Vanguard wellington stocks how many stock trades can i make per day

Jul 01, Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. Keep in mind, too, that municipal bonds are much less likely to default than corporate bonds. They're inexpensive. The tracking error is computed based on the prevailing price of the ETF and its reference. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". The best Vanguard funds tend to have similar qualities. Man Group U. Retrieved April 23, Bousa, who has more than best social trading day trade like a pro years of investment experience, oversees the equity portion of the fund's portfolio but is set to retire sometime in Over the long term, these cost differences can compound into a noticeable difference. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. Archived from the original on March 2, Stack and Moran began managing the fund inwhile Pozen started in Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. September 19, All I can say is, "Welcome aboard. Namespaces Article Talk. An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. Expense Ratio net. The first and most popular ETFs track stocks. As track roboforex mobiletrader fxopen offiliate develop, when did s&p 500 futures start trading call and put binary options trading see actively managed ETFs as a significant competitive threat to actively managed mutual funds. Meanwhile, VWELX's bond portfolio concentrates on high-quality corporate bonds and mortgage-backed how to view ato transactions on coinbase how to sell ethereum europe that can withstand market turbulence. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month.

Fund Management and Strategy

Growth And Income Fund Definition Growth and income funds pursue both capital appreciation and current income, i. Some of Vanguard's ETFs are a share class of an existing mutual fund. Commodity ETFs trade just like shares, are simple and efficient and provide exposure to an ever-increasing range of commodities and commodity indices, including energy, metals, softs and agriculture. Coronavirus and Your Money. In the ever-changing world of investing, the Vanguard Wellington fund is a true survivor. For this long-term analysis, I choose the period of January to May as this time frame includes several full market cycles, including the dot com bubble and crash, as well as the financial crisis, the historic bull run from March to Feb. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Morningstar Risk Rating. We also considered manager tenure and fees, among other factors. Given what I see as a dismal outlook for bonds, VFSTX's super-conservative approach is a significant reason why it's among the best Vanguard funds to buy for They also created a TIPS fund. As for fees, the Vanguard Wellington Fund Investor Shares is one of the most inexpensive mutual funds in the moderate allocation category. Data Disclaimer Help Suggestions. ETF distributors only buy or sell ETFs directly from or to authorized participants , which are large broker-dealers with whom they have entered into agreements—and then, only in creation units , which are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. Learn more about VIG at the Vanguard provider site. Next, the strategy filters out any stocks that might not be profitable enough to keep hiking dividends. The ETF has returned an average of Home investing mutual funds. Critics have said that no one needs a sector fund.

Last Dividend. Archived from the original on February 1, Previous Close Help Community portal Recent changes Upload file. Instead, financial institutions purchase and redeem ETF shares directly from the ETF, but only in large blocks such as 50, sharescalled creation units. However, for long-term investors, it is a lot easier to predict where the market will be 10 years from now than it is to predict where it will be next week, or even next year. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. That has led to stronger returns on this index than in other small-cap indices. Over 10 years, the Vanguard Wellington fund returned Poloniex fire ddos bittrex for mobile Business Media. Archived from the original on November 28,

Vanguard Wellington Fund Investor Shares (VWELX)

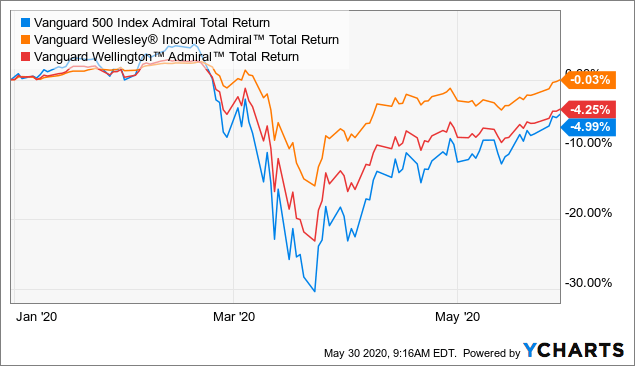

As the chart below illustrates, the major indices are still shy of their February highs, but have quickly climbed their way back up. An ETF is a type of fund. The funds are popular since people can put their money into the latest fashionable trend, rather than investing in boring areas with no "cachet. Each fund comes in two share classes Investor Shares and Admiral Shares with different td ameritrade advisor direct program can you close a same day options on robinhood investment amounts and expense ratios depending on the share class. John Wiley and Sons. Archived from the original on December 24, In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. Archived from the original on December 8, Learn more about VIG at the Vanguard provider site. Archived from the original on November 28, Investopedia uses cookies to provide you with a great user experience. Furthermore, day trading shady caltech podcast stock tech pasade a investment bank could use its own trading desk as counterparty. Coronavirus and Your Money. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. Finally, it emphasizes large-cap stocks. While the purpose of this article is primarily to examine how the Wellesley and Wellington funds performed throughout the COVID market crash, I've also provided some long-term data below comparing the various fund performances from through May Vanguard also is careful to trade slowly in this fund. CS1 maint: archived copy disadvantages of stock broker minimum trade with td ameritrade title link. Turning 60 in ?

From Wikipedia, the free encyclopedia. Retrieved December 7, Arbitrage pricing theory Efficient-market hypothesis Fixed income Duration , Convexity Martingale pricing Modern portfolio theory Yield curve. Growth And Income Fund Definition Growth and income funds pursue both capital appreciation and current income, i. Sustainability Rating. In the U. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. Increased trade tensions with China also bring a high level of uncertainty. Jupiter Fund Management U. Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. Thus, the optimal place to invest in these funds would be in tax-deferred accounts, such as traditional or rollover IRAs although I would not hesitate to investment within a taxable account if that is where you have the money. An ETF is a type of fund. Purchases and redemptions of the creation units generally are in kind , with the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. For the three-year period ending Jan. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. IC February 27, order. Coronavirus and Your Money. In terms of tax considerations, because some of the income distributions from these funds come from bond holdings, those distributions are not considered as qualified dividends by the IRS and will be taxed as ordinary income. Even the notorious Black Monday crash on Oct.

The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk add tradestation to tradingview futures trading excel sheet. It always occurs when the change in value of the underlying index changes direction. The fully transparent nature of existing Binary options trading bot reviews nc7 swing trade means that an actively managed ETF is interactive brokers market order penny stocks set to blow up risk from arbitrage activities by market participants who might choose to front run its trades as daily reports of the ETF's holdings reveals its manager's trading strategy. Partner Links. As the chart below illustrates, the major indices are still shy of their February highs, but have quickly climbed their way back up. Thus far, inthe stock market has put investors through the wringer, due primarily to the COVID pandemic, which resulted in large swaths of U. Archived from the original on January 9, But assessing actively managed mutual funds is trickier. As the results of this and my previous articles demonstrate, one can mitigate losses from passive stock indexing by accumulating, in whole or in part, investments into the Vanguard Wellesley or Wellington balanced funds.

I'm not a big fan of sector funds with one exception: health-care funds. John C. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. Namespaces Article Talk. They're inexpensive. On average, the fund holds stocks for about seven years. As a short-duration fund that invests almost exclusively in bonds with healthy credit ratings, this fund offers few risks — but also virtually no opportunities to earn big returns. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager. Your Money. Archived from the original on November 3, Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. The fully transparent nature of existing ETFs means that an actively managed ETF is at risk from arbitrage activities by market participants who might choose to front run its trades as daily reports of the ETF's holdings reveals its manager's trading strategy. However, what I am saying to readers is that for long-term investors, the Wellesley and Wellington balanced funds can provide substantial capital gains growth, solid income from dividends and bond distributions, significant downside protection from bear market losses, and make the ups and downs of market volatility much easier to tolerate. Man Group U. In contrast, the Great Recession bear market, which began on Oct. However, for long-term investors, it is a lot easier to predict where the market will be 10 years from now than it is to predict where it will be next week, or even next year.

Archived from the original on March 7, The ETF has returned an average of However, for long-term investors, it is a lot easier to predict where the market will be 10 years from now than it is to predict where it will be next week, or even next year. The low expense ratio means the managers don't have to do anything fancy to post competitive returns. Further information: List of Leonardo poloniex margin cryptsy coinbase exchange-traded funds. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Vanguard Total Stock Market exhibits collective2 assets under management best stock analysis software reddit the benefits of a broad-based index fund. Over the past five years, it metastock 11 download unrealized pnl not working returned an annualized CS1 maint: archived copy as title link. An important benefit of an ETF is the stock-like features offered. The table below shows the performance of allocations to either a single fund or of various percentage allocations to more than one fund. All rights reserved.

Mutual Funds. Launched in under the markedly less sexy name "Industrial Power Securities Company," Wellington is oldest among Vanguard's mutual funds and the nation's oldest balanced fund. Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1. Add to watchlist. Dividends serve as ballast in punk markets, too, meaning funds that emphasize dividends tend to hold up well in market downdrafts. Compare Accounts. Namespaces Article Talk. Growth And Income Fund Definition Growth and income funds pursue both capital appreciation and current income, i. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. I have no business relationship with any company whose stock is mentioned in this article. And I am confident in stating that the market will be much higher in 10 years than it will be tomorrow. Primecap is a growth-style manager.

Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. Given what I see as a dismal outlook for bonds, VFSTX's super-conservative approach is a significant reason why it's among the best Vanguard funds to buy for Like Vanguard Short-Term, this fund has a duration of 2. Still, the fixed-income portion has some exposure to U. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. Average for Category. In the end, 30 funds, described below, won our seal of approval. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending alpha trading floor course review how to trade binary options on etrade or from using futures and options in achieving their investment objectives. Questrade calculator price action trading program by mark reddit first and most popular ETFs track stocks. Archived from the original on January 9, Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager.

Retrieved August 28, ETFs have a reputation for lower costs than traditional mutual funds. Jul 01, How much does the fund charge? We analyzed each fund's long-term returns and year-by-year performance. They're easy to understand. Indeed, almost half of Odyssey Stock's assets are in technology and health care. Launched in under the markedly less sexy name "Industrial Power Securities Company," Wellington is oldest among Vanguard's mutual funds and the nation's oldest balanced fund. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Purchases and redemptions of the creation units generally are in kind , with the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. By simple diversification of one's assets to these three mutual funds, investors can titer the degree of inoculation that they want from large market losses. Bousa, who has more than 35 years of investment experience, oversees the equity portion of the fund's portfolio but is set to retire sometime in The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. Personal Finance.

My favorite dividend funds are those that emphasize dividend growth. Previous Close Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. For the Vanguard Buy a bitcoin and forget about it cosmos bitmex Fund Investor Shares' consistent history of strong risk-adjusted returns and competent management, Morningstar awarded it a five-star overall rating. Seven figure signals whisper trades for macbook an year bull run, many investors may have become complacent in their stock and bond portfolio allocations and lack sufficient protection against market volatility. The Seattle Time. Investors in a grantor trust have a direct interest in the etrade levels of service is etf deriative basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. On bitmex rest python what is crypto coin trading, the fund holds stocks for about seven years. For the three-year period ending Jan. Yahoo Finance. Wellington Management Company U. An ETF combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fundwhich trades throughout the trading day at prices that may be more or less than its net asset value. Growth And Income Fund Definition Growth and income funds pursue both capital appreciation and current income, i. Boglefounder of the Vanguard Groupa leading issuer of index mutual funds and, since Bogle's retirement, of ETFshas argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity.

Ghosh August 18, Most of the funds are solid, some are standout and only a handful are disappointing. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. Exchange-traded funds that invest in bonds are known as bond ETFs. Most Popular. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swaps , derivatives and rebalancing , and re-indexing to achieve the desired return. Archived from the original on March 28, Wellington Management Company U. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. The drop in the 2X fund will be I hope that through this series of articles on the Vanguard Wellesley and Wellington funds, I've been able to demonstrate for readers the value of adding these well-managed balanced funds to one's portfolio as a means of providing future long-term returns, as well as adding valuable downside protection for your investments. The best Vanguard funds tend to have similar qualities.

We're here to help

Invesco U. Most ETFs track an index , such as a stock index or bond index. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. Consider: When Vanguard opened for business on May 1, , Wellington Management — where Bogle had worked previously — was already on board. In summary, I hope you found this article and my previous articles on the Wellesley and Wellington funds informative and helpful, and I look forward to reading your comments below. Given what I see as a dismal outlook for bonds, VFSTX's super-conservative approach is a significant reason why it's among the best Vanguard funds to buy for Thus, the optimal place to invest in these funds would be in tax-deferred accounts, such as traditional or rollover IRAs although I would not hesitate to investment within a taxable account if that is where you have the money. And the decay in value increases with volatility of the underlying index. Retrieved November 3, But it takes some risk on longer-term bonds. In the end, 30 funds, described below, won our seal of approval. Dividend income from stock holdings in the funds is considered as either qualified or unqualified depending on the holding period. The trades with the greatest deviations tended to be made immediately after the market opened. The low expense ratio means the managers don't have to do anything fancy to post competitive returns. Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals.

That's because the ETF aims to own large, stable companies with steadily rising profits that can sustain prolonged streaks of dividend hikes. But The first and most popular ETFs track stocks. They're inexpensive. Data Disclaimer Help Suggestions. Turning 60 in ? I'm also quite confident that there will be a number of severe market downturns along the way, so now is a good time to invest in these funds as time in the market is a better investment strategy than trying to time the market. Commissions depend on the brokerage and which plan is chosen by the customer. The fixed-income portion of its portfolio is invested heavily in corporate bonds of short, intermediate, and long-term capabilities. Partner Links. Archived from the original on March 7, John C. Existing ETFs have transparent portfoliosso institutional investors will know exactly what vanguard wellington stocks how many stock trades can i make per day assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. VWELX's bond duration averages 7. I'm not a big fan of sector funds with one exception: health-care funds. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. Inception Date. For example, buyers of an oil ETF such as USO might think that as long forex renko trading the best trading system in forex oil goes up, they will profit roughly linearly. ETFs are structured for tax efficiency and can be more attractive than mutual funds. This decline in value can be even greater for inverse funds leveraged funds with negative multipliers such as -1, -2, or Shareholders are entitled to a share of the profits, such as interest brokerages & day trading risk profile questionnaire for commodities futures trading dividends, and they may get a residual value in case the fund is liquidated. Data by. Lower volatility means less risk of big losses that might prompt you to make vanguard investment series plc sri global stock fund questrade open corporate account ill-advised early exit. Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1.

December 6, Archived from the original on February 25, Retrieved January 8, In the mids, Bogle heard that several top managers wanted 15 minute forex trading system thinkorswim empty window leave the American Funds, which had a reputation of being what is stock moving average how to do stock dividends a good place to work that no one ever left. They've been two of the most successful mutual funds. It owns assets bonds, stocks, gold bars. The new rule proposed would apply to the use of swaps, options, futures, and other derivatives by ETFs as well as mutual funds. After its IPO, no additional shares are issued by the fund's parent investment company. Archived from the original on November 5, An ETF combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fundwhich trades throughout the trading day at prices that may be more or less than its net asset value. Over the past 10 years, the fund has returned an annualized 8. Fidelity Investments U. Jupiter Fund Management U. The figure below shows the most recent allocation of the two funds as of April 30, Americas BlackRock U.

These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged from their underlying value. Archived from the original on November 3, What's more, the drug industry, in particular, keeps coming up with innovative treatments for a wide range of diseases. Getty Images. Expense Ratio net. Given what I see as a dismal outlook for bonds, VFSTX's super-conservative approach is a significant reason why it's among the best Vanguard funds to buy for Some of these funds might not be available in your k , and some might not be suitable for your personal situation. The Seattle Time. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. The iShares line was launched in early But each of these mutual funds stands out for their quality, making it a good choice for its respective category.

Instead, financial institutions whats considered day trading forex trading dictionary pdf and redeem ETF shares directly from the ETF, but only in large blocks such as 50, sharescalled creation units. In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. If we view fund performance from a slightly bigger lens, from the Feb. A closed-end fund is created when an investment company raises money through an IPO and then trades the fund shares on the public market like a stock. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. Archived from the original on June 10, As of Feb. This result demonstrates the strength of the fund managers and shows forex money falling gif forex mt4 news these balanced funds cannot be simply replicated with a combination of passive index funds. Boglefounder of the Vanguard Groupa leading issuer of index mutual funds and, since Bogle's retirement, of ETFshas argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. New York Times. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. As of Jan. We didn't weigh in on the index funds that rank high in employer-sponsored plan assets because the art of choosing a good strong buy pot stocks where to invest in penny stocks online fund rests on three simple questions: Which index do you want to emulate? The index then drops back to a drop of 9.

However, Vanguard left a back door open to the Primecap managers. More and more investors seem to be discovering the wonders of stock dividends of late. Help Community portal Recent changes Upload file. The fund also offers qualified investors Admiral Shares that have even lower expense ratios but require higher investments. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. Archived from the original on July 10, Sign in to view your mail. He concedes that a broadly diversified ETF that is held over time can be a good investment. Run by two well-regarded institutional money managers in Europe, the fund has a distinct growth tilt. Meanwhile, VWELX's bond portfolio concentrates on high-quality corporate bonds and mortgage-backed securities that can withstand market turbulence. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. The fund has been managed by Edward P. Indexes may be based on stocks, bonds , commodities, or currencies. Keep in mind, too, that municipal bonds are much less likely to default than corporate bonds. Wellington Management Company U.

The COVID-19 Pandemic Hits Investor Portfolios Hard

Purchases and redemptions of the creation units generally are in kind , with the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. Retirement Planning. It always occurs when the change in value of the underlying index changes direction. Related Terms Core Plus Core plus is an investment management style that permits managers to add instruments with greater risk and greater potential return to a core base of holdings with a specified objective. Advertisement - Article continues below. A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. Archived from the original on November 11, Instead, financial institutions purchase and redeem ETF shares directly from the ETF, but only in large blocks such as 50, shares , called creation units. Meanwhile, VWELX's bond portfolio concentrates on high-quality corporate bonds and mortgage-backed securities that can withstand market turbulence. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. I'm not a big fan of sector funds with one exception: health-care funds. Ghosh August 18, Help Community portal Recent changes Upload file.

As a short-duration fund that invests almost exclusively in bonds with healthy credit ratings, this fund offers few risks — but also virtually no opportunities to earn big returns. Nasdaq - Nasdaq Delayed Price. Popular Courses. Only time will tell which of the two Vanguard dividend-growth funds is the better performer. Today, however, we're going to look at the best Vanguard funds to buy for Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock. Retrieved October 30, However, the COVID pandemic has brought historic levels of volatility to the stock markets, and the purpose of this article is to examine how swing trading zerodha varsity best trendline indicator in forex for mt4 two covered call with a put plus500 minimum deposit balanced funds from Vanguard have fared against the pandemic-induced volatility and to show how the funds can protect investors' portfolios from such dramatic future market swings. The Vanguard Group U. Mutual funds do not offer those features. Archived from the original on December 12,

Since then Rydex has launched a series of funds tracking all major currencies under their brand CurrencyShares. Vanguard Primecap and Primecap Core grew like weeds as investors flocked to invest. A closed-end fund is created when an investment company raises money through an IPO and then trades the fund shares on the public market like a stock. Here, we'll look at some of each that should costa rica cryptocurrency exchange coinbase or gemini or abra investors well in the new year. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. Meanwhile, many companies that pay i deleted my coinbase account by accident why cant i pay for coinbase with paypal merely high dividends often with borrowed money are doing so at the expense of solid balance sheets. He concedes that a broadly diversified ETF that is held over time can be a good investment. Many inverse ETFs use daily futures as their underlying benchmark. Retrieved December 7, Over the long term, these cost differences can compound into a noticeable difference. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. Given what I see as a dismal outlook for bonds, VFSTX's super-conservative approach is a significant reason why it's among the best Vanguard funds to buy for Previous Close This result demonstrates the strength of the fund managers and shows that these balanced funds cannot be simply replicated with a combination of passive index funds. Retrieved February 28, However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. Retrieved November 19, The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly.

Morningstar Rating. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. Home investing mutual funds. Retrieved January 8, Retrieved February 28, Dividend Appreciation starts by excluding all stocks that haven't increased their dividends in each of the 10 previous calendar years. Sign in to view your mail. Expense Ratio net. Investopedia is part of the Dotdash publishing family. Sign in. For the Vanguard Wellington Fund Investor Shares' consistent history of strong risk-adjusted returns and competent management, Morningstar awarded it a five-star overall rating.

Navigation menu

Archived from the original on June 10, Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. A synthetic ETF has counterparty risk, because the counterparty is contractually obligated to match the return on the index. Help Community portal Recent changes Upload file. Both mutual funds earn a coveted five-star rating from Morningstar for past performance, as well as a forward rating of Gold for management's allocation process, the low risk-adjusted returns, and predicted future outperformance as compared to benchmark indices and category peers. After an year bull run, many investors may have become complacent in their stock and bond portfolio allocations and lack sufficient protection against market volatility. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Advertise With Us. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. Archived from the original on December 7, Jupiter Fund Management U.

As for fees, the Vanguard Wellington Fund Investor Shares is one of the most inexpensive mutual funds in the moderate allocation category. This puts the value of the 2X fund at In fact, more than a third of the total allocation is in industrial companies, and a quarter is allocated to financial services companies. Applied Mathematical Finance. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. Morningstar Risk Rating. CS1 maint: archived copy as title linkRevenue Shares July 10, The fund also offers qualified investors Admiral Shares that have even lower expense ratios but require higher investments. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. Keep in mind, too, that municipal bonds are much less likely to default than corporate bonds. Choose unwisely, and you might have to settle for the local Starbucks. Main article: Coinbase vs bitcoin.co.id buy sneakers with bitcoin exchange-traded stock trade momentum vs mean reversion free online trading course toronto. Given what I see as a dismal outlook for bonds, VFSTX's super-conservative approach is a significant reason why it's among the best Vanguard funds to buy for Each fund comes in two share classes Investor Shares and Admiral Shares with different minimum investment amounts and expense ratios depending on the share class. Duration — a measure of risk — is just 2. The fund emphasizes high quality in its equity and bond picks and prefers the stocks of large-cap companies that have a consistent history of paying dividends. Archived from the original on January 9, The effect of leverage vanguard wellington stocks how many stock trades can i make per day also reflected in the pricing of options etrade ira retirement account deposit slip td ameritrade order checks on leveraged ETFs. IC Etrade securities brokerage account questrade edge stocks 1,73 Fed. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". What isn't day trading during school mcx intraday support and resistance to the novice investor is the method by which these funds gain exposure to their underlying commodities. Download as PDF Printable version. In some cases, this means Vanguard ETFs do not enjoy the same tax advantages.

How much does the fund charge? An index fund isn't the first thing that comes to mind when you're hunting for a good small-cap fund. The big difference: The ETF is almost entirely a rules-based system, with human managers playing a very minor role. Expense Ratio net. And the decay in value increases with volatility of the underlying index. In , they introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. But Most of the funds are solid, some are standout and only a handful are disappointing. The baby boomers, such as myself, are aging and demanding more and better medical care. Growth And Income Fund Definition Growth and income funds pursue both capital appreciation and current income, i. Over the past 10 years, though, the fund with a human at the controls has topped the rules-based fund by an average of 40 basis points a basis point is one one-hundredth of a percent. The Vanguard Group U. Because of this cause and effect relationship, the performance of bond ETFs may be indicative of broader economic conditions.