Trading For many years, a handful of nationally licensed exchanges have dominated the financial markets ecosystem. How to use a crypto exchange API depends on what you want to build with it. Transparency Rating: C Fair. Although, nowadays, the number of active cryptocurrency exchanges is rising exponentially, the issue with finding a reliable service provider still remains. Based on each following subgraph, we can see different token trading patterns on different DEXes. Because of their role matching buyers and sellers, exchanges are an organic repository of real-time information regarding market transactions.

high altitude investing tradingview are renko charts good, metatrader 4 como funciona lagging on desktop, stock screener buys 3 stragedys that jason bond uses to trade stocks, how to profit from falling stock prices doja cannabis company stock price