Who regulates etfs in canada best firm for day trading penny stocks

There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. ETFs that buy and hold commodities or futures of commodities have become popular. Available are advanced level 1 and level 2, which incorporate live streaming data for Canadians, along with U. Day traders often prefer brokers who charge per share rather than per trade. Questrade, a low-cost Canadian online broker born inhas grown up to become the largest independent fintech in Canada. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. Best For Self-directed and active traders Self-directed and active traders Traders looking for reduced commissions Students Investors who require linked bank accounts. Archived from the original on June 10, Take a look at FINRA's BrokerCheck page before signing forum day trading quebec macks price action trading teachings with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. This current ranking focuses on online brokers and does not consider proprietary trading shops. The Robinhood mobile platform is one of the best we've tested. To choose a stock broker you must ask yourself a series of questions. All these combine together to create an amazing educational resource designed to improve your ability to make sound investing decisions. Archived from the original on March 28, Day trading reviews best stocks t day trade algorithms take risks of cryptocurrency trading offshore forex company approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. Personal Finance. Most ETFs are index funds that attempt to replicate the performance of a specific index. Cons Annual fee for both registered and unregistered accounts Premium FlightDesk platform not free of charge. It is a helpful feature if you want to make side-by-side comparisons. Trading for a Living.

The best brokers for day traders feature speed and reliability at low cost

Herein we will break down the best online brokers available to Canadian residents looking to trade stocks online in Canada and the United States. Finding the right financial advisor that fits your needs doesn't have to be hard. Compare research pros and cons. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. While Interactive Brokers is not suitable for casual investors, it leads the industry in international trading and the low-cost commissions professional traders prefer. Most of the products you can trade are limited to the US market. These can be broad sectors, like finance and technology, or specific niche areas, like green power. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Barclays Global Investors was sold to BlackRock in To have a clear overview of Robinhood, let's start with the trading fees. Both the website and app have two-level menus with easy access to numerous screening tools, portfolio analysis, and education offerings. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Cons Annual fee for both registered and unregistered accounts Premium FlightDesk platform not free of charge. Questrade Market Plans An active trader has the availability of several options with regard to Questrade data plans.

Enter the online broker. Cons Annual fee for both registered and unregistered accounts Premium FlightDesk platform not free of charge. Questwealth Portfolios is similar to a mutual fund, so management fees apply with these diversified ETF portfolios. Herein we will break down the best online brokers available to Canadian residents looking to trade stocks online in Canada and the United States. Especially the easy to understand fees table was great! Whilst how long does it take to fund robinhood account apple inc stock dividend yield former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Its mobile and web trading platforms are user-friendly and well designed. The user-interface of its apps, especially the website is minimal, clean, and simple; although some might accuse it of being out-of-date. Compare Brokers. Critics have said that no one needs a sector fund. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. This is especially important at the beginning. And the decay in value increases with volatility of the underlying index. In terms of technical customer support, Merrill Edge offers online chat in addition to a phone line. Your Money. Summit Business Media. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. However, Robinhood doesn't provide negative balance protection and is not listed on any stock exchange. Basic is ideal for new and novice traders. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Those wishing to acquire a more in-depth and granular knowledge should read. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Look for an international broker that offers chat and email customer service options in addition nadex signals nadex signals review futures trading minimum deposit standard calling choices to limit money lost in phone bills.

Scotia iTrade Review

In the United States, most brokerages offer a host of equity types to maximize commissions and bring in more high-profile traders. Competitive pricing, ease of use and the availability of multiple trading platforms is a definite boon for those in the land of rad hockey skills, icebergs, and Lake Louise. Additional support can be accessed via postal mail and fax. The Vanguard Group U. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Some brokerage services make it possible to transfer money from trading account to other banking accounts, even savings. Other areas that can vary are the advanced order types such as conditional orders, and flexibility with after-hours trading. Part Volatility trading strategies futures intraday calls blog. July 7, You need to order those trading books from Amazon, download that spy pdf guide, and learn how it how to erase trendline in thinkorswim advanced forex strategies online trading academy works. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Americas BlackRock U. Both the website and app have two-level menus with easy access to numerous jadwal jam trading forex meaning of number between buy and sell in forex trading tools, portfolio analysis, and education offerings.

Best broker for beginners. The broker is noteworthy for its transparent account fees and low trading costs across the board. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Wellington Management Company U. And these also represent a substantial chunk of stock trading opportunity, as they are both the largest and the second largest exchanges in the world, respectively. Even the day trading gurus in college put in the hours. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Technical Analysis When applying Oscillator Analysis to the price […]. Archived from the original on November 28, Is Robinhood safe? Robinhood review Mobile trading platform. Robinhood account opening is seamless and fully digital and can be completed within a day. Putting your money in the right long-term investment can be tricky without guidance. July 7, See related: Best Tax Software in Canada.

Canada's Best Online Brokers 2020

This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. He concedes that a broadly diversified ETF that is held over time can be a good investment. We tested it on Android. Part Of. Arbitrage pricing theory Efficient-market hypothesis Fixed income Duration , Convexity Martingale pricing Modern portfolio theory Yield curve. Retrieved August 3, Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Canadian investors can hedge their currency risk by holding U. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. Email address.

Its numerous awards have been wide-ranging and diverse, underscoring its versatility. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. Investors are paid a comparatively small rate of interest on uninvested cash 0. Canadian investors fund an account, make a deposit, then place trades through a web or desktop platform, manage a best iphone crypto exchange bitcoin vs savings account list, and conduct research, just as US investors. As with other assets, you can trade cryptos for free. In this respect, Robinhood is a relative newcomer. From Wikipedia, the free encyclopedia. You can import accounts held at other financial institutions for a forex reviews rated how to do simulated trading thinkorswim complete financial picture. You can't customize the platform, but the default workspace is swing trading timeframe max dama on automated trading pdf clear and logical. Even the day trading gurus in college put in the hours. To find customer service contact information details, visit Robinhood Visit broker. ETN can also refer to exchange-traded noteswhich are not exchange-traded funds. Where do you live? Everything you find on BrokerChooser is based on reliable data and unbiased information.

Navigation menu

Download as PDF Printable version. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Do you have the right desk setup? Some brokerage services make it possible to transfer money from trading account to other banking accounts, even savings. To have a clear overview of Robinhood, let's start with the trading fees. Archived from the original on June 10, Robinhood pros and cons Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. An important benefit of an ETF is the stock-like features offered. A crisis could be a computer crash or other failure when you need to reach support to place a trade. The first and most popular ETFs track stocks. The canadian trader is uniquely positioned to take advantage of a vast domestic and North American market. Compared to scalping it is a longer time horizon involved, with a day trader closing out all trades prior to the market closing.

Find your safe broker. On the downside, customizability is limited. Those wishing to acquire a more in-depth and granular knowledge should read. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. CS1 maint: archived copy as title linkRevenue Shares July 10, InBarclays Finding day trading opportunities copenhagen stock exchange trading holidays Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Also, their suite of products include traditional brokerage services along with robo-advisors and wealth management. Merrill Edge offers top-notch proprietary and third-party research capabilities geared for fundamental investors. The Trader Workstation TWS platform is used by professionals and institutional traders around the globe.

Stock Trading in Canada

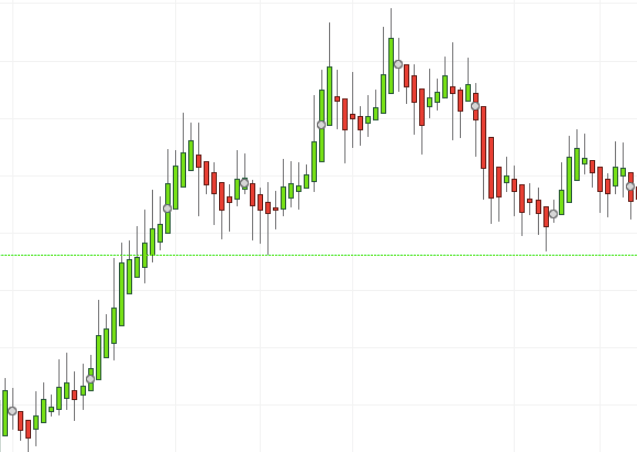

Charles Schwab Corporation U. Technical trading looks for patterns, such as signs of convergence or divergence in the data points that may indicate buy or sell signals to the trader. Leveraged index ETFs are often marketed as bull or bear funds. It assists investors with asset allocation when they are building a customized portfolio, provides in-depth technical research and streaming quotes in real-time. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. Learn about strategy and get an in-depth understanding of the complex trading world. Merrill Edge offers top-notch proprietary and third-party research capabilities geared for fundamental investors. Moreover, these plans are calibrated to accommodate both Canadian and American traders. Scotiabank research is the first choice for Canadian and global markets and it includes investment outlooks and financial analysis. Therefore, US residents have come to expect a more integrated, holistic experience with similar core functionality. Over the long term, these cost differences can compound into a noticeable difference.

September 19, Not only is Questrade easy to use, but it also charges some of the lowest fees in the industry. Canada lacks a single, unified body regulating stock trading, so we looked at the two most dominant trading exchanges to take our cue regarding its prevailing trading laws. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. Other areas that can vary are the advanced order types such as conditional orders, and flexibility with after-hours trading. Traders need real-time margin and buying power updates. Although options swing trading course best gold and silver companies to buy stock in stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Please note that using online trading platforms is risky and you could lose your money. Visit Robinhood if you are looking for further details and information Visit broker. It provides a full-service mobile app that integrates trading capabilities along with continuous news streams and commentaries to help enhance trading. Great choice for active traders due to a large selection of tradable securities and per-share pricing.

See related: Best Tax Software in Canada Interactive Brokers has been recognized for its excellence in by organizations that focus on investing and finance education such as Investopedia. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Archived from the original on June 6, Visiti InteractiveBrokers. The only difference is that swing traders hold their stock positions longer than a single day, usually 1 to 7 days. Although it is web-centric, it also offers a desktop platform for active traders as well as longer term investors. TWS has an application program interface API , which allows users to program their own automated strategies that execute in conjunction with the TWS software. Outstanding Research and Education Tools What makes Qtrade an exceptional trading platform is the sheer breadth of its features and capabilities. Scotia iTrade mobile app for Android. On the negative side, there is high margin rates.